Market positioning from the COT report – Tuesday, 31st December 2024:

- Futures traders were net-long the USD by $28.5 billion at the end of 2024

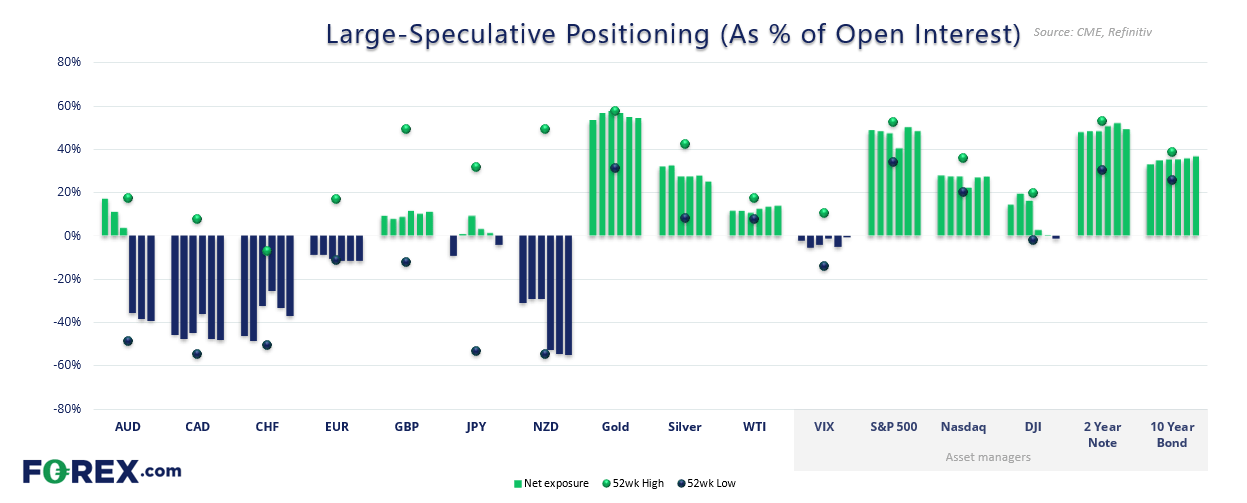

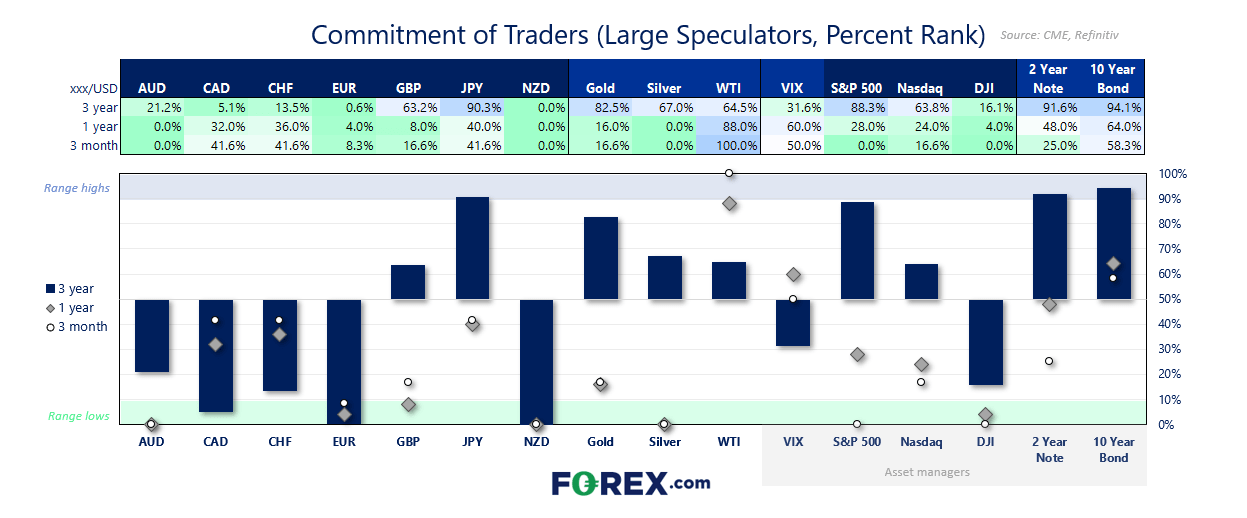

- Net-short exposure to NZD/USD futures reached a record high for a third consecutive week

- Large speculators increased their net-short exposure to AUD/USD futures to a 33-week high

- They also flipped back to net-short yen exposure after a 4-week hiatus at net long

- Asset managers flipped to net-short Dow Jones futures, and reduced net-long exposure to S&P 500 futures for four of the last five weeks of the year

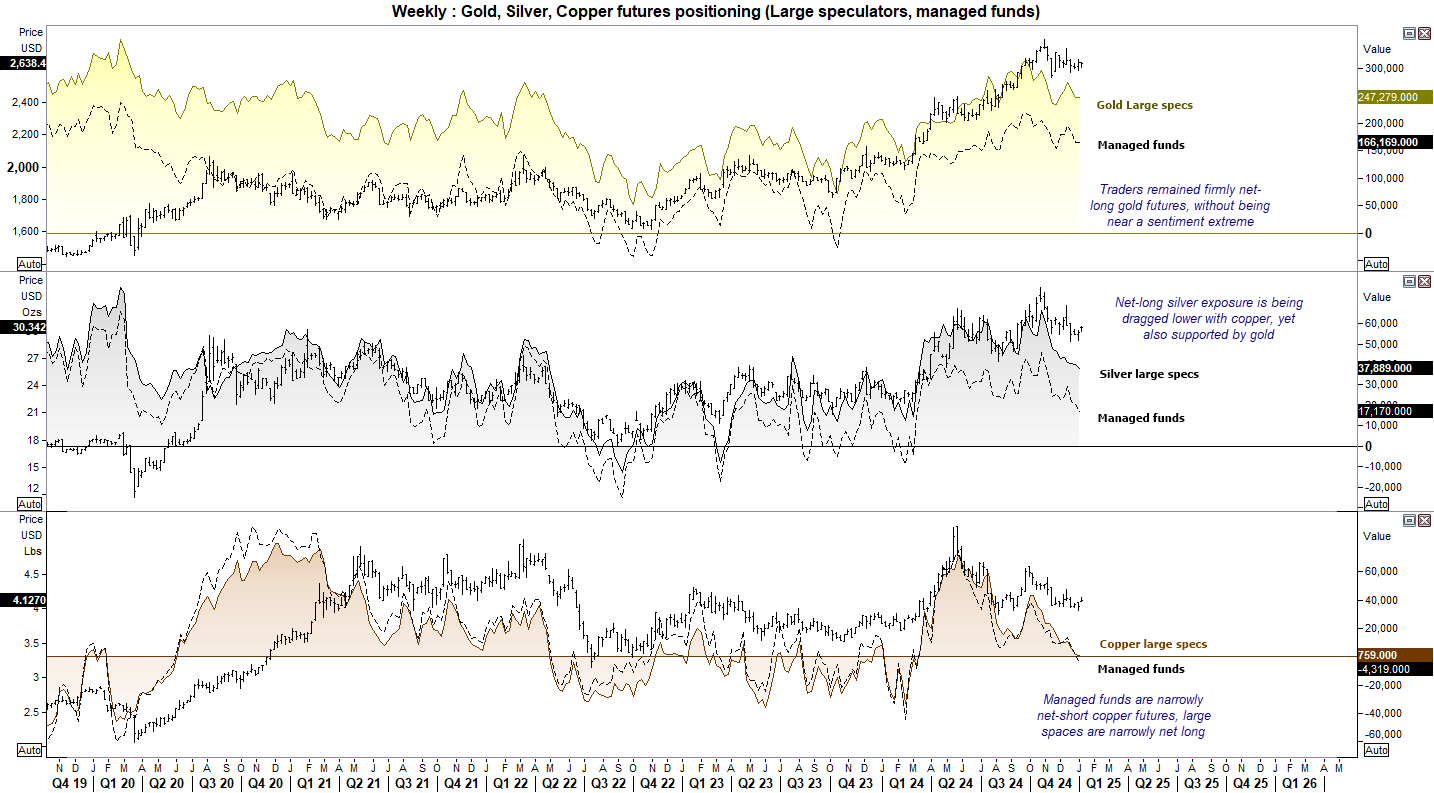

- The week-over-week change to gold futures was effectively flat among large specs and managed funds, both of whom remain firmly net long without being near a sentiment extreme

- Managed funds flipped to net-short exposure to copper futures, large specs reduced their net-bullish exposure to just 759 contracts

- Net-long exposure to WTI crude oil futures rose to a 23-week high

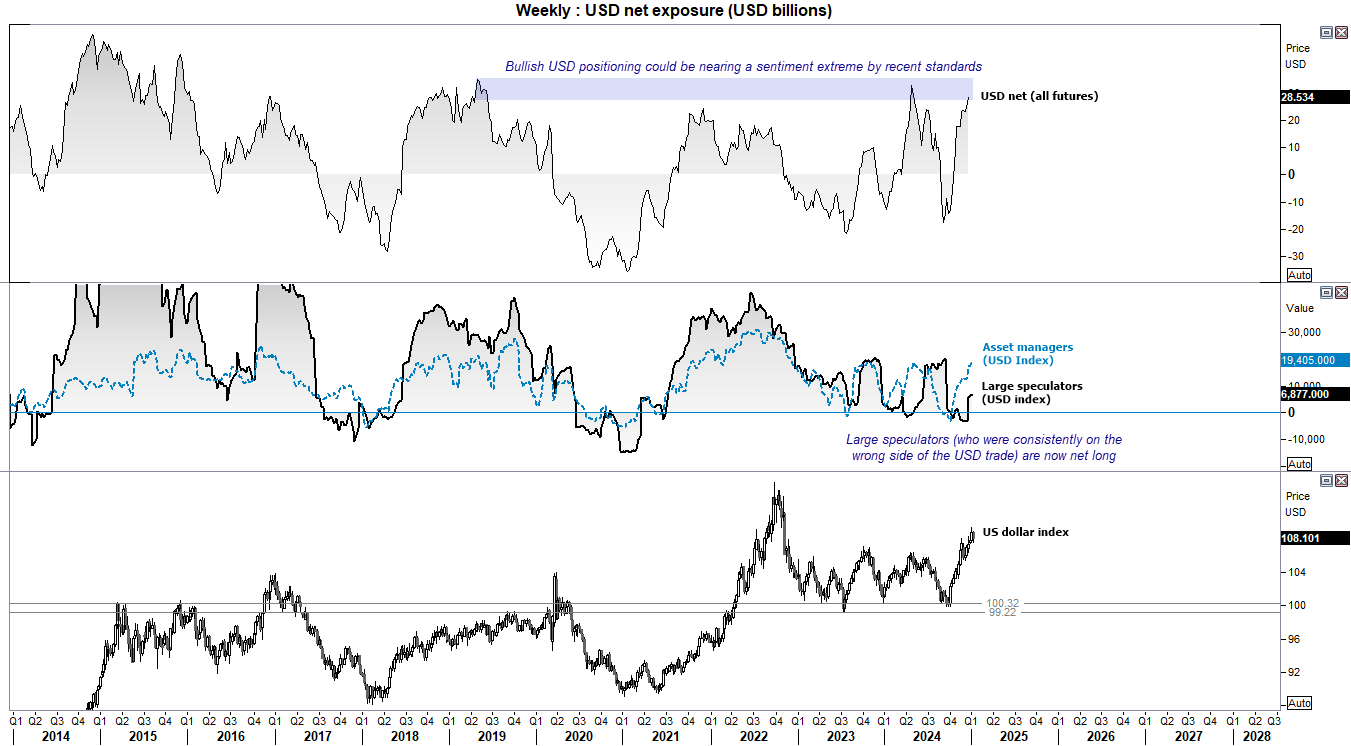

US dollar positioning (IMM data) – COT report:

Traders bid the USD index to a 2-year high by the end of December. And it was fully backed by market positioning from several angles. Asset managers pushed net-long exposure to a 2-year high with gross-longs reaching a 1-year high. Gross shorts fell to a mere 220 contracts. Futures traders were long the USD by $28.5 billion (a 33-week high). And large speculators were net-long for a third week.

If anything, that final point could be a red flag because large speculators have been consistently on the wrong side of the USD trade, so I cannot help but wonder if they are once again late for the party.

The USD is already trading lower this week on reports that Trump’s trade policies might not be so aggressive after all. And that could prompt an unwind of the Trump trade if this proves true (which I suspect it will).

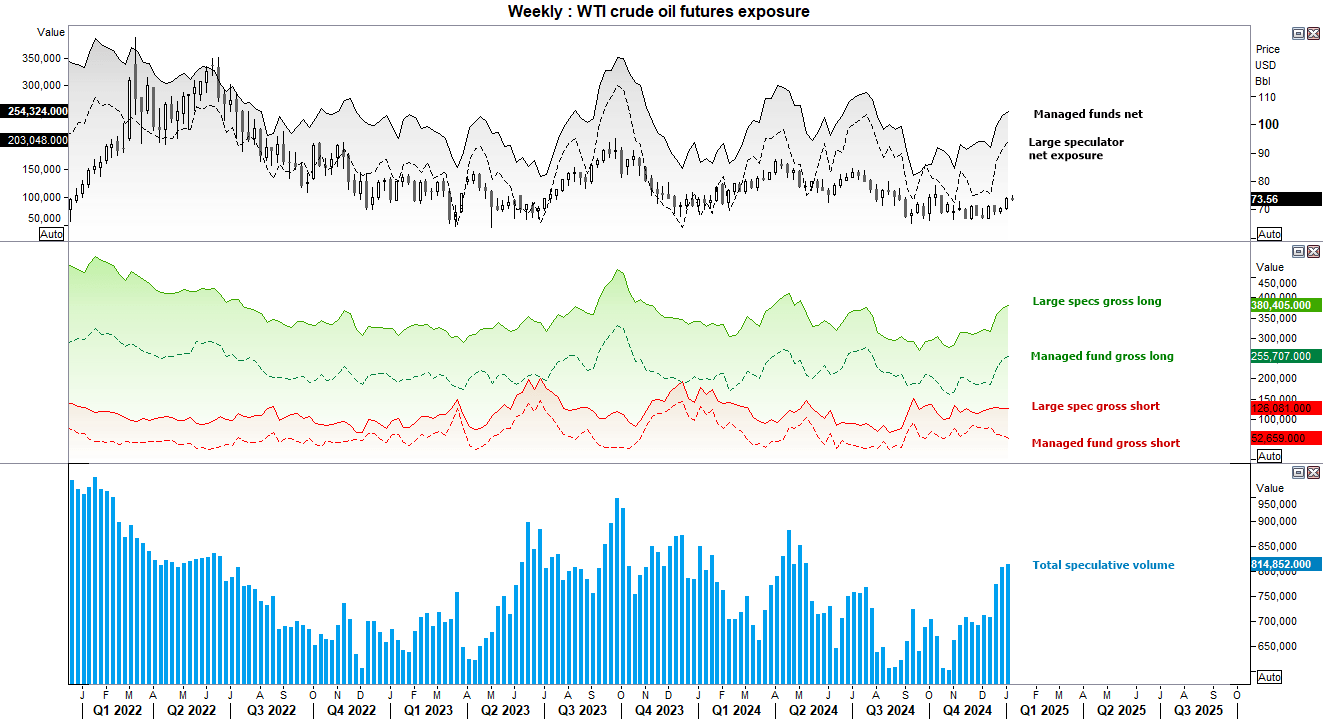

WTI crude oil (CL) positioning – COT report:

The rise of net-long exposure to WTI crude oil futures is also being accompanied with a solid increase of speculative volumes. Which are clearly predominantly bullish bets as gross longs are rising among both sets of traders, while gross shorts are flat for large specs and falling for managed funds. But while prices are also rising, it is not to the same degree as net-long exposure.

This means we need to see prices get their skates on to close the gap with the pre-emptively bullish bets, or we could see a reversal of these bets and prices get supressed further.

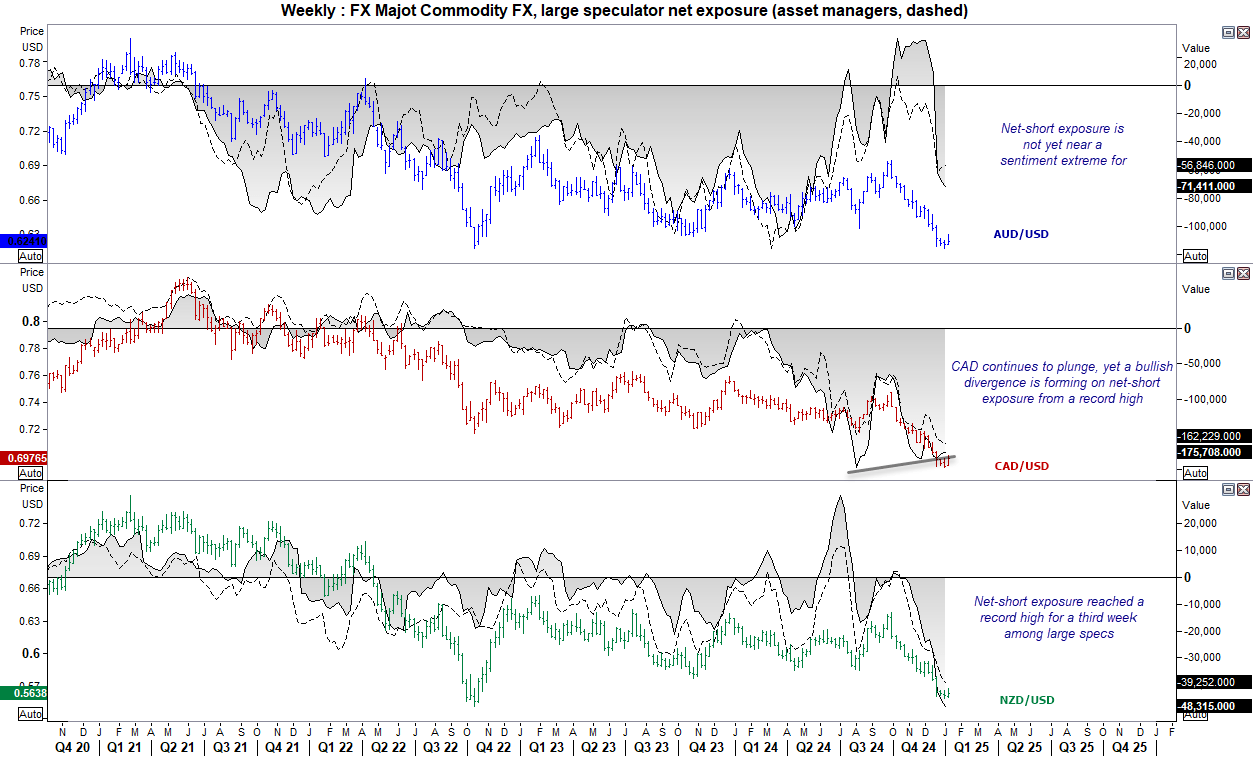

Commodity FX (AUD, CAD, NZD) futures – COT report:

Commodity currencies clearly felt the heat of the Trump trade, getting dragged lower with the Chinese yuan alongside bets of central bank cuts. Net-short exposure to NZD/USD futures reached a record high for a third consecutive week among large speculators, with prices scrambling to hold above the 2022 low.

While the Canadian dollar’s freefall remained in play, net-short exposure is trying to stabilise – even if at very bearish levels. But there is a slight bullish divergence forming, and I suspect we’re a lot closer to the end of its bearish move than the beginning. We just need the correct catalyst to shake some bears out from these lows.

AUD/USD could be looking at a move below 60c. Although it is worth noting that AUD/USD has struggled to stay beneath there for any length of time this century. Still, while net-short exposure is bearish is not yet at a sentient extreme which could pave the way for further losses if the yuan continues to decline.

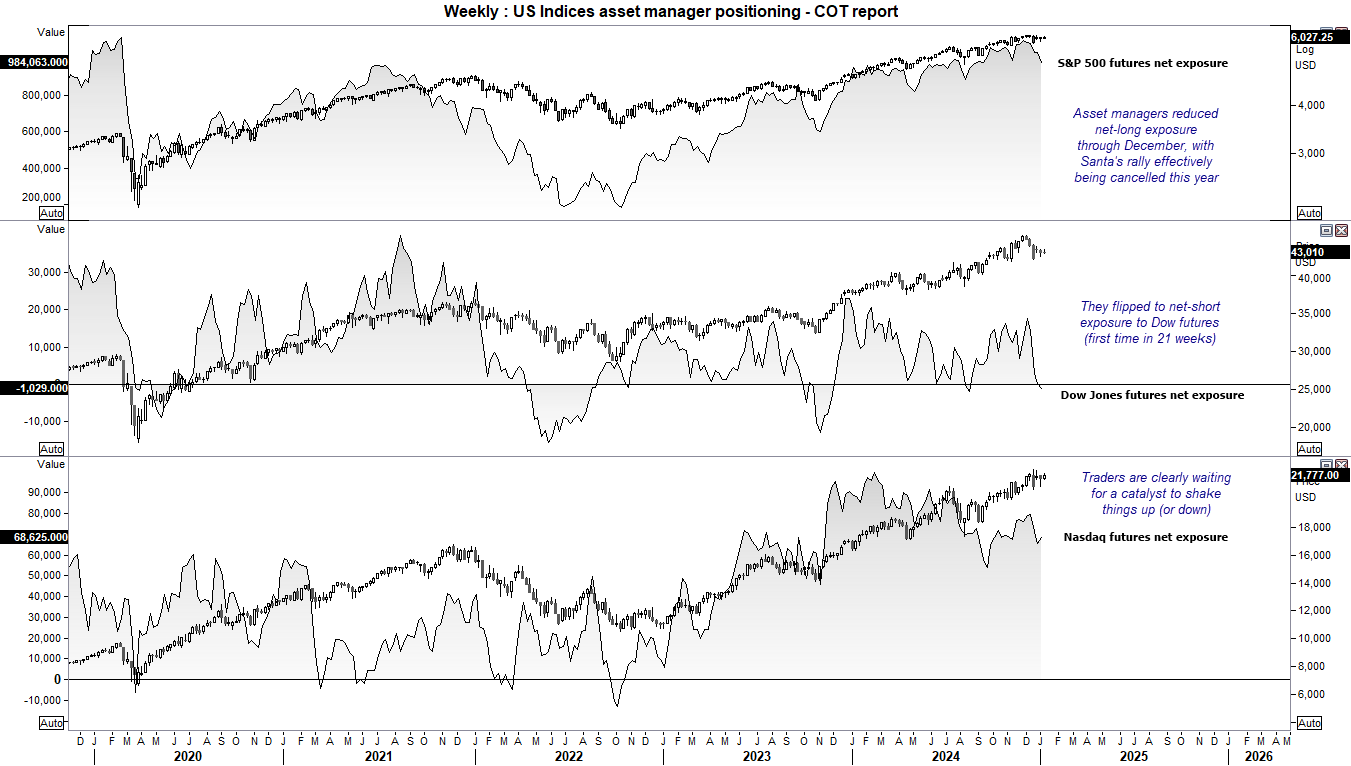

Wall Street indices (S&P 500, Dow Jones, Nasdaq 100) positioning – COT report:

Asset managers reduced net-long exposure to S&P 500 futures for four of the past five weeks. Perhaps this means something, given December is usually associated with the strongest gains of the year. Instead, the market effectively moved sideways to cancel Santa’s rally.

Asset managers also flipped to net-short exposure to Dow Jones futures, their first such move in 21 weeks. Meanwhile, net-long exposure was a tad higher for the Nasdaq last week.

With the Nasdaq and S&P 500 pinned to a tight range just beneath their record highs, it suggests some level of confidence from traders overall. But we are clearly waiting for a fresh set of catalysts, the most obvious being when Trump’s policies come into play.

Metals (gold, silver, copper) futures - COT report:

Gold appears to be in a healthy correction against a very strong bullish trend. I am not convinced we’re in for a particularly deep pullback, looking at how well supported gold is from large specs and managed funds. Therefore, dips may be more likely to be bought by investors looking for any sort of discount as the year progresses.

Yet silver seems to be caught between the flows of gold and copper, with bullish demand for gold supporting silver with copper suppressing its potential. Managed funds have flipped to net-short exposure, while large specs have trimmed net-long exposure to a mere 759 contracts.

As suggested above, we’re basically in holding pattern as we wait for Trump’s administration to readjust expectations of the Trump trade. Should his policies not be as aggressive, it could boost bullish bets on copper and silver, weaken the USD and helped commodity FX rally from very low lows.