What is the IFO Business Climate report?

The IFO Business Climate Index (ifo Index) is a soft leading indicator for the German economic development. The ifo Index is collected every month by the Institute for Economic Research (ifo). This survey involves sending questionnaires to around 7000 German companies in the manufacturing, construction, wholesale and retail sectors. These questions ask for the future and current business situation, business demand and the number of employees. The score is determined by the difference between positive and negative answers. If the ifo index is higher,

When the figure is greater than anticipated, the economic situation in Germany is assessed with greater confidence.

When it is lower than expected, it usually means that the survey takers are more pessimistic about the future business environment in the country.

When is the next IFO Business Climate report?

September 24th, 2024

What have we seen until now?

In August we received a reading slightly higher at 86.6 than expectations of 86.0. However, the actual numbers have been declining since June 2024 by 0.6 to 1.6 making the latest release the lowest number since February.

In August, the Jimdo-ifo-Business environment for independent contractors declined dramatically. The Jimdo-ifo business climate index dropped to its lowest position since the year's commencement, from -13.4 to -18.4 points. According to Ifo specialist Katrin Demmelhuber, "the lack of orders remains a key problem." Both big businesses and customers were hesitant to place orders, and a lot of small stores and service providers saw a decline in sales. On the other side, tourism offered a glimmer of hope as things started to get better.

The ZEW Economic Sentiment Index for last week dropped dramatically as well, from 19.2 in August and predictions of 17 to 3.6 in September 2024, the lowest since October 2023. This was the third month in a row that economic sentiment declined. Now there is an equal mix of optimists and pessimists, according to ZEW President Achim Wambach. Additionally, the current circumstances index dropped from -77.3 to -84.5, the lowest level since May 2020.

In 2023, foreign direct investment (FDI) in Germany reached its lowest point in ten years, according to a report published by the IW Institute.

A separate report by UNCTAD also revealed that FDI inflows into Germany plummeted by 76.2% in 2022 compared with the previous year.

Data from S&P Global also revealed that Germany's Manufacturing Purchasing Manager Index (PMI), a key indicator of business conditions, has contracted for 25 consecutive months, due to steep and accelerating declines in new orders, purchasing activity, and employment.

What can we expect for the ifo business climate?

A reading lower, could fall in line with the recent ECB rate cut for now. However if the drop occurs too fast then this could give fears of persisting recession. A reading higher could show that the economy is picking up again and potentially helping the EUR.

DAX analysis

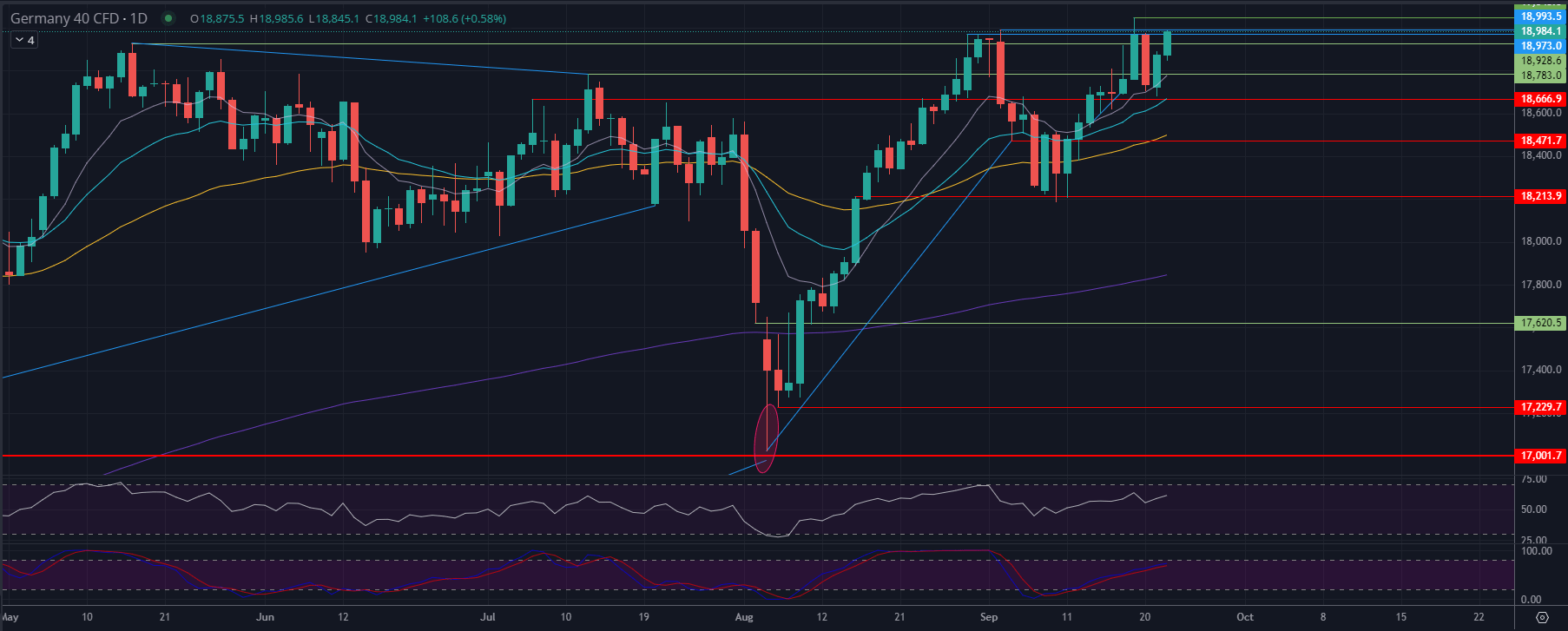

After last week’s increase to new all-time highs, the DAX had given back most of those gains by the close on Friday. Yesterday the DAX index managed to close the day with a plus of 0.74%.

Today the DAX and other European counterparties opened the day in the green due to a big gain from Asian indices, due to news from China unveiling stimulus to boost the economy. This has seeped over into European counterparties, as a stronger Chinese economy could mean that demand for European manufacturing could increase. This comes at a seemingly right time, as the European markets are battling with low industrial production.

Technically we have now moved upwards from the support level at 18,783 and have broken straight through the resistance level at 18,929 where we are now getting closer to the all-time high at around 19,048.5.

The RSI is continuing to trend upwards in bullish territories, and the Stochastic RSI is also trending upwards and is not yet in overbought territory. A bullish scenario will require us to maintain the 18,929 level for the day to make the next move toward the all-time high mark. A breakdown from these levels will require us to break through the 18,929 level and consequently the 18,783 level. With speeches by policy makers on the agenda and a series of high importance economic calendar events on the agenda this week, we can expect movement in the market according to the data.