Silver Talking Points:

- From metals mania to a metals massacre as both silver and gold have sold-off in the aftermath of the US election.

- Given the rally in the US Dollar we could be seeing an expected shift in rate policy from the FOMC; but this theme is far from over as Silver was at a fresh decade-high just a few weeks ago and the bigger picture retains bullish potential if the 30-handle can hold the lows.

In the month of October both silver and gold put in strong bullish moves and while the latter had been strong for most of 2024, it was silver that began to show more impressively last month. Silver prices broke out to a fresh 12-year high and eventually ran up to the 35-level in silver futures, which finally started to slow the breakout, and the weekly bar from that test showed as a doji.

Since then, that indecision has pushed a turn and the past three weeks have seen sellers reversing the bulk of the September and October breakout; but it wasn’t until this morning that the 30-level came back into the picture and, so far, that’s helping to set support. That’s the same line-in-the-sand that held highs in 2020 and 2021 and it remains relevant near-term.

Silver Futures (SI) Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

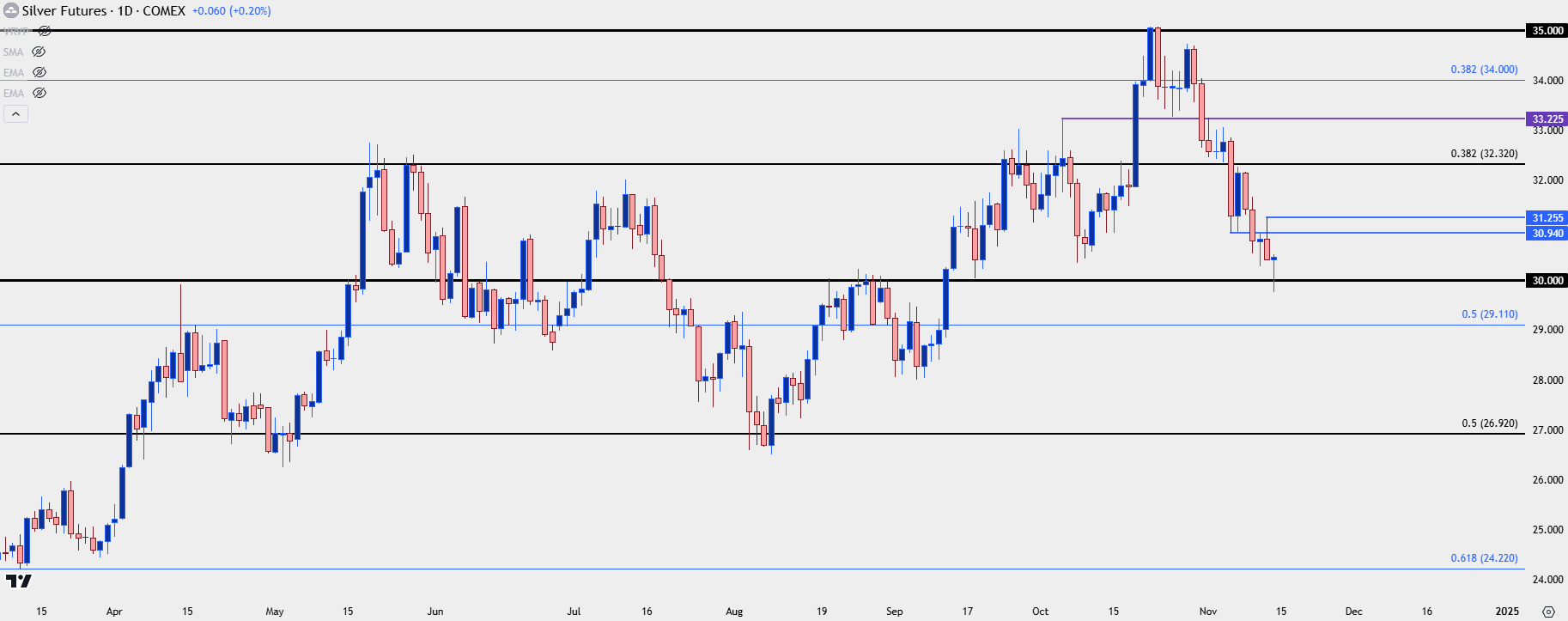

Silver Daily

The 30-handle was also in-play as resistance in August, and the pullback from that held a higher-low before the next test led to breakout. After the breakout in September, the following pullback held a higher-low above that price before bulls ultimately pushed up to that fresh 12-year high a month later.

This morning was the first test of $30 since that happened and so far, there’s been a response from bulls pushing prices back above. But at this stage it’s still too early to definitively say that it’s bottomed as we’d need some follow-through to show greater confirmation of that.

The prior lower-low plots at 30.94 and the prior lower-high at 31.26. If bulls can push through that in early-trade next week, then the prospect of bullish continuation could come back into the picture with a bit more confidence.

Silver Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist