Siemens AG (SIE) Q4 2024 Earnings Preview

Siemens AG is set to release its Q4 2024 earnings on November 14, with expectations for a slight decline in revenue but an increase in net profit compared to the same period last year.

Earnings Release Date: November 14, 2024

Revenue Forecast: €20.77 billion (down from €21.39 billion YoY)

Net Profit Forecast: €1.87 billion (up from €1.72 billion YoY)

Full-Year Forecasts:

- Revenue: €75.89 billion (down from €77.77 billion in 2023)

- Net Profit: €8.20 billion (up from €7.95 billion in 2023)

Key Divisional Insights

- Digital Industries (DI) Division

- The DI division faces ongoing challenges, particularly due to destocking in China. Analysts at JPMorgan expect this headwind to persist into fiscal 2025, likely dampening DI orders and revenues in the coming quarters.

- Siemens projects DI’s comparable revenue to be 4% to 8% lower YoY, with an expected profit margin of 18% to 21%.

- Smart Infrastructure (SI) Division

- SI is expected to see another quarter of robust demand, driven by growth in sectors like data centers, power distribution, and electrification.

- Siemens forecasts comparable revenue growth of 8% to 11% for SI, with profit margins ranging between 8% and 10%. Analysts believe margins could reach the upper end or exceed the forecasted range.

Full-Year Guidance and Analyst Expectations

Siemens reaffirmed its full-year guidance in August, maintaining expectations for:

- Comparable revenue growth for the Siemens Group.

- Digital Industries profit margin at the lower end of the guidance range.

- Smart Infrastructure profit margin at the upper end of the range.

Recent Technological Developments

- Industrial Copilot Extension: Siemens extended its Industrial Copilot functionalities, adopted by thyssenkrupp Automation Engineering to improve automation processes. This generative AI-powered system assists in industrial engineering and operations, including automation code writing. Thyssenkrupp plans to deploy it globally by 2025.

- SIMATIC ET 200SP e-Starter: Siemens launched the SIMATIC ET 200SP e-Starter, which provides 1000 times faster short-circuit protection compared to conventional systems. Designed for worldwide use, it integrates fully with Siemens' Totally Integrated Automation (TIA) platform.

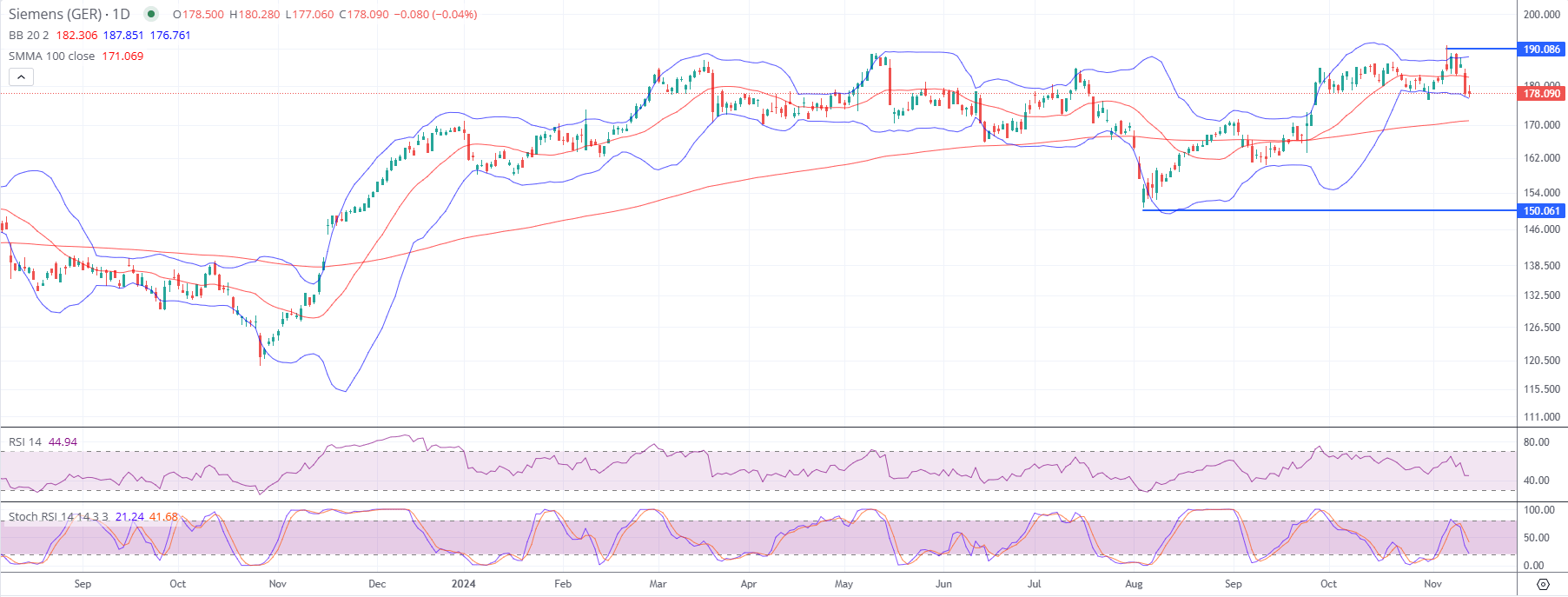

Siemens (SIE) Technical analysis

Support Levels:

€177.22 (Recent low from the past week)

€176.06 (Recent low from the past month)

€150.68 (Year-to-date low)

Resistance Levels:

€190.96 (52-week high and recent resistance)

€188.92 (Recent high from the past week)

€200.00 (Psychological level and near analyst target price)

Market Outlook

While Siemens’ revenue may face some pressure due to challenges in the Digital Industries division, the Smart Infrastructure division remains strong. The company’s commitment to technological innovation, including its AI-powered Industrial Copilot and the SIMATIC ET 200SP e-Starter, underscores its focus on enhancing productivity and efficiency in industrial automation. The Q4 results will offer insights into Siemens’ resilience amid headwinds, and investors will be keen to see how these innovations support future growth.

Siemens AG stock is showing strength, trading near its 52-week highs. The overall trend remains bullish, supported by multiple technical indicators and the stock's position relative to its moving averages.

Key levels to watch:

A break above €190.96 could signal further upside potential, possibly testing the psychological level of €200.00.

If the stock falls below €177.22, it might test the support levels at €176.06 or lower.

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom