US futures

Dow future -0.07% at 44,760

S&P futures 0.09% at 6044

Nasdaq futures -0.23% at 21118

In Europe

FTSE 0.87 % at 8377

Dax 0.19% at 19947

- US stocks edge lower aid China tit for tat trade escalation

- Fed rate cut expectations for December rise after Fed speakers

- US JOLTS jobs opening data is due

- Oil rises ahead of this week’s OPEC+ meeting

Stocks slip with China & jobs data in focus

U.S. stocks are edging lower on Tuesday after the S&P 500 and the NASDAQ closed at record levels in the previous session.

Rallying tech stocks helped the two major indices reach new highs, although the Dow Jones ended the day 100 points lower.

The market edging lower after news that China will begin banning the export of some rare minerals to the US in a tit-for-tat escalation of the tech war between the two powers. Materials being banned for export to the US are critical for some semiconductors, EV batteries, and solar technology.

This comes after Trump demanded at the weekend that BRICS member countries, which include China, commit to The US dollar as a reserve currency.

The market is finding some support from a slightly higher chance of a 25 basis point cut this month, following Fed Waller and Williams's comments. Federal Reserve chair Jerome Powell will speak tomorrow.

Attention is now turning to Jolts job openings, which are expected to increase modestly to 7.48 million, up from 7.44 million in September. The data comes ahead of ADP payrolls and the US nonfarm payroll data later in the week.

Corporate news

Tesla is driving lower after CEO Elon Musk's record-setting pay package was struck down by a Delaware judge. This came as deliveries from the Shanghai plant declined for a second straight month in November.

AT&T is rising pre-market after saying it expects sustained profit growth over the coming years.

Salesforce is due to report after the close and is expected to show a 7% increase in revenue to 9.3 billion and EPS of $2.45. The focus will be on agent force and its AI strategy. The share price has traded up 26% so far this year.

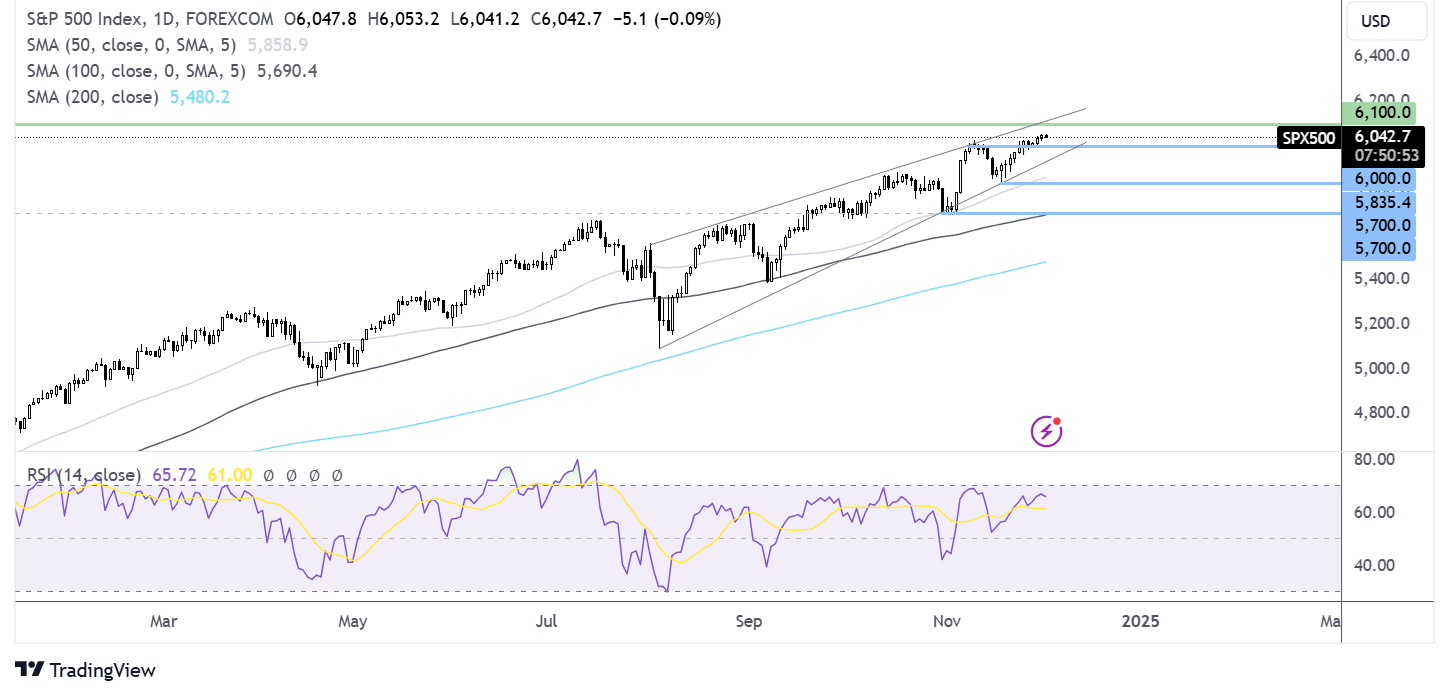

S&P500 forecast – technical analysis.

The S&P500 continues to rise, recovering from the mid-November low of 5830, rising to a fresh all-time high of 6050. With blue skies above, buyers will look to extend gains towards 6100 as the next logical target. Still, the move higher appears to be losing steam. A move below 6000 negates the near-term uptrend, and a break below 5830 creates a lower low, opening the door to 5700, the 100 SMA, and the December low.

FX markets – USD falls, EUR/USD rises

The USD is falling after strong gains yesterday, and as Federal Reserve official Christopher Waller said, he is leaning towards a rate cut on December 18th. The market is pricing in a 72% probability over 25 basis point reduction. Thereafter, the Fed is expected to cut rates by 25 basis points a quarter.

EUR/USD is rising after steep losses yesterday, but the outlook remains weak as French PM Michel Barner is set to face a vote of no confidence tomorrow, which he is almost certain to lose. This means the political uncertainty in France is likely to continue and comes alongside economic weakness after data yesterday showed the manufacturing recession in the eurozone continues with few signs of letting up.

GBP/USD is holding steady around 1.2650 after losses yesterday. UK CBI data showed that UK retailers had the weakest sales last month since April. However, this is likely because Black Friday is in December this year. Adobe data showed that Britons spent 5.2% more on Black Friday /Cyber Monday this year.

Oil rises ahead of this week’s OPEC meeting.

Oil prices are riding for a second straight day but remain within a familiar range as investors look ahead to the OPEC+ meeting later this week.

The group of oil producers is expected to extend oil output cuts until the end of the first quarter of next year, offering some support to the market. Concerns over a supply surplus and weak demand from China mean the group has little choice but to postpone increasing supply to protect prices.

On the demand side, upbeat data from China this week has helped the mood, although expectations that Saudi Arabia will cut its crude price for Asian buyers to the lowest level in four years are an ominous sign.

Looking ahead API inventory data is due to be released ahead of EIA data tomorrow.