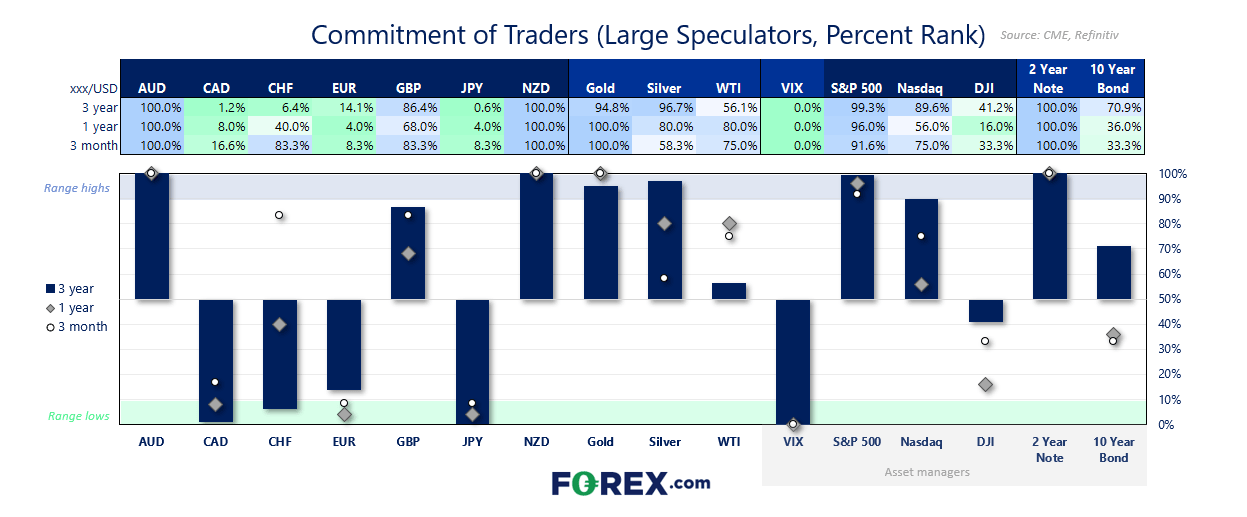

Market positioning from the COT report - as of Tuesday June 25, 2024:

- Large speculators flipped to net-short exposure to EUR/USD futures

- Net-short exposure to AUD/USD futures fell to a 3-yar low

- Bets against VIX futures were reduced by -17.7% (-10.9k contracts)

- Large speculators increased longs exposure and trimmed shorts on commodity FX majors AUD, CAD and NZD

- Shorts bets against gold futures were reduced by -12.3% (-5.4k contracts)

- Gross shorts against silver futures were also down -15.3% (-4.5 contracts)

- Asset managers had a more bullish view on Nasdaq futures with gross shorts -16.2% lower (-4k contracts) with gross longs rising 7.7% (7.8k contracts)

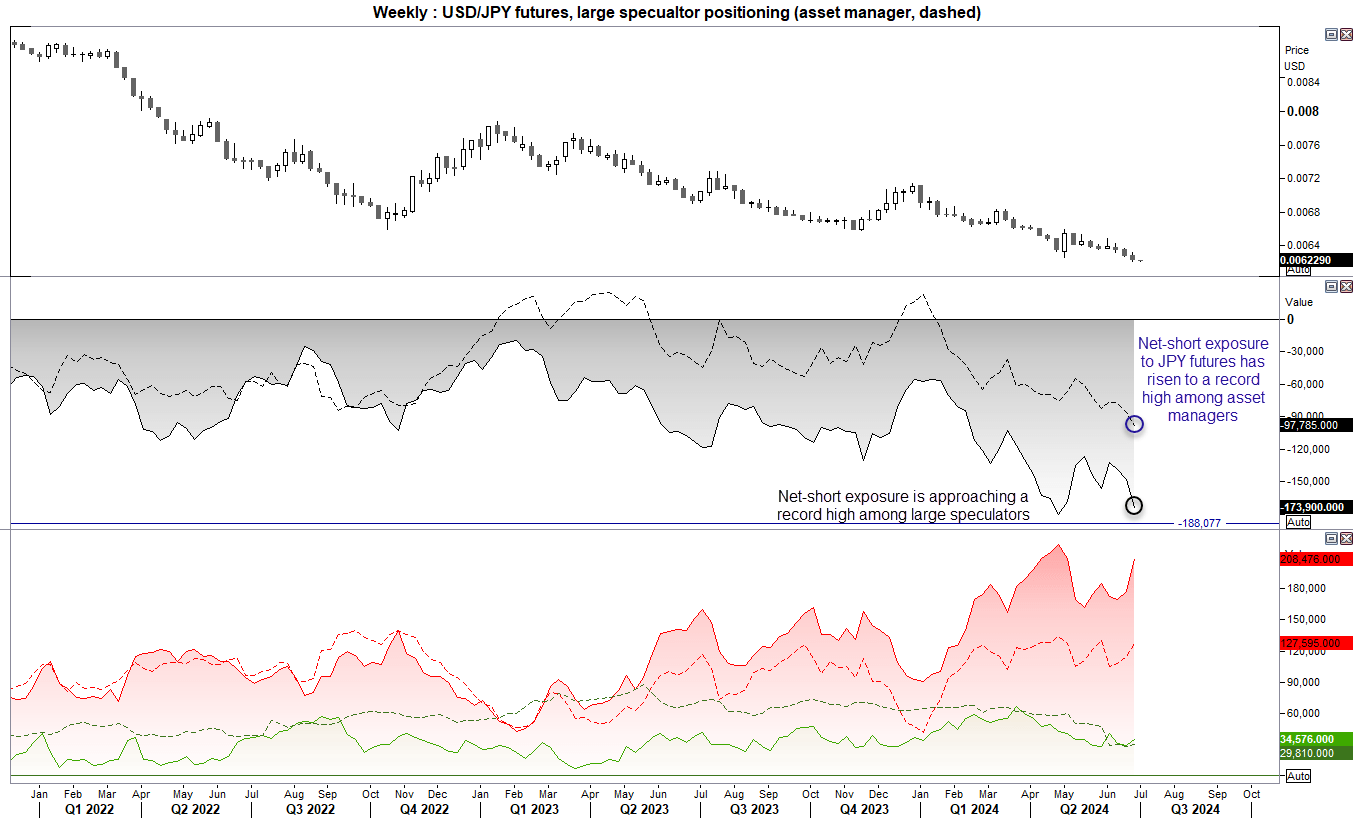

JPY/USD (Japanese yen futures) positioning – COT report:

Net-short exposure to yen futures rose to a record high last week, and is very close to one for large speculators. Whilst this is a classic setup for a sentiment extreme, it will likely take another intervention from the MOF to shake bears out of their positions. Besides, Japan's central authorities are more concerned with the speed at which the yen declines over the level it actually trades at. So even with USD/JPY continues to rise, it doesn't necessarily suggest a sharp reversal is imminent just because of the extreme positioning of speculators. But if US data continues to weaken this week, perhaps USD/JPY could have some sort of a shakeout from its highs.

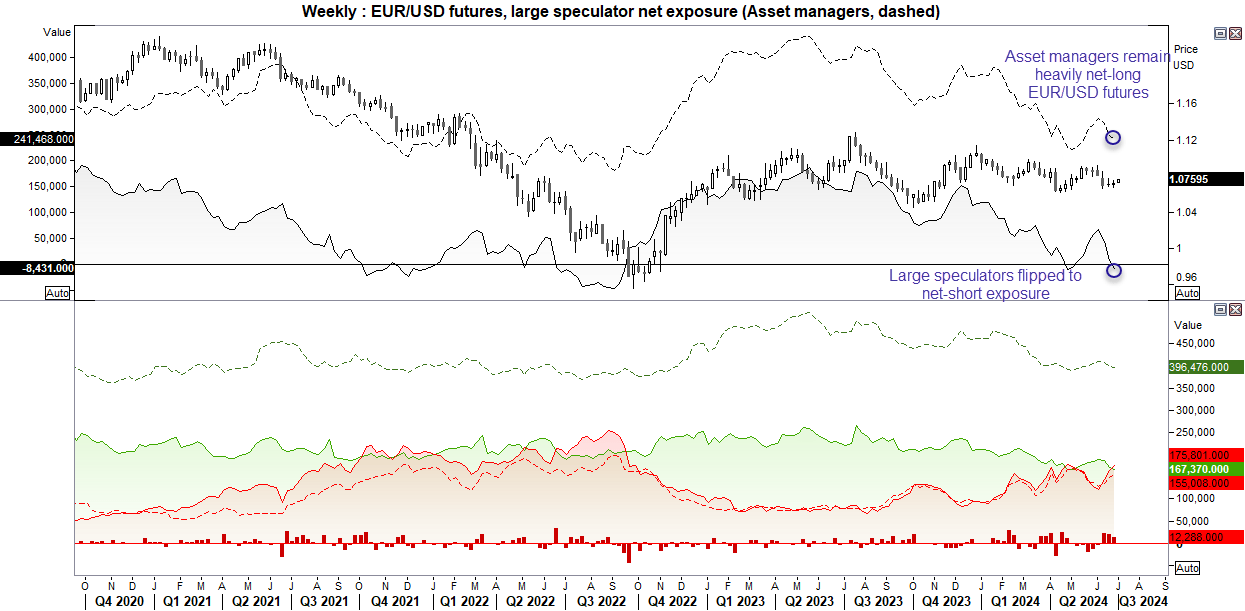

EUR/USD (Euro dollar futures) positioning – COT report:

Concerns that the far-right could form a majority government in the French elections weighed on the euro ahead of voting day, and saw large speculators flip to net-short exposure ahead of the event. But only just. Yet with Marine Le Pen falling just short of the mark to form a majority government, euro pairs gapped higher at Monday’s open in Asia, which means this set of traders may have revered to net-long exposure.

Still, with the PM’s hands likely to be tied, it doesn’t make for a great case to be long euro. But if US data continues to deteriorate this week, the euro could stand to benefit from the weaker US dollar on bets of Fed cuts.

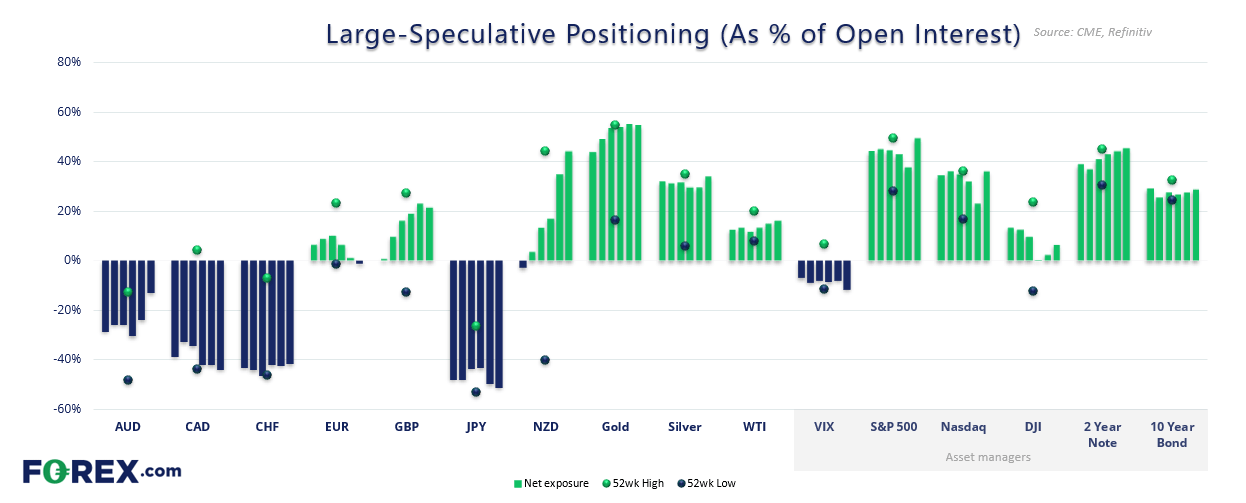

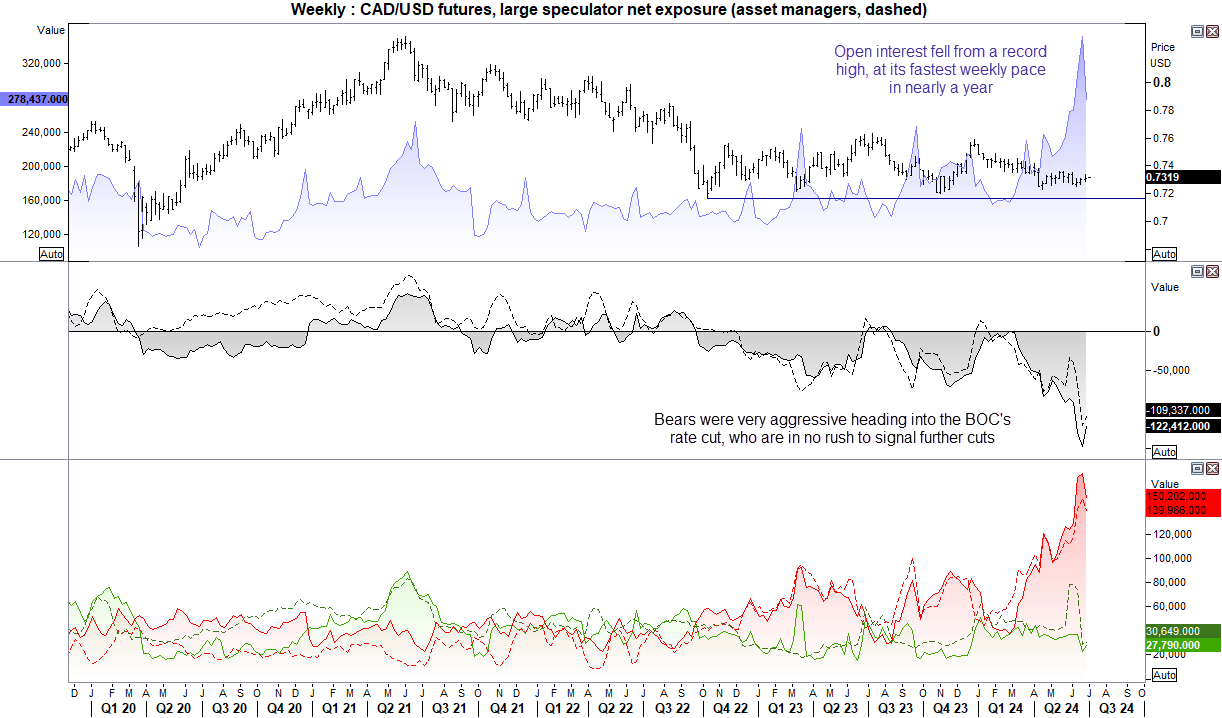

CAD/USD (Canadian dollar futures) positioning – COT report:

The sentiment extreme warning for CAD bears I have warned about is playing out. Bears became very aggressive heading into an anticipated rate cut from the BOC, who refrained from signalling further cuts – as we suspected. This has seen open interest fall at its fastest weekly pace in nearly a year, from a record high.

However, prices are not exactly ripping higher and plenty of bearish bets remain on the table. But if appetite for risk can hold, there could be further room for short covering and a higher Canadian dollar, relative to the USD over the coming weeks.

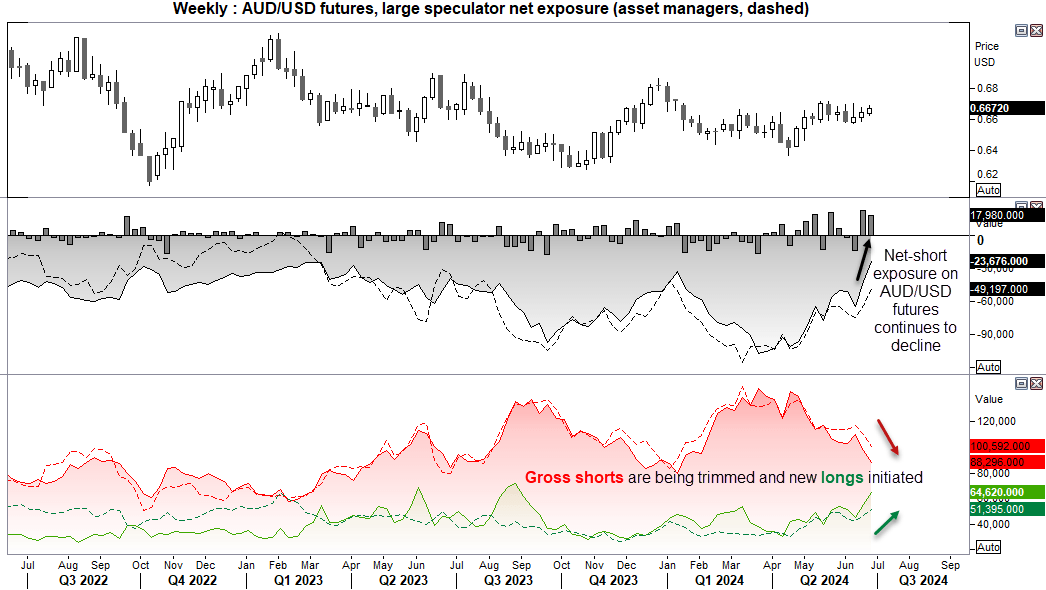

AUD/USD (Australian dollar futures) positioning – COT report:

Short covering on AUD/USD futures has sent net-short exposure to a 3-year low among large speculators. This was before Australia was hit with another uncomfortably hot inflation report last week. Given that US PCE data cooled faster than expected, alongside the likelihood of another RBA hike at their next meeting, it seems only a matter of time before they revert to net-long exposure – assuming they haven't already.

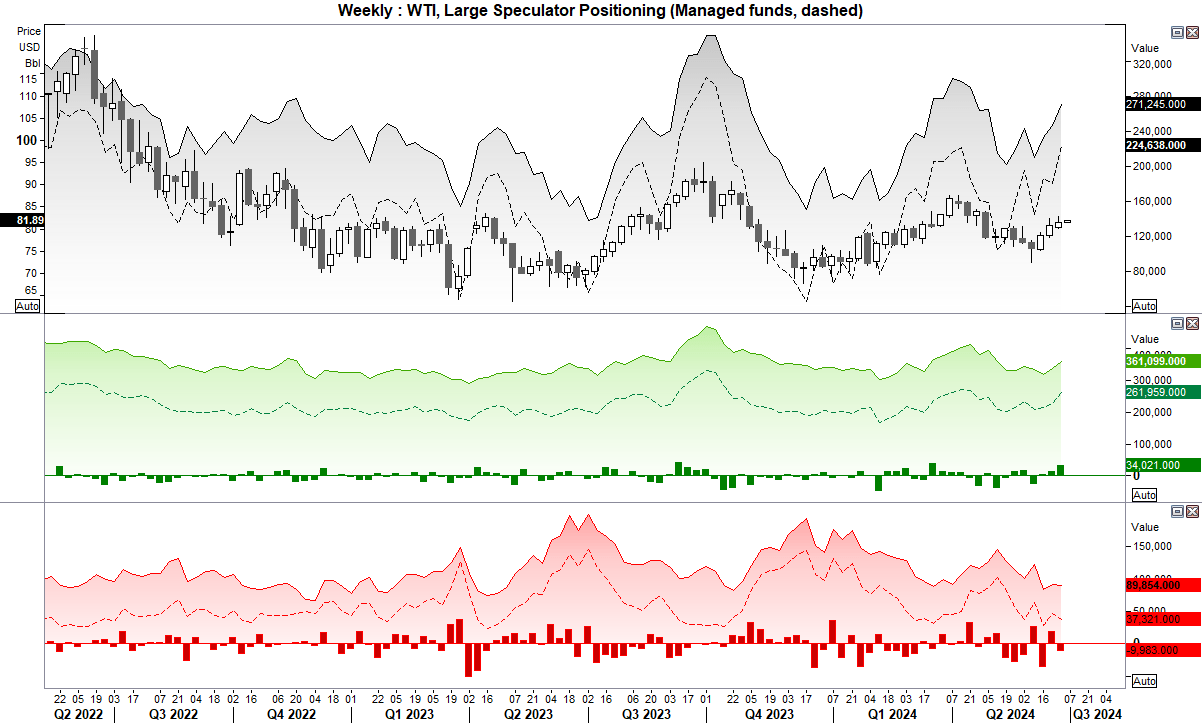

WTI crude oil (CL) positioning – COT report:

Positioning on crude oil continues to paint a constructive bullish picture, with gross longs increasing while shorts remain contained. Both large speculators and asset managers increased longs and trimmed shorts last week as crude oil prices rose for a third consecutive week. This is not to say positioning is extremely bullish, but the bulls' case seems more appealing than a bear case at present, and there are no imminent signs of a sentiment extreme.

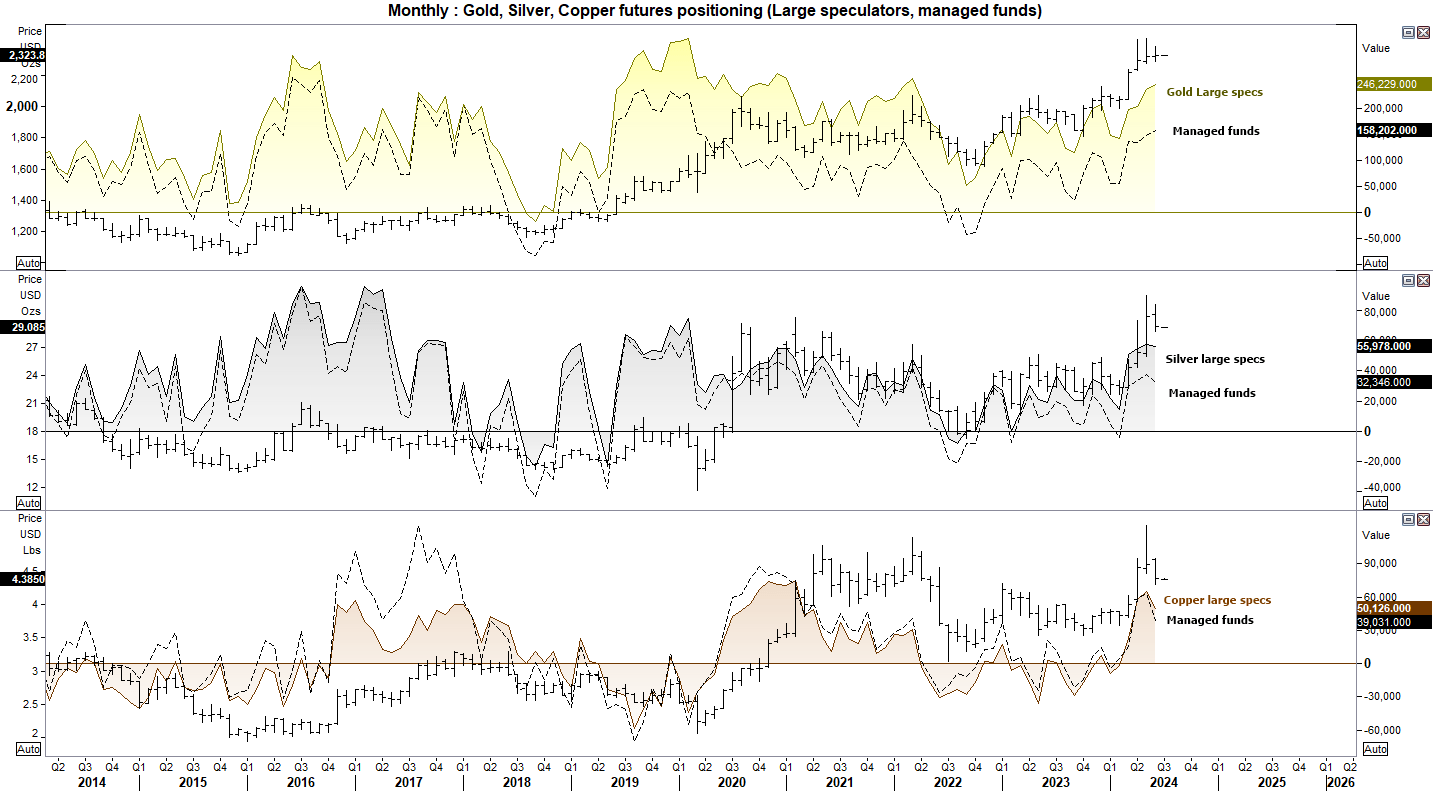

Gold, silver, copper futures positioning – COT report:

Large speculators reduced gross-short exposure to gold and silver futures by 12.3% and 15.3%, respectively. Given that both markets have retraced from their cycle highs over the past few weeks and formed a form of indecision candles last week, it is possible we may have seen a cycle low, which could favour bulls seeking dips. I'm not seeing the same love for copper futures yet, with both large speculators and managed funds increasing gross-short exposure and remaining effectively flat for new longs.

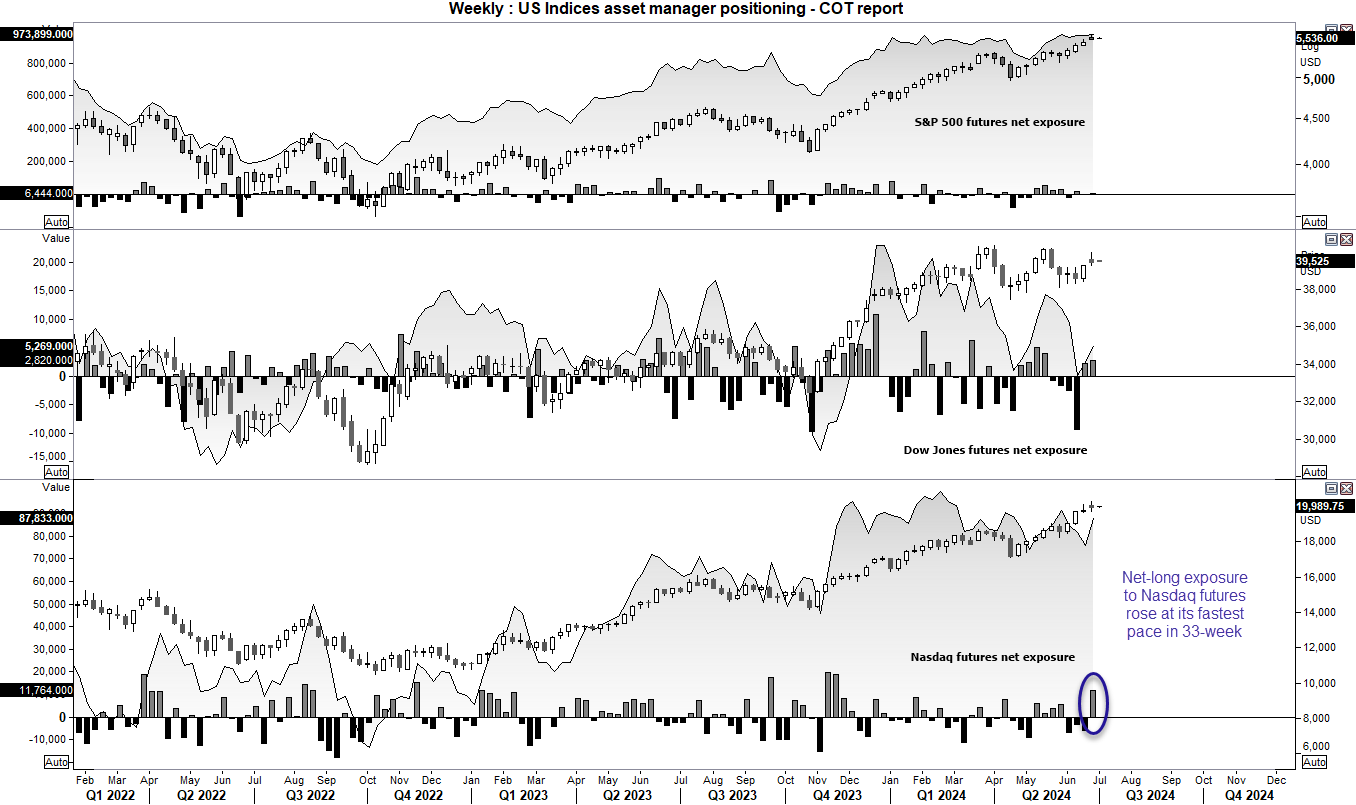

S&P 500, Dow Jones, Nasdaq 100 futures positioning – COT report:

Traders made a relatively bullish shift towards US indices ahead of the key PCE inflation report last week, with net-long exposure among asset managers rising for the S&P 500 and Dow Jones Industrial Average. Yet it is the Nasdaq 100 that stands out, with net-long exposure rising at its fastest weekly pace in 32 weeks. Gross shorts were reduced by 16.2% (-4,000 contracts), and longs increased by 7.7% (7,800 contracts). Exposure to the S&P 500 was little changed, yet asset managers increased gross long exposure to Dow Jones futures by 15% (2,700 contracts).