The US dollar and yields have enjoyed a strong rally over the past five weeks, thanks to hotter US data, Fed members pushing back on rate cuts, and Trump leading in many polls. But with the US election on our doorstep and the potential for a delayed result, could this tie the Fed’s hands at this week’s meeting?

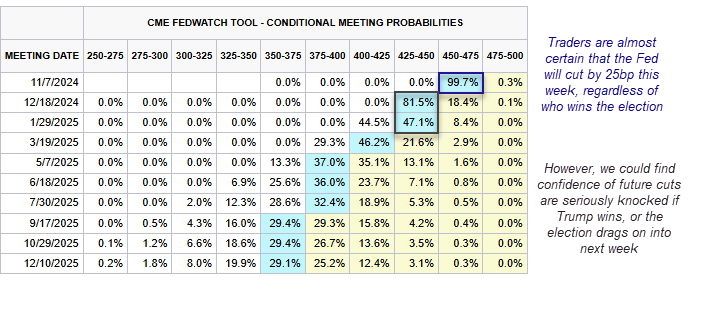

With Fed fund futures implying a 99.7% chance of a 25bp cut this week, it would come as an almighty shock to markets if they didn’t. And unlike other central banks such as the BOJ or SNB, the Fed tend not to surprise much these days. Instead they slowly shape their message to guide markets where they want, with various levels of success and of course failure. This means the Fed are very likely to cut this week regardless of the fact it lands on election week. However…

Which way the election swings could dictate the Fed’s forward guidance

The bigger question for traders is if the Fed hint at another 25bp in December. While Fed fund futures imply they will cut in December with an 81.5% probability, those odds could very quickly plunge if Trump wins the presidency as his policies are deemed to be inflationary.

Besides, US economic data remains strong, and the case for higher rates becomes stronger if data continues to outperform overall.

The US economy remains robust, but there are bumps in the road

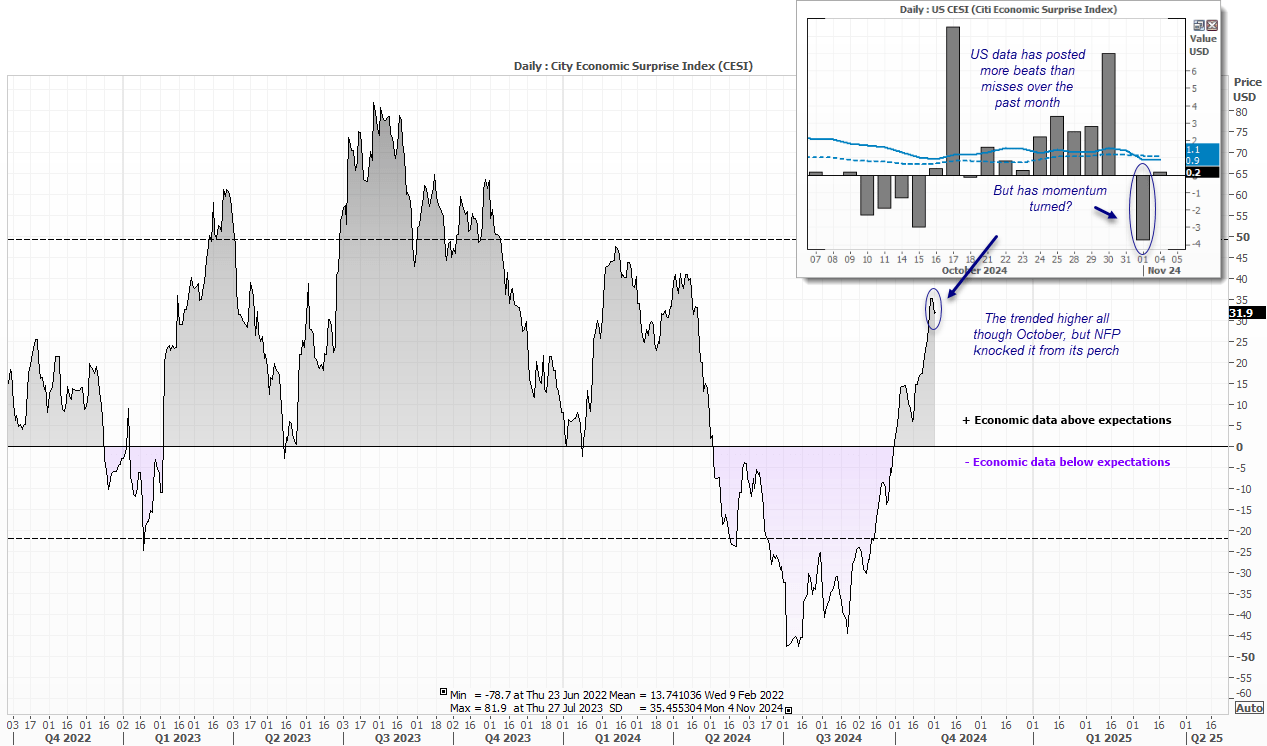

We know that US economic data has generally surprised to the upside in recent weeks. In fact it began turning for the better back in July according to the Citi Economic Surprise Index (CESI), with data falling shorts of gloomy forecasts through to October before it began to beat more favourable forecasts over the next five weeks. This saw traders drastically scale back their dovish Fed bets and sent the US dollar and yields soaring.

What has since excited doves is the weak NFP payroll last Friday, which saw a mere 12k job added (its lowest since the pandemic). Yes, that is a weak number, but unemployment remains low at 4.1% and average earnings also increased. This makes it tricky for the Fed to be too dovish this week in my opinion, especially if Trump wins.

A Trump Presidency and the Fed:

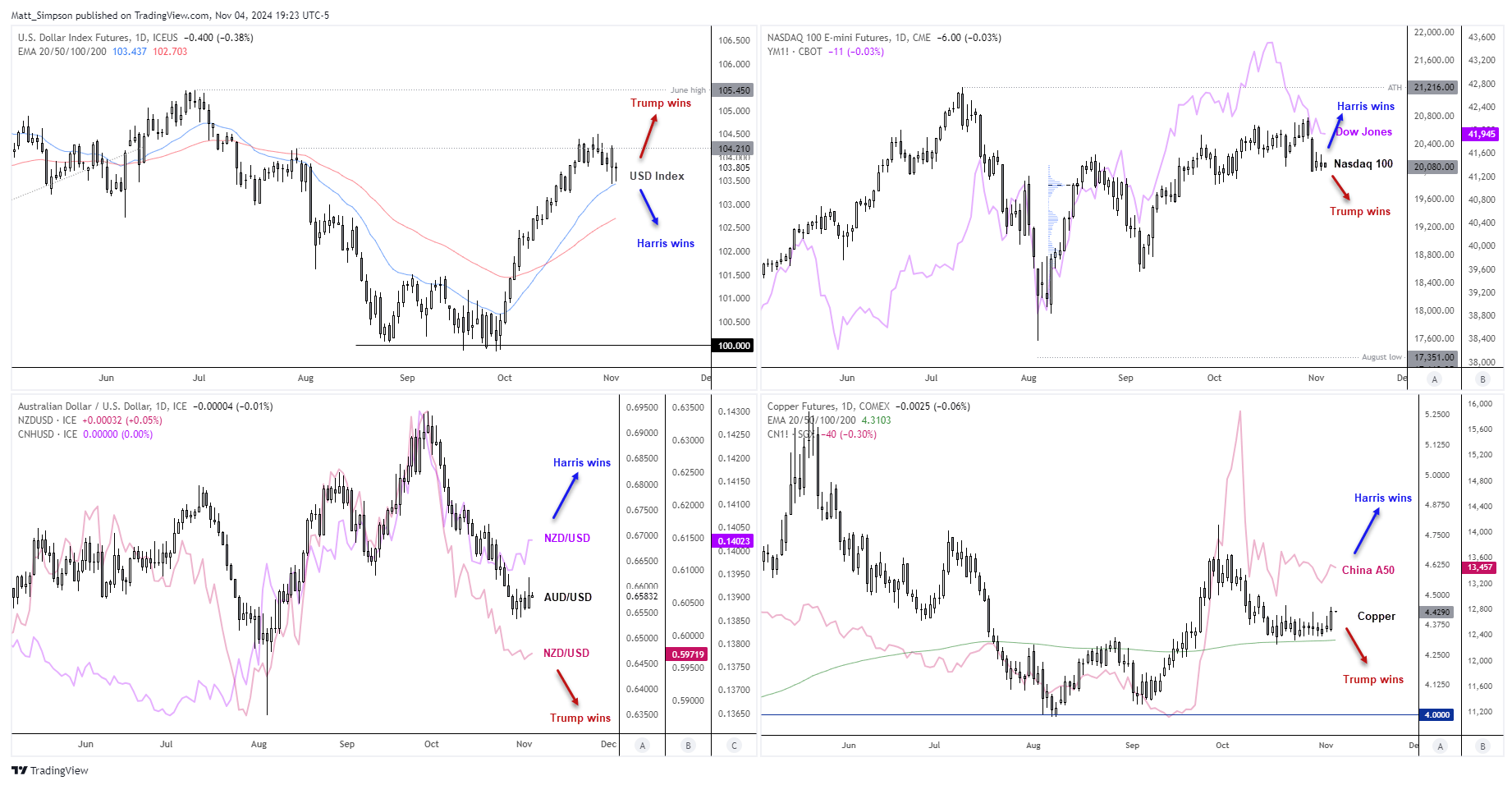

At a fundamental level, Trump's policies are considered to be more inflationary. This implies that another Trump presidency could maintain the elevated levels of the US dollar and the yield curve, or even increase them, on the assumption that the Federal Reserve will need to keep interest rates higher for an extended period. This argument becomes even stronger if US data continues to outperform.

- It could also be risk off for sectors and markets tied to trade, given Trump plans to slap a hefty 60% tariff on China’s imports, alongside less chunky tariffs for other trade partners

- Technology, manufacturing, energy, healthcare and consumer goods stocks could fade selling pressure from Wall Street

- USD/CNH could outperform as the USD rallies and China allow their currency to weaken in an effort to maintain competitive for trade

- This could spell trouble for AUD/USD (and therefore NZD/USD) which currently share a strong correlation with the yuan

A Harris Presidency and the Fed:

Conversely, a Harris win could weigh on the USD and yields, as it could allow the Fed more wriggle room to cut in the face of weaker data. I suspect it could also trigger a risk-on rally which should be supportive of commodities and therefore commodity currencies.

- AUD/USD and NZD/USD could lead gains against the US dollar in a risk-on bounce

- Wall Street indices are likely to perform, led by the Nasdaq 100 as part of a relief rally

- Copper could bounce alongside other base metals on the aversion of a trade war

- USD/CNH could turn lower as Beijing sighs in relief that another trade war is less likely to materialise

But what if they election results take too long to arrive?

If neither candidate has secured the 270 votes by Thursday to secure their place in the Whitehouse, the Fed may need to revise their message. And I suspect the Fed will keep their cards close to their chest and not feel inclined to be too dovish if they cut, assuming that they do at all.

Conclusion

- A Trump win could seriously hamper the Fed’s ability to cut again in December.

- If the election drags on and we do not know the winner by Thursday, the Fed may feel inclined to keep the lid on any forward guidance.

- And knowing markets, that will be taken as ‘no cut for Christmas’ and potentially send the USD higher.

- A Harris win could allow the Fed to deliver a dovish cut, prompt a risk-on rally for commodities, commodity FX and Wall Street

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge