We have most big companies having reported earnings already and now NVDA is the last of big Tech to report for this quarter.

All in all, the first quarter was completed on a positive note for tech and now we wait for NVIDIA to see how the NASDAQ will perform.

Meanwhile, both the S&P and NASDAQ finished yesterdays at another record high.

All in all, the first quarter was completed on a positive note for tech and now we wait for NVIDIA to see how the NASDAQ will perform.

Meanwhile, both the S&P and NASDAQ finished yesterdays at another record high.

International news

After falling below the 39,000 mark, the Nikkei 225 underperformed in the face of conflicting data releases. While trade data was disappointing, machinery orders exceeded expectations and revealed an unexpected M/M expansion.

GBP/USD jumps 37 basis points as UK inflation surprises market watchers, reducing the likelihood of a June BOE cut.

Longer-term higher, the EUR/JPY is still moving up, approaching the 170 mark.

This morning's UK inflation report revealed that April's inflation increased from 3.22 percent to 2.3%.

Corporate news

AstraZeneca revealed plans to enhance its current portfolio and introduce 20 new medications before 2030 in order to reach $80 billion in total revenue by 2030, up from $45.8 billion in 2023. AstraZeneca will keep funding R&D and innovative technology while concentrating on productivity in order to meet this goal and maintain growth past 2030. By 2026 and beyond, the company hopes to produce a core operating margin in the mid-30s percentage range.

Even though Palo Alto Network exceeded Q3 EPS projections, the company's shares fell 9% in aftermarket trading.

Li Auto's shares fell about 13% after the company revealed lower-than-expected Q1 profits.

Zoom's shares remained stable as its sales increased 5.3% year over year, above projections.

Three times as much Bitcoin was bought by Bitcoin ETFs than has been mined in May thus far.

On Monday, OpenAI declared that it was removing the Johansson-sounding ChatGPT voice, one of five available. After being approached by Johansson’s lawyer.

NVIDIA EARNINGS - 22 May 2024

Nvidia's options volatility anticipates an 8% swing in either direction by Friday.

This translates to a $200 billion market value swing, which is greater than the market capitalization of around 90% of S&P 500 companies.

NVIDIA TECH ANALYSIS

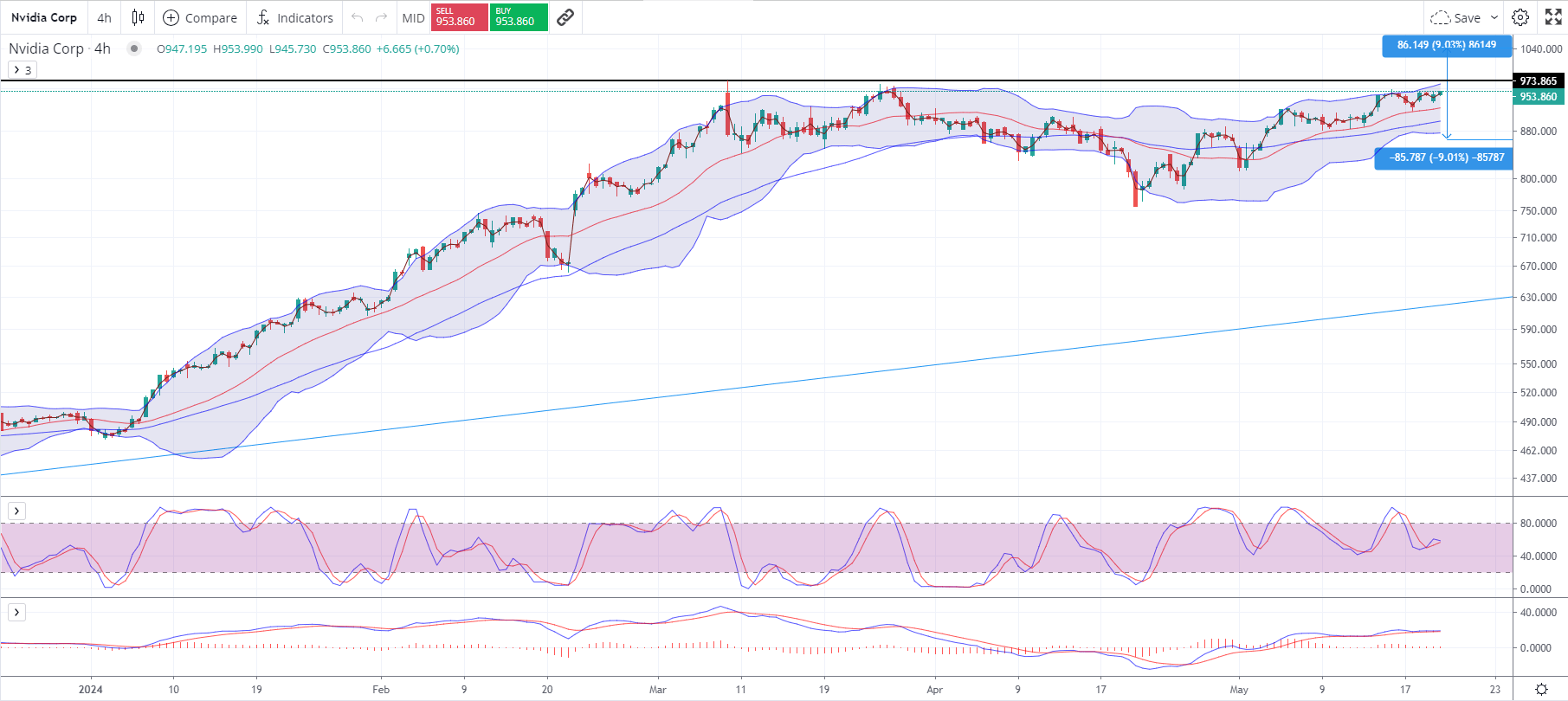

Given the 8% anticipated move by NVIDIA due to earnings, the upside would anticipate a breakthrough of the previous high, reached in the beginning of March. To the upside the move would also imply a move above the 1,000 level. This will not be easy being a strong psychological level as well as uncharted territories. The downwards move would coincide exactly with the 50EMA level acting as support around the 880 level, which is also the previous top reached on the 30th of April.

On the 4H chart, the Stochastic RSI shows that buyers have been hovering around the overbought territories implying constant buying pressure. While the MACD has also sloped upwards from negative territories and remains in an elevated state. Sometimes technical analysis can give us an edge; however the market will react sometimes even “irrationally”. Meaning, perhaps the price is already priced in, or even if NVDA beats expectations but not by a lot, this could leave investors possibility unexcited, and causing a selloff in the progress having hoped for more. Everything is on the cards today, however one thing is sure, to move a Trillion-dollar company, Billions are required.

Trade smart,

Philip P