Upcoming OPEC Monthly Report: What to Expect on August 12, 2024

The Organization of the Petroleum Exporting Countries (OPEC) is set to release its highly anticipated monthly report on August 12, 2024. This report is a crucial document for traders and analysts in the energy sector as it provides comprehensive data on oil production, demand forecasts, and inventory levels among member countries. It serves as a key indicator of market trends and potential shifts in oil prices, influencing trading strategies and investment decisions globally.

Recap of the Last OPEC Monthly Report

The July 2024 OPEC Monthly Report revealed a modest increase in oil production among member countries, with total output rising by 200,000 barrels per day. The report also noted stronger-than-expected global oil demand, particularly in Asia, which helped counterbalance concerns about slower economic growth in other regions. This news positively impacted the market, resulting in a slight increase in oil prices as traders gained confidence in sustained demand and managed supply levels.

We should approach the recent developments in crude oil markets with a degree of caution. While North Sea Dated and WTI values showed some recovery in late June, it's important to recognize that this upturn may not necessarily indicate a stable trend. The improvement, primarily driven by strong purchasing activities and improved market sentiment, could be temporary.

It's worth noting that despite these positive signs in the physical crude market, the gains in spot prices were held back by volatile futures markets. This volatility suggests underlying uncertainties that we shouldn't overlook. The selling pressure faced by ICE Brent and NYMEX WTI futures in early June is a reminder of how quickly market dynamics can shift.

We should also be wary of the mixed signals from U.S. crude stocks and refining margins. The increase in stocks and drop in margins, particularly for gasoline, could potentially limit further upward movement in light sweet spot benchmarks.

The situation in the East of Suez market adds another layer of complexity. The downward pressure on medium sour crude due to increased availability in the spot market serves as a reminder that different segments of the oil market can move in opposing directions.

While some price increases were observed on a monthly average, with North Sea Dated and WTI's first month rising slightly, we must remember that Dubai's first month actually decreased. This divergence underscores the need for a careful, nuanced approach when interpreting these market movements.

In conclusion, while there are some positive indicators, we should remain vigilant and avoid drawing overly optimistic conclusions from these complex and potentially volatile market conditions.

The upcoming OPEC report is anticipated to address these challenges and provide updated projections. Key areas of focus include:

1. The organization's strategy to maintain price stability while adapting to evolving global energy trends.

2. Updated production and demand forecasts in light of recent disruptions and technological advancements.

3. Potential measures to mitigate market volatility and preserve OPEC's market share.

4. The growing focus on renewable energy and climate change mitigation efforts may also factor into OPEC's long-term production planning and market outlook.

5. Additionally, non-OPEC producers, particularly U. S. shale oil companies, may react to OPEC's decisions by adjusting their own production levels, further complicating the global supply-demand balance. The interplay between OPEC's actions and the response of non-OPEC producers could have lasting effects on oil prices and energy markets worldwide.

Caution that an inadequate response to these changing dynamics could result in increased oil price volatility and potential erosion of market share for OPEC members.

Analyst Expectations for the Upcoming Report

The 2024 global oil demand growth forecast stands firm at 2.2 mb/d, with no changes from last month's assessment. OECD oil demand will increase by 0.2 mb/d, while non-OECD demand will surge by 2.1 mb/d. For 2025, we project a strong global oil demand growth of 1.8 mb/d year-on-year, maintaining our previous forecast. OECD oil demand will rise by 0.1 mb/d, and non-OECD demand will expand significantly by 1.7 mb/d. These figures clearly demonstrate the continued strength and resilience of the global oil market, with non-OECD countries driving the majority of growth in both years.

Analysts have varied expectations for the upcoming OPEC report. Some anticipate a further increase in production as member countries respond to higher global demand, especially during the summer driving season.

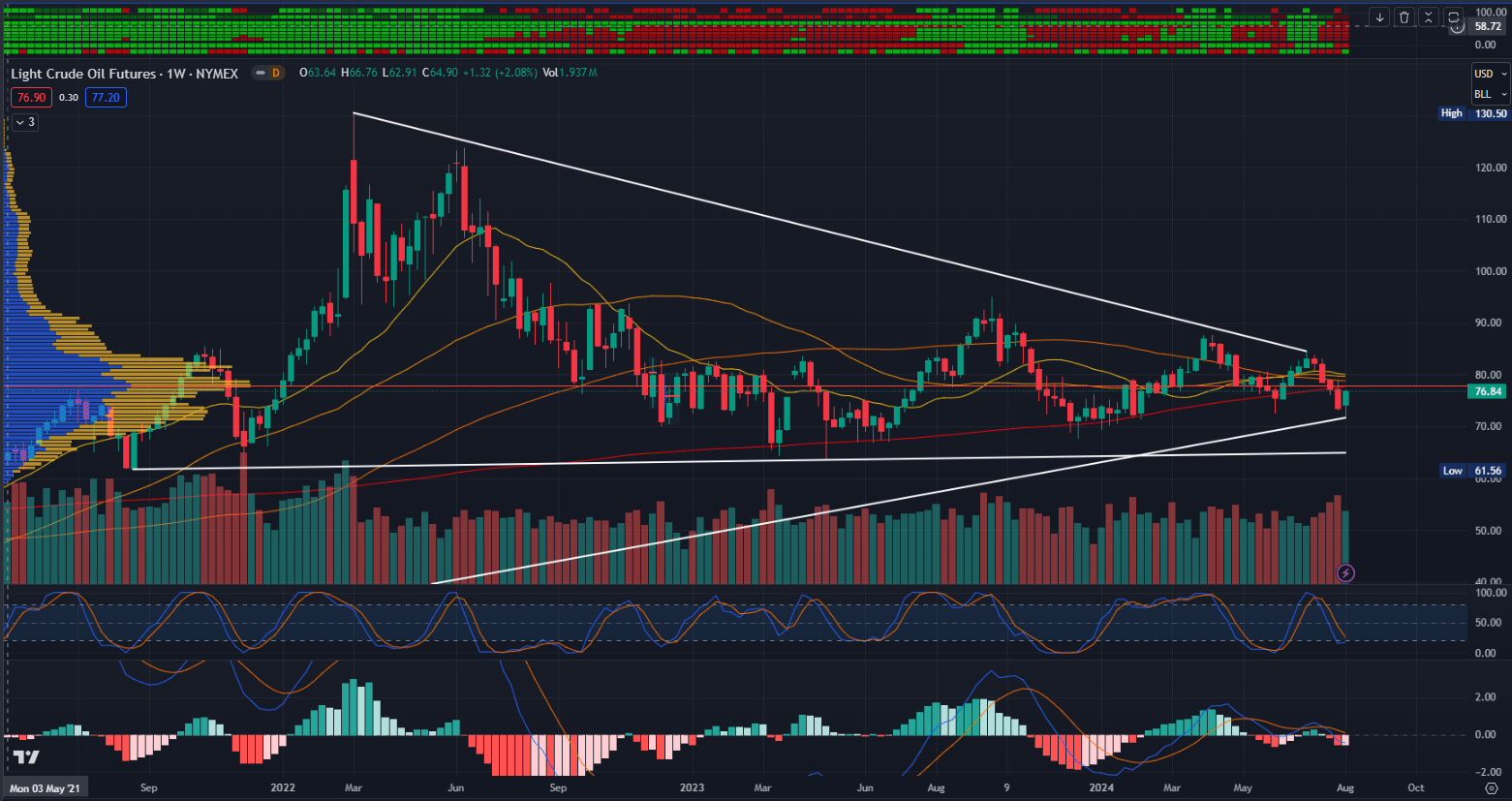

Crude Oil Technical analysis

Timeframe: Weekly

Exchange: NYMEX - forex.com

Chart Elements

- Price: $76.84

- Support Levels: $61.56, $70.00

- Resistance Levels: $130.50, $107.00, $90.00

- Indicators: Stochastic Oscillator, MACD, Volume Profile

- Moving Averages: 50-week MA, 100-week MA, 200-week MA

Analysis

The price movement is currently constrained within a symmetrical triangle pattern, with the upper boundary acting as resistance around $81.00 and the lower boundary acting as support around $70.00. The stochastic oscillator indicates a potential oversold condition, given that it hovers near the 20 level, signaling potential buying interest. The MACD shows decreasing momentum with a bearish crossover. However, being close to the middle line and the bearish volume being less than last week, seen by the red/white candle, could show a potential reversal, which falls in line with the forming RSI crossover at oversold levels.

The price has recently bounced off the $70.00 support level and is currently trading near the 100-week moving average, setting a potential higher low compared to previous dips. This suggests cautious optimism for a bullish reversal, although significant resistance looms ahead.

The lower level around 71 is the downside support for this moment, and a break above the 200 EMA level could give the confirmation for a move higher.