- S&P 500 futures have been rangebound for weeks

- The unwind of dovish Fed rate cut bets has not been overly impactful

- US inflation report on Thursday may provide the catalyst for a directional shift

Overview

S&P 500 futures have shown little interest in the major repricing of Federal Reserve rate cut expectations caused by Friday’s blowout non-farm payrolls report for September, raising the question whether Thursday’s US consumer price inflation (CPI) report is as big a risk event as some make it out to be.

Fed rate cut bets unwound aggressively

The unwind of dovish Fed rate cuts bets over the past few weeks has been remarkable to watch, seeing futures traders pare the number of cuts priced by the end of 2025 from nine to less than six amidst signs of continued US economic resilience.

While the rates recalibration has greatly impacted some rate sensitive asset classes, when it comes to US stocks, the big blue-chip names could barely care less based on the rangebound price action we’ve seen over the past week.

Perhaps it’s because the largest constituents aren’t reliant on the generosity of capital markets for funding given their huge cashflows, or that traders are waiting for earnings season to see whether elevated expectations for earnings growth are justified, but there has been almost no obvious directional deviation whatsoever.

US inflation report eyed

I get the sense traders are waiting for a catalyst to provide a meaningful price signal. Perhaps the inflation report will deliver it, but unless we see a major downside surprise for the core figure that reignites hopes for a 50bps cut in November despite continued strength in the economy, a price signal itself may be the catalyst to break the market out of its funk.

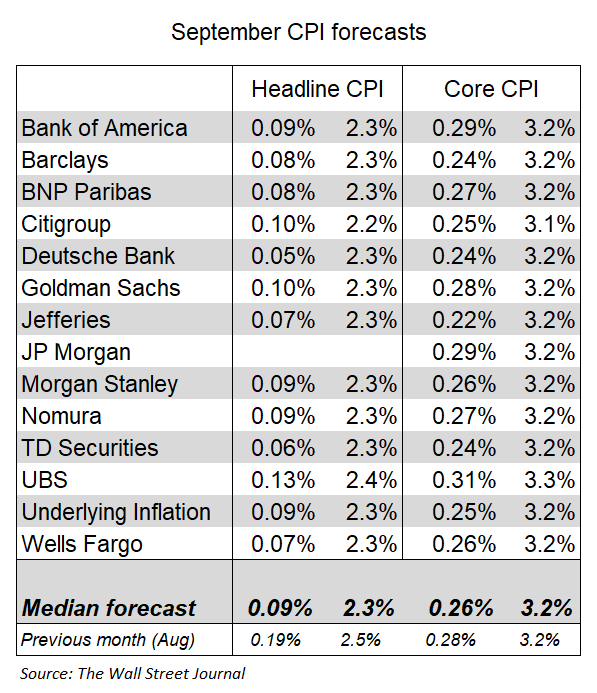

This graphic posted on X by Nick Timiraos from the WSJ shows what major investment houses are forecasting for the inflation report.

Source: X, Nick Timiraos

S&P 500 squeezing up against support

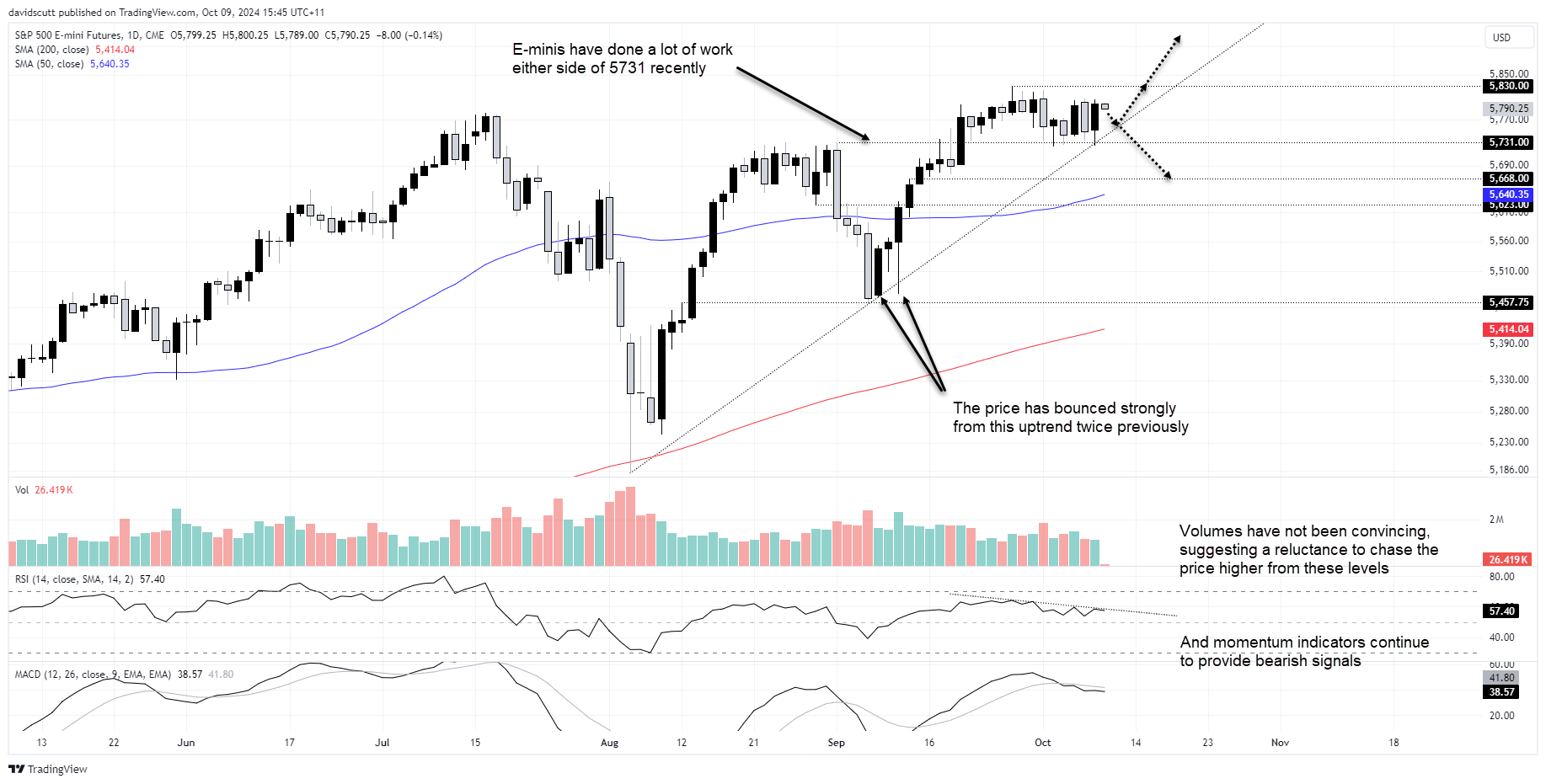

S&P 500 futures have been rangebound since the middle of September, attracting buying on dips below 5731 with offers emerging on pushes towards the record high of 5830 on the topside.

However, with the price starting to squeeze against the uptrend dating back to the lows struck on August 5, you get the feeling that the next couple of days could be instructive when it comes to directional risks moving forward.

From a momentum perspective, RSI (14) and MACD are providing bearish signals, suggesting risks may be skewing towards a downside break. Volumes have also been waning, hinting there’s a reluctance to chase the price higher from these levels.

If the price were to break beneath the downtrend, shorts could be established targeting 5731, 5668, the 50-day moving average and 5623. A break and close below would boost conviction behind the trade. A stop loss above the trendline would offer protection against reversal.

Alternatively, if the price were to break above the record high of 5830, traders could use it to build bullish setups around, allowing for longs to be established above with a stop below for protection.

-- Written by David Scutt

Follow David on Twitter @scutty