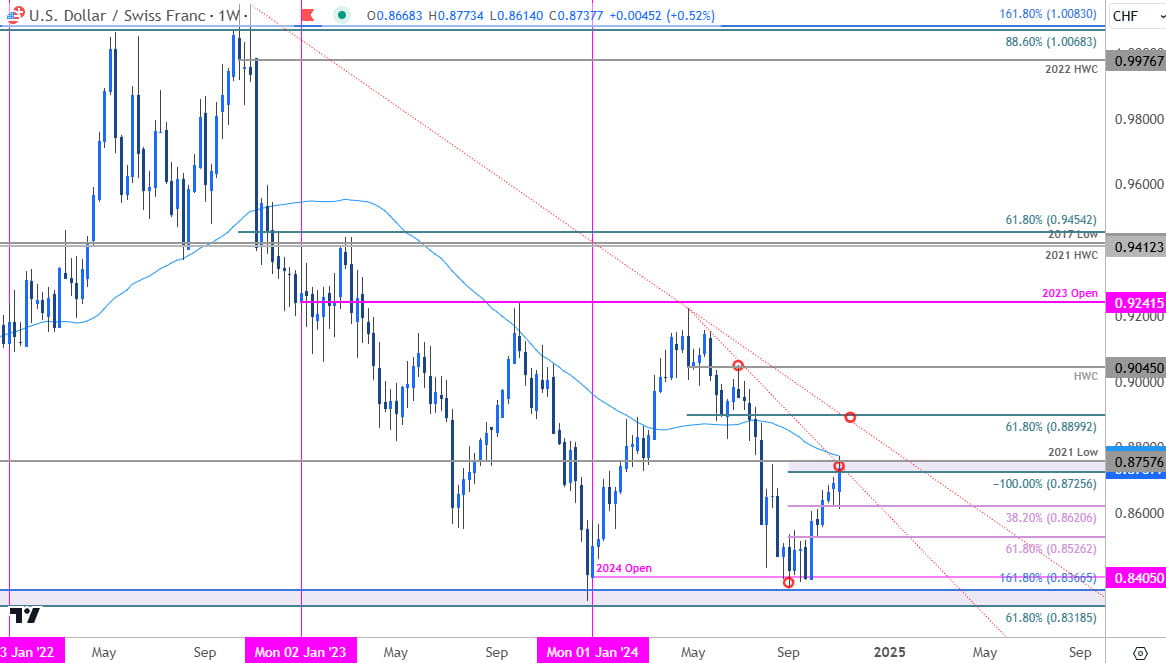

Swiss Franc Technical Forecast: USD/CHF Weekly Trade Levels

- USD/CHF marks fourth-weekly rally – bulls now testing April downtrend

- November opening-range is preserved just below resistance- breakout imminent

- Resistance 8725/74 (key), 8899, 9045- Support 8620, 8526 (key), 8405

The US Dollar rallied for a fourth consecutive week against the Swiss Franc with USD/CHF stretching into major resistance at multi-month highs. Its decision time for the bulls as the post-election rally challenges the April downtrend. These are the update targets & invalidation levels that matter on the USD/CHF weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD/CHF setup and more. Join live on Monday’s at 8:30am EST.Swiss Franc Price Chart – USD/CHF Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CHF on TradingView

Technical Outlook: USD/CHF is testing major resistance on the heels of this week’s US election and subsequent Fed rate decision with price exhausting into the April downtrend at 8725/57- a region defined by the 100% extension of the September range breakout and the objective 2021 swing low. Note that the 52-week moving average caught the intra-week highs just above 8774 and the multi-week rally remains vulnerable while below this zone.

Initial support rests at this week’s low / the 38.2% retracement of the September advance at 8614/20- note that this region also defines the November opening-range low. A break / close below this zone would threaten a larger correction towards the 61.8% retracement at 8526- losses should be limited to this threshold for the September uptrend to remain viable. Subsequent support seen at the objective yearly open at 8405 with 8318/66 still critical.

A topside breach / close above the yearly moving average exposes a major technical confluence at the 61.8% retracement of the yearly range near the 99-handle. Note that the 2022 trendline also converges on this zone over the next few weeks- look for a larger reaction there IF reached. Initial resistance objectives eyed at the 2024 high-week close (HWC) at 9045 in the event of a breakout.

Bottom line: The USD/CHF rally exhausted into confluent resistance this week and while the medium-term outlook remains constructive, the immediate advance may be vulnerable here. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- the immediate focus is on a breakout of the November opening-range (the election-day range) for guidance. Losses would need to be limited to 8526 IF price is heading for a breakout on this stretch with a close above the yearly moving average needed to fuel the next leg of the advance. Review my latest Swiss Franc Short-term Outlook for a closer look at the near-term USD/CHF technical trade levels.

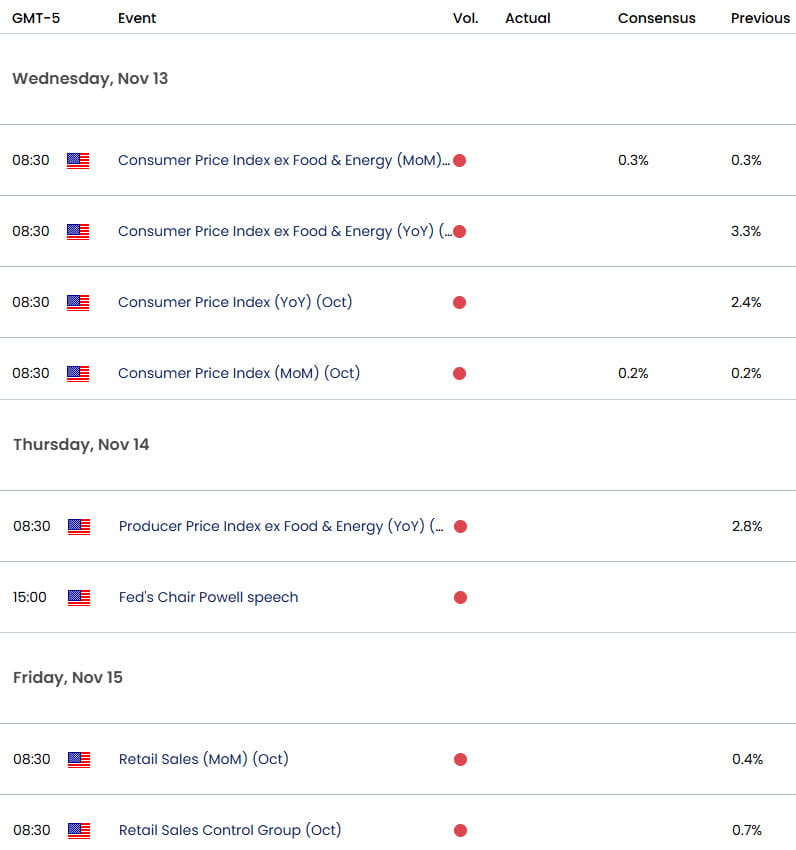

USD/CHF Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- Australian Dollar (AUD/USD)

- Gold (XAU/USD)

- Silver (XAG/USD)

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- British Pound (GBP/USD)

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex