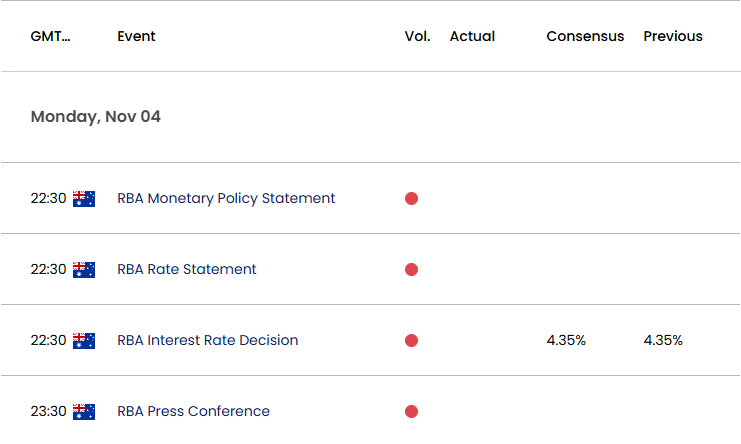

Reserve Bank of Australia (RBA) Interest Rate Decision

The Reserve Bank of Australia (RBA) stuck to the sidelines for the seventh consecutive meeting, with the central bank keeping the cash rate at 4.35%.

Australia Economic Calendar – September 24, 2024

The RBA stuck to the same script from its last meeting as officials acknowledged that ‘inflation has fallen substantially since the peak in 2022,’ with the central bank reiterating that ‘inflation is still some way above the midpoint of the 2–3 per cent target range.’

As a result, the RBA warns that ‘our current forecasts do not see inflation returning sustainably to target until 2026,’ and Governor Michele Bullock and Co. may keep Australia interest rates on hold throughout the remainder of the year as ‘sustainably returning inflation to target within a reasonable timeframe remains the Board’s highest priority.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

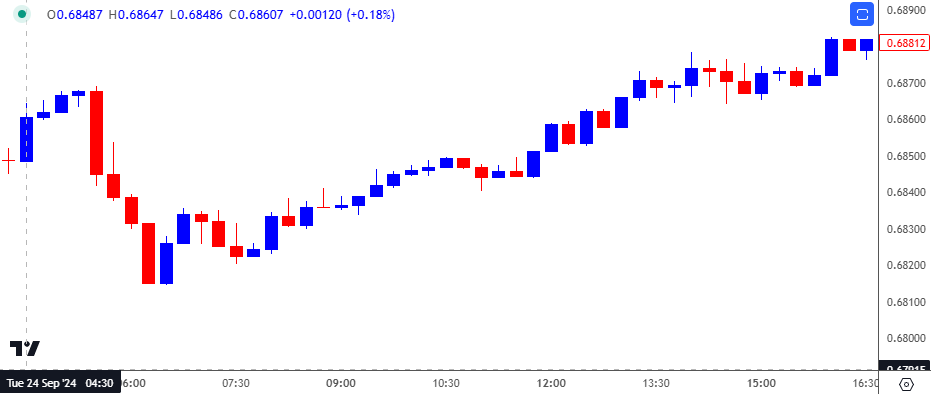

AUD/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

AUD/USD came under pressure following the RBA rate decision as Governor Bullock revealed that ‘we didn’t explicitly consider an interest rate rise’ while speaking at the press conference, but the reaction was short lived as the exchange rate closed the day at 0.6892. AUD/USD defended the advance following the RBA meeting to end the week at 0.6902.

Looking ahead, the RBA is expected to keep the cash rate at 4.35% for eight straight meetings, and the central bank may continue to tame speculation for lower interest rates as the board continues to combat inflation.

With that said, more of the same from the RBA may generate a bullish reaction in AUD/USD as the central bank remains reluctant to switch gears, but a material change in the forward guidance for monetary policy may drag on the Australian Dollar as market participants prepare lower interest rates.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

Euro Forecast: EUR/USD Recovery Persists Ahead of Euro Area CPI Report

British Pound Outlook: GBP/USD Recovery Emerges Ahead of UK Budget

USD/JPY Forecast: RSI Continues to Flirt with Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong