Where are the numbers?

The Japan GDP numbers are in and according to the Cabinet Office, Japan's economy grew by an annualised real 2.9% in Q2, which was revised down from an initial report of 3.1% due to lower-than-expected private consumption and capital spending within the country.

However, even with the downward revision, the number was higher than forecast, and is the first expansion in two quarters.

On a quarter-on-quarter basis, the real gross domestic product increased to 0.7% over the previous quarters -0.6%. Although estimations from preliminary estimates were 0.8%, but the difference is marginal.

Capital Expenditures for Japan came in at 0.8% whereas the last reading was at 0.9%. However, this slight revision can be taken lightly in comparison to the last 2 quarters negative readings.

More than half of Japan’s GDP comes from private spending, which rose by 0.9% for the first time in five quarters. However, the improvement was less than the 1.0% previously reported because of lower-than-expected demand for domestic food service businesses, as the consumer appears to be shifting priorities in spending habits.

These latest data on GDP supported the assessment that the fourth-largest economy in the world is rebounding at a moderate rate, supporting the argument for the Bank of Japan to increase its policy rate once again in the following meeting, after doing so twice already this year, with the latest interest rate hike having been in July.

The Cabinet Office also reported that auto shipments contributed the most to an increase in exports of 1.5%, which was previously reported at 1.4%.

Senior economist Shinichiro Kobayashi of Mitsubishi UFJ Research and Consulting stated, "The downward revision is within the scope of a minor adjustment and there is no change to the view that the economy is recovering moderately."

Where do we go from here?

The viewpoint therefore still stands by policymakers and economists, that although expectations of an expanding economy in Japan persist for the July to September quarter, that the economy might not be expanding as much as previously thought, mainly due to decreasing domestic consumer spending. This can be said, as spending decreases have been observed especially in “Travel, Leisure & Entertainment.” In the meantime, the real salary growth was stated to have increased year-over-year in June and July. However, the June and July (real) wage gain was more strongly supported by summer bonuses than by a rise in base pay and for July, the household expenditure data was rather disappointing.

There is therefore a growing chance that the private consumption momentum in the July–September period will be less robust than anticipated.

Japan's GDP surpassed 600 trillion yen for the first time, reaching a nominal total of 607.58 trillion yen ($4.3 trillion), a goal set by the government in 2015 under former Prime Minister Shinzo Abe.

In a Bloomberg survey conducted last month, the median estimate stated that economists anticipate Japan's economy will grow at an annualised rate of 1.7% this quarter. The rate would be significantly higher than the 1% that the central bank views as the upper limit of the country's possible growth rate range. This suggests that even after two rate hikes earlier this year, economists still anticipate inflationary pressure as the BOJ maintains policy rates at the lowest level among major peers.

When will the next policy meeting be?

Following the most recent raise to 0.25% in July, the prospects for another rate increase in October or December are expected to be the main focus of the central bank's upcoming policy meeting, which will be on September 20.

NIKKEI Reaction

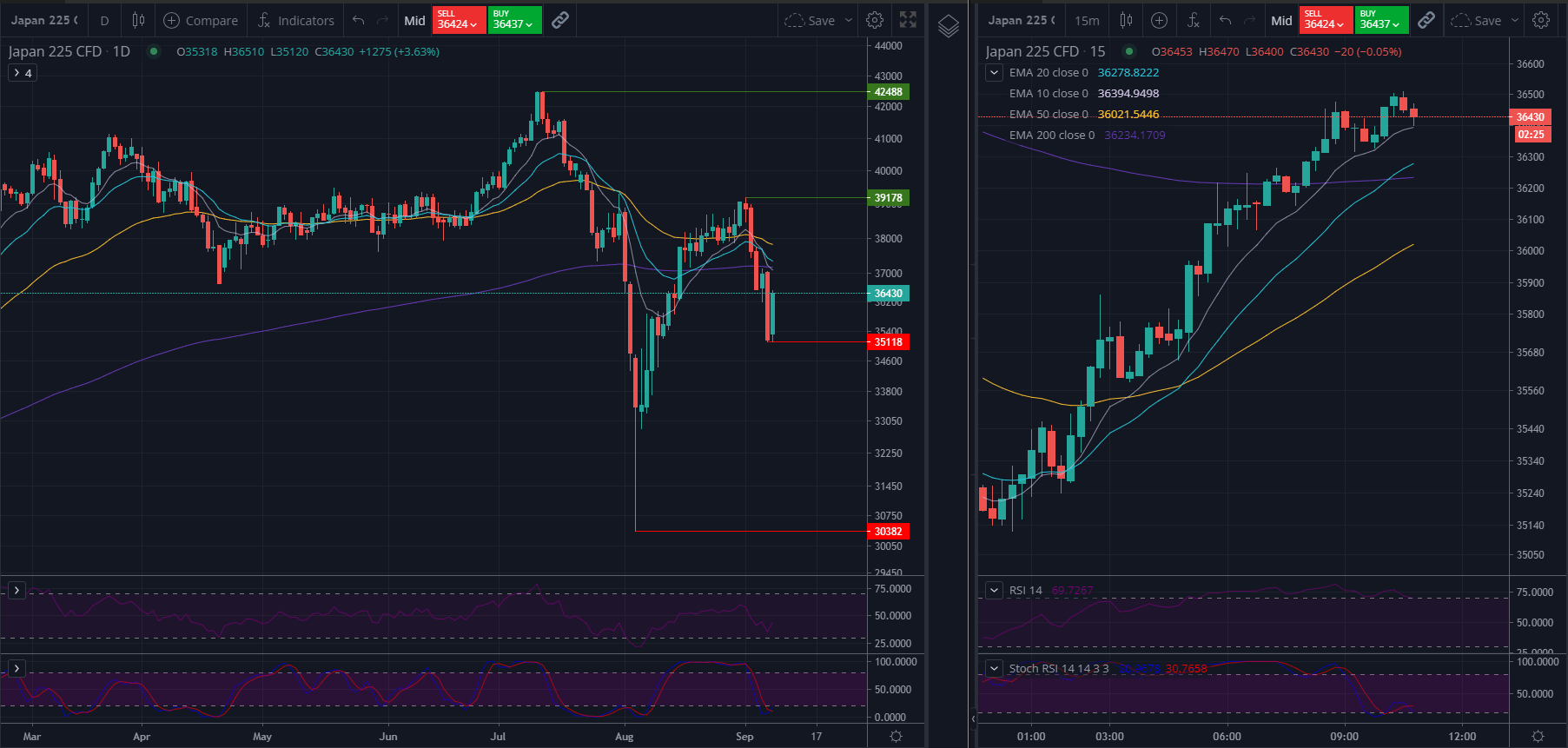

After the NFP scare that not only affected the US markets but also global markets, the Nikkei has added 1,400 points as seen on the Daily chart.

From here we are currently building up velocity as the Stochastic RSI appears to be crossing over within the oversold area which could potentially indicate a continuing reversal from the 35,118 level. If the RSI also continues its upwards trajectory, then a continuing upwards velocity could continue. The price has been increasing already from market open in the Asian session ahead of the GDP numbers release. This could indicate an existing positive bias from speculators. At these levels, we will either see a consolidation around these levels or a move higher to challenge last week’s high. In contrast, should the bears take over, then a challenging of Fridays low is possible.