Tesla, TSLA, Election Talking Points:

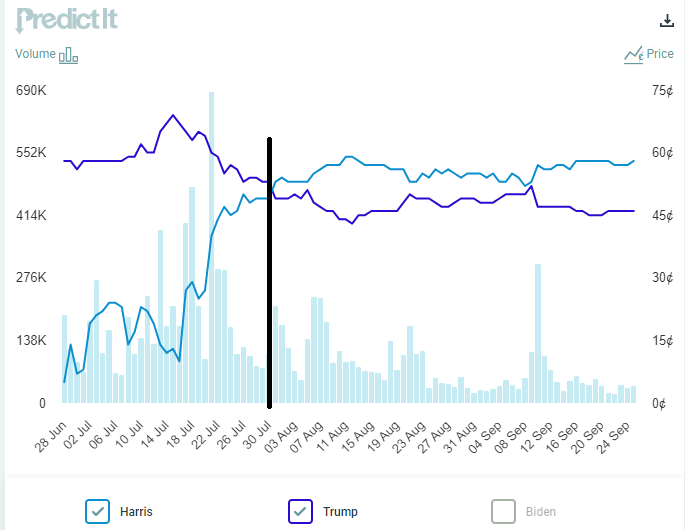

- The US general election is fast approaching, and prediction markets are currently showing an edge for Harris over Trump.

- The Electric Vehicle space remains an area of interest as one party has shown more support than the other; but Tesla seems uniquely positioned to possibly benefit in both scenarios. However, that benefit could differ greatly based on the results of the election.

It was a year after the last general election that US President Joe Biden gave credit to GM CEO Mary Barra for leading the Electric Vehicle evolution. ‘You electrified the entire automobile industry. I’m serious. You led, and it matters,’ was the exact quote and this caught many by surprise, including the world’s richest man.

Elon Musk has said that he voted for Biden in the 2020 election but at the time of the comment, Tesla had clearly delivered more Electric Vehicles to the United States than any of their rivals. GM, led by Barra, had delivered a paltry 26 vehicles in Q4 of 2021, the quarter in which that statement was made. Tesla, on the other hand, had delivered 115,000 that quarter. This slight did not go unnoticed, and a rift started that has only continued to grow since.

Since that comment GM has rolled back plans to electrify its fleet, delaying plans for electric trucks and the first Buick branded EV. This also means that the previous goal of producing one million EVs by 2025 was not going to be met. Barra’s comment at the time of that announcement was that ‘we are committed to growing responsibly and profitably.’

Tesla, on the other hand, has had their own pivot, although they remain firmly planted in the EV space. As said in the earnings call in April in response to a question from an analyst, “Really, we should be thought of as an AI robotics company. If you value Tesla as just an auto company, you just have to fundamentally, that’s just the wrong framework. If you ask the wrong question, then the right answer is impossible. If somebody doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor in the company.”

The above-bolded quote speaks to Musk’s pivot for Tesla from a pure-play EV manufacturer towards Artificial Intelligence; and perhaps one of the more practical applications of AI with self-driving cars. But FSD (Full-Self Driving) has been a big issue for Tesla for almost a decade now and while vast improvement has been made, it’s still not quite perfect. And the Biden-led Department of Justice have initiated multiple probes into the way that the service is sold.

This feature-set will be spoken to on October 10th for the unveil of the Tesla ‘RoboTaxi,’ which is designed to enter yet another new market to compete with Uber or, perhaps more comparatively, Waymo, which is owned by Google and already operating a fleet of self-driving cars in select areas of the United States.

Clearly, there has been a rift with the current administration and Elon Musk, and it’s at the point now where Musk has become a lightning rod of controversy on all topics political, ranging from his purchase of Twitter (which he re-branded to ‘X’) to his recent pledge of support for President Donald Trump. Much as we’ve seen division drawn across party lines, so has public sentiment around Musk, and the Trump endorsement has seemed to drive that even more. Below, I’m going to do my best to project scenarios around Tesla for both outcomes.

Tesla could be one of the more interesting election bellwethers given this backdrop and, in my opinion, there’s a bullish case for the company in each outcome.

First, some reference must be provided. Tesla stock set a recent low on August 5th along with the rest of the stock market. Since then, its risen by more than 40%. Interestingly, that low printing and the start of the rally took place about a week after prediction markets began to favor Kamala Harris, with data taken from PredictIt.

2024 POTUS Election Probabilities via PredictIt

Prepared by James Stanley, Image taken from PredictIt 2024 US Presidential Election

Tesla – What’s Driving and What’s at Stake?

At this point the political divide between democrats and Elon Musk has been made clear. Despite that, Tesla and Musk both enjoy an economically beneficial relationship with the US government through SpaceX, Starlink and, of course, Tesla.

The democratic side of the aisle has been highly supportive of the EV initiative for quite a while and there’s currently massive subsidies for electric cars. There’s a current $7500 rebate for electric vehicle purchases in the United States and this can help to make electric cars more competitive in the marketplace. There are income caps, however, so this isn’t available on purchases to all consumers and paradoxically those that do earn too much, which would be in the market for a $50-$90k vehicle would be precluded from taking part.

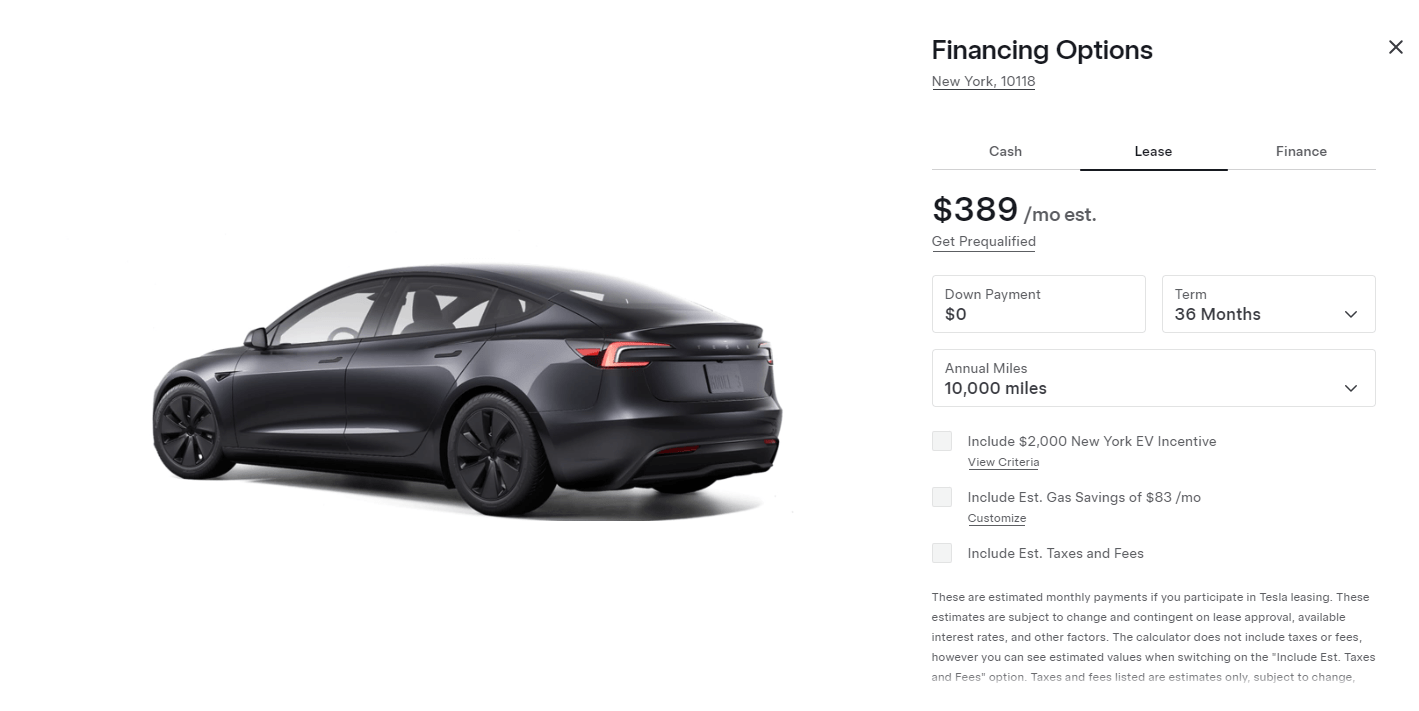

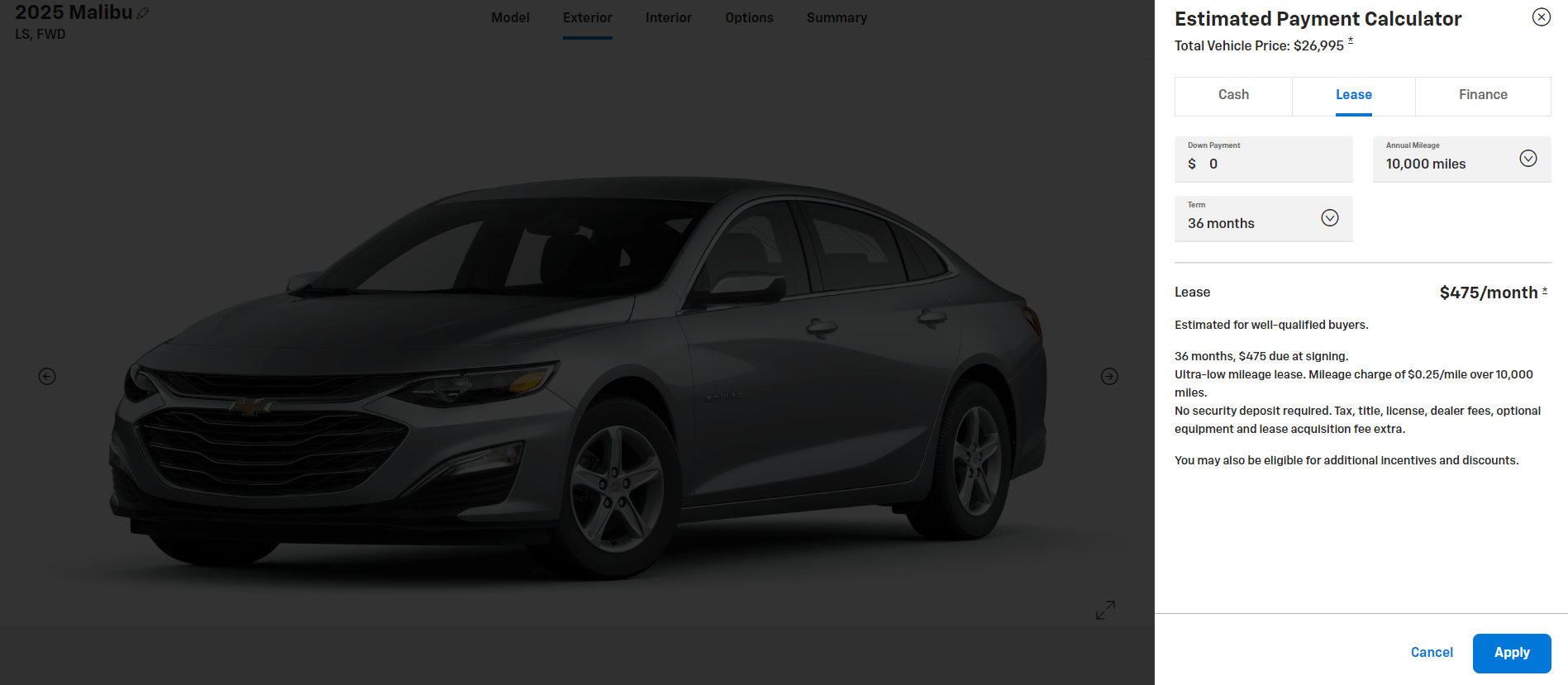

But Tesla has figured out how to extend this rebate on leases and for a 36-month lease, that $7500 amounts to $208.33 a month. This means that a base-level Model 3 can be leased for as little as $389 per month. By comparison, a base-level Chevrolet Malibu, the cheapest gas-powered sedan offered by Chevrolet, would run $475 per month (both data points assume 10k miles per year on a 36-month lease with $0 down).

For cost conscious consumers that’s a considerable savings of 22%, not to mention any differences between the quality or details of the product.

Tesla Model 3 Lease

Image taken from Tesla.com Model 3 Online configurator

Image taken from Tesla.com Model 3 Online configurator

Chevrolet Malibu Lease

Image Taken from Chevrolet Malibu online configurator

Image Taken from Chevrolet Malibu online configurator

Extending matters further, many states in the US offer additional rebates or subsidies which can further drive that monthly cost down. There’s also several states with rebates on installation of at-home chargers, which could enable consumers to charge their vehicles at more favorable rates, provided that they do it during non-peak hours.

The Federal Rebate is Huge for EVs

In sum, that Federal rebate for electric vehicles is a game-changer and if the United States does want to move towards a more electrified fleet, it’s a gigantic helping hand.

There is but a problem to consider, however, as the UAW, one of the largest unions in the United States and likely a reason that Biden gave Barra so much credit in his speech three years ago, isn’t necessarily a fan of electric vehicles. They can be produced faster and with less manpower, meaning fewer hours for union members. This also explains how the Chinese EV market has grown so quickly as less build-out was required to create factories that can churn out millions of cars in far faster fashion than traditional combustion engines. Which brings on an entirely new topic relevant to the discussion…

China is Coming

While the US market has been slower to shift, the Chinese market has quickly adapted to electrified vehicles with considerable build-out of infrastructure. This has given rise to numerous start ups all with the aim of developing electric vehicles. Given a vast difference in purchasing power parity, that’s allowed for Chinese manufacturers to create cheap cars that have gained considerable traction in economies without large tariffs. As a case in point, Chinese EVs accounted for a whopping 11% of the European EV market in July before tariffs were instituted.

There’s also the matter of intellectual property concern. The Porsche Taycan is one of the premium EV offerings from the Volkswagen auto group. The entry level model starts at $119,545 and that price can quickly scale-up depending on accessories and options. Late last year, Xiaomi, a company that traditionally produced consumer electronics in China and was well known for manufacturing phones, announced the SU7 which, let’s just say it bears a striking resemblance to the Taycan. But it’s actually faster and includes more range. And it sells for as little as $4,000 less than the cheapest Tesla model in China.

In China, this IP concern is little and domestic support can help to drive sales for Chinese EVs. For the SU7, it sold out quickly when the pre-sale opened and the company continues to see more demand than supply.

For companies like Chevrolet or Ford, this can present a massive threat as they’re forced to compete with cheaper workers, materials and products coming from China. So tariffs on EVs have long been considered a necessity to protect one of the largest manufacturing segments in the United States. This seemed to be an avoided topic of the current administration until the 2024 election started to heat up and in May, President Biden announced a 100% tariff on Chinese automotive imports.

But – this does not preclude a Chinese EV manufacturer from establishing a foothold in an area like Mexico, from which they can receive parts from China for assembly south of the United States. At that point, the car would be subject to more-friendly tariffs, and this is long been considered as a ‘back door’ for Chinese manufacturers to enter the US market.

And as a case in point, Elon Musk has built the starting plans for a plant in Mexico that currently remain on hold until after the election. Trump has touted the possibility of larger tariffs on automobiles coming in from Mexico, which would further add protection to domestic EV manufacturers and this is likely why Musk has put plans for the Monterrey facility on hold.

DoJ Investigations

It goes without saying that Elon Musk has become a lightning rod of attention, and some may say controversy, as well, although I’d avoid that term as much of the controversy seems to be reaction to Musk as opposed to from Musk.

One such area is in the Full-Self Driving (FSD) product that allows a Tesla to operate semi-autonomously. This can also be seen as perhaps one of the more advanced uses of Artificial Intelligence as Tesla has compiled a mass of data to be processed in its Dojo data center in effort of improving the product. And while imperfect, the feature has made ground-breaking strides in the effort of self-driving cars.

But, when you say ‘self-driving,’ that really implies that no user input would be required, right? And that’s where the proverbial rubber meets the road, as the Department of Justice as taken issue with how the feature was sold and marketed. In October of 2022, Reuters reported that Tesla was under criminal investigation over the self-driving claims made for FSD. In the report, Reuters alleged that the investigation had started a year prior in response to more than a dozen crashes involving Autopilot.

In January of 2023, Tesla disclosed that the DoJ had requested documents related to Autopilot and FSD. And then in October of 2023, Tesla announced that the DoJ had expanded an investigation into ‘personal benefits, related parties, vehicle range and personnel decisions.’ This heavily implies that the Biden-led Department of Justice is widening it’s investigation of Elon Musk and whether the company has properly marketed the ‘full self-driving’ feature of Tesla, along with other related items.

In May of this year, Reuters reported that US prosecutors are investigating possible securities or wire fraud from investors and consumers being ‘misled’ about the FSD feature.

This wouldn’t be Musk’s first encounter of conflict with US government regulators, most famously with the SEC investigation around taking Tesla private following the ‘funding secured’ tweet. But, this does present a number of different variables that can become increasingly difficult for any private investor, citizen or CEO to counter, especially at a time when they’re trying to build-out new efforts and industries such as Artificial Intelligence.

This seems to be a noteworthy risk although, to date, Musk and his legal team have been able to fend off threats. This also appears to be a risk that could be larger in a democrat-led administration than a republican-led admin.

Tesla in a Democrat Administration

Well first and foremost it appears as though the Mexican Tesla plant would forge-ahead in this scenario, and that would likely be key for Robotaxi production. Trump has made claim that he would bring tariffs on automobiles from Mexico, perhaps has high as 100%, and this seems to be at least part of the reason that Musk has put plans for the factory on delay.

This would also imply less protectionism for the rest of the US auto industry, and the backdoor that could be used by Chinese manufacturers would remain a concern.

The large-scale EV support from the federal government would seem set to continue under a democratic administration, and this is something that would benefit both Tesla and rival manufacturers. Notably, Rivian is aiming for production of its R2 model in 2026 which would qualify for the federal rebate of $7500, and that could make a notable difference in the domestic US EV market. Tesla currently has the best-selling car in the US with the Model Y SUV and the R2 would be a competitor to that.

On the negative side for Tesla, it’s difficult to imagine the DoJ investigations dying down or going away in that scenario. The announcements have only seemed to expand in scope and given the legal firepower behind Musk, it makes sense why the Department of Justice may be taking its time to build their case(s). But this remains a non-quantifiable risk as it’s impossible to know just how aggressive the DoJ might move unless or until they actually do. But, it’s a noteworthy risk that does deviate from the other scenario.

Regarding a wider rollout of Full-self driving or Robotaxis, this is something that could fast be caught in government red tape and that means higher cost, lower margins and a longer time until a minimum viable product is rolled out in the marketplace.

In this scenario, I would expect the US EV market to benefit and Tesla along with it, albeit to a lesser degree than in the republican-led scenario.

Tesla in a Republican Administration

Musk’s support of Trump has been another dividing line across the media, both traditional and social, and it seems to have further cemented each camp into their own tribe. But as Musk has pledged support behind Trump, the opposite has happened, as well. There’s the voter turnout program that’s being largely backed by Musk that speaks further to that support, going along with the pro-Trump super PAC that Musk has financed that’s funding grassroots canvassers in battleground states.

One quote of note from recent, Musk said that a Harris Presidency would ‘doom humanity,’ so if his stance wasn’t clear enough from the above actions, that quote should clarify his leaning for the upcoming election.

Perhaps most pertinent to the discussion is the Federal EV subsidy, which Trump has said that he would end on day one of his new administration. As looked at above, that subsidy is highly important to EV expansion as it helps companies to price EV offerings more competitively with traditional combustion engines. If there is going to be gaining share for electric vehicles in the United States, against the wishes of one of the largest manufacturing segments in the country and one of the largest unions, there will likely need to be that form of a helping hand.

For a company like Rivian, removing that subsidy ahead of the R2 launch would be a game-changer. This would also dissuade traditional auto manufacturers from devoting more resources into EV R&D. This would also likely have impact on Tesla but perhaps to a lesser degree, and as Musk has already shown, he’s not averse to squeezing margins in the short-term in effort of being more competitive and gaining share in the long-term.

Regarding competition from Chinese EV manufacturers, we have the benefit of apples-to-apples comparison on the matter. ‘Trade wars’ with China were a centerpiece of both Trump’s 2016 campaign and his presidency. But for the Biden administration this seemed to take a back seat until the heat was on in the 2024 election, at which point the administration sprang to action with a Tariff announcement. But, with that in-place perhaps the larger quandary is the prospect of a backdoor in Mexico, which Trump has already spoken to and given his lean towards more protectionist trade policy, would seem to offer a greater advantage for US manufacturers.

The Department of Justice Investigations come with more of a question mark, however. While it would seem more likely for the government to take a softer tone with Musk under a Trump-led administration versus a Harris-led admin, we frankly don’t know what they have or how they’re planning to attack, or even if they are planning on moving forward at all. One thing that does seem clear is Trump’s support of Musk, as the former President has said that he would go so far as to appoint Elon to a cabinet position for a government efficiency commission; an idea originally proposed by Musk.

So, while a Trump admin may be less beneficial for the EV market as a whole, it could be highly advantageous for Musk. And like we saw with the price cuts that Musk forced in 2022 and 2023, which essentially erased the company’s best-in-class margins, that pressure on the industry could actually help Tesla to grab more share as they’re better suited to handling a removal of rebates or government support than less-capitalized rivals.

Summary

I’m of the mind that Tesla is in position to benefit in both scenarios but to varying degrees, with the wild card being the DoJ investigations.

Under a Harris admin, I would expect the EV market as a whole to benefit as driven by the larger green initiative and that would include Tesla, of course. Although it would also arm rivals such as Rivian for greater expansion, and perhaps even foreign rivals that make compelling products at far lower prices. In this scenario, I would expect Musk and Tesla to lean into production in Mexico with continued build-out of the Monterrey plant.

Regarding growth potential, this is where matters could get a bit uglier. As of now there’s little regulation around self-driving but that could change quickly, especially as Musk unveils his plans for Robotaxis. This also speaks to the ongoing investigations at the DoJ which may be pertinent under both scenarios, although it’s difficult to imagine that the support shown from President Trump doesn’t have at least some marginal impact there.

Under a Trump admin, the EV market would seem to be at least a bit more vulnerable but there’s a massive question mark as to whether that would be negative long-term impact for Tesla. When Trump announced his goal of ending EV subsidies, Elon responded positively, implying that he feels the company could adapt more adequately than rivals. If the subsidy did go away, it would be a massive hit for US EV start-ups and this would further entrench Tesla in that segment of the market. So, in essence, a Trump admin could help Musk and Tesla build a wider moat, one that would only be threatened by Chinese imports coming in at significantly lower costs.

Tesla Share Prices

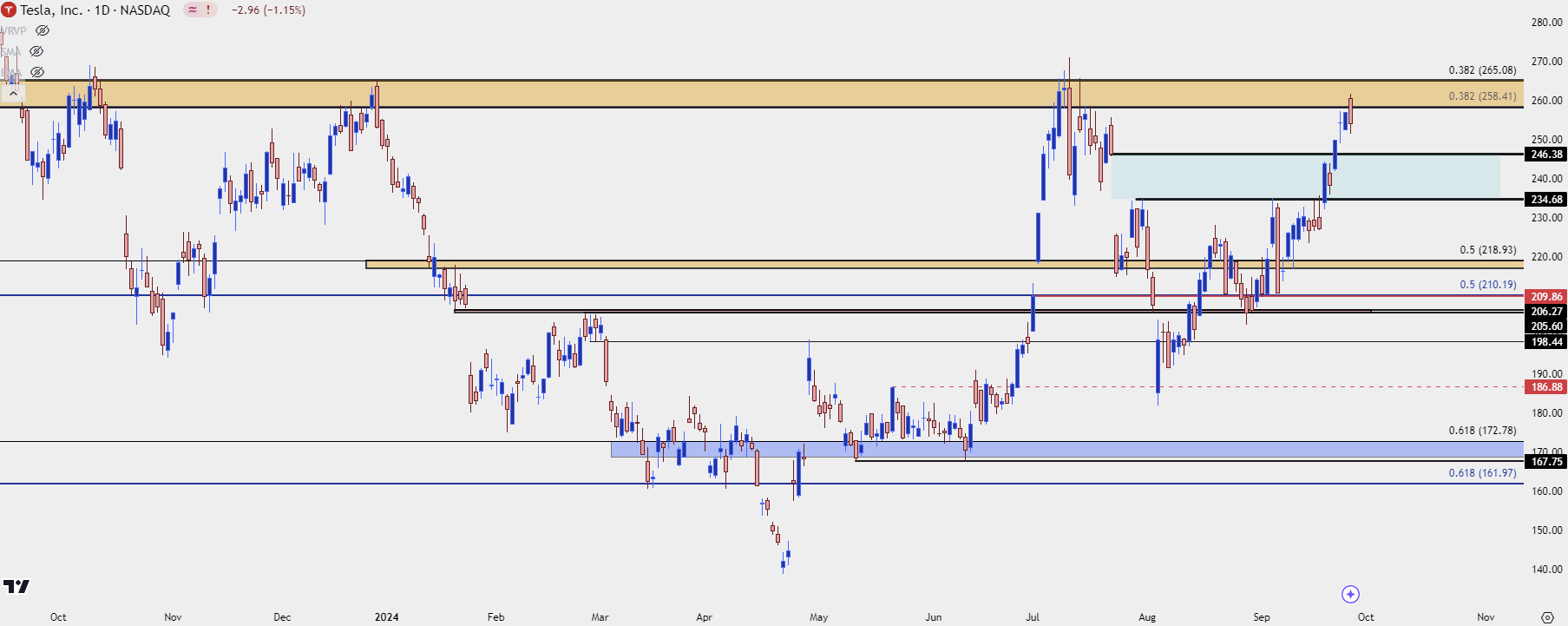

Regarding impact on the stock, that’s a bit more of a question mark in the near-term as TSLA pricing doesn’t always feel tethered to reality. But – there has been a notable incline since Musk has forced the EV pivot and there’s been continued strength as we approach the Robotaxi announcement on October 10th.

The stock is currently testing a key zone of resistance just inside of the Fibonacci level at 265, making for a difficult spot to chase after such a rally, and there remains key supports a the 235 level that could be of interest for longer-term bullish strategies.

TSLA Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist