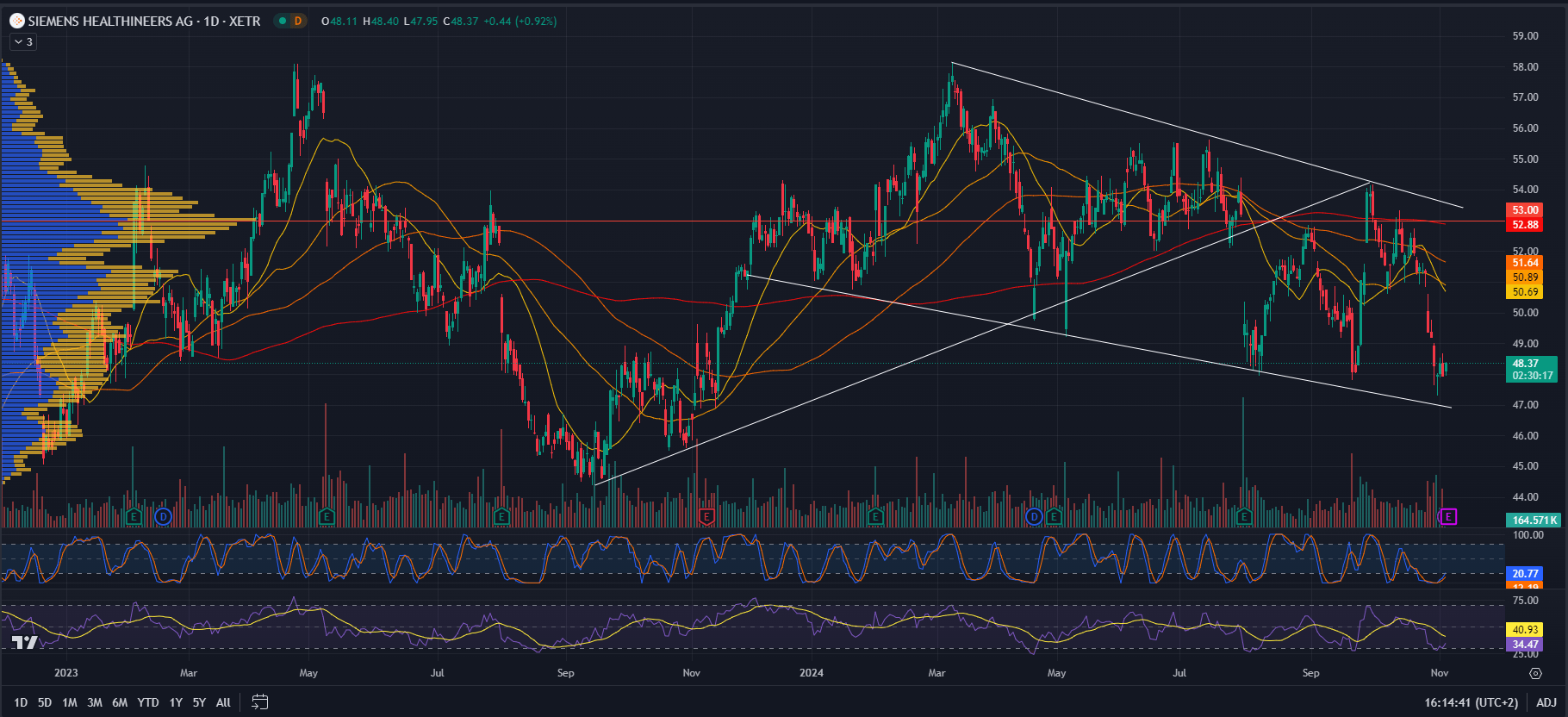

Siemens Healthineers Q3 2024 Earnings Preview

Earnings Release Date: Wednesday, November 6, 2024 (Before Market Open)

Expected EPS: €0.65 (up from €0.52 in the previous quarter)

Expected Revenue: €6.33 billion (up from €5.42 billion in the previous quarter)

Siemens Healthineers (XETRA: SHL) is set to release its Q3 2024 earnings report, with analysts expecting a strong quarter. Earnings per share (EPS) are forecasted to reach €0.65, an increase from the €0.52 reported in the previous quarter. Revenues are expected to come in at €6.33 billion, also higher than the €5.42 billion posted in Q2. Over the past 12 months, Siemens Healthineers’ stock price has gained 4.64%, supported by robust earnings performance.

Recent Performance and Growth Prospects

Siemens Healthineers has shown impressive earnings growth over recent quarters, often meeting or slightly exceeding analyst expectations. In the last year, the company grew EPS by 16%, with earnings rising 5.3% from three years ago, largely due to strong growth in the last 12 months. Looking forward, analysts anticipate Siemens Healthineers’ EPS to grow by 19% annually over the next three years, outpacing the broader market’s expected growth of 15% per year.

Valuation and Market Sentiment

The company’s P/E ratio reflects high investor expectations for future growth. With Siemens Healthineers forecasted to perform better than the broader market, shareholders are holding onto shares, anticipating a more prosperous future. However, the high P/E means the stock is priced for continued strong growth, which could cause concern among shareholders if the company’s earnings growth slows.

UBS Downgrade and Market Challenges

Siemens Healthineers was recently downgraded by UBS from a “buy” to a “neutral” rating due to concerns about medium-term growth prospects, particularly in the Chinese market. While Siemens Healthineers has historically been successful in China, new competition from domestic players such as United Imaging and Mindray is creating headwinds.

UBS analysts expect China’s healthcare market growth to slow, forecasting a flat performance in Q1 2025 and only 5-10% growth thereafter, even with anticipated economic stimulus in the region. This outlook contrasts with more optimistic market projections and poses a challenge for Siemens Healthineers, which relies heavily on imaging technology sales in China as a growth driver.

Conclusion

Siemens Healthineers is expected to deliver solid earnings growth for Q3 2024, with a strong performance in EPS and revenue. However, challenges in the Chinese market and increased competition could affect the company’s medium-term outlook. Investors will closely watch this earnings report to gauge whether the company can sustain its momentum amid rising competitive pressures.

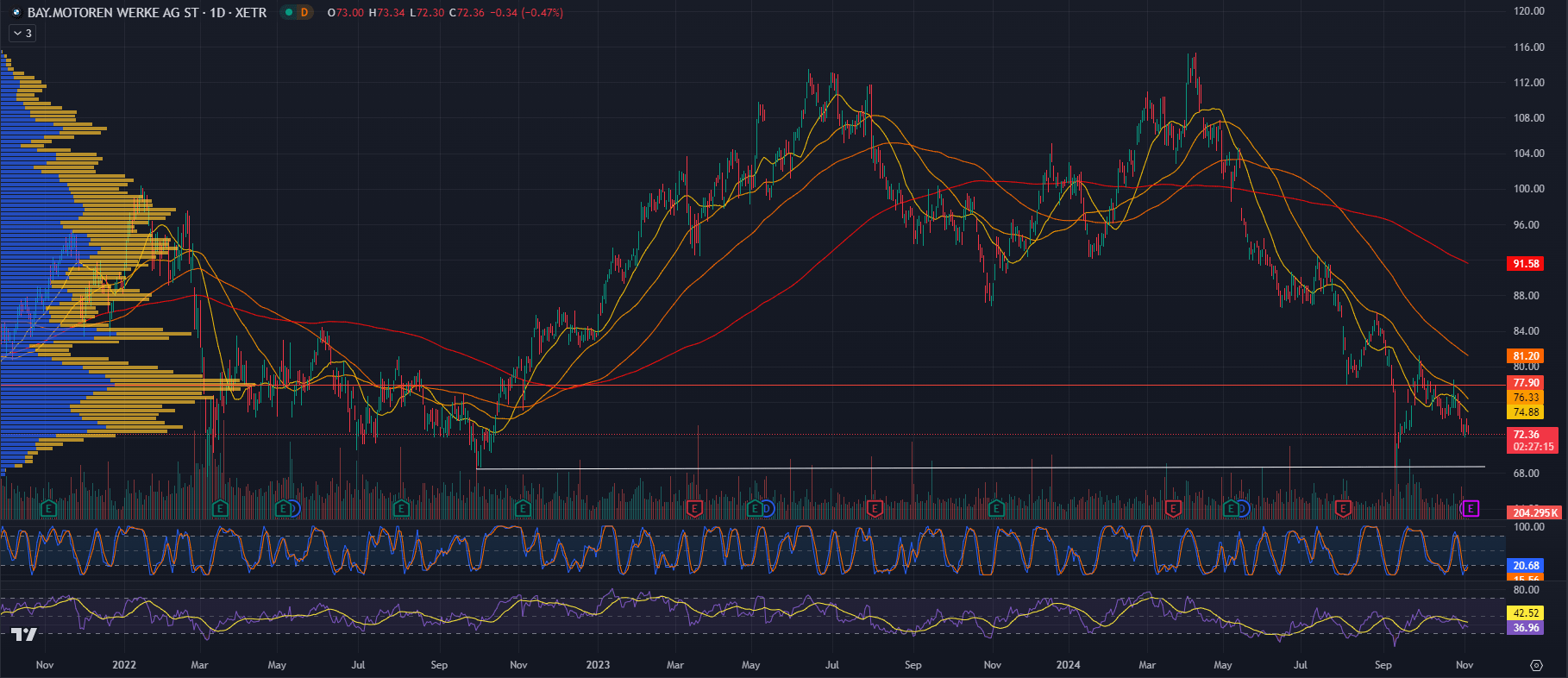

BMW Q3 2024 Earnings Preview

Earnings Release Date: November 6, 2024

Expected EPS: €1.37 (down from €4.20 last year, -67.38%)

Expected Revenue: €33.54 billion (down from €38.46 billion last year)

BMW AG is set to release its Q3 2024 earnings on November 6. Analysts are forecasting a substantial decline in earnings per share (EPS) to €1.37, a 67.38% drop from €4.20 in Q3 2023. Revenue is also expected to decrease from €38.46 billion to €33.54 billion. In the last eight earnings releases, BMW has alternately exceeded and missed expectations, but this report is likely to reveal a significant downturn in EPS and revenue.

Revenue Breakdown

BMW’s revenue is primarily generated from three segments:

- Automotive: €132.39 billion

- Motorcycles: €3.15 billion

- Financial Services: €37.87 billion

Negative Factors

- Stock Performance and Market Pressure

BMW has lost 28% year-to-date, whereas the DAX has gained 15% in the same period. This disparity reflects the challenges BMW is facing and the market’s concerns about its performance. - Decline in Growth Projections

BMW’s compound annual growth rate (CAGR) in net income was 7% over the past eight years, but projections for the next three years are negative, with a -5% CAGR for net income and a -12% CAGR for operating income. - Declining Free Cash Flow

Over the last four quarters, BMW has seen a reduction in free cash flow, which could impact its ability to fund operations, dividends, and new investments. - Vehicle Recalls

BMW recently announced a recall of over 390,000 vehicles due to faulty airbags. The financial impact of these recalls could further weigh on its profitability and bottom line.

Positive Factors

- High Dividend Yield

BMW currently offers a dividend yield of 8.26%, making it attractive for income-focused investors. However, given the financial pressures, management may consider reducing the dividend in the near term to preserve cash. - Strong Balance Sheet

BMW holds €259.1 billion in assets against €168.8 billion in liabilities, providing it with sufficient resources to cover liabilities and maintain financial stability. This solid balance sheet should help BMW manage its financial commitments despite recent challenges.

Conclusion

BMW’s Q3 2024 earnings report is expected to reveal significant declines in earnings and revenue, reflecting ongoing difficulties in both its operational and financial performance. The anticipated EPS drop, declining free cash flow, and recent vehicle recalls underscore the challenges BMW faces. While the high dividend yield and strong balance sheet offer some stability, the projected declines in income growth suggest that BMW may face continued pressure in the near term. Investors should closely monitor this earnings report for further insights into BMW’s ability to navigate these challenges and any strategic responses from management.