Micron Technology Earnings: A Critical Insight into the Semiconductor Sector

On Wednesday, December 18th, Micron Technology Inc. (NASDAQ: MU) is set to release its fiscal Q1 2025 earnings after market close. As one of the leading memory and storage solutions providers, Micron’s performance is closely monitored as a barometer for the global semiconductor industry, particularly in the face of evolving AI demand and ongoing economic uncertainty, making this a perhaps interesting event of the day.

Earnings Expectations

Wall Street analysts are forecasting earnings per share (EPS) of $1.73 for the quarter, marking a significant recovery from previous losses. The expected revenue stands at approximately $8.68 billion, due to strong demand for memory products, particularly DRAM and NAND chips, which are critical components in AI-driven data centers and computing systems.

Micron’s post-pandemic turnaround has been fueled by a confluence of factors, including:

- AI Infrastructure Demand: Companies like Microsoft, Google, and Amazon are driving record investments into data centers, creating demand for high-bandwidth memory (HBM) and advanced DRAM solutions.

- PC and Smartphone Recovery: While consumer electronics saw sluggish demand earlier this year, signs of a rebound in PC and smartphone shipments are expected to lift Micron’s sales.

- Improving Inventory Management: Excess inventory, which plagued the industry last year, has normalized, allowing Micron to stabilize pricing and margins.

Market Reaction and Investor Focus

Micron’s key areas of focus for investors include:

- DRAM and NAND Pricing: With memory prices starting to rebound after bottoming earlier in 2024, investors will look for evidence of sustainable price recovery. DRAM sales, which constitute roughly 70% of Micron’s revenue, will be a crucial driver of results.

- AI and High-Performance Computing: The company is a key supplier of advanced HBM3 chips, which power AI applications like machine learning and large language models. Increasing demand in this segment is expected to contribute meaningfully to revenue.

- Outlook for 2025: Investors will scrutinize Micron’s forward guidance for fiscal Q2 2025, particularly in light of global macroeconomic uncertainties and lingering supply chain disruptions. Clarity on AI-driven demand growth and margin trends will be key.

- Operating Margins: Improved cost efficiencies and pricing stability are expected to enhance Micron’s operating margins. Investors will focus on management’s commentary regarding long-term gross margin targets as pricing pressures ease.

Broader Industry Implications

Micron’s earnings report comes at a time when the semiconductor industry is navigating a complex landscape. While AI has sparked a surge in high-performance chip demand, geopolitical tensions between the U.S. and China and uncertainties around global supply chains remain challenges.

Furthermore, Micron’s performance will set the tone for other semiconductor giants like Samsung and SK Hynix, as analysts look for signals about industry recovery and demand stabilization across key sectors.

Stock Performance and Options Activity

Ahead of the earnings report, Micron’s stock has shown strength, reflecting optimism about AI demand and industry recovery. Analysts expect an implied move of $10.33, signaling potential volatility post-earnings. Options volume remains elevated, indicating significant investor interest.

For 2024, Micron’s stock has rallied over 40%, outperforming the broader Nasdaq Composite. This reflects confidence in the company’s strategic positioning in AI memory solutions and its ability to capitalize on recovering demand.

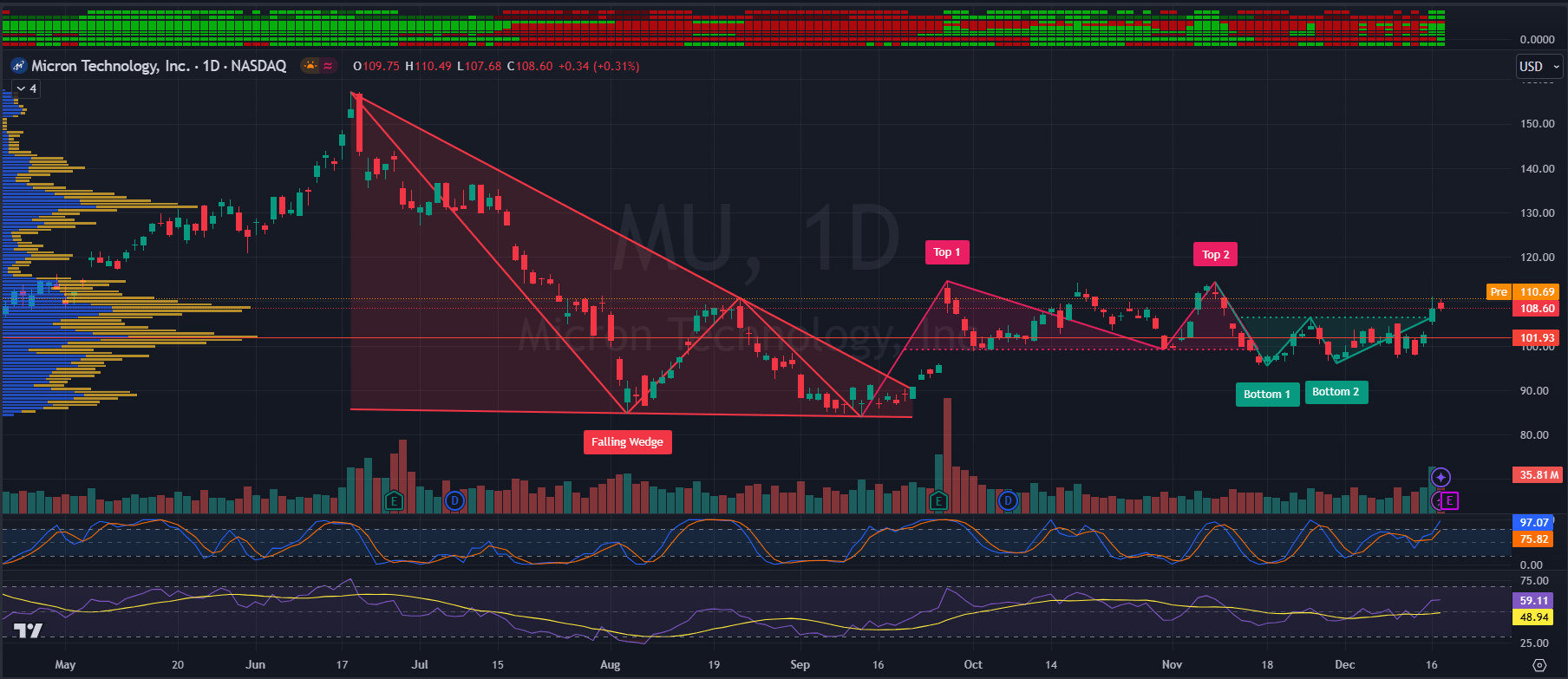

Technical Analysis - Micron Technology, Inc. (MU) - 1-Day

Chart Analysis:

- Key Technical Patterns:

- Falling Wedge: A bullish reversal pattern identified in July-August. Price broke upward from this wedge, signaling the start of a recovery.

- Top 1 & Top 2: These peaks highlight resistance zones, indicating areas where bullish momentum stalled.

- Bottom 1 & Bottom 2: A double bottom pattern emerged between November and December, signaling strong support near the $90 zone and a potential trend reversal.

- Current Price Action:

- Price has broken above key resistance at $101.93 and is now testing levels near $110.69.

- Volume has increased significantly, supporting the upward breakout, which strengthens the bullish outlook.

- Indicators:

- Stochastic Oscillator: At 97.07, it signals overbought conditions, suggesting potential short-term consolidation or pullback.

- RSI (14): Currently at 59.11, showing bullish momentum but not yet overbought, leaving room for further upside.

- Volume Profile: Significant trading volume is visible in the $100-$110 range, indicating this zone as a key area of interest for traders.

- Resistance and Support Levels:

- Immediate Resistance: $110.69 (current pre-market high).

- Support: $101.93, which previously acted as resistance but now serves as support.

Outlook:

- Bullish Scenario: If price sustains above $110.69 with continued volume, further upside toward $115-$120 is likely.

- Bearish Scenario: A pullback to test support at $101.93 is possible, especially given overbought Stochastic levels.

Conclusion

Micron Technology’s earnings on December 18th are set to provide critical insights into the semiconductor sector’s recovery trajectory. With expectations for a strong rebound in DRAM and NAND sales, driven by AI infrastructure and improving market conditions, the report could further solidify Micron’s leadership in the memory segment. Investors will closely monitor the company’s outlook for 2025 and key metrics such as pricing trends, margins, and demand projections to gauge broader industry health.

Micron’s results will not only influence its own stock trajectory but also serve as a leading indicator for the global semiconductor industry as it heads into a potentially transformative 2025.