Meta Platforms Q3 2024 Earnings Preview

Earnings Release Date: October 2024

Expected EPS: $5.21 (+18.7% YoY)

Expected Revenue: $40.16 billion (+17.6% YoY)

Meta Platforms (META) is expected to deliver strong growth in both earnings and revenue when it reports its Q3 2024 results. Analysts are forecasting earnings per share (EPS) of $5.21, which would represent an 18.7% increase from the same quarter last year. Revenue is expected to come in at $40.16 billion, up 17.6% year-over-year.

Key Growth Drivers:

- Artificial Intelligence and CRM Tools: Meta's new AI-powered tools and Customer Relationship Management (CRM) systems are expected to drive higher returns on investment and boost incremental ad spending. These innovations are particularly geared towards helping advertisers achieve better engagement and conversion rates, further monetizing Meta's extensive user base.

- Monetization of Messaging and Reels: Meta has been increasingly monetizing Reels and its messaging platforms like WhatsApp, which are poised to deliver strong revenue contributions this quarter. These platforms are expected to be key drivers of ad revenue growth, particularly as Meta continues to roll out new advertising formats on these channels.

- Political Ad Spend: With modest political ad spending this quarter, Meta may see a further uplift in ad revenue, adding to its already strong advertising performance.

Recent Developments:

- Partnership with Lumen Technologies: Meta recently partnered with Lumen Technologies (LUMN) to enhance its network capacity. This collaboration will provide Meta with secure on-demand bandwidth, supporting its AI applications and the company's broader push into advanced computing needs. This partnership is expected to position Meta well for future growth in AI-related services and applications.

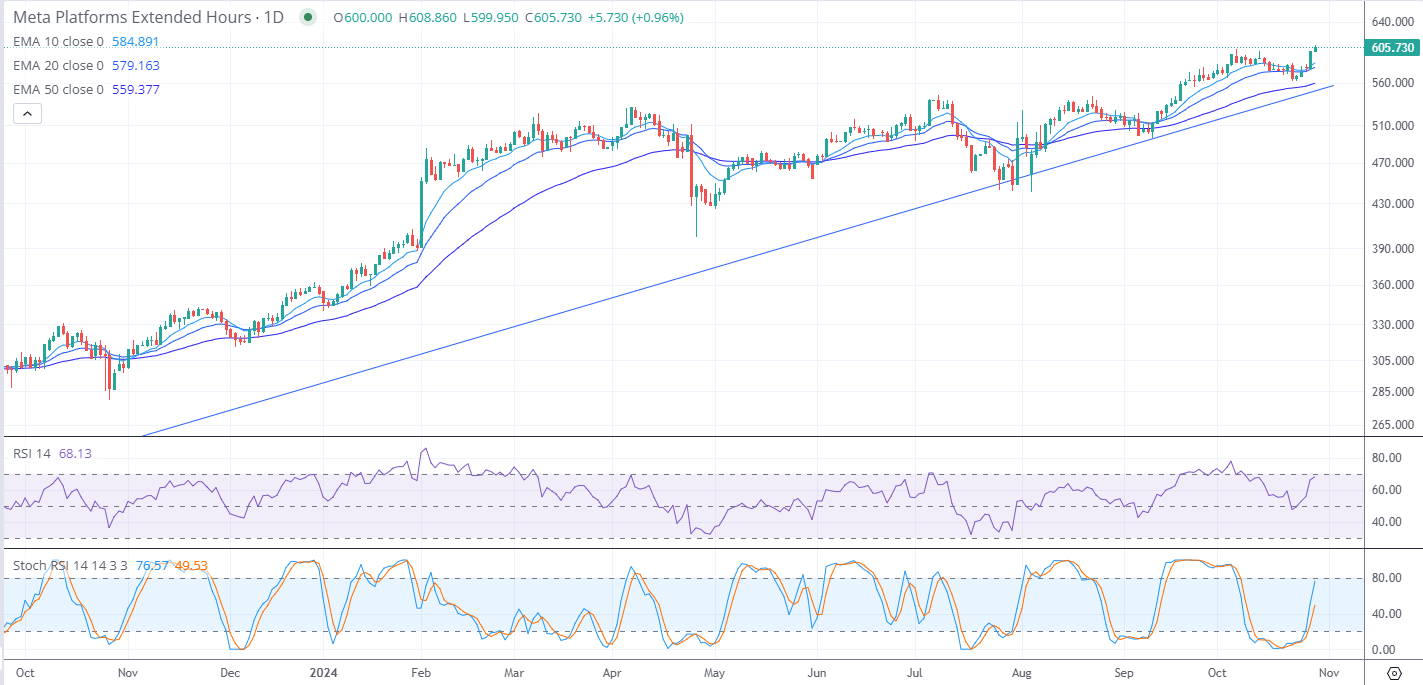

Stock Performance:

- Over the last three months, Meta's stock price has gained 13.53%, outperforming the S&P 500’s 5.19% gain in the same period. Meta has beaten earnings estimates in the past six consecutive quarters, and investors are optimistic that the company will continue this trend in Q3 2024.

Challenges Facing Meta:

- Regulatory Scrutiny: Meta remains under significant regulatory scrutiny, particularly around privacy, data protection, and antitrust issues. Increased regulation could impact profitability by forcing operational changes or leading to fines, which may constrain the company's ability to expand freely.

- Intense Competition: Meta faces stiff competition from platforms like TikTok and other emerging social media channels that are vying for user attention and ad revenue. This competition necessitates constant innovation to maintain its dominant position in the market.

- User Growth Stagnation: While Meta boasts a large global user base, user growth in mature markets like the U.S. and Europe has slowed. To continue its revenue growth, Meta will need to find ways to attract new users in emerging markets without diluting its monetization strategy.

Conclusion:

Meta is expected to report strong Q3 2024 earnings, driven by continued success in AI-powered tools, Reels and messaging monetization, and a strategic partnership with Lumen Technologies. However, ongoing regulatory pressures, increasing competition, and slower user growth in key markets could present headwinds.

Microsoft Q3 2024 Earnings Preview

Earnings Release Date: October 2024

Expected EPS: $3.11 (up from $2.99 YoY)

Expected Revenue: $64.57 billion (up from $56.52 billion YoY)

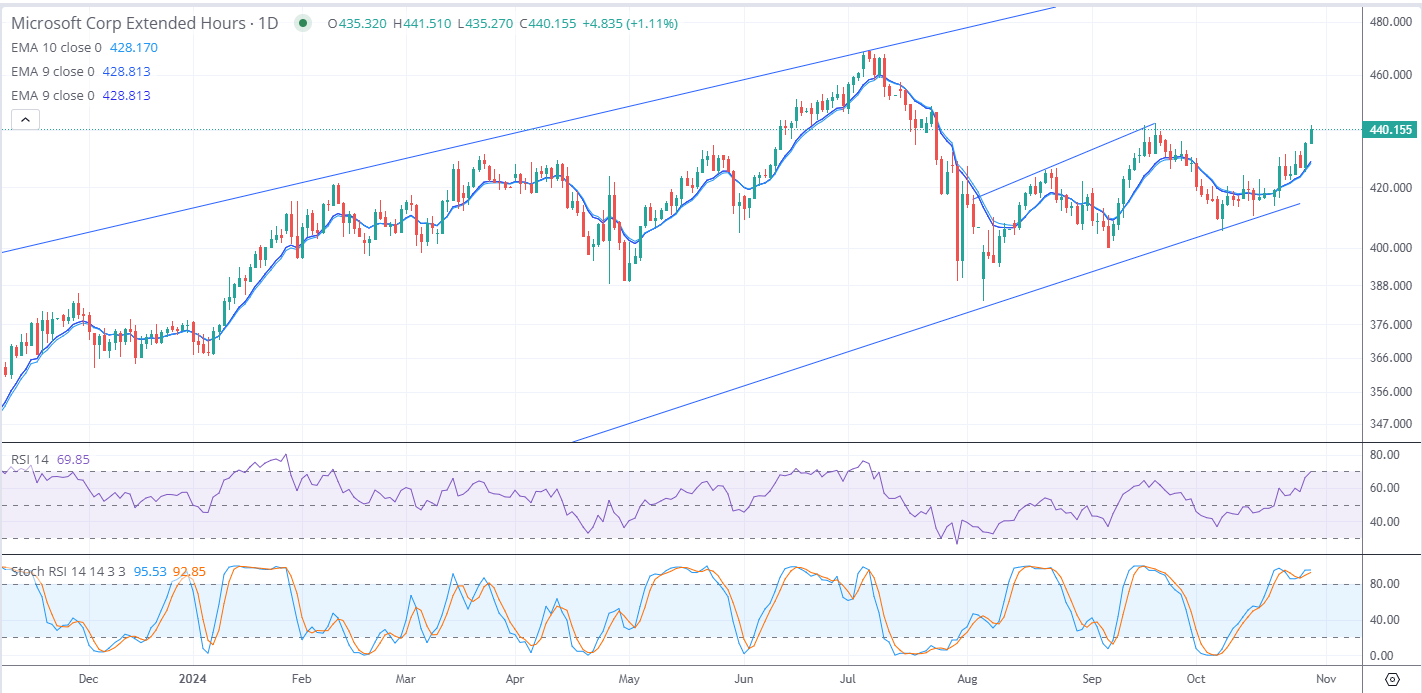

Microsoft Corporation is set to announce its Q3 2024 earnings this week, marking the first report since its business resegmentation aimed at better aligning results with business management. Key changes include a new Microsoft 365 Commercial products and cloud services segment, merging commercial Office 365 and Windows Commercial revenues along with other product revenues, all within the broader Productivity and Business Processes section.

While overall revenue remains unaffected, investors should approach segment comparisons with caution, as analyst consensus estimates may not fully account for these changes. Microsoft’s guidance for this quarter projects:

- Productivity and Business Processes: $27.75 billion to $28.05 billion

- Intelligent Cloud: $23.80 billion to $24.10 billion

- More Personal Computing: $12.25 billion to $12.65 billion

Key Focus Areas for Investors:

- Azure Revenue Growth: Microsoft anticipates 33% growth in Azure's constant-currency revenue, slightly down sequentially. Analysts expect cloud infrastructure demand for AI training to drive continued medium-term growth, even as near-term growth appears limited.

- Strong Free Cash Flow: Microsoft’s financial strength is highlighted by its free cash flow margin, exceeding 30%. This allows for strategic investments in growth initiatives, particularly in cloud and AI infrastructure.

- Long-Term Growth Potential: The company has a history of consistent earnings and revenue growth. Analysts expect normalized EPS growth of 13% over the next year, with long-term returns projected at 15% annually over the next five to ten years. The current non-GAAP P/E ratio is relatively attractive, sitting slightly above the five-year average by only 6.5%.

Potential Risks and Headwinds:

- Cyclical AI Demand: The current boom in AI adoption could be cyclical, with potential growth slowdowns if macroeconomic conditions tighten. Heavy AI investment by Microsoft and its peers may lead to overcapacity, potentially impacting long-term returns.

- Regulatory and Legal Scrutiny: With 32% of Microsoft’s risk stemming from legal and regulatory factors, increased scrutiny on data privacy and AI governance could impact AI operations.

- Investment Risks in AI Infrastructure: With 21% of Microsoft’s risk related to Tech & Innovation, heavy investments in AI-driven initiatives could result in lower-than-expected returns if AI market growth slows.

Conclusion:

Microsoft is poised for a strong earnings report, driven by robust growth in Azure, solid free cash flow, and long-term growth potential. Despite potential risks related to cyclical AI demand, regulatory scrutiny, and over-investment in AI, the company remains attractive for long-term growth investors, especially given its historical resilience and financial strength.