- Nikkei 225 struggling to revisit record highs despite weaker yen, improved risk appetite

- Hang Seng still powering higher as state support boosts optimism

- US inflation and retail sales the main risk events on the macro calendar

Nikkei unconvincing as Hang Seng heats up

Japan’s Nikki 225 and Hong Kong’s Hang Seng have been like chalk and cheese coming out of the pandemic. As one surged, the other floundered. But perhaps the tide is starting to turn?

The high-flying Nikkei is looking shaky, with tailwinds from a weaker yen, corporate reforms and rampant risk appetite now arguably priced in. After climbing to record highs, you get the sense traders are questioning what will be the catalyst to drive the next leg higher?

In contrast, the unloved and underinvested Hang Seng has stealthily entered a bull market after careening to multi-year lows earlier in the year. With no meaningful correlation with western stock markets and nowhere near as sensitive to macro events abroad, it’s an interesting trade prospect right now, either directly or part of a pairs trade.

With Chinese policymakers said to be considering a proposal to exempt individual investors from paying taxes on dividends for Hong Kong stocks purchased via China’s Stock Connect, according to Bloomberg, the measures being rolled out to support market gains continue to grow.

Key macro events to watch

Looking at the macro event calendar next week, there is little from either Japan or China . And of those events there are, it’s questionable how much impact they’ll have on either index.

I’ve lost track of when Japanese data last moved Japanese markets, so Tuesday’s producer price inflation report nor Thursday’s preliminary Q1 GDP report could easily deliver nothingburgers. In China, the April ‘data dump’ on Friday will receive plenty of media attention but unless it reveals a big deviation from the current trend of a sluggish and uneven recovery, it’s hard to see it influencing the Hang Seng.

US CPI offers limited event risk

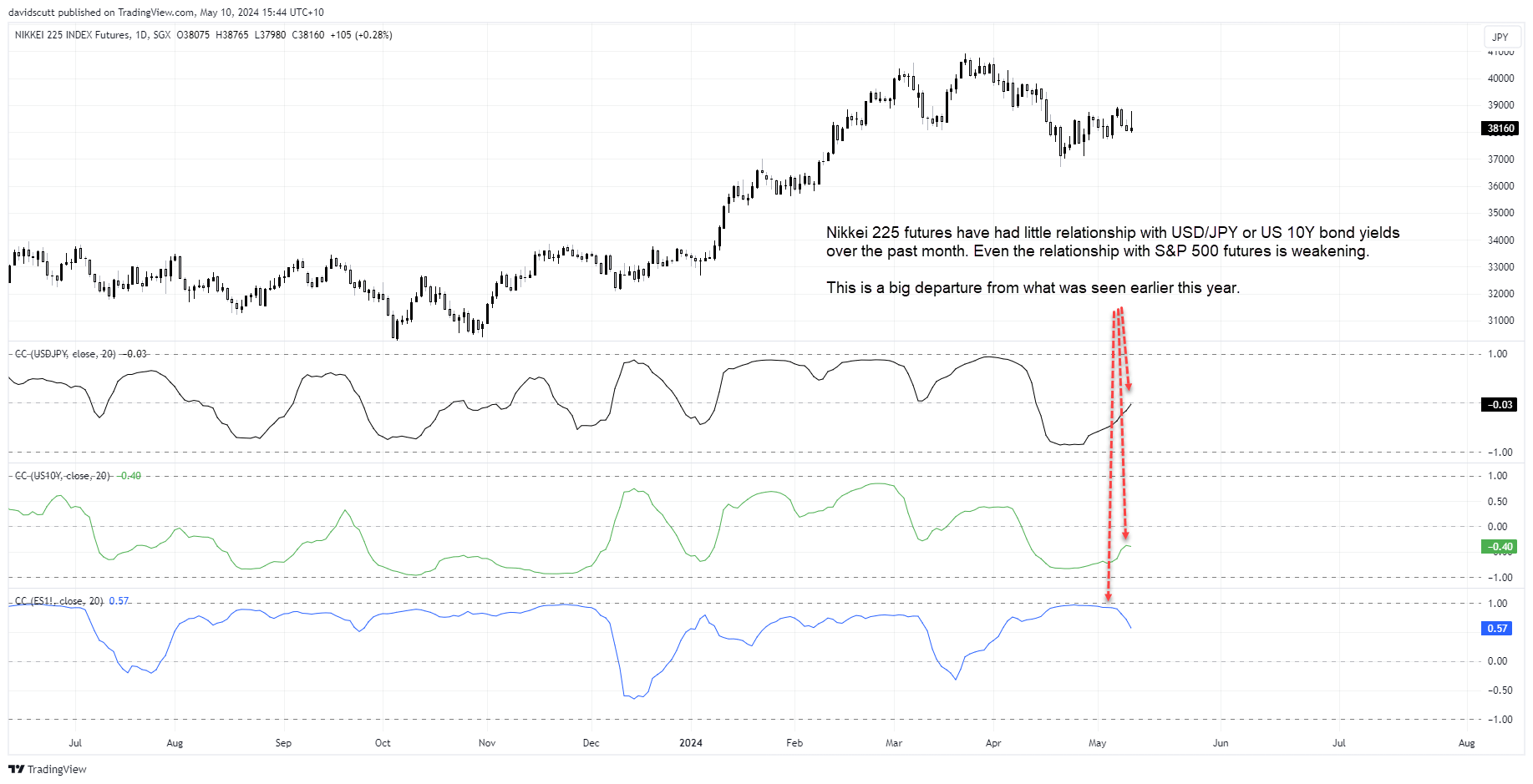

Internationally, while the strong, positive correlation with US shorter-dated bond yields and S&P 500 earlier this year has weakened substantially over the past month, Wednesday’s US consumer price inflation report presents major event risk, not only for the Nikkei 225 but markets more broadly.

Headline and core inflation are expected to increase by 0.3% in April, down a tenth on the 0.4% prints of March. While that would signal renewed disinflation, it’s worth remembering that those rates annualise out to double the Fed’s 2% target.

US retail sales data will be released alongside the inflation report, providing an early glimpse on whether the US consumer continued to power the economy in the early parts of Q2. With US data starting to rollover, any sign of weakness in the consumer may see the US dollar and yields slide unless the inflation report comes in hot.

Elsewhere, Tuesday’s producer price inflation and Thursday’s jobless claims report could generate volatility in Japanese markets, the latter especially after last week’s unusually large increase.

While there are numerous Federal Reserve speakers, including Jerome Powell on Tuesday, it comes across as far too premature for FOMC members to deviate from the higher-for-longer rates message they’ve been curating over the past couple of months. Even though it's obvious the Fed is looking for excuses to cut, shifting towards a more dovish stance based on a small selection of data appears unlikely.

Nikkei 225 outlook

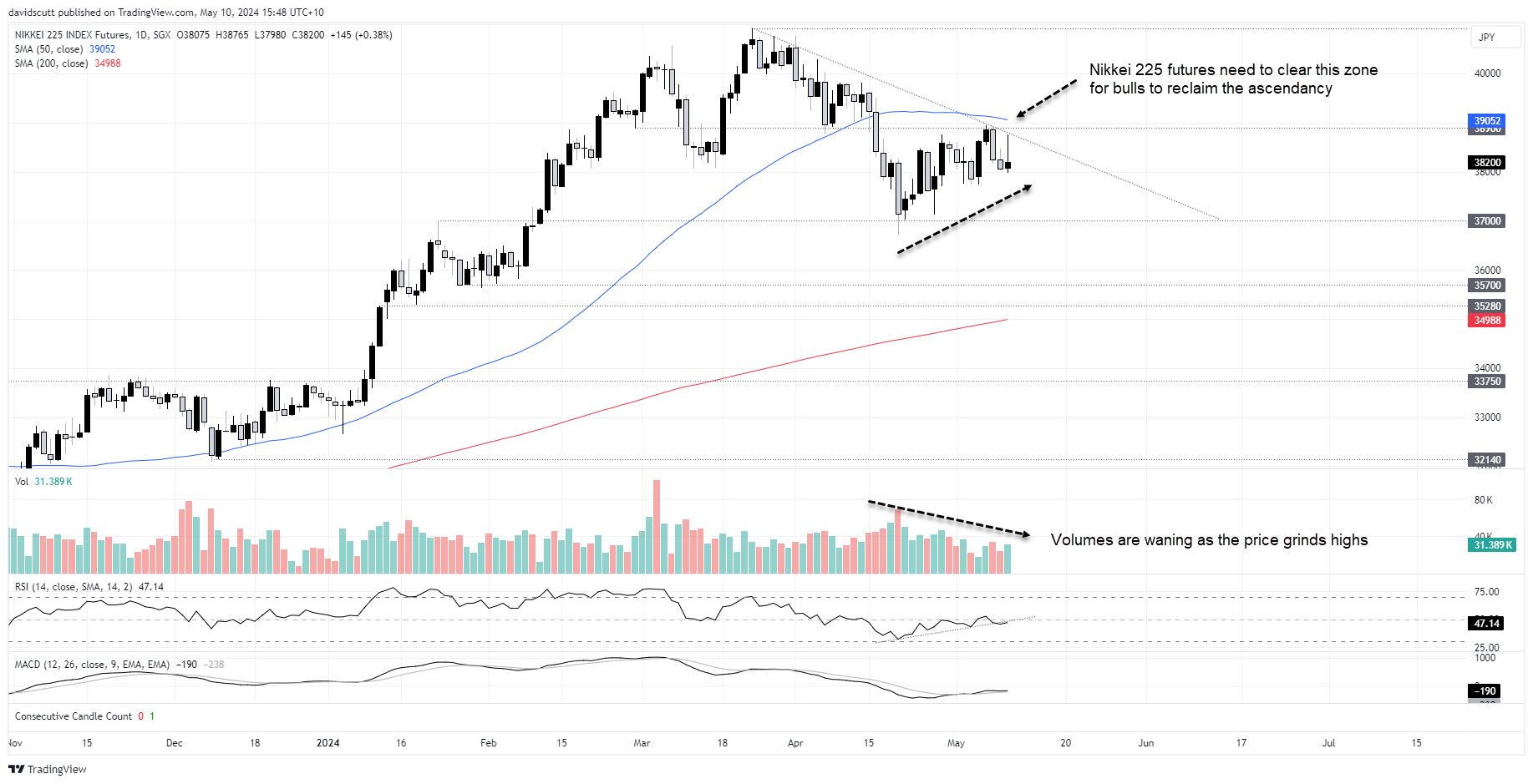

As opposed to the relentless run higher seen earlier this year, the rebound in Nikkei 225 futures from the lows struck on April 19 has been tepid, grinding slowly higher as volumes have fallen away. Of concern for bulls, the price continues to be rejected at downtrend resistance running from the record highs. It has also been unable to reclaim the 50-day moving average which was an important level earlier this year, nor break horizontal resistance located at 3900. Upside momentum also looks unconvincing.

Unless futures can break above the 50DMA, downtrend resistance and 39000, a revisit to 37000 or even 35700 could be on the cards, especially if USD/JPY were to resume its reversal lower.

Hang Seng outlook

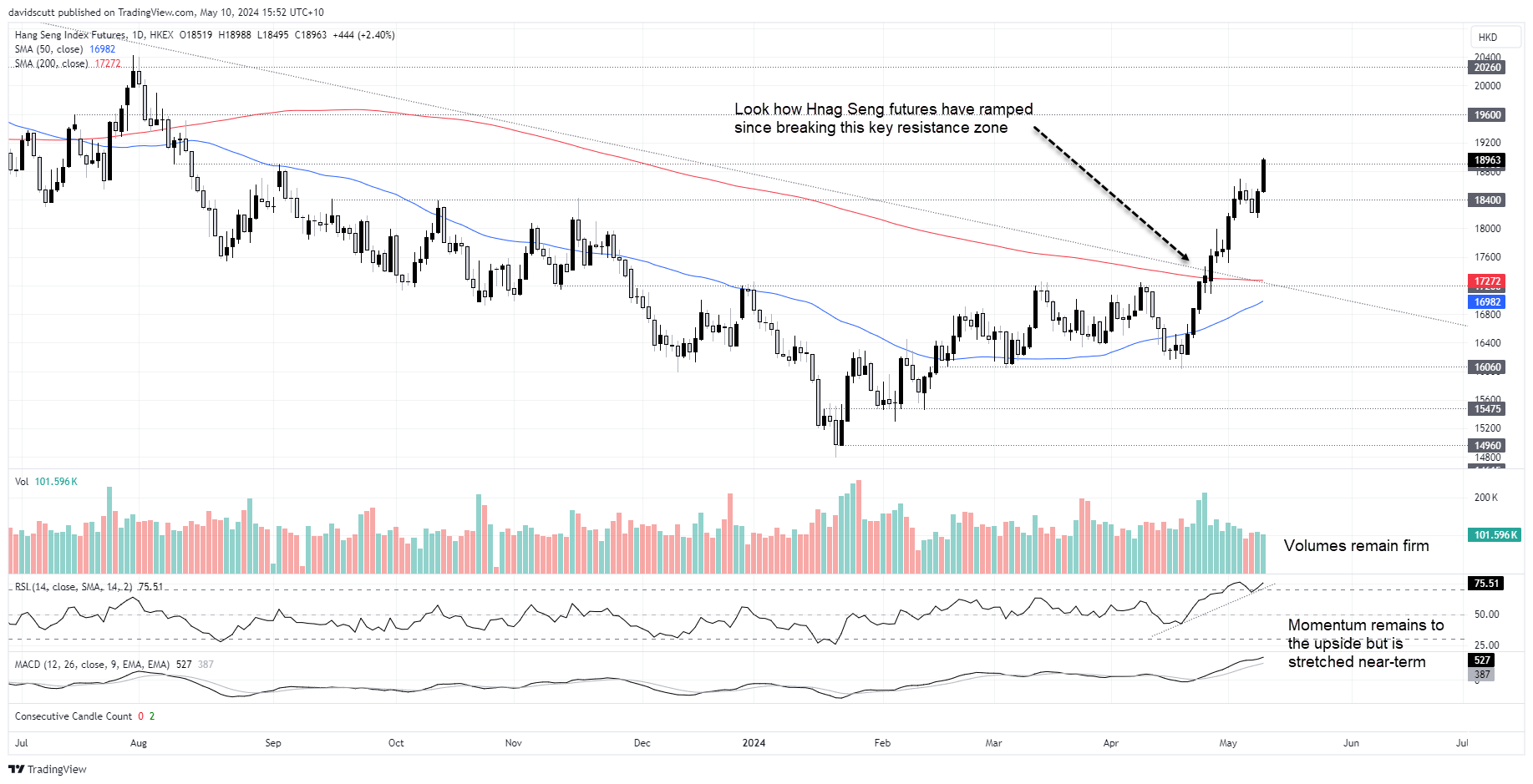

Hang Seng futures have been in beast mode since breaking the 200-day moving average and long-running downtrend resistance dating back to early 2021, extending the gain from lows hit in January to over 27%. It was nice to jump on this train early.

While futures had a minor pullback after clearing horizontal resistance at 18400, the price action late last week was definitive with a bullish outside day followed by another bullish candle on Friday, coinciding with the Bloomberg article mentioned earlier.

It now sits just shy of minor resistance at 19000. Above, 19600 is level to watch with the price doing plenty of work either side of it in the middle of last year. 20260 and 20800 are the next levels after that.

Given the bullish tone, dips between 18000 to 18400 are likely to be bought, should the price get back there. Mirroring the price action, momentum remains to the upside, although RSI is sitting in marginally overbought territory which may deter some bulls from entering at these levels.

-- Written by David Scutt

Follow David on Twitter @scutty