JPMorgan's Expected Earnings Report (Wednesday, 15th)

JPMorgan Chase’s Q4 earnings report, set to release on Wednesday, January 15, 2025, will be closely watched by investors for insight into the bank’s financial health and outlook for 2025. Here's what is generally expected:

- Revenue & Earnings Growth: Analysts are likely to focus on JPMorgan's ability to continue growing in a challenging macro environment, which includes interest rate fluctuations, geopolitical risks, and inflationary pressures. JPMorgan has benefitted from rising interest rates in recent quarters, as higher rates lead to increased net interest income (NII), which is a major revenue stream for the bank.

- Cost Control: With the bank's ongoing cost-cutting measures, analysts will be interested in JPMorgan's ability to improve its efficiency ratio and keep expenses in check while investing in new technologies and regulatory compliance.

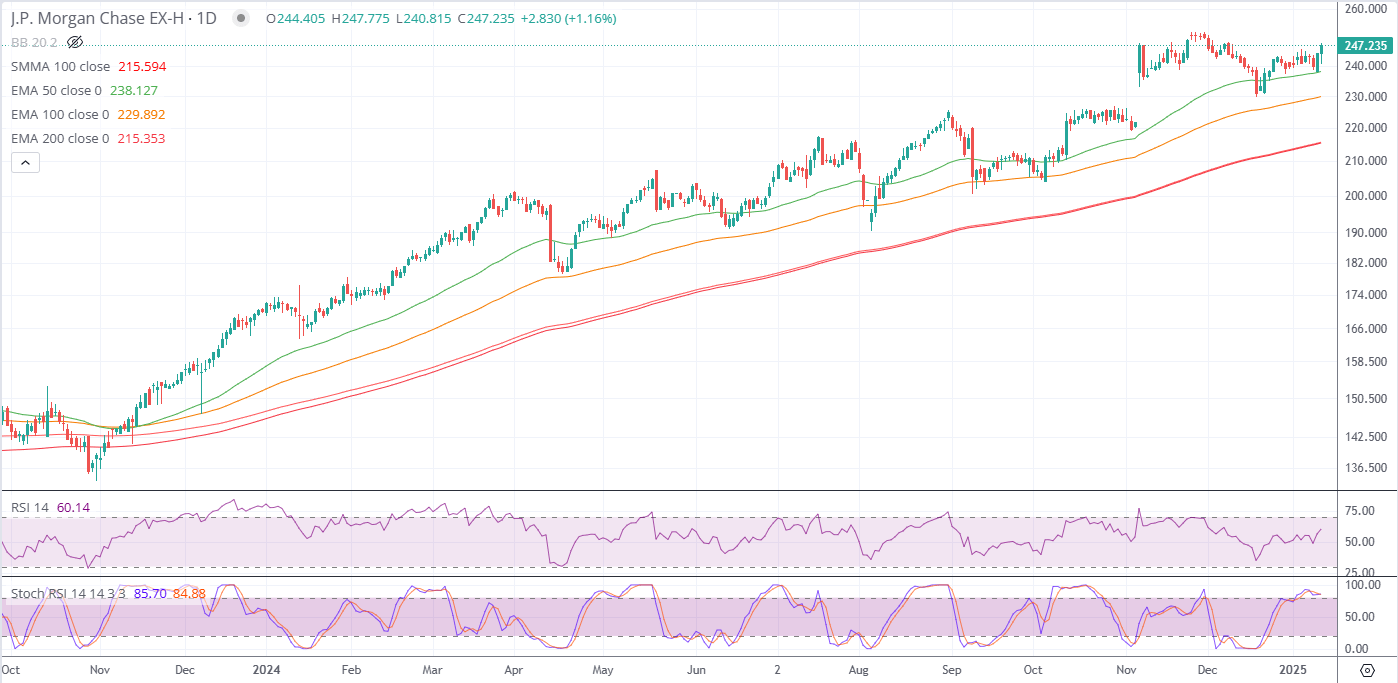

JPMorgan Stock Performance (2024):

As of early January 2024, JPMorgan's stock has appreciated by approximately 41%. JPMorgan has been benefiting from strong earnings growth, stable dividend payouts, and its position as one of the most resilient global banks.

S&P 500 Performance (2024):

The S&P 500 index has appreciated around 23% in the same period. While JPMorgan's stock performance has outpaced the S&P 500, this shows strong relative performance within the broader market.

Analyst Expectations & Beat Rate (Last 9 Earnings Releases)

JPMorgan has been a consistent performer in terms of beating analyst expectations. Over the last 9 quarters, the bank has successfully exceeded earnings estimates in 8 out of 9 releases, delivering strong results that reflected both top-line growth and operational efficiency. The only quarter it did not beat expectations was likely driven by unforeseen market conditions or one-off events, such as regulatory fines or increased loan loss provisions.

This 89% beat rate demonstrates strong execution and reflects investor confidence in JPMorgan’s ability to deliver even in challenging environments.

Risks Facing JPMorgan

- Credit Losses: A potential risk for JPMorgan could be an uptick in loan delinquencies as higher interest rates or economic stress could weigh on consumers and businesses. Any increase in credit provisions for bad loans could dampen earnings.

- Regulatory Challenges: As one of the largest banks globally, JPMorgan is subject to stringent regulations, especially under the Dodd-Frank Act in the U.S., and European regulatory frameworks. Any new regulatory hurdles, particularly related to capital requirements, anti-money laundering efforts, or consumer protection, could result in increased compliance costs or restrictions.

- Economic Slowdown: A slowdown in global economic activity, rising inflation, or an economic recession could reduce demand for loans, slow investment banking revenues, and create a more challenging environment for JPMorgan's earnings growth.

- Geopolitical Risks: JPMorgan has significant global exposure, particularly in Europe, Asia, and emerging markets. Geopolitical risks such as political instability, trade wars, or the continuation of the war in Ukraine could negatively impact international earnings.

- Cybersecurity Risks: As with all major financial institutions, JPMorgan is exposed to the risk of cyberattacks, data breaches, or technological disruptions. Any such incident could harm its reputation, expose it to lawsuits, and lead to regulatory penalties.

- Market Volatility: While JPMorgan has benefited from higher interest rates, any sharp corrections in equity or bond markets could hurt investment banking revenues or lead to trading losses.

Benefits JPMorgan Currently Faces

- Rising Interest Rates: JPMorgan has greatly benefited from the higher interest rate environment. With its large loan book, rising rates boost net interest income (NII), a key driver of profitability for JPMorgan and other large banks.

- Diversified Business Model: JPMorgan’s diversified business model—spanning retail banking, wealth management, commercial banking, investment banking, and asset management—provides resilience across various economic cycles. When one segment underperforms (e.g., investment banking), others can help offset the losses.

- Strong Balance Sheet & Capital Position: JPMorgan has a robust capital position and liquidity, which gives it the ability to weather economic stress better than smaller banks or non-financial institutions.

- Technological Leadership: JPMorgan has been at the forefront of fintech, investing heavily in digital banking, AI, blockchain technology, and cybersecurity. This positions the firm well for long-term growth and operational efficiency.

- Global Leadership: As the largest U.S. bank by assets, JPMorgan benefits from its global presence, strong brand, and wide-reaching financial services, which provide access to a large and diverse customer base.

- M&A Potential: JPMorgan has historically been an acquirer of smaller financial institutions, potentially benefiting from further consolidation in the banking industry. If any attractive acquisition targets arise, JPMorgan could bolster its earnings and market position.

Conclusion

JPMorgan's earnings report on January 15, 2025, is expected to reflect continued growth, driven by strong fundamentals, cost discipline, and a solid balance sheet. While macroeconomic risks such as credit losses and regulatory challenges exist, JPMorgan’s diversified business, technological investments, and leadership position offer substantial upside potential. Given its outperformance versus the S&P 500 and the consistent ability to beat analyst estimates, the bank is well-positioned for future growth, provided it can navigate any headwinds.