- Copper prices have surged to 11-month highs

- Concerns over potential supply shortages in China sparked the move

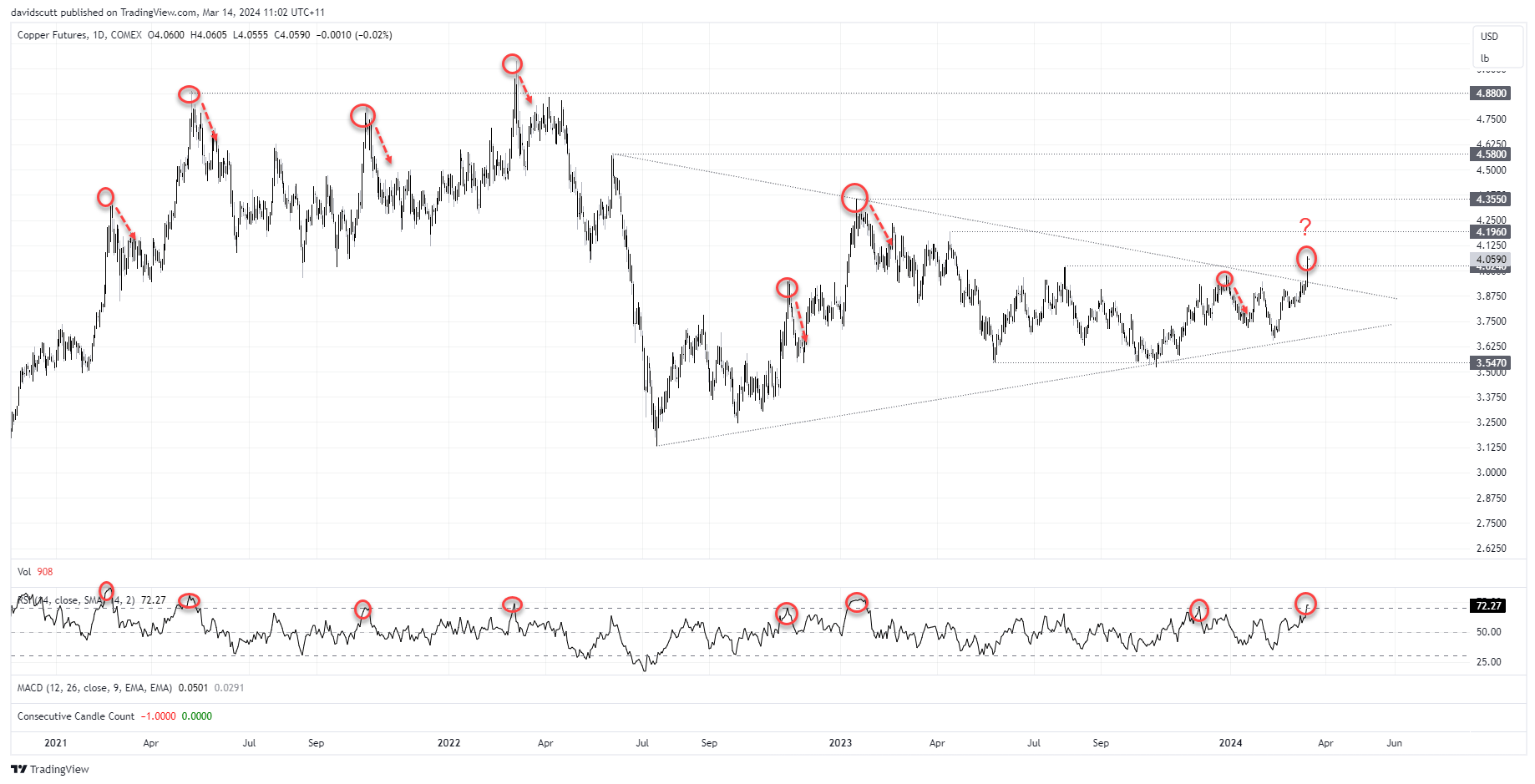

- Copper has lousy track record whenever it’s been this overbought on RSI in the past

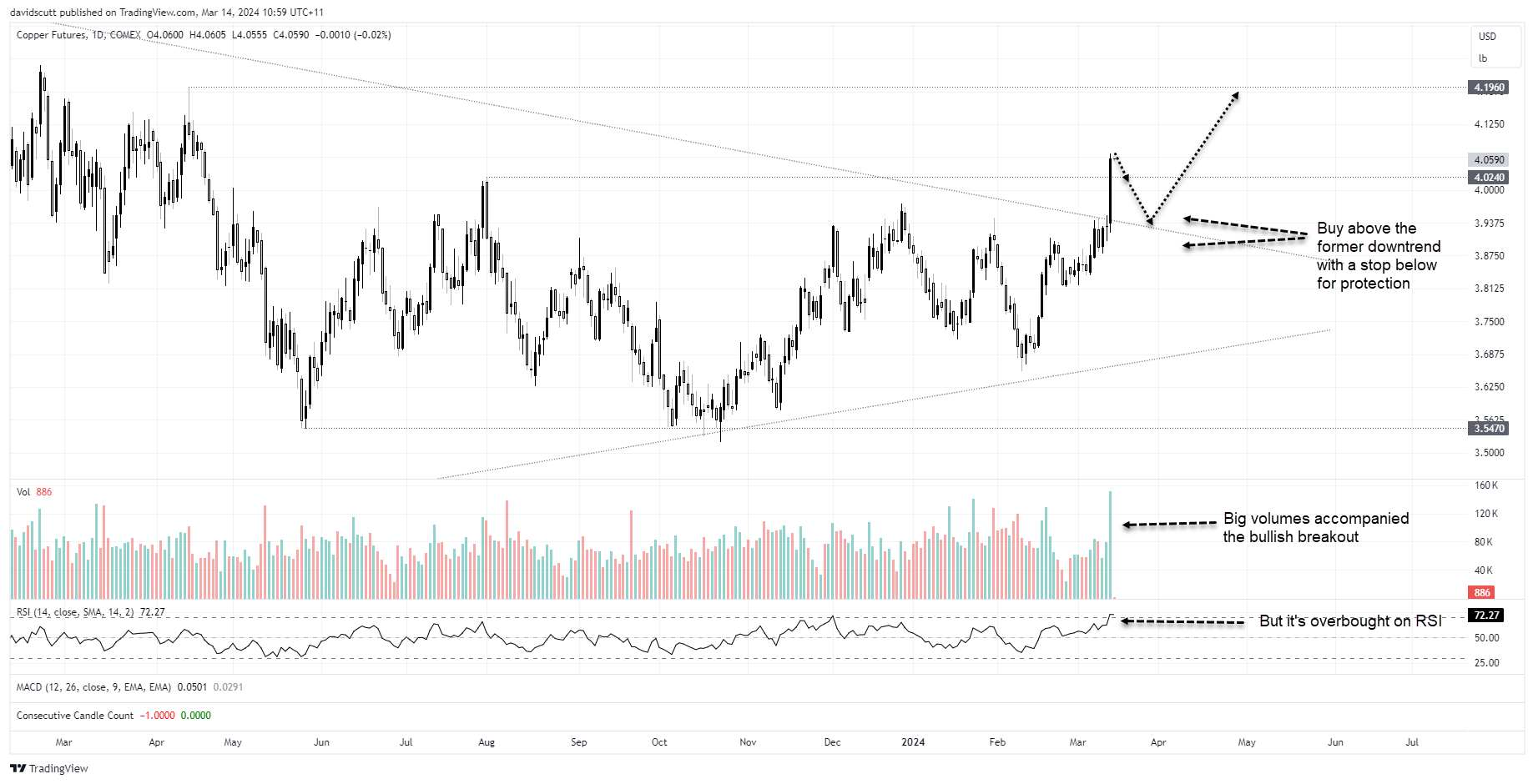

Copper is surging on the back of a technical break and production curbs in China, leaving COMEX futures sitting at levels not seen in close to a year. It’s now overbought and getting plenty of market attention. Those considering buying the break may want to look at copper’s track record whenever it’s been this overbought on the four hourly chart in the past. As such, it may pay to wait for a possible retest of the former downtrend resistance before considering going long.

Chinese output curbs send copper prices surging

As reported in financial media late Wednesday, copper's surge coincided with an agreement being reached among some Chinese smelters to cut production due to a collapse in processing fees, raising fears about a shortage of refined red metal. Discussions are still ongoing, according to sources with knowledge of the talks.

Chinese smelters, the largest refined producer and consumer globally, are facing a financial crunch as fees paid to convert copper concentrate into metal slumped, heightening the risk of output cuts that could deliver a supply crunch for downstream users. The drop has been driven by a combination of factors, including upstream copper mine closures, decreasing mine output, and increased competition from smelters globally.

Leading to a bullish break in COMEX copper

The news had an immediate impact on copper prices, sending futures on major commodity exchanges surging around the world. You can see the bullish break in the four hourly chart below, accompanied by extremely strong trade volumes on COMEX – a bullish combination if there ever was one.

It’s easy to see why some may be looking to buy the break, but one thing that caught my eye is just how lousy copper has been whenever it’s been this overbought in the past on RSI using this timeframe. I’ve zoomed out to show why there’s room for caution, removing the volume indicator and circling the times when copper has been this overbought in the past.

But here’s a reason for caution

While I freely admit the breakout looks tempting to buy, I’m inclined to wait for a potential retracement before slinging into a long, especially as we’ve seen similar moves in gold and silver beforehand.

Dips below $4 would provide a decent entry point, allowing for a stop to be placed below the former downtrend for protection. Given the ease the price took out the highs from July 2023, an initial upside target would be around $4.20.

For those brave enough to short the break, you could flip the trade idea around and look to sell here with a stop above Wednesday’s high looking for a retest of the former downtrend.

-- Written by David Scutt

Follow David on Twitter @scutty