Market Reaction and Economic Outlook Post-Election

Donald Trump’s Victory and Market Reactions

With Donald Trump poised to reclaim the presidency after a night of sweeping victories, the markets are reacting strongly. U.S. stock futures and the dollar are surging as investors anticipate pro-business policies, potential tariffs, and inflationary spending that may prompt the Federal Reserve to reconsider further rate cuts. Trump’s likely win of both the electoral college and popular vote is the first for a Republican in 20 years, suggesting solidified support for his policy direction.

While Republicans are set to secure the Senate, Democrats are expected to control the House of Representatives. This setup could lead to legislative gridlock on some issues but might allow Trump to push forward his economic agenda, which markets have embraced.

Impact on Global Markets and Commodities

Trump’s anticipated policies, including potential new tariffs, have already shaken global markets. Chinese stocks dropped sharply on fears of new U.S. tariffs, while the DAX also fell on concerns about European product tariffs. Cryptocurrencies like Bitcoin have soared to new highs, with investors likely seeing crypto as a hedge against inflationary policy. The S&P 500 also hit record highs, reflecting investor optimism about U.S. economic growth under Trump’s policies.

Relief for Cryptocurrencies

UBS and the Move Toward Blockchain and Tokenization In a significant move, UBS launched its first tokenized fund, uMINT, on the Ethereum blockchain, joining BlackRock and other financial giants in embracing blockchain technology. This fund provides institutional-grade cash management on a decentralized platform, leveraging money market instruments in a managed risk environment. UBS’s new fund aligns with its broader “UBS Tokenize” initiative, which has already seen digital bonds and blockchain-based cross-border transactions. The trend indicates a growing adoption of blockchain in traditional finance, potentially enhancing transparency, security, and efficiency in fund management.

Federal Reserve and Upcoming Rate Cuts With the U.S. Federal Reserve’s interest rate decision expected on Thursday, analysts at ING anticipate a 25 basis point rate cut on November 7, regardless of the election outcome. The Fed appears to be pivoting away from its inflation concerns to focus on a cooling job market. Following a 50 basis point cut in September, ING expects another rate cut in December, totaling 100 basis points for the year, as the Fed aims to move to a more neutral policy stance.

Crypto Inflows Surge Amid Market Uncertainty Cryptocurrencies recorded a strong week with $901 million in investment inflows, highlighting investor confidence in digital assets as a hedge against potential inflationary risks and economic volatility. This inflow underscores the resilience of crypto markets in times of macroeconomic uncertainty, as investors increasingly view cryptocurrencies as alternative assets amid traditional market fluctuations.

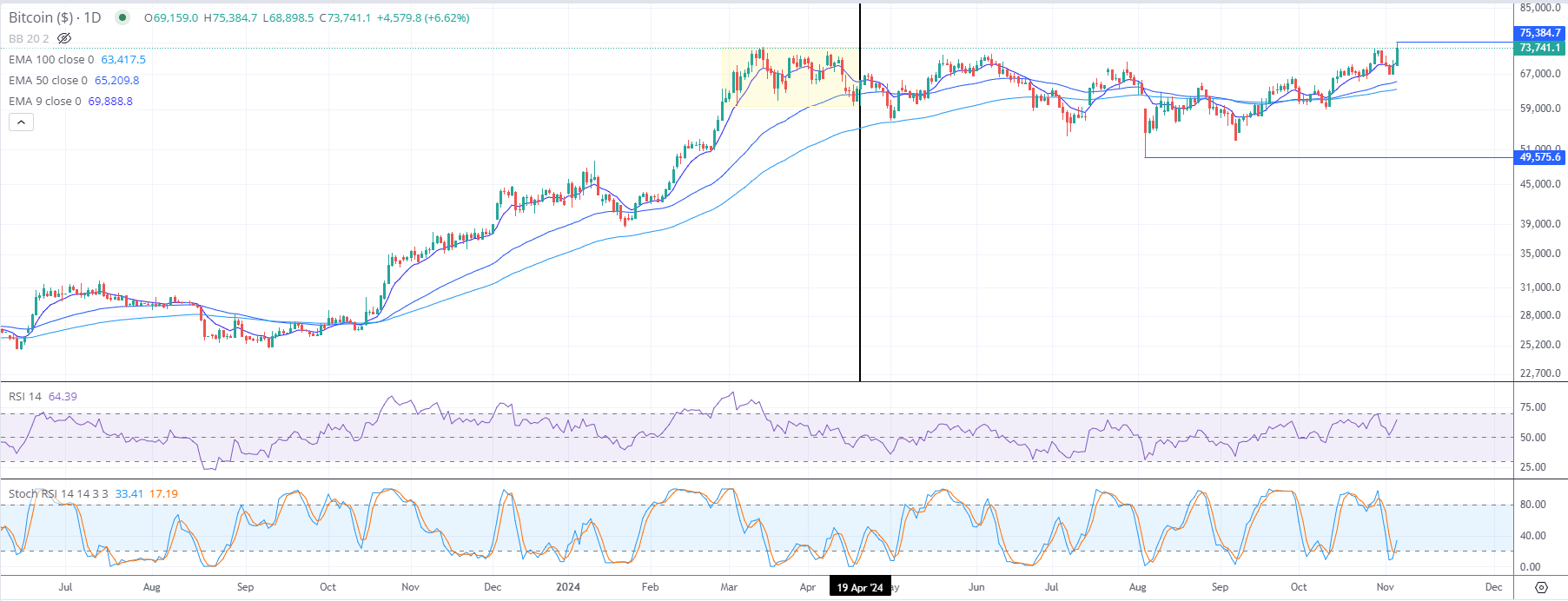

Bitcoin (BTC/USD) daily chart - Technical Analysis

1. Uptrend with Strong Bullish Momentum:

- Bitcoin is in a clear uptrend, making higher highs and higher lows. The price recently tested levels around $75,384, which is a significant resistance area.

- The consistent uptrend is supported by the alignment of key exponential moving averages (EMAs) below the price, reinforcing the bullish outlook.

2. Support and Resistance Levels:

- Resistance:

- The immediate resistance is around $75,384, the recent high. Breaking above this level could signal further bullish movement toward new highs.

- Support:

- Near-term support is at $65,209.8 (50-day EMA) and $63,417.5 (100-day EMA).

- A major support level exists at $49,575.6, which is far below current levels but represents a strong floor in case of a significant pullback.

3. Moving Averages (EMA 9, 50, 100):

- The EMAs are aligned in a bullish formation, with the EMA 9 around $69,888.8, the EMA 50 at $65,209.8, and the EMA 100 at $63,417.5. The price is well above these averages, showing strong upward momentum.

- The EMA 9 is acting as dynamic support in the near term, and a price above this level indicates sustained bullish momentum.

4. RSI and Stochastic Oscillator:

- The RSI is at 64.39, approaching overbought levels but not yet extreme. This suggests that there is still room for further upward movement.

- The Stochastic Oscillator is at 33.41, indicating a recent dip into oversold territory. If it turns upward, it may signal a continuation of the bullish trend after a brief consolidation.

5. Potential Consolidation Zone:

- The yellow shaded region around $60,000 to $68,000 indicates a consolidation zone from previous price action. If Bitcoin encounters resistance at $75,384, it may pull back and find support within this zone before attempting to break out again.

BullishThesis - Scenario 1: Bullish Breakout:

- If Bitcoin breaks above $75,384, we could see an acceleration of the uptrend, potentially aiming for $80,000 or even higher. The RSI indicates there’s room for further upside, and as long as the price remains above the EMA 9, the bullish momentum is likely to persist.

Bearish Thesis - Scenario 2: Short-term Pullback and Consolidation:

- Should Bitcoin face strong resistance at $75,384 and fail to break higher, it may retrace to find support around the EMA 50 or EMA 100. This pullback would allow for consolidation before another attempt to breach the resistance.

- The consolidation zone around $60,000 to $68,000 could provide a stabilizing area for the price in case of a pullback.

Conclusion:

Trump’s victory is expected to drive market optimism domestically while adding pressure to global markets, especially China and the EU. The Fed’s rate cut strategy, upcoming policies, and cryptocurrency adoption are key areas to watch in this changing economic landscape.

Bitcoin’s technical setup remains bullish with strong upward momentum, but it’s approaching a critical resistance at $75,384. A breakout above this level could open the door to higher targets. However, if it fails to break through, a pullback to key EMAs or the consolidation zone could be on the agenda.