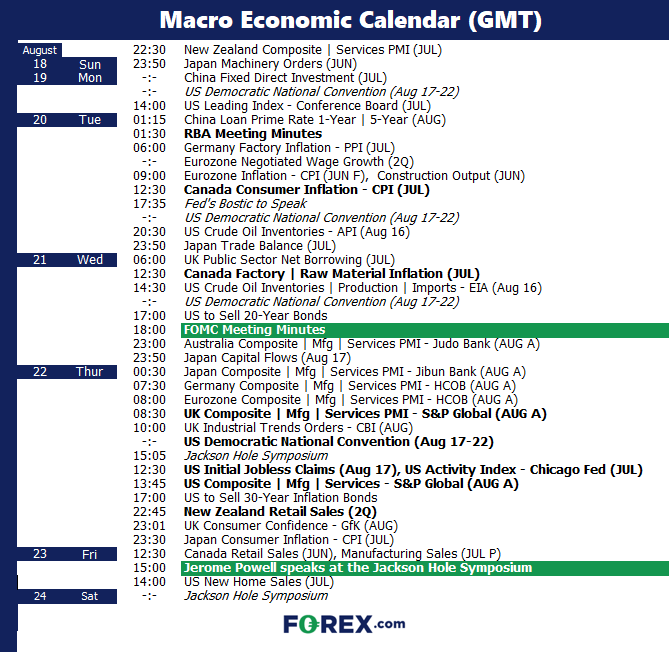

Flash PMIs are the notable economic data releases nest week, although the headline event will be Jerome Powell’s speech at the annual Jackson Hole symposium. It will allow him to hammer home the Fed’s stance on Friday, and therefore likely to take precedence over the FOMC minutes released two days prior. Canada’s inflation report is key for BOC watchers, who continue to make their cash rate decision on a ‘per meeting’ basis.

The Week Ahead: Calendar

The Week Ahead: Key themes and events

- Jackson Hole Symposium

- FOMC minutes

- US Democratic National Convention (Aug 17-22)

- Flash PMIs

- Canada CPI

FOMC minutes (Wednesday 21 August)

This is one of those events that we need to keep on our radars, but in all likelihood we already know what the Fed think. Which is that the Fed will continue cutting rates in September, and continue in December through to next year. Besides, Jerome Powell will provide the Fed’s most up-to-date stance the next day, which leaves little in the way of surprise from the minutes.

US demographic convention (Saturday 17 – Thursday 22 August)

This is really just a box-ticking exercise for Kamala Harris to be officially nominated Kamala Harris as their Presidential nominee. But it is an important step none the less. It could give Kamala a bump in the polls, although some would be wise to remember that polls don’t always get it right.

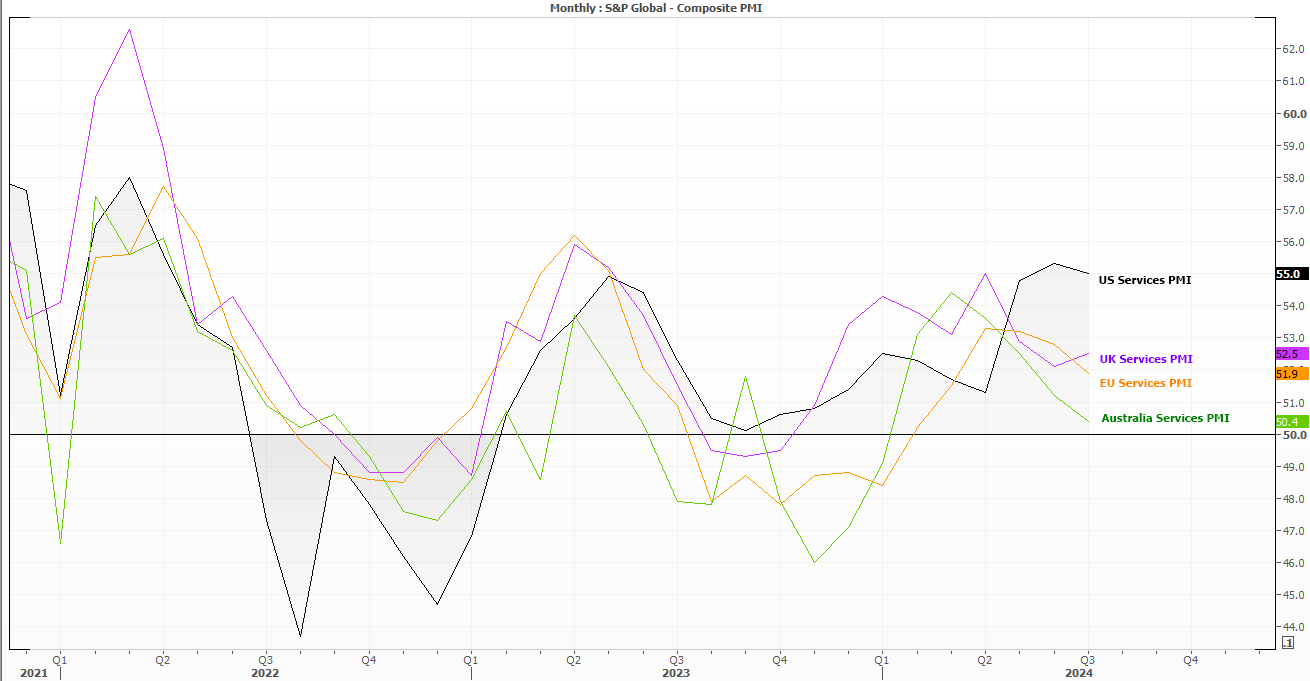

Flash PMIs

Were it not for flash PMIs, there would be a real lack of traditional economic data points that matter for the week. Even so, Jerome Powell’s speech is likely to have a suppressive effect on volatility unless some real curve balls are thrown.

Traders should keep an eye US services inflation to see if it shows a further deceleration. A gradual deceleration keeps the soft-landing mantra alive, whereas weaker-than-expected numbers (such as headline, new orders, prices or employment) could prompt a bout of risk-off as traders price in yet more Fed cuts. Hotter figures from the UK make it more difficult for the BOE to cut, which is likely bullish for GBP/USD.

Trader’s watchlist: EUR/USD, GBP/USD, USD/JPY, AUD/USD, S&P 500, Nasdaq 100, gold, crude oil

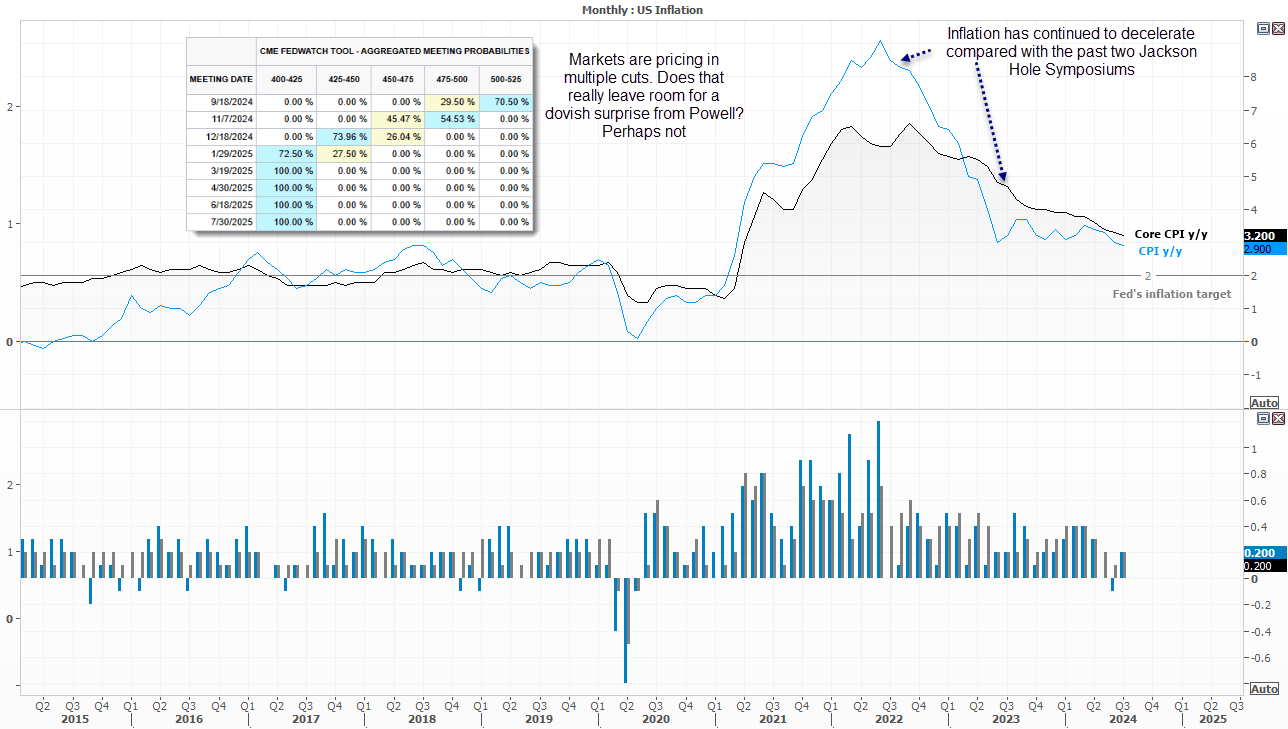

Jerome Powell’s speech at the Jackson Hole Symposium (Friday 23 August)

The Jackson Hole symposium is an annual gathering of central bankers and economists from around the world. It is a forum for the Fed chair to discuss the state of the economy and the Fed's monetary policy plans.

Jerome Powell's speech at the Jackson Hole symposium in 2022 was a major policy announcement, in which he outlined the Federal Reserve's plans to combat inflation “forcefully and rapidly” and was committed to bringing inflation back down to its 2% target.

Last year Powell emphasised that the Fed were prepared to raise rates further if needed, citing uncertainties such as labour market dynamics, the neutral rate and the Russia-Ukraine war. He needn’t have, as the Fed had in fact just raised their rates for the last time of the cycle.

Jerome Powell delivers his latest Jackson Hole speech on Friday at 10:00 ET (15:00 GMT), which you can watch live on YouTube. Given the significance of the event, it could be treated like an FOMC meeting, which means volatility is likely to be very low leading into the event and trading activity grinds to a halt.

But it remains debatable as to whether he can really deliver a dovish surprise for traders, given the already-dovish market pricing. Fed fund futures imply four 25bp cuts are to arrive by January. So if there is to be a surprise at all, it could be that he’s not as dovish as traders want to hear.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, VIX, bonds

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge