Market Brief – Martin Luther King Day and Global Market Dynamics

As we observe Martin Luther King Day, it's worth reflecting on the significance of his leadership in the Civil Rights Movement and his enduring legacy of advocating for nonviolent activism. While markets and banks in the U.S. are closed today, global market participants are navigating a range of economic and geopolitical developments with cautious optimism.

U.S. Markets: Cautious Anticipation Amid Inauguration

U.S. markets are closed for Martin Luther King Jr. Day, leading to a likely tapering of trading activity following European market hours. However, attention is squarely on President Donald Trump's second-term inauguration and his policy announcements. Trump’s remarks during a rally on Sunday suggested a focus on tariffs, energy, and technology. Key points include:

- Trade and Tariffs: Trump reiterated his commitment to curbing immigration and introducing tariffs to protect domestic industries.

- Energy and AI: He plans to unleash energy resources, including using emergency powers to expedite AI infrastructure development.

- Executive Orders: Trump promised to sign close to 100 executive orders, signaling immediate and aggressive policy implementation.

Global Market Overview

Asia

- Japan: The Nikkei gained 0.7%, driven by expectations of a potential Bank of Japan rate hike. However, the yen's strengthening against the dollar is creating headwinds for export-oriented sectors.

- China: The yuan appreciated following a positive phone call between Trump and President Xi Jinping. Chinese markets reflected modest gains after GDP growth for Q4 2024 came in at 5.4%, aligning with Beijing’s 5% annual target.

Europe

- European markets remained flat as investors awaited clarity on U.S. policy. Concerns over protectionist tariffs and weaker-than-expected U.K. retail sales are adding pressure on European equities.

Commodities

- Oil: Brent crude and WTI saw slight dips, trading at $81.42 and $78.95, respectively, amid speculation over U.S.-Russia energy policy shifts.

- Gold and Silver: Gold hovered around $2,705 per ounce, while silver prices gained 0.15%, potentially due to anticipation of industrial demand, especially for renewable energy technologies.

IMF Economic Forecasts: Germany at the Bottom

The International Monetary Fund (IMF) updated its global economic outlook for 2025, projecting overall growth of 3.3%. Key highlights include:

- India and China Lead: India is expected to grow by 6.5%, and China by 4.6%, driving global expansion.

- U.S. Growth Revised Up: The U.S. growth forecast was raised to 2.7%, reflecting anticipated fiscal and trade policies under Trump’s administration.

- Europe and Germany Lag: The Eurozone is projected to grow by 1.0%, with Germany trailing at 0.3%, the lowest among major economies. Contributing factors include:

- Structural Challenges: Industrial slowdowns and weak consumer spending.

- Protectionism: Potential U.S. tariffs on European goods could further dampen growth.

Economic Calendar and Outlook

- Europe: Key STOXX 600 companies, including Givaudan and Ericsson, will report quarterly earnings this week.

- U.S.: 40 S&P 500 companies are set to announce results, including Netflix, American Express, Procter & Gamble, and Johnson & Johnson.

- UK: The unemployment rate for November is expected to rise from 4.3% to 4.4%, potentially amplifying stagflation concerns amidst weak growth and persistently high inflation.

Crypto

In anticipation of President Donald Trump's inauguration for his second term, the cryptocurrency market has experienced notable volatility. Bitcoin surged past $109,000, reflecting investor optimism about potential pro-crypto policies under the new administration.

This optimism is fueled by expectations of favorable regulatory changes and the appointment of crypto-friendly figures in key positions.

However, the launch of a Trump-branded memecoin has raised concerns among industry experts, who caution that such ventures could undermine efforts to legitimize the cryptocurrency sector.

As of January 20, 2025, Bitcoin is trading at $108,411, Ethereum at $3,386.40, and XRP at $3.26, indicating a dynamic and responsive market environment.

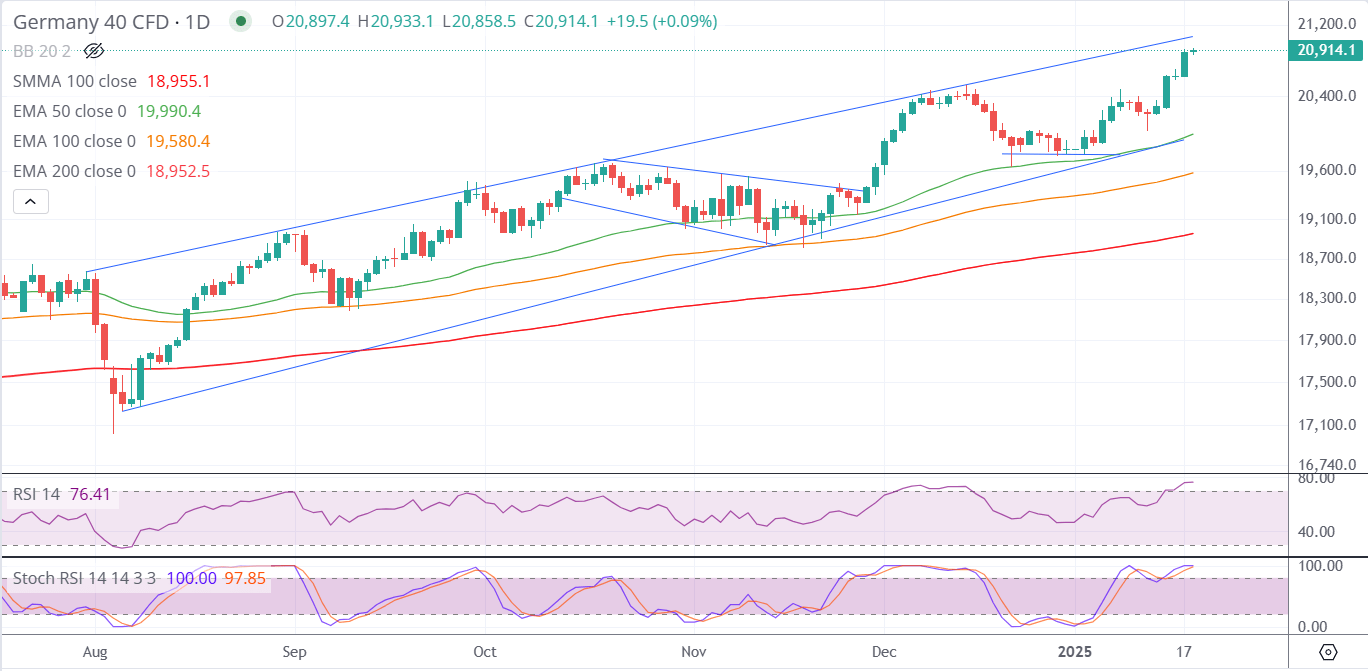

DAX Technical analysis

The DAX (Germany 40) continues its bullish trend within a well-defined ascending channel, as observed on the daily chart. The price is approaching the upper boundary of the channel near 21,000, signaling potential resistance. Momentum remains strong, with the index trading above key moving averages: the 50 EMA (19,990.4) and the 100 EMA (19,580.4) acting as dynamic support levels.

Technical indicators suggest caution as the RSI is at 76.41, indicating overbought conditions. Similarly, the Stochastic RSI is at 100, further highlighting the likelihood of a short-term pullback or consolidation. However, the overall trend remains positive, supported by higher lows and higher highs, keeping the bullish sentiment intact unless there is a significant breakdown below the 50 EMA.

In summary, while the DAX remains firmly in an uptrend, traders should watch for potential resistance at the channel's upper boundary and signs of profit-taking due to overbought conditions. A breakout above 21,000 could extend gains, but a pullback to the mid-channel or key moving averages may provide buying opportunities.

Conclusion

As the week begins with Martin Luther King Jr. Day, global markets are balancing optimism with caution. Investors are closely monitoring President Trump’s policy directions, particularly regarding trade and energy, while IMF forecasts highlight ongoing challenges for Europe, especially Germany. Crypto is fuelled by Trump optimism.

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom