US futures

Dow future 0.34% at 42803

S&P futures 0.3% at 5991

Nasdaq futures 0.15% at 21600

In Europe

FTSE -0.1% at 8240

Dax 0.85% at 20145

- US JOTS job opening & ISM services PMI data due

- Nvidia rises after new AI superchip unveiling

- Biden administration blacklists Tencent & CATL

- Oil rises on supply worries

Stocks rise ahead of ISM services PMI

U.S. stocks are heading for a positive open as investors await economic data and further insight into the incoming Trump administration's policies.

US jolts job openings and ISM services PMI data are due later in the session. Signs of ongoing resilience within the economy could further dampen Federal Reserve rate cut expectations. The data comes ahead of Friday's non-farm payroll, which is likely to be the first major test for the markets in 2025.

Signs of a stronger labor market and worries over reviving inflation could see the Federal Reserve sit on the sidelines until later in the year. The US 10-year treasury yield has risen to 4.63%, near its highest level since May 2024.

Richmond, Fed President Thomas Barkin is scheduled to speak and will be watched closely for clues about inflation and the need to keep borrowing costs restrictive.

As well as watching the data, market participants continue to weigh up uncertainties surrounding President-elect Donald Trump's potential trade tariffs. Trump denied reports that his team was considering a less aggressive approach to tariff policies.

Corporate news

Nvidia is set to open over 2% higher after its chief executive, Jensen Huang, delivered a keynote speech on Monday outlining the company's AI plans. The company also announced new partnerships and products, including an AI super chip and new gaming chips for PCs utilising its Blackwell technology.

Tencent ADRs are set to open lower after the US blacklisted Tencent Holding and Contemporary Amperex Technology Co. for alleged links to the Chinese military. The surprise move and we just weeks before Donald Trump takes office, targets the world's largest gaming publisher and a top EV battery maker. Both stocks have denied links to the military. The move threatens to escalate tensions between the world's two largest economies.

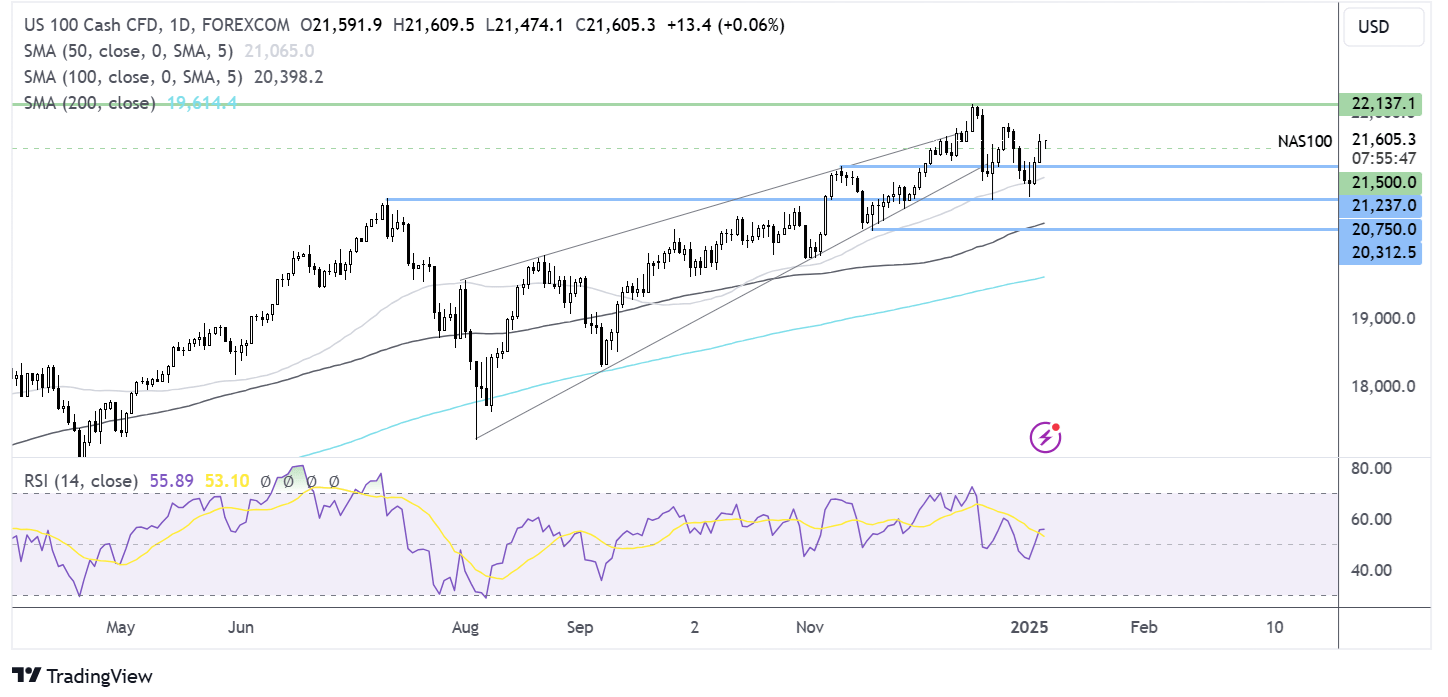

Nasdaq 100 forecast – technical analysis.

The Nasdaq 100 recovered from the 20,780 low for a second time, rebounding above the 50 SMA to its current level around 21,500. Buyers will need to retake 21,850 to create a higher high and open the door to 22,200 and freh all time highs. Meanwhile, support can be seen at 21,250 the November high. Below here 20,780 the January low comes back into play.

FX markets – USD falls, EUR/USD rises

The USD has fallen to a weekly low as markets consider Trump's prospect of less aggressive trade tariffs. The USD has appreciated following Trump’s win on expectations of inflationary measures such as trade tariffs and tax cuts.

EUR/USD is rising but lacks conviction as it gives up earlier gains. Eurozone inflation rose to 2.4% YoY, up from 2.2%. Core inflation remained at 2.7%. The blip isn’t expected to knock the ECB off its rate-cutting path. Meanwhile, eurozone sentix investor confidence slipped to -17.7 in January, down from -17.5 in December. Gemany’s recessionary economy is dragging on sentiment.

GBP/USD is rising for a third straight day, pushing above 1.25 amid a weaker USD and despite mixed retail sales data. Figures from the British Retail Consortium showed that sales rose 3.2% annually in December after falling 3.3% in November. However, in Q4, sales rose just 0.4%.

Oil rises on supply worries

Oil prices are rising, paring earlier declines, amid fears of tight supply related to sanctions on Russian and Iranian oil.

Due to sanctions on Russian and Iranian oil, there has been an increase in demand for Middle Eastern oil, reflected in Saudi Arabia's hiking oil prices to Asia.

Shandong Port Group in China also issued a notice on Monday banning US-sanctioned oil vessels from its network, tightening the supply picture.

Meanwhile, cold weather in the US and Europe has also boosted heating oil demand, providing support for prices.

Technically, oil is in overbought territory, so surprise games could be limited.