- NZ activity sluggish despite rate cuts, soft surveys remain recessionary

- Markets, economists favour 50bps RBNZ cut, 75bps looks underpriced

- Cash rate 175bps above neutral, according to RBNZ estimates

- Path of least regret may be to front-load cuts with 84-day break between meetings

- NZD/USD driven by US rates, not domestic outlook

RBNZ November preview

New Zealand's economic activity shows little sign of recovery despite significantly lower interest rates, with many sentiment surveys still languishing in recessionary territory. For the Reserve Bank of New Zealand (RBNZ), this underscores the urgent need for much less restrictive monetary policy.

With inflation expectations anchored around the midpoint of its 1–3% target range and with projections for another 175 basis points of rate cuts this cycle, the board may be tempted to cut by more than 50 basis points with an 84-day gap between its November and February meetings. A truly jumbo cut next Wednesday could be the path of least regret to stimulate the economy over summer.

Go big before summer break?

The risk of a 75-basis-point cut looks underpriced ahead of next week’s RBNZ meeting, particularly given the bank's history of surprising markets under Governor Adrian "shock and" Orr.

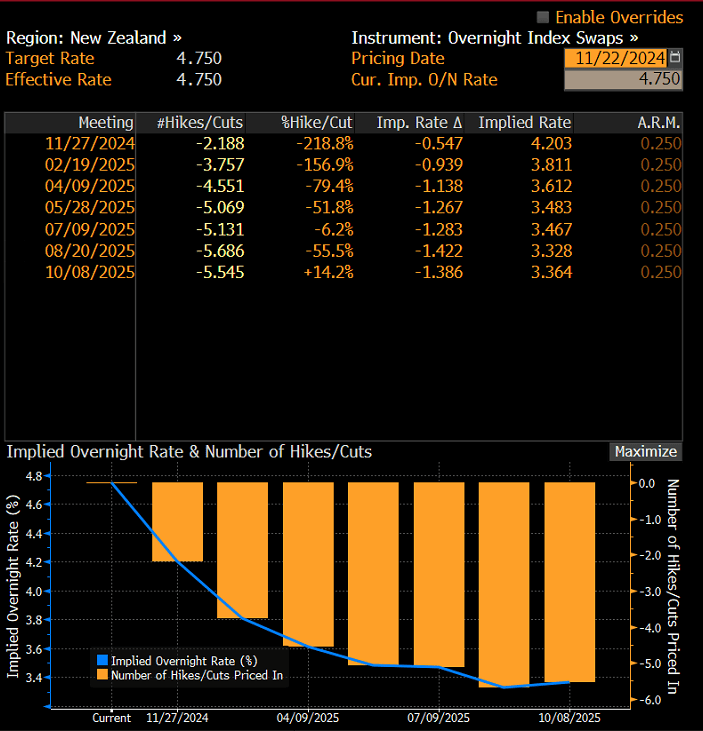

Heading into next week’s rate decision, a follow up 50-point move is favoured. Swaps markets put the probability at a little over 80%, with an even larger 75 the rank outsider at less than 20%. Economists are also backing a 50, with 27 of 30 surveyed by Reuters expecting a reduction to 4.25%.

Source: Bloomberg

Path of least regret

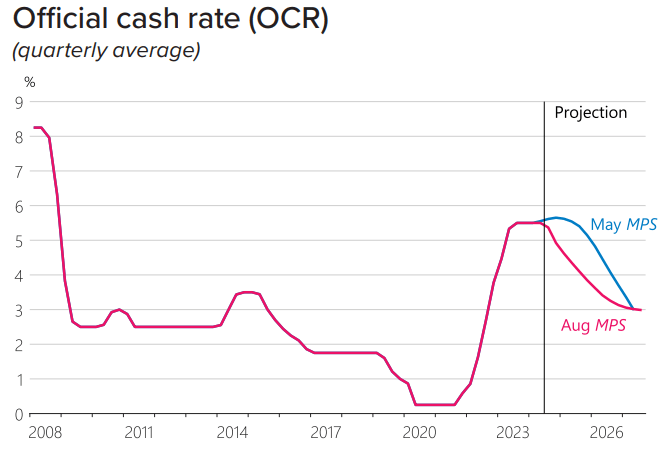

Caution around larger cuts is understandable, especially after the RBNZ moved from 25 to 50-basis-point reductions in September. It could amplify economic concerns further. However, the risk of hesitation when policy is clearly too restrictive outweighs concerns over market perceptions. Based on its own forecasts, the RBNZ sees the neutral cash rate – where its neither restrictive nor stimulatory for the inflation outlook – at 3%, which it expects to reach by late next year or early 2026.

Source: RBNZ

With the current rate 175 basis points above neutral, why not front-load cuts to speed up the transition? Even a 75-basis-point cut next week would leave policy a full percentage point above the estimated neutral rate, maintaining a degree of restraint and mitigating the risk of inflation reigniting.

And let’s be honest, New Zealand activity data suggests the threat of demand-driven inflation is close to non-existent.

Assessing inflation reacceleration threat

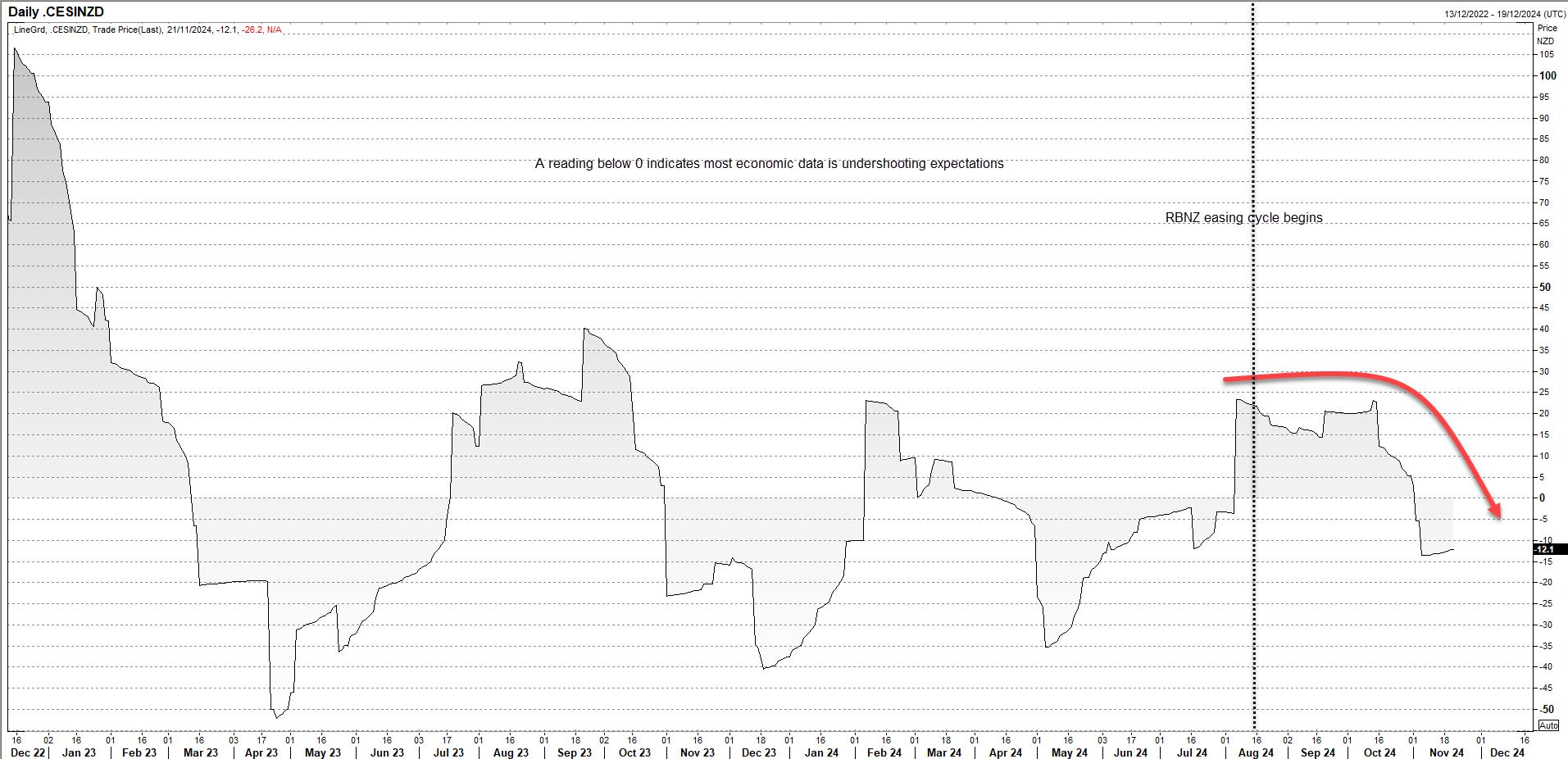

Citi's Economic Surprise Index remains negative, showing data consistently underperforming expectations nearly three months into the easing cycle. While monetary policy operates with lags, the persistence of dire soft sentiment indicators is troubling.

Source: Refinitiv

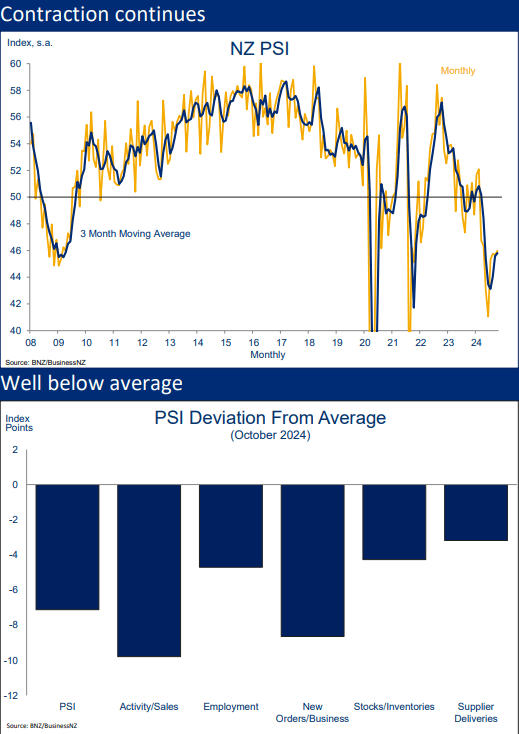

The BNZ Performance of Services Index (PSI) released this week hit 46.0 in October, indicating contracting activity. It’s a level comparable to the depths of the Global Financial Crisis and has shown minimal improvement since the RBNZ began cutting rates. Leading indicators like sales and new orders remain far below historical averages. Where does the inflation threat come from given that outlook? Not the domestic economy the RBNZ can influence.

Source: BNZ

It makes the case for a bold move compelling, especially given the long gap between decisions. A 75-point cut looks mispriced at less than 20% probability, in my view, with risk-reward dynamics favouring positioning for such an outcome.

Domestic rates outlook not driving NZD/USD

Before we look at the technical picture for NZD/USD, it’s worthwhile addressing a concern often heard whenever big policy moves are being contemplated: that lower rates will lead to investors fleeing the Kiwi.

The analysis below disputes that, at least based on what’s been happening recently. While there’s little doubt a 75-point move would likely lead to kneejerk shunt lower for NZD/USD, beyond the short-term, it’s the US bond curve you should be interested in.

Source: Trading View

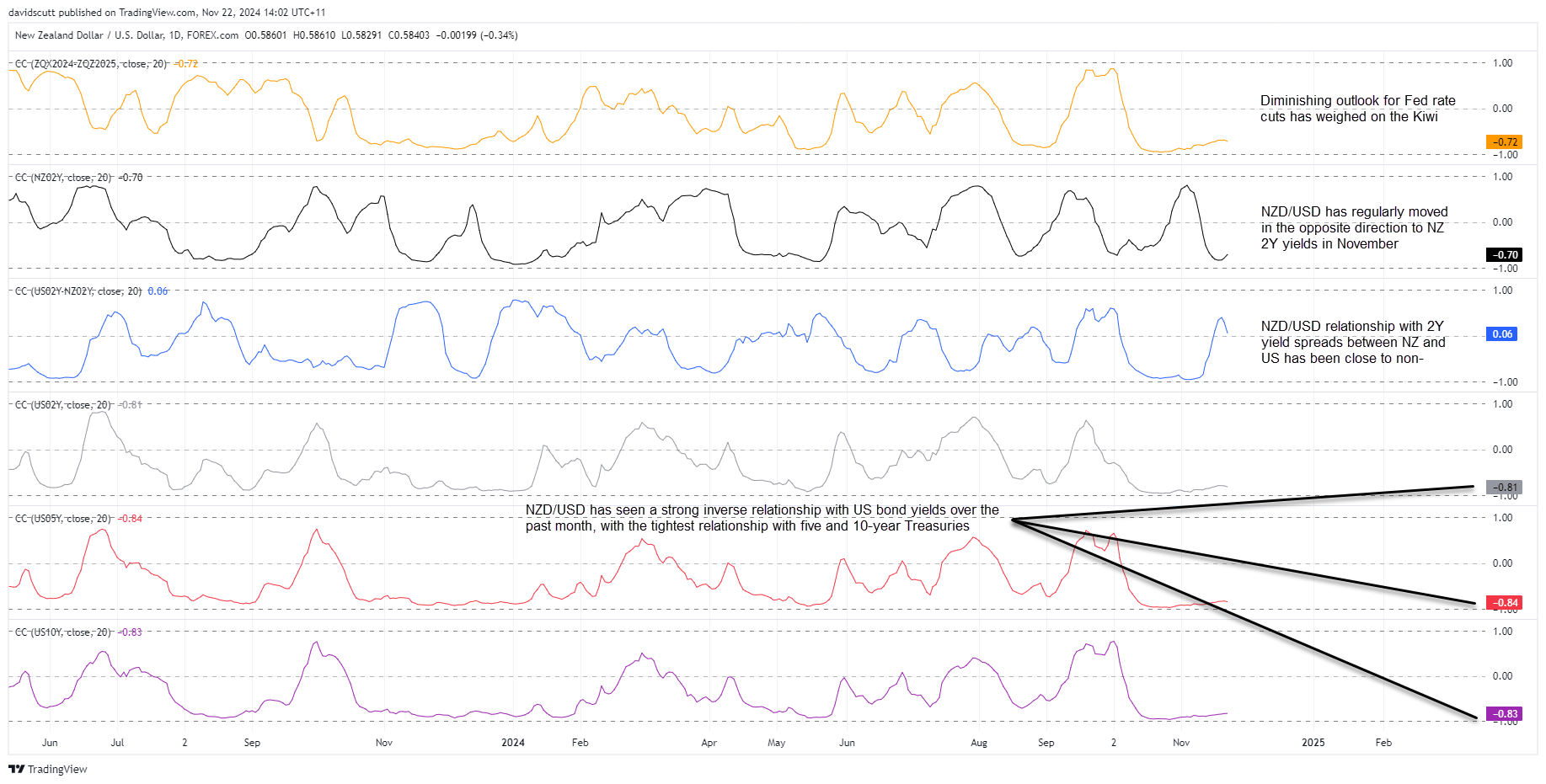

Over the past month, NZD/USD has had the strongest relationship with US bond yields between five and 10-years. The Kiwi has often moved in the opposite direction to US yields over this period. The inverse relationship has also been strong with US two-year yields, albeit marginally weaker.

Tellingly, the correlation with New Zealand two-year yields is moderately negative, suggesting the Kiwi has tended to push higher when domestic rates have fallen. Tell me again that lower rates will lead to a Kiwi massacre?

Just to reinforce the point, the relationship between US and New Zealand two-year yield spreads has essentially been zero in November. It’s US rates driving the bird.

NZD/USD technical picture

Source: Trading View

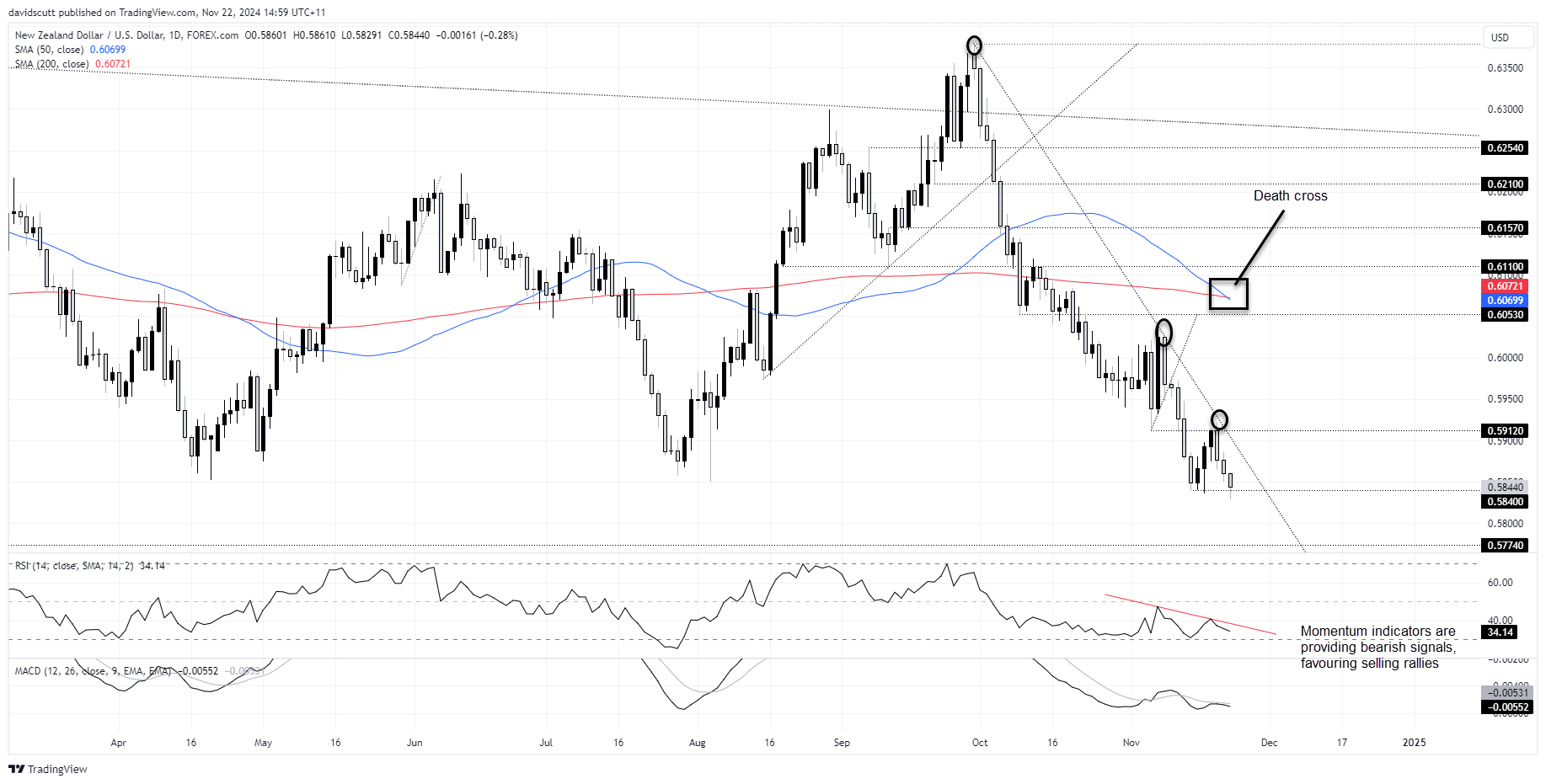

NZD/USD looks heavy on the charts, hitting fresh 2024 lows earlier in today’s session. With the price in a downtrend, mirroring momentum indicators such as RSI (14) and MACD, it’s an obvious sell-on-rallies play. Symbolically, the 50-day moving average has crossed its 200-day equivalent from above, delivering what’s known as a “death cross”. I don’t tend to put much weight on such occurrences, but it’s probably appropriate.

Near-term, buying has been evident below .5840, making that the first downside level of note. Beyond, .5774 and .5600 should be on the radar, coinciding with market bottoms of prior years. If the Kiwi were to break the downtrend its trading in, which appears unlikely near-term, .5912 and .6053 are levels of potential resistance.

-- Written by David Scutt

Follow David on Twitter @scutty