US futures

Dow futures -0.64% at 34233

S&P futures -0.86% at 4364

Nasdaq futures -1.30% at 14776

In Europe

FTSE -0.45% at 7703

Dax -1.2% at 15558

- The Fed points to higher rates for longer

- US jobless claims beat forecasts at 201k vs 225k

- GBP/USD falls after the BoE leaves rates unchanged

- Oil extends losses after a hawkish Fed

The Fed points to higher rates for longer

US stocks are pointing to a weak start, extending losses from the previous session as investors continue to digest the September Federal Reserve rate decision.

While the Fed left interest rates on hold at the 22-year high of 5.25% to 5.5%, in line with forecast, the central bank pointed to higher rates for longer, including another rate hike this year.

In addition to supporting another rate hike this year, the Federal Reserve also projected less easing next year with rates expected to fall just 50 basis points in 2024 down from the 100 basis points of cuts that were projected in the June meeting.

A hawkish stance from the Fed suggests that the Fed may not start easing monetary policy until later in 2024 than initially expected, as the resilient U.S. economy is met with tight monetary policy.

As if on cue initial jobless claims came in stronger than expected, falling to 201K down from 220K, and defying expectations of a rise to 225K. The data highlights the ongoing strength in the US labour market.

Looking ahead, attention will remain on the economic calendar with existing home sales data due later. expectations are for home sales to remain relatively constant at 4.1 million marginally higher than the 4.07 million recorded in July.

Corporate news

FedEx has jumped over 5% premarket after Q1 earnings beat expectations. FedEx posted EPS of $4.55 ahead of the $3.71 forecast, on revenue of $21.7 billion, modestly below forecasts of $21.74 billion.

Klaviyo, the marketing automation firm which IPO’d yesterday is set to fall 1% but remains above the IPO price of $30.

Other stocks that debuted recently, including ARM and Instacart, are also trading lower premarket. After strong debuts, the stocks are wobbling, raising questions over the health of the IPO market.

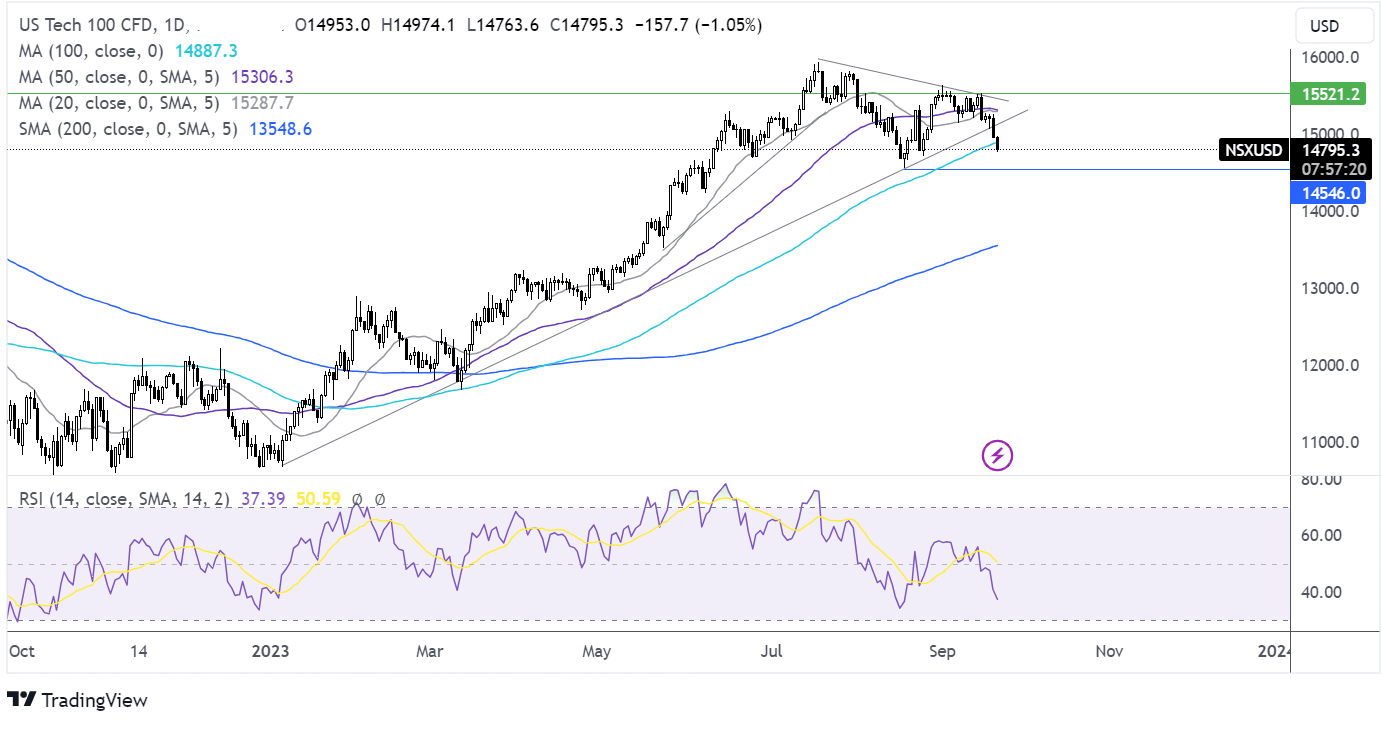

Nasdaq 100 forecast – technical analysis.

The Nasdaq has broken below its rising trendline dating back to the start of the year, the 15000 and the 100 sma, keeping sellers optimistic of further losses. Sellers will now look towards 14550 the August low for support. Meanwhile, any recovery in the price needs to retake the 100 sma at 14880 and 15000 round number, to test the rising trendline resistance at 17200.

FX markets –USD rises, GBP falls

The USD is climbing higher tracking treasury yields northwards after the Federal Reserve indicated that interest rates would rise higher and stay higher for longer. The US dollar is on track to book its 10th straight week of gains, a rally of this length hasn't been seen since 2014.

EUR/USD fell to its lowest level in six months against the US dollar after the Fed's rate decision. A hawkish Fed is in contrast to the ECB last week, which raised interest rates by 25 basis points but hinted that that could be the last hike. Looking ahead, eurozone consumer confidence data is due, and ECB president Christine Lagarde is expected to speak her comments will be monitored closely for clues over the future path of interest rates.

GBP/USD has fallen below 1.23, dropping to its weakest level in six months after the Bank of England unexpectedly left interest rates on hold at 5.25%. Most analysts had expected a 25 basis point increase. This is a significant climb down from expectations just a few weeks ago. The Bank of England vote split was four to five to leave rights on hold for the first time in almost two years after inflation unexpectedly fell in August and amid growing signs of an economic slowdown in the UK.

EUR/USD -0.25% at 1.0635

GBP/USD -0.63% at 1.2263

Oil falls after the Fed

Oil prices are falling on Thursday, extending losses from the previous session, which were the largest declines in oil prices in a month. The price is coming under pressure after the Federal Reserve pointed to higher interest rates for longer, which offset the impact of a drawdown in US crude stockpiles.

The Fed's hawkish stance could dampen economic growth across the coming year and hurt the oil demand outlook.

The US dollar has also surged to its highest level since early March, making oil more expensive for buyers with other currencies.

Investors are shrugging off EIA inventory data, which showed that crude stockpiles fell in line with forecasts, dropping 2.14 million barrels.

WTI crude trades -0.4% at $89.14

Brent trades -0.4% at $92.22

Looking ahead

15:00 Eurozone consumer confidence#

15:00 ECB Lagarde to speak

15:00 US Existing home sales