Hannover Rueck SE Q3 Earnings and Revenue Projections

Hannover Rück is scheduled to report its Q3 2024 earnings on November 11, 2024. Q3 revenue projections lie around 6.57 Billion and 4.62 earnings per share.

Revenues for year end 2024 have already been released and have not been revised for the past 30 days:

- Reinsurance revenue growth is expected to be more than 5% for the full year 2024, based on constant exchange rates.

- Group net income for 2024 is targeted to reach at least €2.1 billion.

Given these projections, Q3 2024 is likely to show continued growth in both revenue and earnings compared to the previous year.

Current Business Environment

Hannover Rück is operating in a dynamic reinsurance market characterized by:

1. Improved risk-adjusted prices and conditions in property and casualty reinsurance.

2. Sustained demand across all segments in life and health reinsurance.

3. A trend towards increasing frequency losses and losses from secondary perils such as flooding.

4. Ongoing economic uncertainties and potential downside risks in the overall economic environment.

Positives

1. Strong Financial Performance: Hannover Rück reported a 21% increase in Group net income to €1.2 billion for the first half of 2024.

2. Revenue Growth: Reinsurance revenue grew by 5.2% to €12.9 billion in the first half of 2024.

3. Profitability: The company achieved a return on equity of 22.3% in the first half of 2024.

4. Solid Investment Performance: A return on investment of 3.3% was generated, beating the full-year target of at least 2.8%.

5. Strategic Growth: Hannover Rück is leveraging retrocession and insurance-linked securities (ILS) to expand its balance sheet capacity and grow profitably.

Negatives

1. Large Loss Exposure: The achievement of the 2024 profit guidance is conditional on large loss expenditure not significantly exceeding the budgeted amount of €1.825 billion.

2. Currency Fluctuations: The company's reported results can be affected by exchange rate volatility.

3. Increasing Frequency Losses: Hannover Rück has observed a trend towards increasing frequency losses and losses from secondary perils such as flooding over the last fiscal quarter.

In conclusion, Hannover Rück appears well-positioned for Q3 2024, with expectations of continued growth in revenue and earnings. The company's strong first-half performance, improved market conditions, and strategic focus on profitable growth through innovative solutions like ILS provide a positive outlook. However, investors will be closely watching how Hannover Rück navigates challenges such as large loss events and market volatility. The Q3 results will be crucial in determining if the company can maintain its growth trajectory and meet its ambitious full-year 2024 targets.

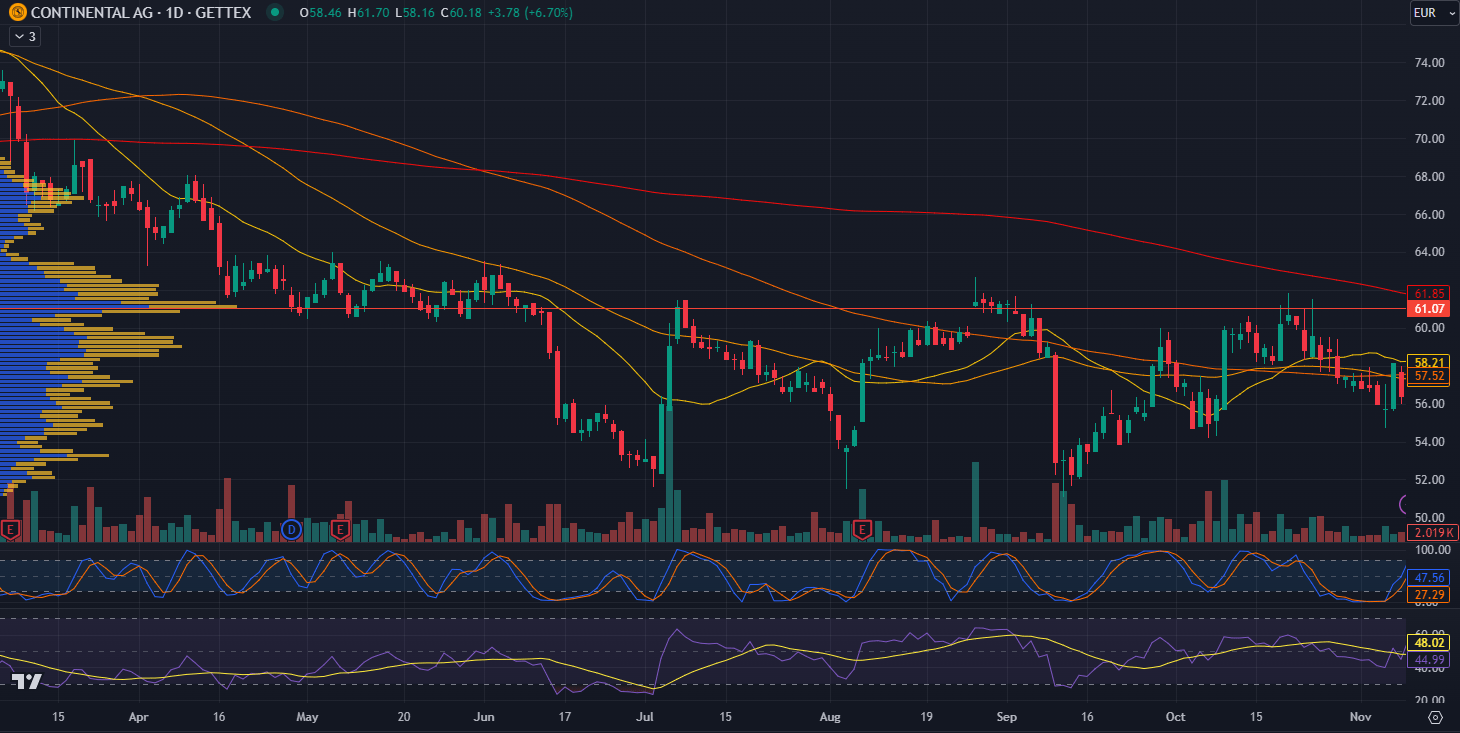

Continental AG (CONG) Q3 2024 earnings expectation

Earnings and Revenue

- Q3 2024 consolidated sales: €9.8 billion (down 4.0% from €10.2 billion in Q3 2023)

- Q3 2024 adjusted EBIT: €873 million (up 36.0% from €642 million in Q3 2023)

- Q3 2024 adjusted EBIT margin: 8.9% (up from 6.3% in Q3 2023)

- Q3 2024 net income: €486 million (up 62.8% from €299 million in Q3 2023)

Revenue Projections

Continental has adjusted its full-year 2024 outlook:

- Sales are now projected in the range of €39.5 billion to €42.0 billion (revised down from €40.0 billion to €42.5 billion)

- Adjusted EBIT margin is expected to be around 6.0% to 7.0%

Current Business Environment

1. Global production of passenger cars and light commercial vehicles decreased by about 5% to 21.6 million units in Q3 2024.

2. Weak industrial markets, particularly in Europe and North America, affecting the ContiTech sector.

3. Improved winter tire sales in Europe.

4. Ongoing challenges in automotive production and industrial sector.

Positives

1. Significant improvement in adjusted EBIT and net income despite lower sales.

2. Strong performance in the Automotive sector, with adjusted EBIT margin improving to 4.2% (up from 2.8% in Q3 2023).

3. Tires sector maintained strong profitability with a 14.5% adjusted EBIT margin.

4. Effective cost management and price adjustments contributing to improved earnings.

5. Strategic focus on making group sectors more agile and market-oriented.

Negatives

1. Overall decline in consolidated sales by 4.0% year-over-year.

2. Adjusted free cash flow decreased by 30.6% to €323 million.

3. Weak performance in the ContiTech sector due to poor industrial demand in Europe and North America.

4. Lowered sales expectations for the full year 2024.

5. Ongoing challenges in the automotive production environment.

In conclusion, Continental AG has shown resilience in Q3 2024 by improving profitability despite challenging market conditions. The company's focus on cost management and strategic pricing has yielded positive results, particularly in the Automotive and Tires sectors. However, the revised downward outlook for full-year sales and ongoing challenges in the ContiTech sector indicate that the company still faces significant headwinds in the current business environment.