- Markets price strong likelihood of two supersized rate cuts from the Fed this year

- Fed unlikely to out-dove market pricing, leading to potential disappointment in riskier asset classes

- Less cuts implies stronger US economic activity, which should benefit corporate earnings

- Technical picture for Nasdaq 100, S&P 500, Nasdaq futures remains bullish on daily timeframes

Overview

The Fed may spark disappointment if it doesn’t signal rate cuts of the same magnitude as currently priced by markets. However, less cuts could actually deliver more upside for US stock futures given the economic implications, meaning any kneejerk selling could provide decent entry levels for traders.

Fed rate cut pricing goes full-bore dove

A string of dovish articles from suspected Fed mouthpieces in the media over recent days has had a dramatic impact on market pricing for the scale of Fed rate cuts over the next year.

In September, a 50 basis point cut is now favoured with 40 basis points priced for this meeting. Over the remaining three meetings of 2024, a whopping 121.5 basis points of cuts are priced, with that figure swelling to 230.5 basis points over the next 12 months.

Fed may disappoint markets

I get why some traders are bullish about the scale of easing expected. Many have only ever known that rate cuts lead equity market gains. But those of us who have been around for multiple cycles would know that’s not always the case.

If the Fed is forced to cut aggressively quickly, it’s not usually because everything is fine and dandy. If it is forced to deliver two super-sized cuts over the next three meetings as pricing suggests, it implies it's way behind the curve in preventing a US recession.

That’s why I don’t think it will signal rate cuts anywhere near as aggressive as markets expect. Doing so while attempting to sell the idea that it’s being preemptive is fraught with danger.

Which could deliver initial weakness in US stock futures

If the Fed signals far less cuts than market pricing, it could easily lead to an initial drop in US equity futures. But if signals a slower pace of cuts, it would imply that growth is expected to hold up, bolstering the case for a soft economic landing. Therefore, less cuts are arguably bullish, not bearish.

That suggests traders should be on alert for buying opportunities on any kneejerk weakness following the Fed decision, especially in more cyclical equity futures markets such as the Russell 2000.

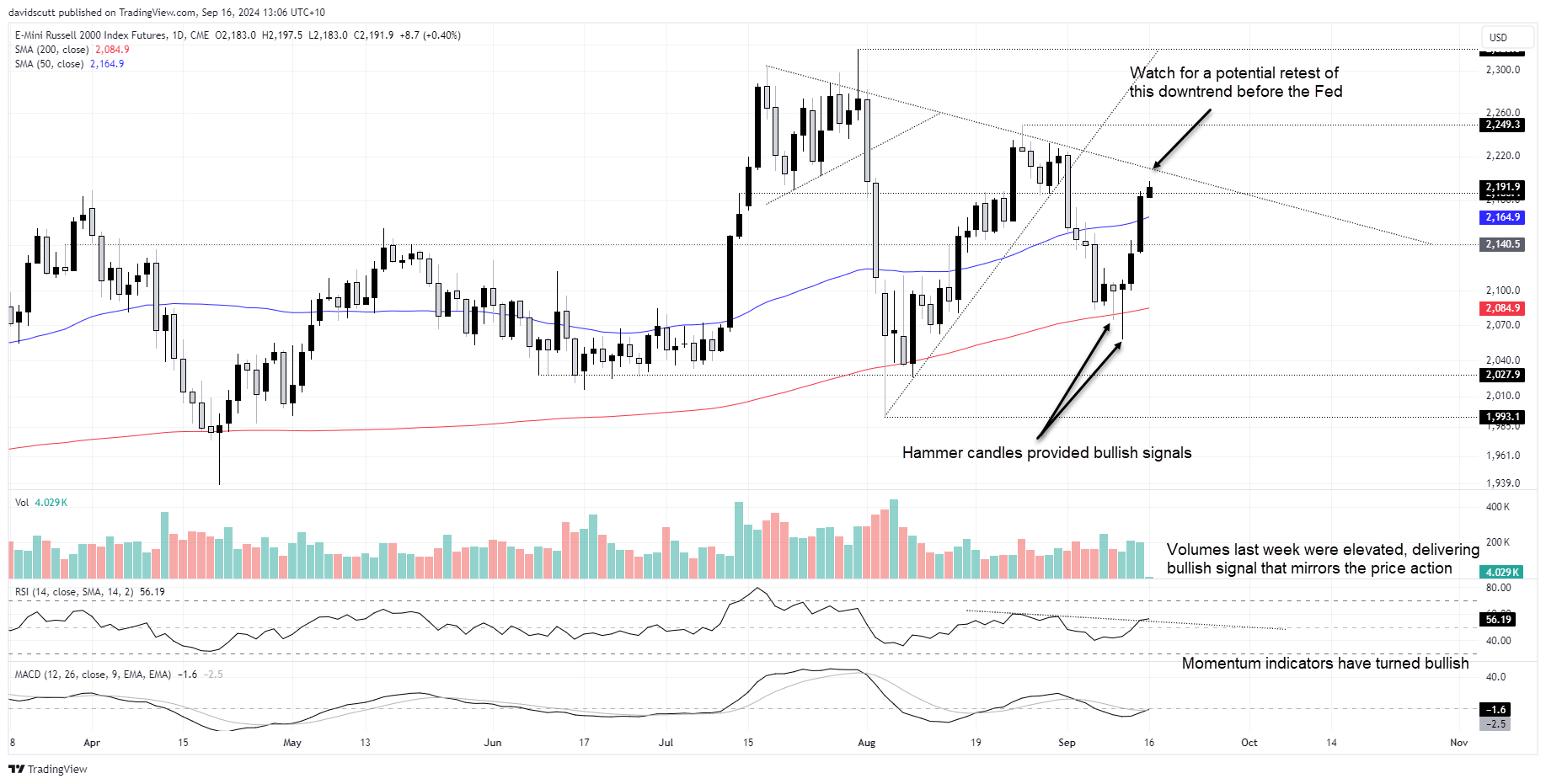

Russell 2000 technical picture brightens

The technical picture for Russell 2000 futures continues to brighten with RSI (14) breaking its downtrend while MACD has crossed over from below, generating a bullish signal on momentum.

The two hammer candles that printed last week following probes below the 200-day moving average likely encouraged traders to buy the dip, helping drive the price back above the 50-day moving average, an important level that has often been respected in recent months. In response to the dovish shift in Fed rate cut pricing seen over the weekend, the price has managed to push through 2186.4, a level that has acted as support and resistance on occasion since July.

Given the price signals and market momentum, a retest of downtrend resistance currently located around 2208 appears likely, with a break of that level potentially opening the door for a push towards 2249.3 and July high of 2320.50.

On the downside, 2180.4, 50-day moving average and 2140.5 are the levels to note if we do see a kneejerk selloff following the Fed.

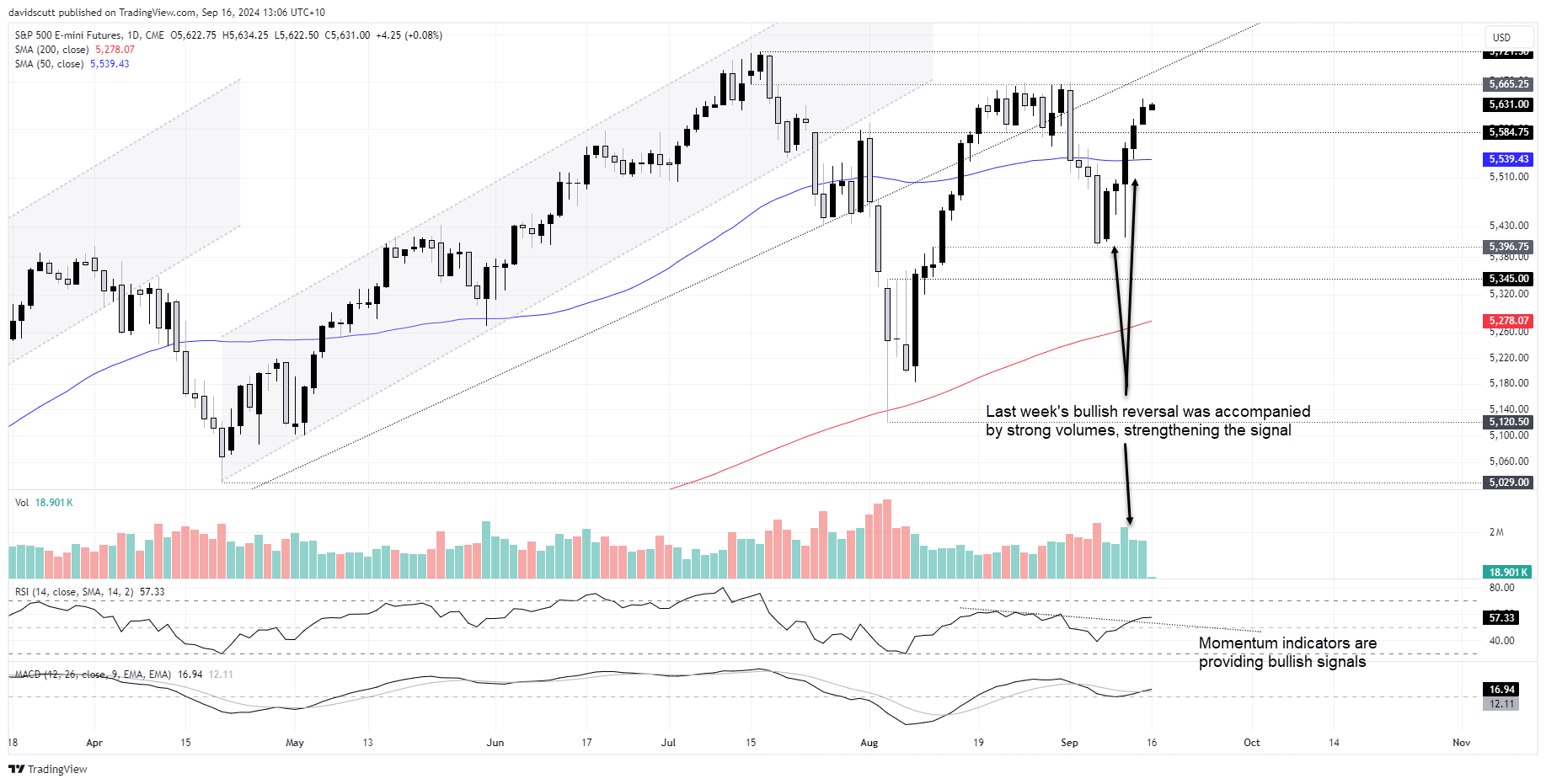

S&P 500 carrying strong bullish momentum

Despite differences in their composition, the technical picture for S&P 500 futures does not look too dissimilar to the Russell, providing bullish signals on momentum after a move back above the 50-day moving average last week.

On the topside, the first level of note is 5665.25 with the record high of 5721.5 the next after that. I’ve left the former uptrend dating back to November 2023 for reference given it has been respected on occasion since being broken.

On the downside, 5584.75, the 50-day moving average and 5396.75 are levels to keep an eye on should we see a pullback.

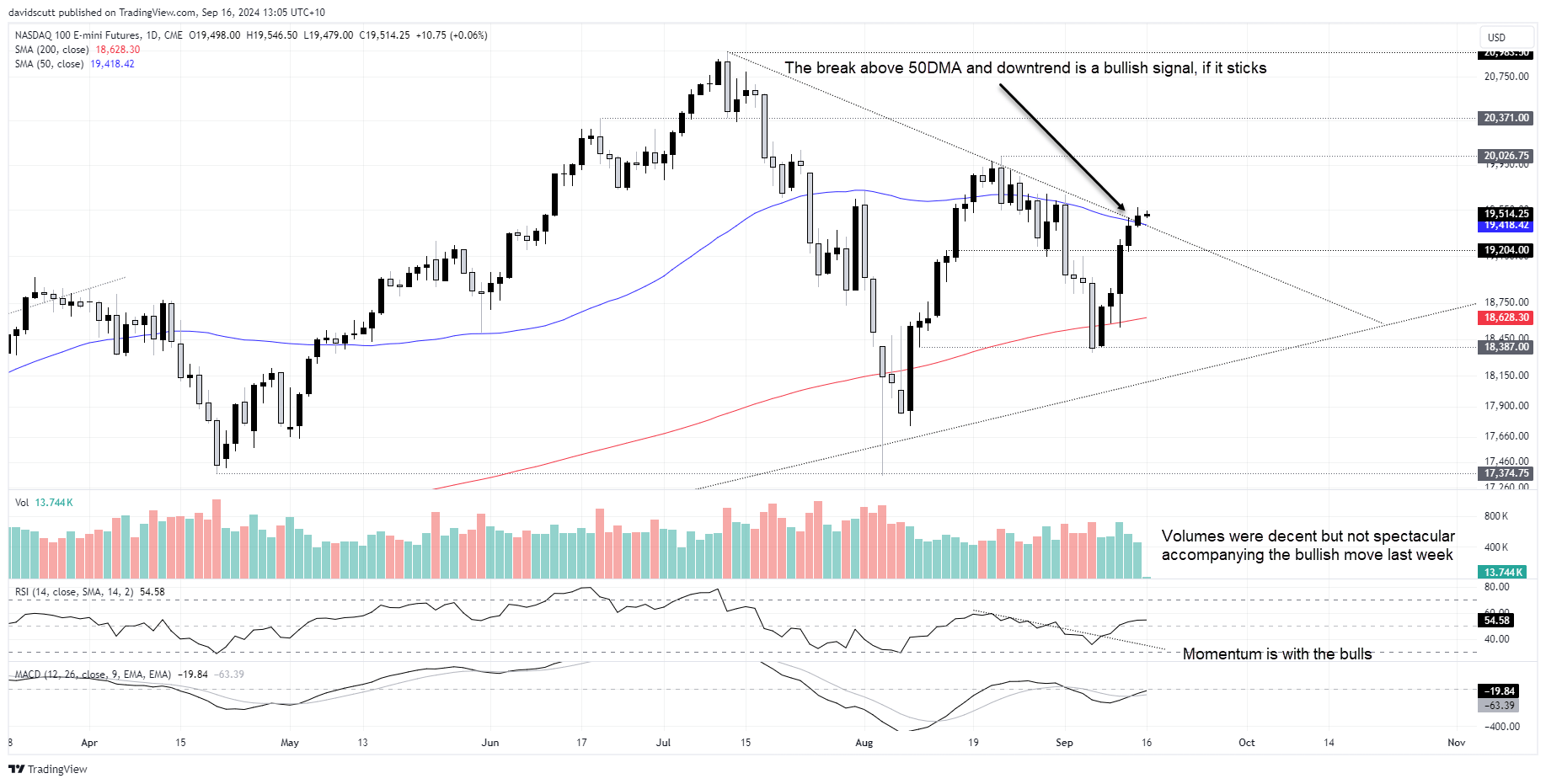

Nasdaq 100 breaks above key technical level

Nasdaq 100 futures are also providing bullish signals, with the price not only taking out the 50-day moving average but also downtrend resistance last week. With RSI (14) breaking definitively higher and MACD crossing over from below, momentum indicators are bullish, pointing to the potential for further gains ahead.

On the topside, 20026.75, 20371 and record high of 20983.5 are levels of note. On the downside, the 50-day moving average, 19204, 200-day moving average and 18387 are levels that traders could build setups around should we see initial disappointment from the Fed decision.

-- Written by David Scutt

Follow David on Twitter @scutty