Swiss Franc Technical Forecast: USD/CHF Short-term Trade Levels

- USD/CHF rally responds to technical resistance- risk for larger bull-market correction

- USD/CHF initial support now in view into the 200-day moving average- risk for price inflection

- Resistance 8899 (key), 8988, 9042/45- Support ~8819/26, 8758, 8698-8709 (key)

The US Dollar snapped a five-day winning streak on Friday with USD/CHF reversing off confluent uptrend resistance. Although the broader outlook remains constructive, the immediate advance may be vulnerable to a larger correction within the multi-month uptrend. Battle lines drawn on the USD/CHF short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD/CHF setup and more. Join live on Monday’s at 8:30am EST.Swiss Franc Price Chart – USD/CHF Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CHF on TradingView

Technical Outlook: In my last Swiss Fanc Short-term Outlook we noted that USD/CHF was testing a major pivot zone ahead of the US elections / the Fed rate decision with the weekly opening-range taking shape just below technical resistance around the 87-handle. The US Dollar ripped higher the following day with a topside breach unleashing a rally of more than 3.5% off the November low.

The rally exhausted into Fibonacci resistance last week at the 61.8% retracement of the yearly range around the 89-handle- note that pitchfork resistance also converges on this threshold and further highlights its technical significance. Daily momentum is now threatening a break back from overbought territory and the broader September rally remains vulnerable while below this threshold.

Swiss Franc Price Chart – USD/CHF 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CHF on TradingView

A closer look at Swissie price action shows USD/CHF reversing off the upper parallel with precision last week with the pullback now approaching initial support at the 200-day moving average / June low / 2021 yearly open at 8819/27- note that the median-line converges on this threshold over the next few days. A break / close below this slope would threaten a larger correction within the multi-month uptrend with subsequent support seen at the 2021 low at 8758 and the 38.2% retracements at 8698-8709- we’ll reserve this threshold as our bullish invalidation level.

A topside breach / close above 8900 is needed to mark uptrend resumption with such a scenario exposing subsequent resistance objectives at the May low near 8988 and the 78.6% retracement / 2024 high-week close (HWC) at 9042/45- look for a larger reaction there IF reached.

Bottom line: The USD/CHF breakout has extended into / responded to confluent technical resistance with the pullback now approaching initial uptrend support- looking for a reaction on test of the median-line. From a trading standpoint, losses should be limited to 8700 IF price is heading higher on this stretch with a breach / close above 8900 needed to mark resumption of the September uptrend.

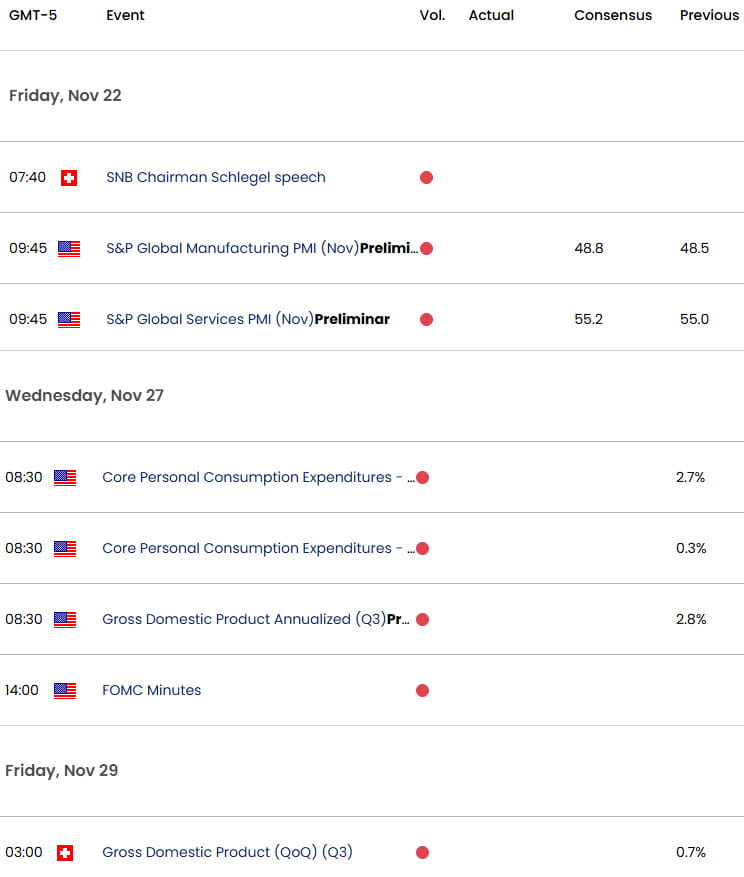

Keep in mind the economic docket is rather light until next week’s key US inflation data- watch the weekly closes here. Review my latest Swiss Franc Weekly Forecast for a closer look at the longer-term GBP/USD technical trade levels.

USD/CHF Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- British Pound Short-term Outlook: GBP/USD in Freefall- Support Ahead

- Euro Short-term Outlook: EUR/USD Breakdown Searches for Support

- US Dollar Short-term Outlook: USD Trump Bump Extends into Resistance

- Australian Dollar Short-term Outlook: AUD/USD Bears Go for the Break

- Canadian Dollar Short-term Outlook: USD/CAD Trump Rally Faces Fed

- Gold Short-term Outlook: XAU/USD Plunges on Trump Victory- Fed on Tap

- Japanese Yen Short-term Outlook: USD/JPY Stalls into US Election, Fed

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex