With Kashkari throwing the word ‘pause’ into the mix ahead of a US CPI report, traders should brace themselves for further USD gains should it come in hotter than expected.

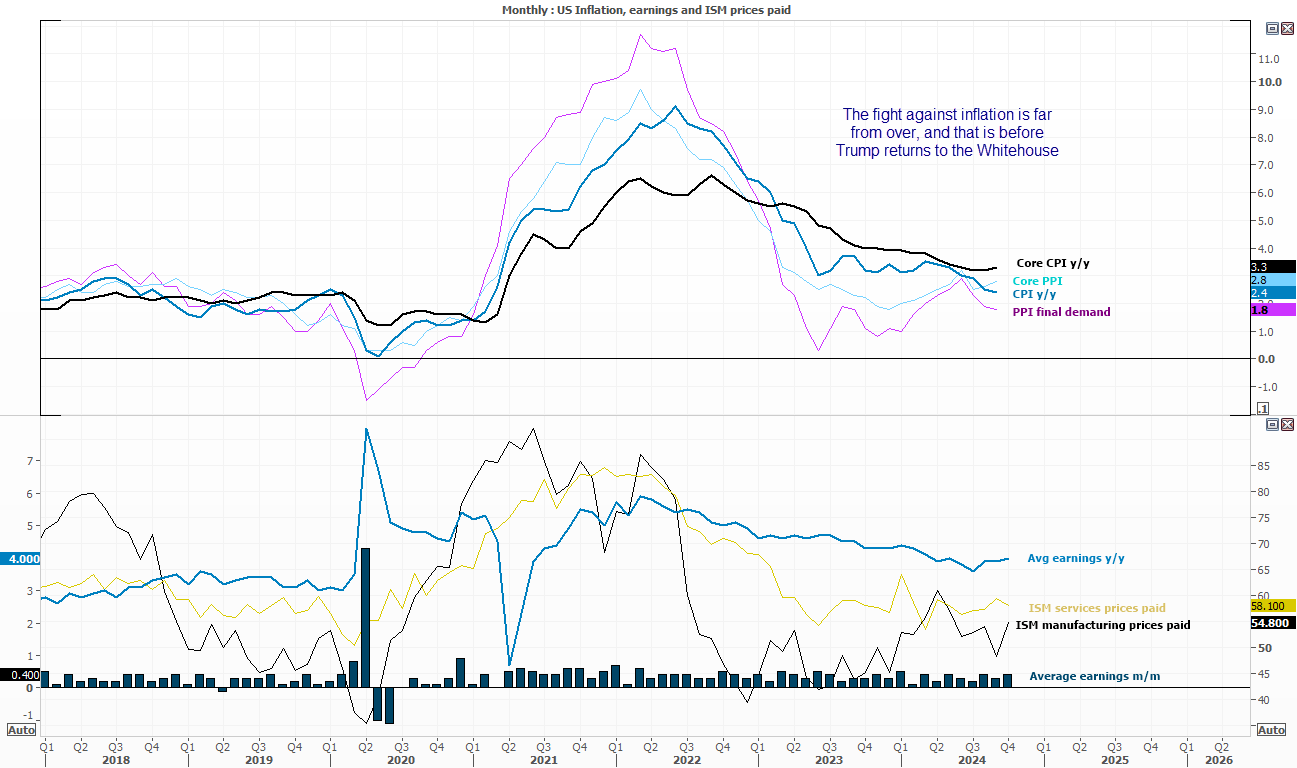

Inflation data has been trending lower for a while, but the fight against it is not over. Especially with Trump 2.0 now in motion, which investors fear will bring higher levels of inflation. Core CPI remains well above the Fed’s 2% target at 3.3% y/y, curled higher by 0.1 percentage point in September and also posted its second 0.3% m/m print in a row. Producer prices also crept higher in September, and the prices paid components of manufacturing reached a 5-month high and services remains elevated at 58.1%.

While a dire NFP job growth figure instilled confidence of more Fed cuts, there seems to be concern from some Fed members that inflation could heat up, even before Trump pick sup the keys to the Whitehouse. On Tuesday, FOMC voting member Kashkari said that “if inflation surprises to the upside before December, it might give us pause”. That is a stark warning that a December cut from the Fed is not a certain at all. Kashkari also noted a strong labour market and that it may take a year or two to get inflation all the way down to 2%. Add Trump’s desire to bolster American jobs into the mix, and you begin to see the problem the Fed face.

Kashkari is also scheduled to speak just as US inflation figures drop at 13:30 GMT, potentially providing a real-time reaction from a voting member on an inflation figure that matters.

- 00:30 - US CPI, FOMC member Kashkari speaks

- 01:30 – FOMC member Williams speaks

- 01:35 – Fed Logan speaks

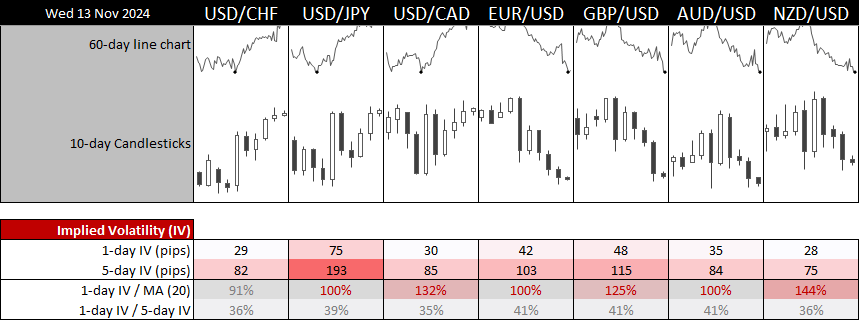

- The 1-day implied volatility is slightly elevated for USD/CAD and GBP/CAD ahead of today’s CPI report

- The IV level is sat at its 20-day average for USD/JPY and AUD/USD

- USD/CHF IV may be understated at 91% of its 20-day SMA, should US inflation come in hot

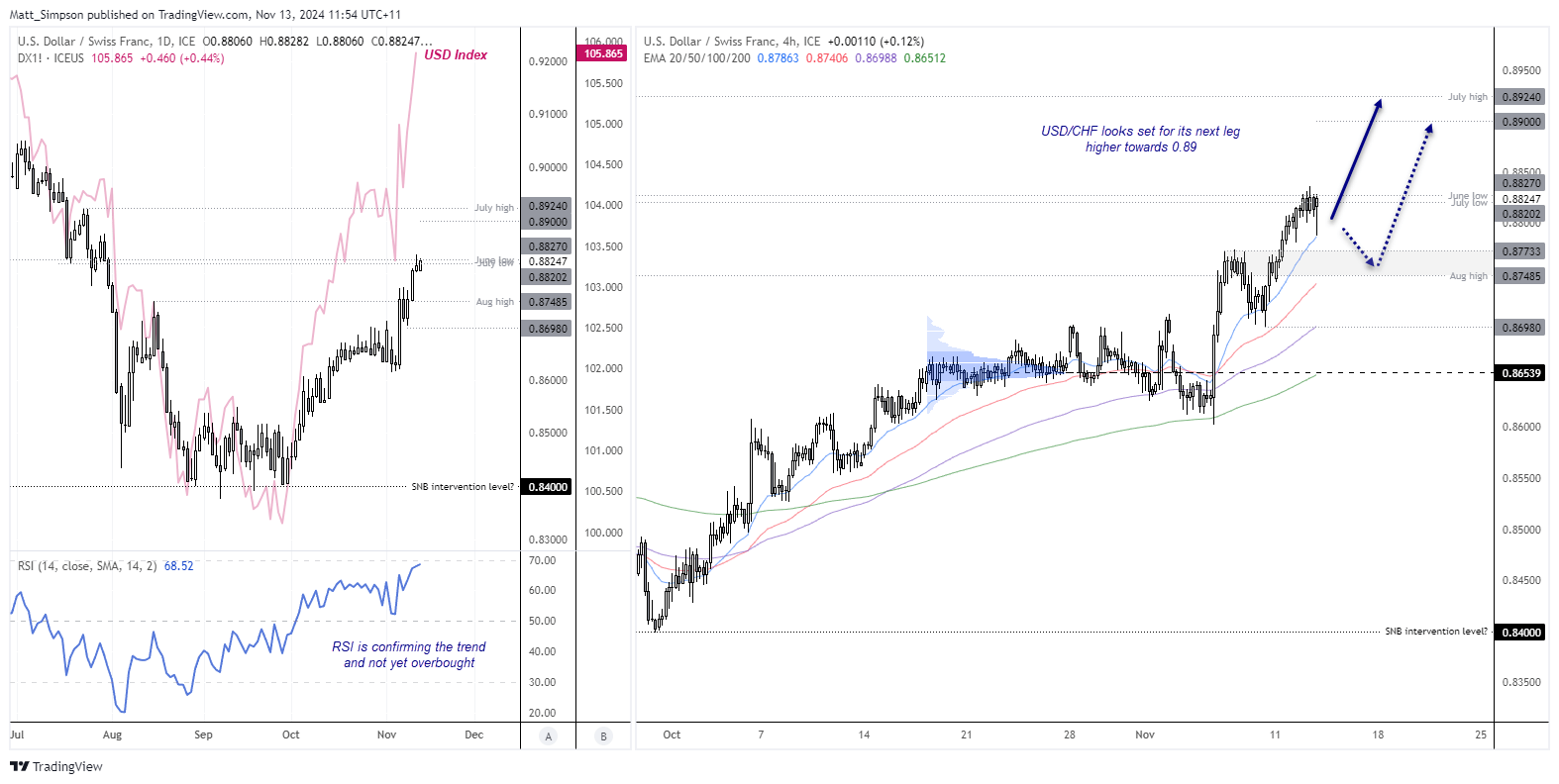

USD/CHF technical analysis

Futures traders remained heavily short Swiss franc futures last week, and aggregate positioning for the USD was net long. And with traders betting on inflationary policies in the US while the Swiss National Bank want a weaker currency, long USD/CHF has been the play. It shares a strong positive correlation with the USD index, although its rally has lagged in comparison and has paused for breath around the June and July lows.

The 1-hour chart shows prices consolidating at the highs and the recent 1-hourb candle respected the 20-bar EMA. The bias is to seek any dips towards the August high in anticipation of another leg high and target the 89 handle, just beneath the July high.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge