The big event of the day will probably be a speech by Fed Chairman Jerome Powell, which will come after the Fed slashed rates last week. Investors will be observing any cues as to what the Fed might do next. In the meanwhile, a 25 basis point rate reduction is anticipated from the Swiss National Bank. Today's schedule also includes Costco earnings, pending home sales, durable goods orders, and weekly jobless claims!

GfK consumer confidence

The GfK Consumer Climate Indicator for Germany increased from a slightly revised -21.9 in the prior period to -21.2 as we enter into October 2024. The most recent data exceeded market estimates of -22.4, primarily due to rises in the willingness to purchase by the consumer (-6.9 recent vs. -10.9 last month) and income expectations (10.1 recent vs. 3.5 in September). In the meanwhile, the desire to save rose even more, while economic outlook fell for the second consecutive month (0.7 versus 2.0). According to Rolf Bürkl, a NIM consumer expert, "the slight improvement in the consumer climate can be interpreted as stabilization at a low level, but is not the beginning of a noticeable recovery."

This could be due to a number of factors, including growing unemployment, rising prices, an increase in corporate bankruptcies, and probable job losses across numerous industries, are contributing to the fragile consumer attitude that exists today. However, could change soon. The DAX has been propelled by the news, and is now at all time highs, due to the anticipation of an increase in economic activity in consumers.

Powell Speech

Chairman of the Federal Reserve Jerome Powell is expected to give a speech later today, and both experts and investors will be paying close attention. Markets are searching for hints regarding the central bank's next moves, currently the bond market expected another 50 bp cut which traders might be wanting to find clues on in today’s speech. Inflationary pressures have slightly subsided but are still over the Fed's target making this a double-edged sword.

Among other recent economic indicators, the US labor market and inflation numbers have conveyed contradictory signals. Powell may reiterate the Fed's ongoing dependence on "data," implying that the Fed will make rate decisions only after considering upcoming economic data. Powell's focus on caution may be interpreted by the markets as a signal that rates would remain high for an extended length of time.

Powell's tone in today's speech might have a big impact on market movements. Equities may rise in response to a dovish tone, or a greater chance of a rate decrease, particularly in rate-sensitive industries like real estate and technology. On the other hand, a pessimistic tone and therefore a hint to leave rates higher for longer can cause decreases in those same industries.

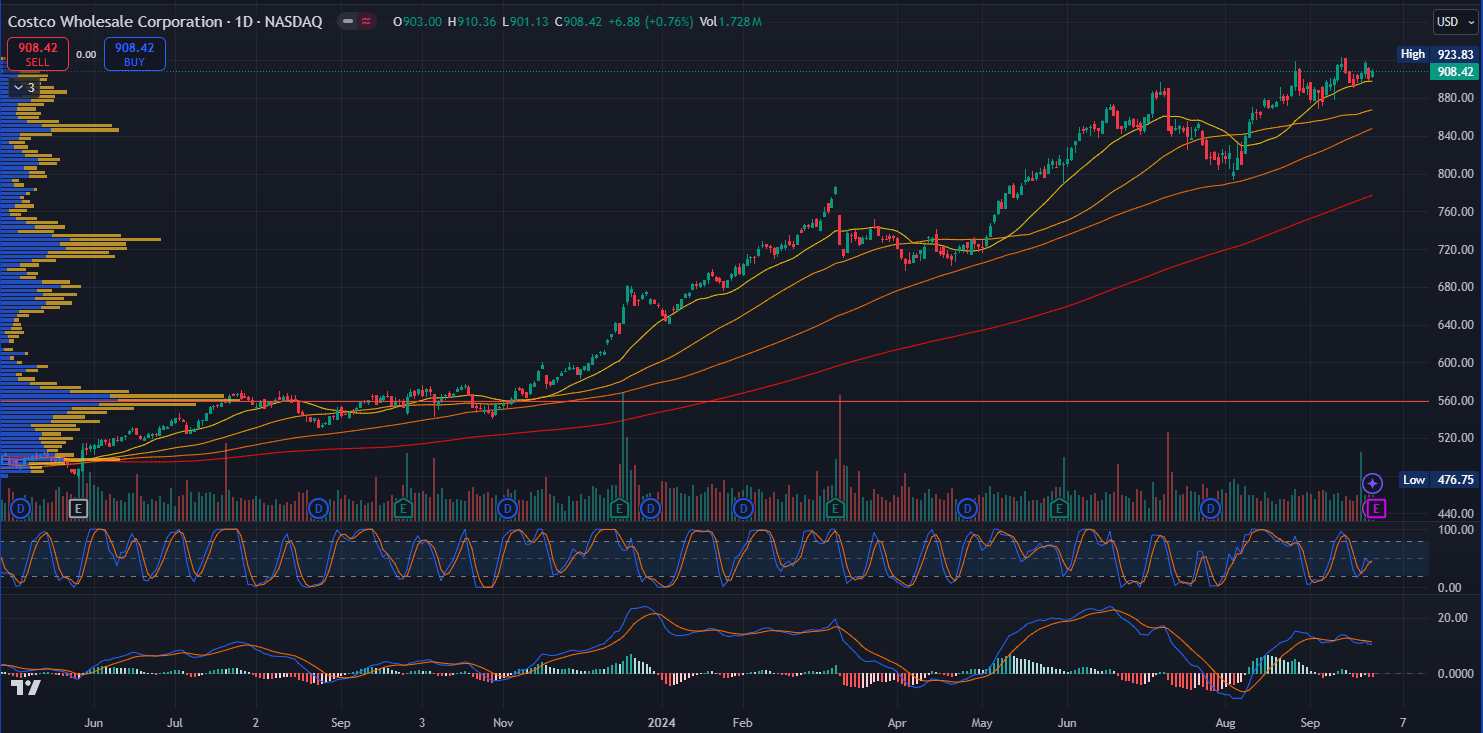

US: Costco (Q4 Earnings)

After reporting earnings-per-share (EPS) of $3.78 on $58.52 billion in revenue just a quarter ago, Costco is predicted to produce EPS of $5.08 on $80.03 billion in revenue this quarter. In addition to declaring a $1.16 dividend in July, Costco also revealed an increase in membership costs.