Home Depot (earnings) - Premarket

Earnings and Revenue Projections

Home Depot is scheduled to report its Q3 2024 earnings on November 12, 2024 in premarket trading. The consensus expectations are:

- Earnings Per Share (EPS): $3.64

- Revenue: $39.2 billion, up 4% from the prior-year level

Positives

1. Strong Market Position: Home Depot maintains its leadership in the home improvement retail sector with a 17% market share.

2. Digital Growth: The company saw a 4% year-over-year increase in online sales in Q2 2024. This indicates a strengthening in its digital performance segment.

3. Professional Customer Segment: Home Depot's focus on professional customers continues to be a growth driver, with the recent acquisition of SRS Distribution contributing $1.3 billion to Q2 sales. This will bring in more large-scale orders for HD.

4. Operational Efficiency: HD has maintained a healthy operating margin around 15.1%. This shows effective cost optimisations.

Negatives

1. Declining Comparable Sales: Home Depot has experienced six consecutive quarters of underperformance of instore sales, with a 3.3% decline in Q2 2024.

2. Consumer Spending Pressure: Higher interest rates and economic uncertainty are leading to weaker spending across home improvement projects.

3. Weather Impact: Extreme weather changes have affected seasonal projects, potentially impacting Q3 performance.

4. Housing Market Weakness: The ongoing softness in the housing market due to high mortgage rates continues to affect Home Depot's performance due to less projects being built.

5. Revised Guidance: The company has updated its fiscal 2024 guidance, now expecting comparable sales to decline between 3% and 4% for the following 52-week period.

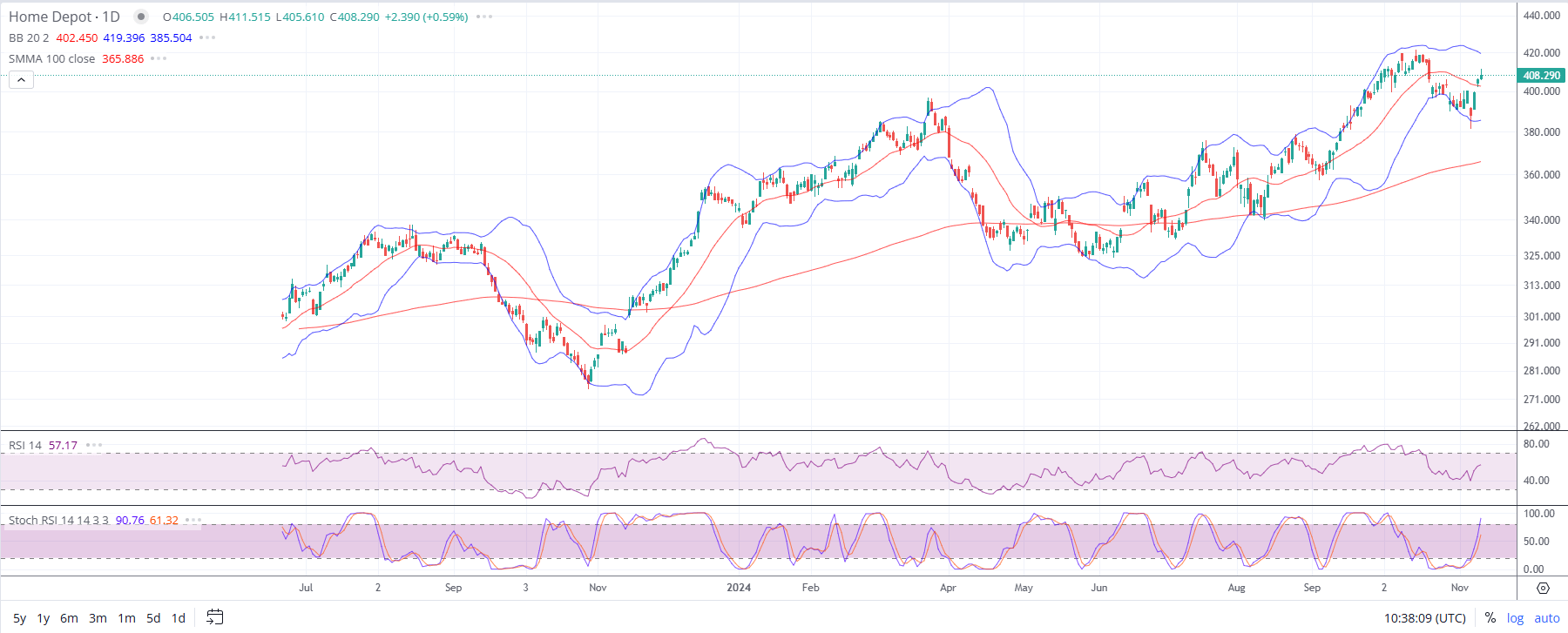

Home Depot Technical Analysis

Key Price Levels

Support Levels:

$405.825 (Today's low)

$396.98 (Daily support)

$394.90 (Short-term support)

$386.30 (Fibonacci S2)

Resistance Levels:

$411.60 (Today's high)

$403.35 (Daily resistance)

$405.01 (Short-term resistance)

$409.75 (Classic R3 pivot point)

Moving Averages:

The 20-day exponential moving average is at $400.37, suggesting a bullish trend as the current price is above this level.

The 50-day exponential moving average is at $392.74, further confirming the bullish trend.

The 200-day simple moving average is at $360.78, indicating a strong long-term uptrend.

Technical Indicators:

RSI(14) is at 50.61, indicating a neutral position.

MACD is at -0.58, suggesting a potential buy signal.

Williams %R is at -63.14, leaning towards a buy signal.

Support and Resistance Analysis

Short-term Support:

The stock has found support around the $405 level, which is reinforced by today's low of $405.825. This level is also close to the daily support of $396.98 identified by technical analysis5.

Short-term Resistance:

The immediate resistance is likely at today's high of $411.60, followed by the psychological level of $420, which is close to the 52-week high of $421.782.

Technically, the overall trend remains bullish, supported by multiple technical indicators and the stock's position relative to its moving averages.

Fundamentally, Home Depot faces slight headwinds from a constrictive economy and uncertainties in the supply chain. However, its strong market position, improving digital growth, and focus on professional customers provide some countering to otherwise not ideal environment.

AstraZeneca (earnings) - Premarket

Earnings and Revenue Projections

AstraZeneca is expected to report its Q3 2024 earnings on November 12, 2024 in premarket trading. The consensus EPS forecast for the quarter is $1.02. Revenue projections for Q3 are around 13.06 Billion.

- In Q2 2024, the company reported record quarterly revenue of $12.9 billion, representing a 17% year-on-year growth at a constant exchange rates.

Given this strong performance and upgraded guidance, it's reasonable to expect Q3 2024 revenue to continue showing robust growth compared to the previous year.

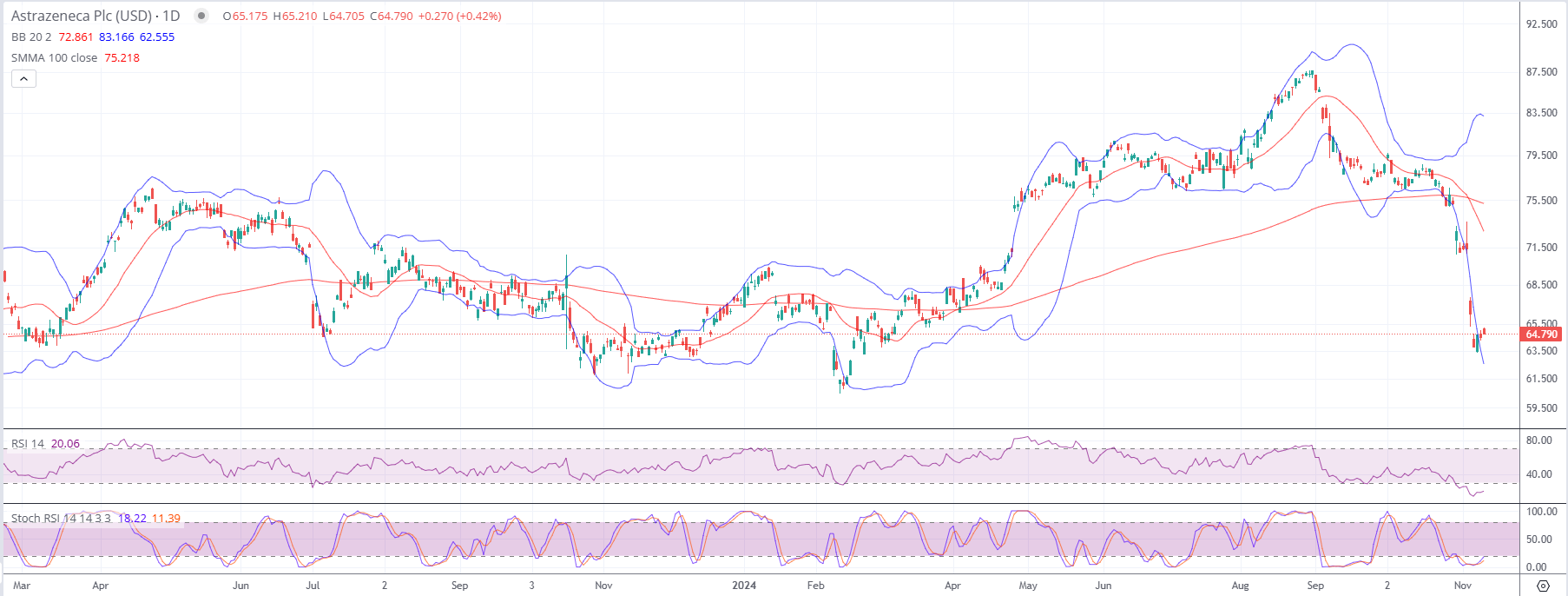

AstraZeneca Technical analysis

Short-term Support:

The stock has found support around the $64.70 level, which is today's low. The daily support level of $64.00 provides another potential cushion if the stock experiences further downward pressure2.

Short-term Resistance:

The immediate resistance is likely at today's high of $65.21, followed by the daily resistance level of $64.77. A break above these levels could see the stock testing the short-term resistance at $66.152.

Market Outlook

AstraZeneca stock is showing a slight positive movement today, trading above its previous close. However, the overall trend appears bearish, given its position below key moving averages.

Key levels to watch:

A break above $65.21 could signal short-term bullish momentum, potentially testing the $66.15 resistance level.

If the stock falls below $64.70, it might test the support at $64.00 or even lower.

Current Business Environment

1. Strong demand across multiple therapeutic areas, particularly in oncology, cardiovascular, renal and metabolism (CVRM), and rare diseases.

2. Continued growth in emerging markets, especially China.

3. Positive results from several Phase III clinical trials, potentially contributing to future growth.

Positives

1. Strong Product Portfolio: AstraZeneca's oncology franchise is performing exceptionally well, with 19% growth to $5.3 billion in Q2 2024.

2. Pipeline Momentum: The company has announced five positive, potentially practice-changing Phase III studies in 2024.

3. Strategic Acquisitions: Recent acquisitions like Fusion Pharmaceuticals ($2.4 billion) and Amolyt Pharma (up to $1.05 billion) are strengthening AstraZeneca's position in radioconjugates and rare endocrine diseases.

4. Operational Efficiency: The company is targeting a mid-30% core operating margin by 2026.

5. Long-term Growth Potential: AstraZeneca has set an ambitious target of reaching $80 billion in total revenue by 2030.

Negatives

1. Currency Fluctuations: If average exchange rates from March 2024 persist, the company anticipates a low single-digit loss on total revenue and a mid-single-digit loss on impact on Core EPS for the full year.

2. Competitive Pressure: The pharmaceutical industry remains highly competitive, requiring continuous innovation.

3. Regulatory Challenges: The impact of drug pricing negotiations, such as those under the Inflation Reduction Act, could affect future revenues.

4. R&D Expenses: Core R&D expenses are anticipated to be in the low 20s percentage of total revenue, which could pressure margins.

5. Market Volatility: AstraZeneca's stock price has shown some volatility around earnings announcements, with a 1.49% decrease following Q2 2024 results.

In conclusion, while AstraZeneca faces some challenges, its strong product portfolio, pipeline momentum, and strategic acquisitions position it well for continued growth. Investors will be closely watching the Q3 2024 results to see if the company can maintain its strong performance and meet the upgraded full-year guidance.