Japanese Yen Technical Forecast: USD/JPY Weekly / Daily Trade Levels

- USD/JPY September reversal extends nearly 6.9% off yearly low- rally testing major pivot zone

- USD/JPY bulls may be vulnerable near-term, outlook constructive above October open

- Resistance 148.73-149.60 (key), ~151, 151.94- Support 146.42/65, 143.63/90 (key), 140.25-141.02

The Japanese Yen is off more than 0.3% this week with USD/JPY rallying nearly 3.9% since the start of October. Last month’s reversal off technical support has now extended into a major pivot zone and the focus is on possible price inflection here in the days ahead. Battle lines drawn on the USD/JPY weekly & daily technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Yen setup and more. Join live on Monday’s at 8:30am EST (also streaming live on YouTube).Japanese Yen Price Chart – USD/JPY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Technical Outlook: In my last Japanese Yen Technical Forecast we noted that USD/JPY had rebounded off major support and that, “losses should be limited to the 142-handle IF price is heading higher on this stretch with a close above 144.63 needed to fuel to fuel the next leg.” Price briefly registered an intraweek low at 141.65 last week but failed to mark a close below 142 with the subsequent rally marking the largest single-week advance in nearly 15 years.

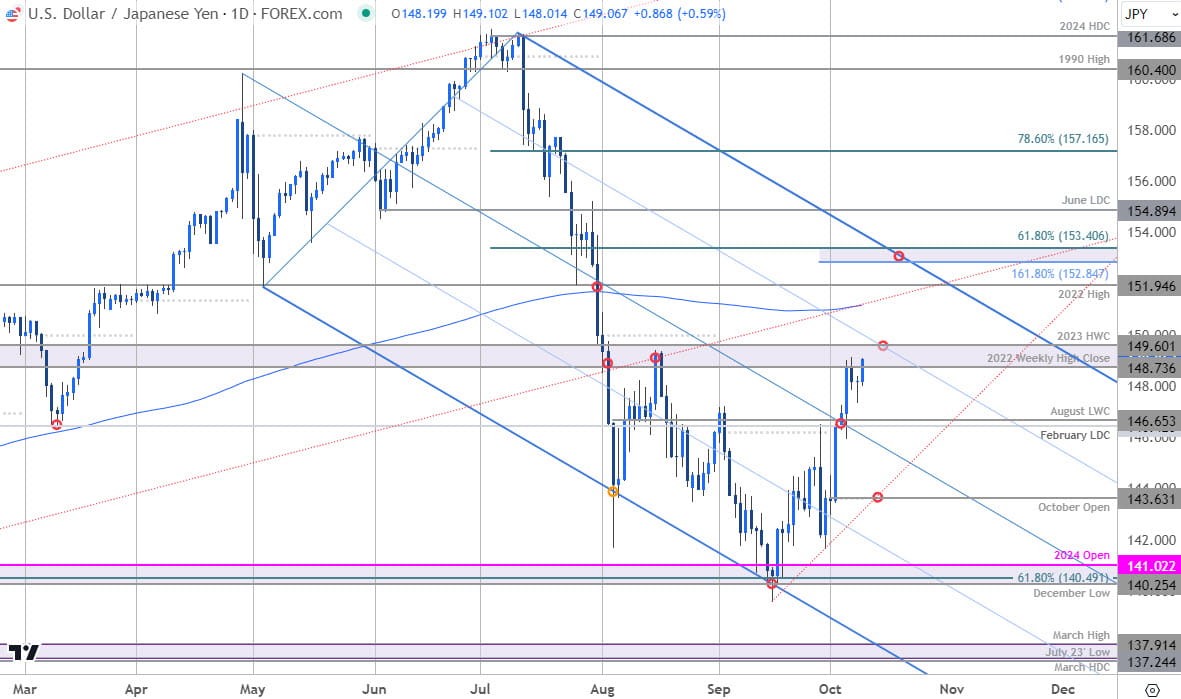

The advance has now extended more than 6.8% off the September low with the rally testing a major resistance pivot this week at 148.73-149.60- a region defined by the 2022 high-close and the 2023 high-week close (HWC). Note that the 52-week moving average rests just higher- the focus is on possible inflection / price exhaustion into this region this week.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

A closer look at the daily chart shows USD/JPY continuing to trade within the confines of the descending pitchfork we’ve been tracking off the July high. A rebound off the lower parallel has now broken through the median-line with the 75% parallel further highlighting near-term resistance at 148.73-149.60.

A topside breach / close above this threshold is needed to keep the immediate advance viable towards the 200-day moving average (currently ~151) and the 2022 high at 151.94. Key resistance is eyed at 152.85-153.40- a region defined by the 1.618% extension of the September advance and the 61.8% retracement of the yearly range. A breach / close above this confluence zone would be needed to invalidate the July downtrend / suggest a larger trend reversal is underway.

Initial support rests with the February low-day close (LDC) / August low-week close (LWC) at 146.42/65 with near-term bullish invalidation now raised to the objective monthly open / 2024 LWC at 143.63/90. Critical support remains unchanged at 140.25-141.02- a close below this threshold would ultimately be needed to mark downtrend resumption.

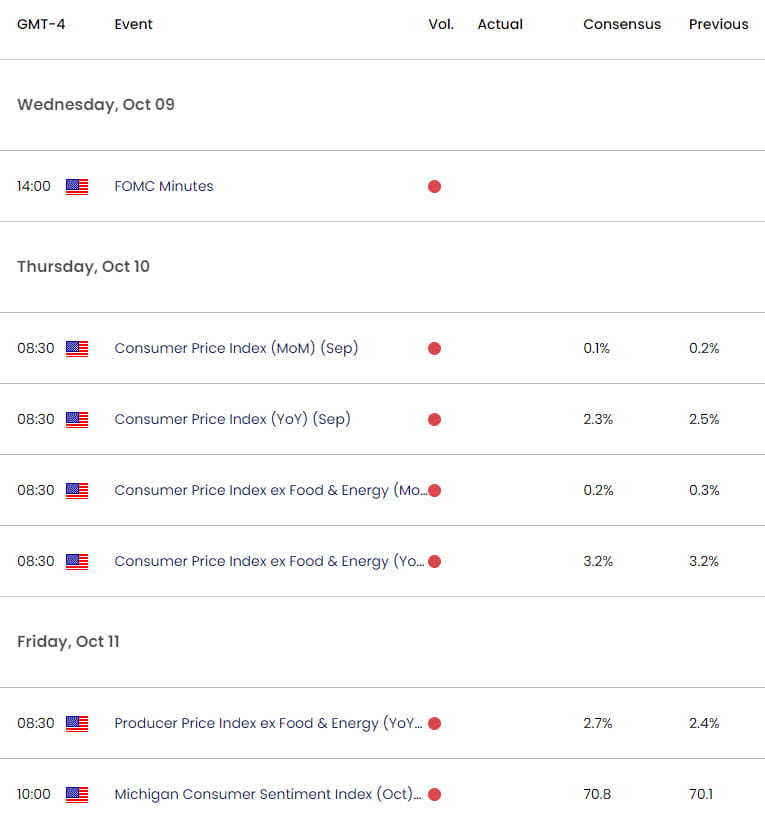

Bottom line: A reversal off key support at the yearly lows in USD/JPY is now testing a major pivot zone into downtrend resistance. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to the October open IF price is heading higher on this stretch with a close above the 75% parallel needed to fuel the next major leg. Keep in mind we get the release of the September Consumer Price Index (CPI) tomorrow - stay nimble into the release and watch the weekly closes here for guidance.

USD/JPY Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- US Dollar Index (DXY)

- Australian Dollar (AUD/USD)

- British Pound (GBP/USD)

- Gold (XAU/USD)

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex