US index futures showed some slight gains this morning as traders geared up for another round of US inflation data (PPI) and awaited the European Central Bank’s rate decision later due shortly. Undoubtedly, some traders will be questioning whether Wednesday’s strong tech-driven rally will see further follow-through. While there’s been some continuation to the upside, any hint of fading momentum could put the bulls back on shaky ground. After all, clear bullish catalysts seem few and far between at the moment. The S&P 500 forecast could yet turn bearish, if we now see another twist in price action.

Why stocks may struggle to sustain Wednesday’s bounce

After Wednesday's impressive tech-driven rally, there’s a question of whether we’ll see any real momentum carry over. The major indices managed a solid recovery from their initial dip post-CPI data, which largely met expectations, though core inflation was slightly hotter than anticipated. Some believe Kamala Harris’ strong debate performance the night before helped lift sentiment, while short-covering likely played a role too, with USD/JPY bouncing back as traders dialled down expectations of an outsized Fed rate cut.

However, with the Bank of Japan turning hawkish just as the Fed seems poised to cut rates, this could keep pressure on USD/JPY, potentially sparking further unwinding of carry trades. So, despite Wednesday's rally, the stock market may still face some challenges. September is typically a difficult month for equities, and this year could be no different, with few bullish catalysts in sight to sustain upward momentum. Additionally, growing concerns about a weakening global economy have already hit commodities like crude oil and copper hard, alongside Chinese equities. On top of that, the upcoming US presidential elections introduce more uncertainty, making investors more cautious about jumping into market rallies.

S&P 500 forecast: technical analysis and trade ideas

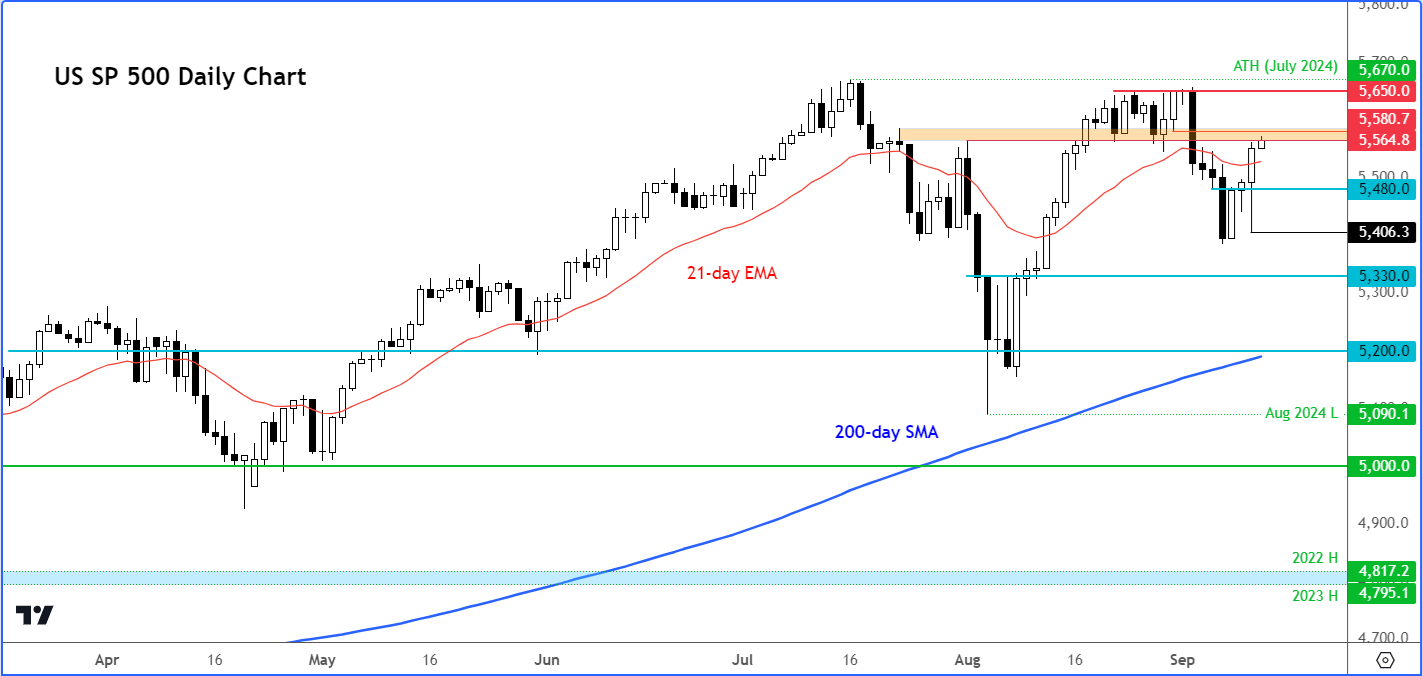

It's all about follow-through at this point, a crucial element that's been lacking since the S&P peaked in July. The recent lower highs means there is a risk that we might be in a broader bearish trend, although confirmation is needed given that we are not very far from that record high now.

Source: TradingView.com

For bullish traders, the key now is to see a higher high and a decisive break above the next potential resistance around the 5650 area. Ahead of that target, the S&P 500 is currently inside a massive pivotal area between 5565 to 5580 (shaded in orange colour on the chart). This area was formerly support before it gave way earlier this month. So, as a minimum, I would want to see the index close above this area today to provide an indication that Wednesday’s rally was not just a short-squeeze bounce.

Now, what about the bears?

For bearish traders, they're on the lookout for any signs of another bull trap. For example, if the S&P 500 fail to stay above Wednesday’s high, we could see a drop back to the support levels near 5,500 or 5480 even. A strong bearish signal would emerge if the index falls below Wednesday’s low of 5406. Should that happen, it would indicate a failure for the bulls, potentially triggering a deeper downside move. This could lead the index to head down to its 200-day average around 5200 and even towards the August lows. But that’s a bridge to cross later. For now, the bears need to push the index below Wednesday’s low of 5406 to spark a major reversal.

Whether you're bullish or bearish, managing risk is essential, especially in today’s volatile market environment. With election uncertainties and economic concerns, volatility is likely to stay high. Traders will want to stay nimble in the weeks ahead as the S&P 500 forecast could easily change.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R