Markets in Focus Ahead of Key US Inflation Data

Markets are trading cautiously ahead of the release of the December US Consumer Price Index (CPI) data, a pivotal factor that could influence the Federal Reserve's monetary policy path. While a milder-than-expected US Producer Price Index (PPI) offered temporary relief, investors remain on edge. A core CPI reading above expectations (0.3% or higher) could push 10-year Treasury yields toward 5%, strengthen the dollar, and spark another round of sell-offs in both equities and bonds.

Mixed Signals from Global Inflation Reports

- US Inflation Concerns: The US PPI rose modestly by 0.2% month-over-month in December, with core prices stagnating. However, components influencing the Fed's preferred inflation metric, the PCE Core Rate, displayed mixed signals. Notably, airfare prices surged by 7.2%, highlighting potential upward risks to inflation forecasts.

- UK Inflation Data: The UK's inflation data painted a mixed picture. The monthly inflation rate rose to 0.3% from 0.1%, but it fell short of the 0.4% forecast. Meanwhile, the annual rate slowed to 2.5% from 2.6%, slightly below expectations, providing a glimmer of relief for policymakers.

Asian and European Markets

- Asia: Japanese markets remained volatile, with the Nikkei fluctuating and the yen strengthening on speculation of a Bank of Japan rate hike.

- Europe: European markets traded flat in the morning session, reflecting investor caution as they awaited key US data.

Dollar Strength and Corporate Impact

The strengthening US dollar continues to be a double-edged sword. While it provides additional gains for euro-based investors holding US assets, it can be a drag on US companies with significant international revenues. Historical data reveals that a 10% quarter-on-quarter appreciation of the dollar reduces S&P 500 quarterly revenue growth by approximately four percentage points, with energy and materials sectors facing the steepest declines.

Corporate Earnings on the Radar

Today's spotlight falls on the financial sector, as several major institutions are set to report Q4 earnings:

- JPMorgan Chase & Co.: Analysts expect EPS of $4.03 on $41.58 billion in revenue, with attention on investment banking performance and economic outlook.

- Citigroup: Forecasted EPS of $1.24 on $19.51 billion in revenue, with trading revenues and expense strategies under scrutiny.

- Wells Fargo: Anticipated EPS of $1.35 on $20.58 billion in revenue, focusing on net interest margins and regulatory developments.

- BlackRock: Expected to post an EPS of $11.33 on $5.63 billion in revenue, with insights into asset flows and fee structures.

On Today’s Agenda

- Consumer Price Index (CPI): The US Bureau of Labor Statistics will release the December CPI data, expected to show a 2.9% year-over-year increase.

- Empire State Manufacturing Index: Analysts forecast modest growth, signaling steady manufacturing conditions.

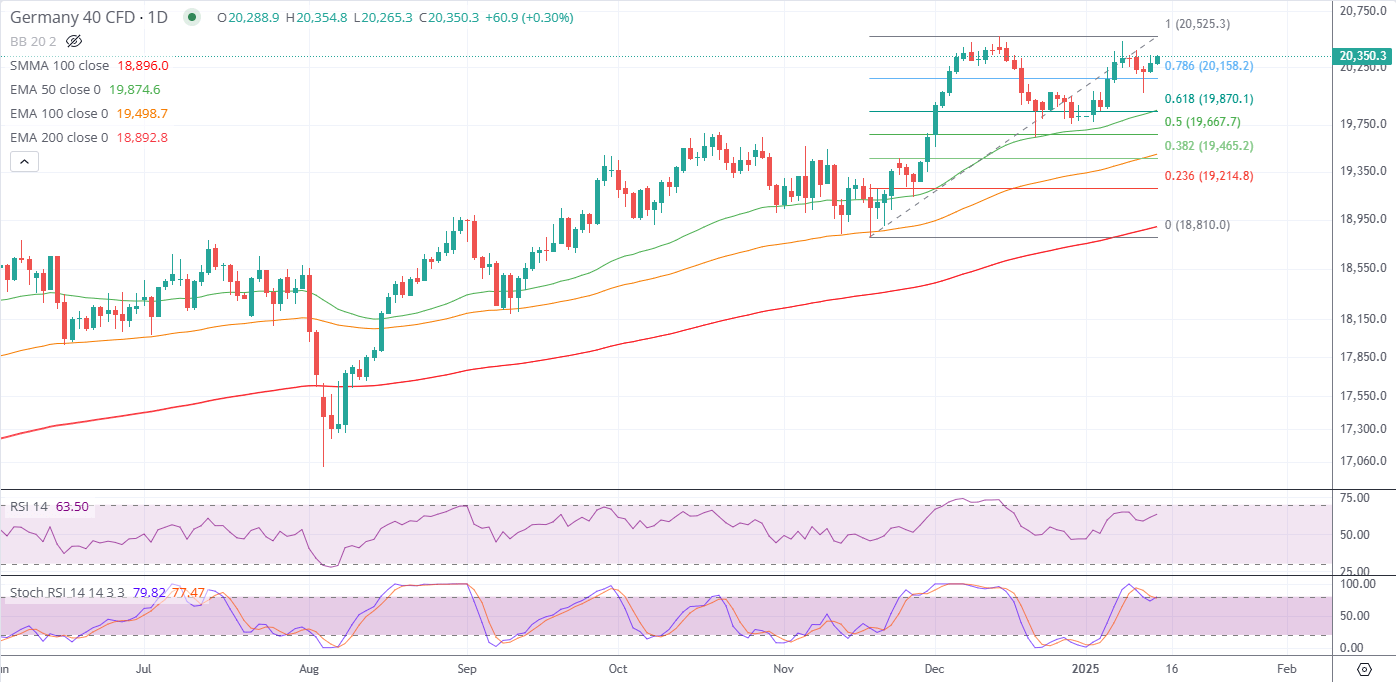

DAX 40 Technical Analysis

- Trend Overview:

- The DAX has been in an uptrend, marked by higher highs and higher lows. Recent price action suggests consolidation near resistance levels around 20,525.

- Key Levels:

- Resistance: The immediate resistance is 20,525, the recent swing high.

- Support Levels (Fib Retracements):

- 20,158 (78.6% Fib level): Key level of support close to current prices.

- 19,870 (61.8% Fib level): This aligns with the EMA 50, making it a critical area.

- 19,465 (38.2% Fib level): Deeper retracement, potential support if bearish momentum increases.

- 19,214 (23.6% Fib level): Minor support level.

- Moving Averages:

- EMA 50 (19,874): Currently providing dynamic support.

- EMA 100 (19,498): Indicates a medium-term bullish trend remains intact.

- SMA 200 (18,896): Far below current levels, confirming the long-term bullish structure.

- Indicators:

- RSI (14): At 63.50, it indicates bullish momentum without being overbought. There’s room for further upside.

- Stochastic RSI: Overbought levels, suggesting potential for short-term consolidation or a pullback.

- Price Action:

- The DAX is testing resistance near its all-time high, with bullish momentum intact but showing signs of exhaustion.

- A break above 20,525 could lead to new highs, while failure to break might push the price back to support levels around 20,158 or lower.

Outlook:

- Bullish Scenario: A decisive break above 20,525 could signal continuation toward uncharted territories, with the next psychological target at 21,000.

- Bearish Scenario: If resistance holds, a pullback toward 20,158 or even 19,870 could occur, which could represent potential areas of interest.

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom