6 September 2024, Friday US August non-farm payrolls

As we approach the release of the US August non-farm payrolls report on 6 September 2024, it's worth reflecting on the complex interplay between economic indicators and market sentiment. The unexpected rise in unemployment to 4.3% in July sparked significant market reactions, highlighting the delicate balance between economic health and monetary policy.

This upcoming report is of particular importance given the recent market recovery prior to the Monday after the July jobs scare. It is interesting to consider how external factors, such as Hurricane Beryl, may have affected the previous data, reminding us of the importance of context when interpreting economic figures.

The expected rebound in job creation to 163,000 and the forecast slight decline in the unemployment rate to 4.2% paint an interesting scenario. These expectations point to a possible stabilisation, but it is important to take these forecasts with a grain of salt.

The potential impact of a further unexpected rise in unemployment is also a consideration worth bearing in mind. As this could reignite concerns about economic growth and potentially alter the course of the recent risk rally. This once again underlines the profound influence that labour market data can have on overall market dynamics and investor sentiment.

Furthermore, the expected rise in the average hourly earnings adds another piece to the economic puzzle. This figure not only reflects the state of the labour market, but also has implications for inflation and consumer spending.

A key focus will be on wage growth, as sustained upward pressure could reignite inflation concerns and potentially influence the Fed's rate cut timeline.

Investors will also pay attention to the labor force participation rate, which has been trending upwards in recent months, potentially offsetting some of the unemployment rate fluctuations.

Substantial upward revisions might suggest that the July data was indeed an anomaly, potentially easing some of the recent economic concerns.

Average hourly earnings are expected to increase 0.3% month-on-month, up from the 0.2% prior.

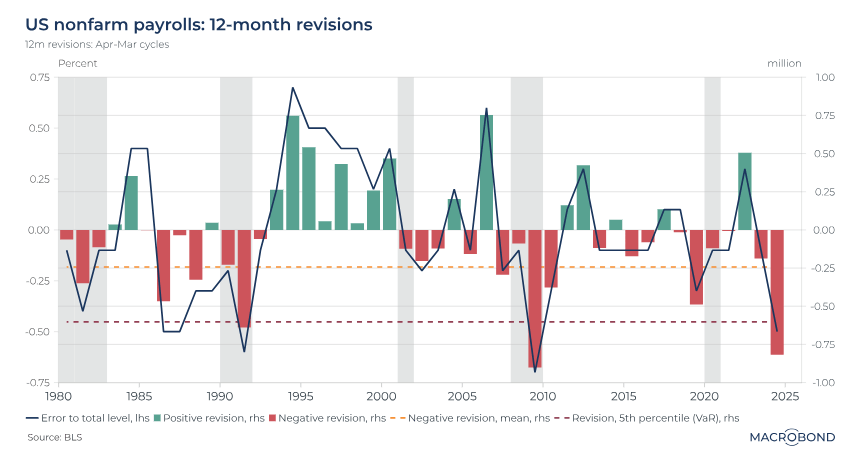

Revisions? What the chart shows

US NFP payrolls revisions - source: Macrobond

During the 12 months ending in March 2024, the US nonfarm payrolls were revised downward by 818,000 jobs, or 0.5% of the initial number.

This represents the largest downward revision since 2009 and significantly exceeds the 95 per cent Value-at-Risk (VaR) forecast of 602,000 and the average negative revision of 243,000.

The NFPs were released last month and showed that 272,000 new jobs were created in May, compared with a consensus estimate of 185,000. However, the US labour market is losing momentum. The average number of new jobs created by NFP between January 2021 and December 2022 was 490,000 per month. Since January 2023, the monthly average has almost halved to 250,000.

From 3.4% in April 2023 to 4% currently, the unemployment rate has also risen, and the number of unemployed claims is also rising.

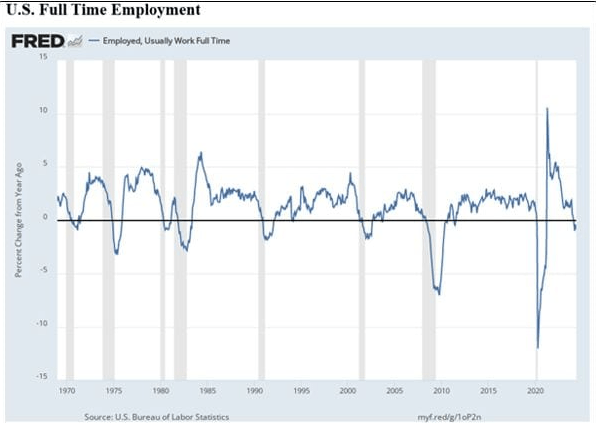

US Full time emplyment trend

The graphic displays the annualized percentage change in the number of Americans working full-time. Since February of this year, full-time employment has been declining on an annualized basis. The graphic shows that all eight recessions since 1970—the darkened areas—have been accompanied by negative readings.

Considering how crucial American consumers are to global economic activity, the employment situation in the country continues to be the most significant economic factor.

Europe: Beneath the data

The eurozone's economic sentiment has stayed relatively low, surrounding the 25th percentile, aside from the economic standstill that has persisted for more than a year. Sector-specific sentiment is likewise negative, with consumer, services, and industry confidence all down over the previous 12 months, although industrial sentiment has improved.

Furthermore, mood toward building and retail has decreased over the previous year, with construction somewhat above the median and retail close to it.

The euro region appears to be having difficulty being optimistic due to a low composite level and mixed views across economic sectors.

Summary: What do traders expect?

In order to preserve their limited stomach for risk, traders are now paying more attention to jobs statistics overall to help determine whether we will actually see numerous Fed cuts combined with a soft landing. Thus, the vacancies, layoffs, ADP employment, and data on unemployment claims will serve as the prelude to the headline payroll figures.

When Jerome Powell declared that "the labor market is no longer overheated" and that "inflation has declined significantly," he paved the way for several rate cuts in Jackson Hole last week. As a September cut is now essentially confirmed, the rate of cuts will now be based on new data.

And for that reason, newly released job statistics is even more crucial.

Traders should therefore keep a close eye on employment figures, the biggest of which is nonfarm payrolls on the first Friday of each month.

Stay informed,