S&P 500 forecast: The US stock market has shown impressive resilience following the recent volatility. Investors, thrilled by the Federal Reserve’s outsized rate cut, have pushed index futures higher. However, there are mixed opinions about what lies ahead. For now, it looks the S&P 500 will open at a fresh record high.

Fed’s Rate Cut and Its Impact on Markets

The Federal Reserve’s decision to deliver a 50-basis point rate cut was largely welcomed by investors. The move was seen as a bold but necessary step to ease economic concerns without sending panic signals reminiscent of the 2008 financial crisis. Fed Chair Jerome Powell emphasised that the cuts are not part of a long-term strategy but rather a proactive measure aimed at stabilising growth, now that inflation appears to be on the path of returning to its target.

Markets initially sold off but quickly rebounded, with S&P 500 futures suggesting a potential new record high is on the horizon at the cash open today. The Dot Plot projection also boosted investor confidence, showing a possible 50 basis points of cuts this year and 100 next year, with the terminal rate expected to hit 3.0% by 2026. But what now?

Can the S&P 500 Rally Continue?

With the S&P 500 up nearly 19% year-to-date, investors are wondering if the rally can be sustained. On the surface, it appears that market sentiment is bullish, bolstered by the Fed’s actions and a series of robust earnings reports. Yet, looming risks, such as global economic slowdown in the Eurozone and China, may challenge this optimism. Moreover, seasonal trends indicate that September is typically a tough month for equities, adding a potential headwind to the current rally – although so far this hasn’t held investors back. With the US presidential election approaching, market volatility could spike, leaving investors hesitant to dive into new rallies without a clear trend.

S&P 500 forecast: Technical Analysis and Key Levels to Watch

Source: TradingView.com

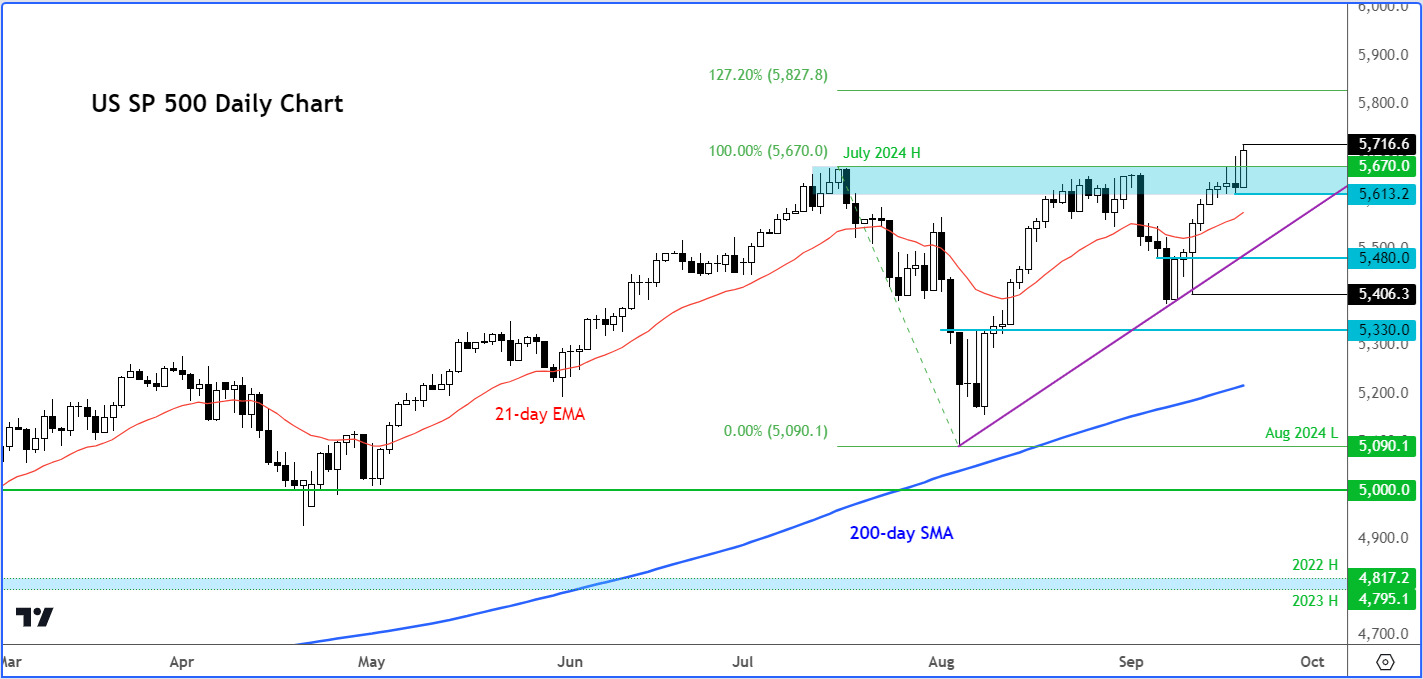

Despite some volatility after the Fed’s rate cut, the S&P 500’s bullish trend remains intact. Traders should keep an eye on the support range between 5613 and 5670, with the upper end of this range marking the high from July. As long as the index holds above this support area, the short-term path of least resistance will remain upwards, potentially keeping the market on course to head towards 5800 or even the 127.2% Fibonacci extension level of 5827, derived from the drop in July.

However, a dip below 5613 would signal a shift towards bearish sentiment, potentially pushing the index down to its next support and short-term trendline around the 5480-5500 area.

Bearish Risks and Market Sentiment

While the bulls are currently in control, bearish traders are watching for signs of a reversal. A drop below recent lows, as suggested above, could signal the end of the short-term bullish bias, reminiscent of the July sell-off when overbought conditions led to a sharp decline. Then, the signal came in the form of a bearish engulfing candle on 17 July. Bearish traders need to wait for a similar confirmation before making any significant moves, given the overall bullish structure of this market.

Risk Management in a Volatile Market

Regardless of whether you're bullish or bearish, managing risk is critical in today's market. With heightened uncertainty surrounding the economy and upcoming elections, volatility is expected to remain high. Traders should stay nimble and be prepared for sudden shifts in the market’s direction.

In conclusion, while the S&P 500 forecast remains cautiously optimistic, several factors could derail the current rally. Staying informed and agile will be essential for navigating the coming weeks. We will, of course, highlight any major shifts in the trends, if observed. Stay tuned.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R