Key Areas of Potential Impact

- Oil Prices and Supply Quotas - Crude Oil Election Outlook

- Global Stock Markets

- Central Bank Policies and Inflation Rates

- Renewable Energy and Tech Investments

- Foreign Relations with the Middle East

- UAE MSCI Index

Oil Prices and Supply Quotas

If Trump returns to the White House, his policies favoring expanded oil production and deregulation could pressure oil prices and prompt OPEC to reassess supply quotas. This could, in turn, impact the UAE's oil revenue. While the UAE has focused on diversifying its economy to lessen oil dependence, crude prices remain a component of its revenue.

In contrast, a Harris administration would likely continue supporting renewable energy, which may benefit UAE’s shift towards sustainable development and reduce global reliance on fossil fuels.

Global Stock Markets

With Harris’s plans to further raise capital gain taxes, her administration is unlikely to have a positive impact on the stock market. Initially, a Harris presidency might lead to a bearish or cautious market reaction compared to a Trump victory.

A Trump win could drive broader market optimism and risk due to anticipated tax cuts and increased tariffs, potentially boosting markets but also introducing some instability. This mixed impact could create both growth opportunities and irregular volatility.

Central Bank Policies and Inflation Rates

With the AED pegged to the US Dollar, inflation rates and interest rate decisions by the Central Bank of the UAE (CBUAE) align closely with those of the US economy and the Federal Reserve. As US inflation rates moved closer to the 2% target, the Fed implemented a 50-bps rate cut, mirrored simultaneously by the CBUAE.

In the context of the upcoming US elections, a Trump presidency could disrupt the easing cycle in monetary policy through tariffs and fiscal stimulus policies, potentially increasing inflationary pressures and directly impacting the UAE economy. Despite inflationary challenges, the UAE’s economy has shown resilience to high inflation and interest rates so far.

Renewable Energy and Tech Investments

The UAE's partnerships with the US encompass major renewable energy initiatives, such as PACE (Partnership for Accelerating Clean Energy), which combines economic and technological efforts to address climate change. A Harris administration would likely continue supporting these initiatives.

However, a Trump victory may introduce uncertainty, given his historical reluctance to prioritize climate action, potentially impacting long-term projects like those aligned with the UAE's Vision 2035.

Foreign Relations with the Middle East

In the context of ceasefire agreements in the Middle East, Trump’s approach is expected to be more aggressive than Harris's, potentially introducing higher costs and market volatility across sectors, including commodities and stock markets in the UAE.

In contrast, Harris is likely to pursue a more diplomatic approach concerning the humanitarian crisis and ceasefire deals, which may support steadier market reactions.

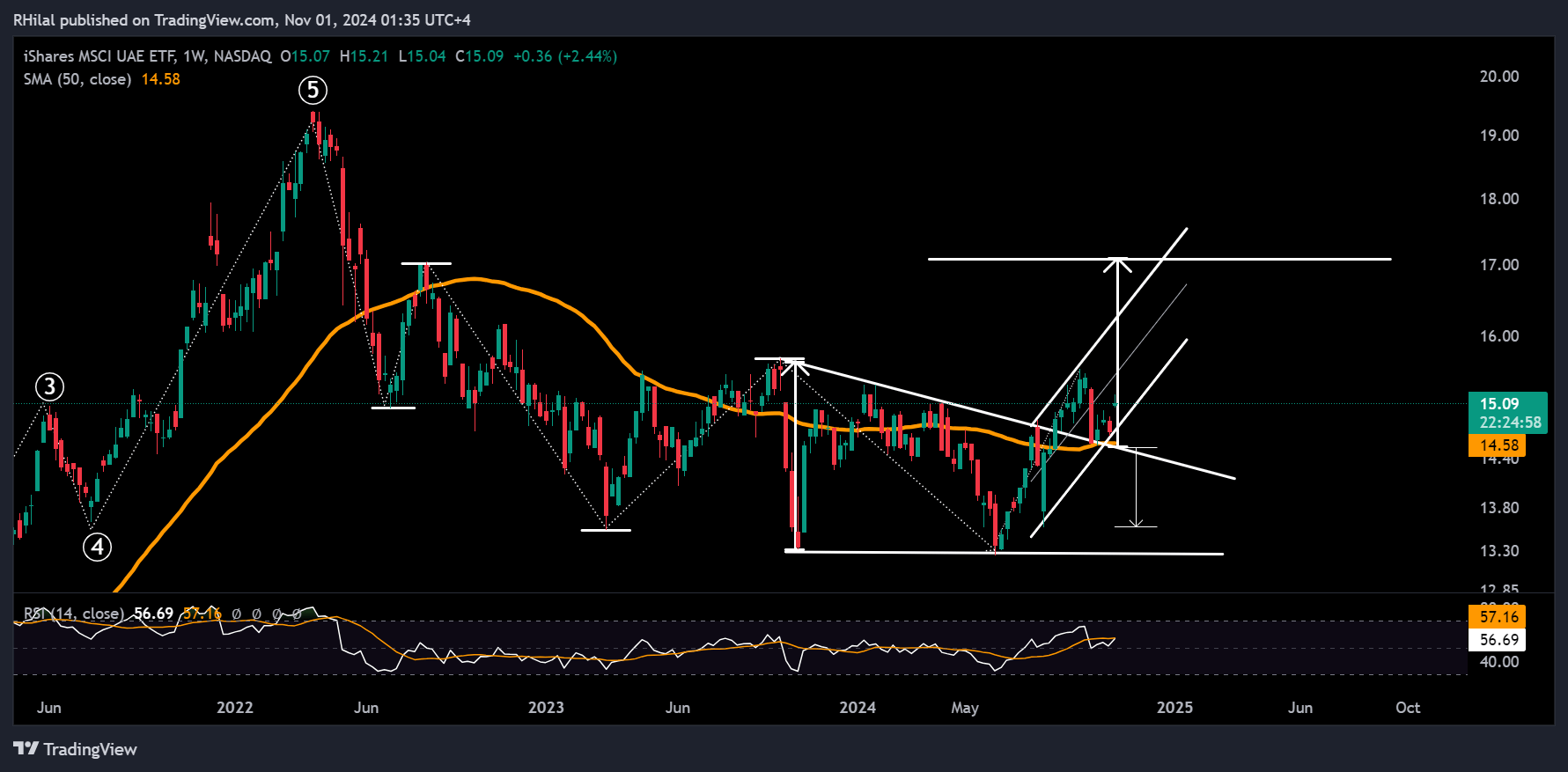

UAE Market Analysis: MSCI UAE Index

UAE MSCI Index: Weekly Time Frame – Log Scale

Source: Tradingview

The UAE MSCI ETF, representing the performance of the UAE’s mid- and large-cap market segments, hit a two-year low in June 2024 after a prolonged consolidation from 2023 to 2024. The index rebounded positively in August 2024, mirroring gains in the US market, and is currently sustaining this breakout, testing its 50-period moving average and maintaining an uptrend from the June lows.

With the US elections and FOMC meeting approaching, a Trump victory could bring broad positive sentiment to markets, albeit with potential short-term volatility. In contrast, a Harris win may prompt short-term pullbacks due to higher tax policy expectations.

Technically, the UAE index appears well-positioned to continue its upward trend, with a strong close above the October 2023 highs (15.70) indicating potential further gains. However, if this resistance is not breached, a pullback toward the two-year support level could occur.

Despite global challenges, the UAE’s economic resilience against inflation, interest rates, and geopolitical tensions is expected to endure, although short-term fluctuations may arise in response to the US election outcome.

— Written by Razan Hilal, CMT – on X: @Rh_waves