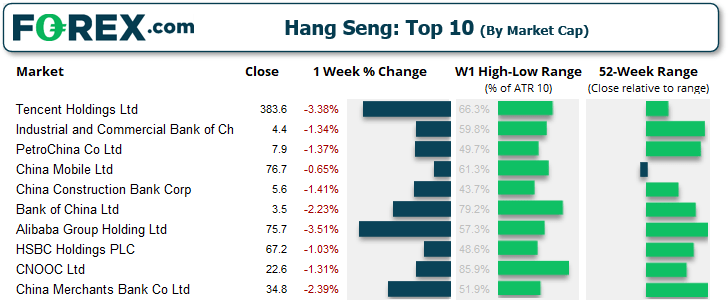

I've had a bullish bias on the Hang Seng and China A50 over the past few weeks. Unfortunately, I had the right idea but the wrong timing. Still, momentum finally turned higher last week. And I’m now looking for it to extend these gains once the current phase of consolidation has passed.

It is now day two of the CCP’s Third Plenum, which wraps up on Wednesday. We’re yet to hear of any solid reforms being announced, but there may be a greater appetite too given yesterday’s economic data.

- Retail sales rose just 2% y/y (3.3% expected, 3.7% prior)

- GDP 0.7% q/q (1.1% expected, 1.5% prior)

- GDP 4.7% y/y (5.1% forecast, 5.3% prior)

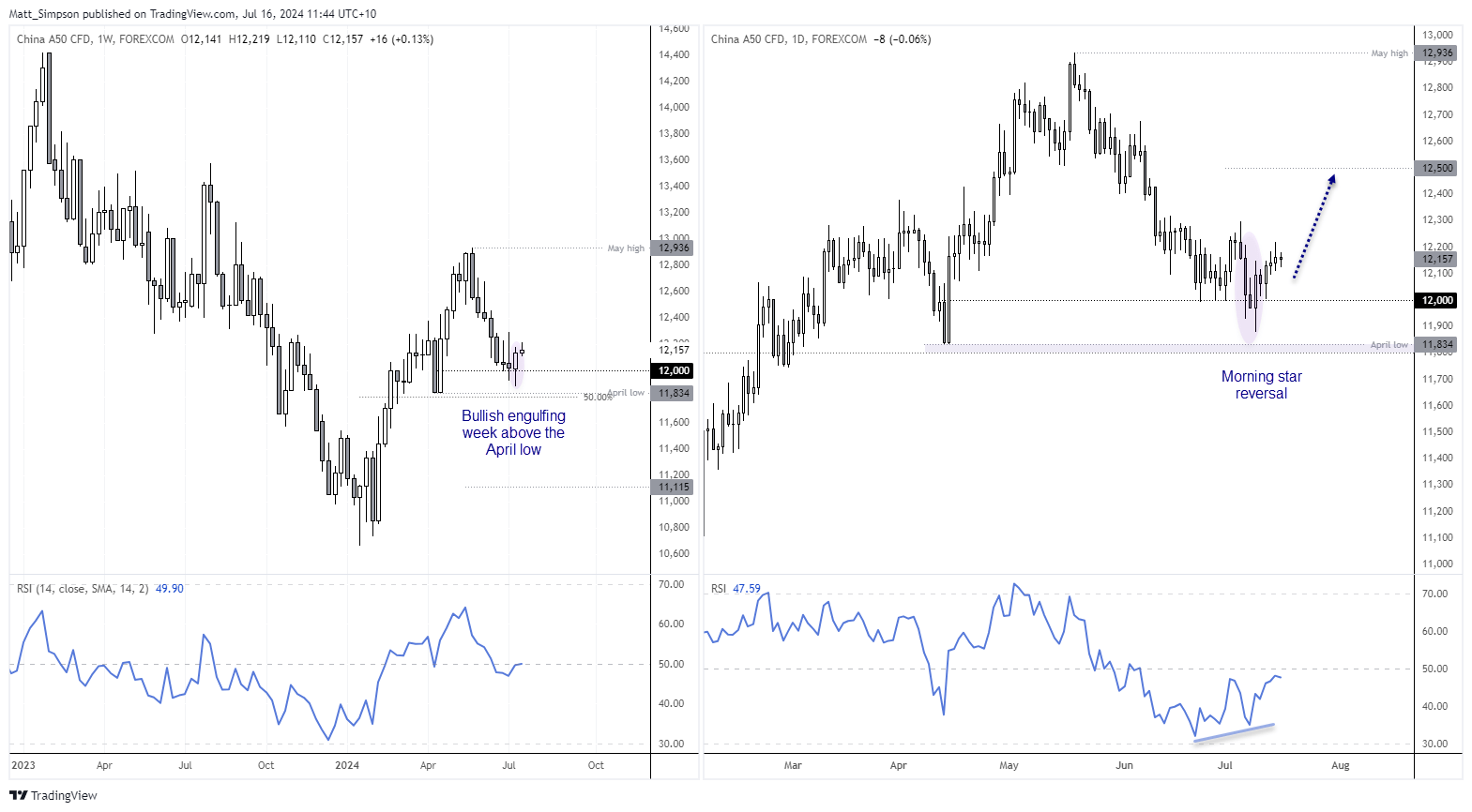

China A50 technical analysis:

The weekly chart formed a bullish engulfing candle last week, its low held above the April swing low and for the 2nd consecutive week the market closed above 12,000. Given the China A50 was already down over 8% from the May high, I suspect we have finally seen the swing low I was anticipating over the past few weeks. The weekly RSI is trying to move back above 50, and the RSI (2) now points higher having rallied form its oversold level.

The daily chart shows a bullish outside day took the market back above 12,000, and forms the final candle of a 3-bar bullish reversal called a morning star formation.

Dips towards 12,000 will likely be favourable to bulls seeking to load up ahead of an anticipated move higher. But if China’s Communist Party (CPP) is to surprise with strong economic reforms during their Third Plenum, the market may not pull back that far beforehand.

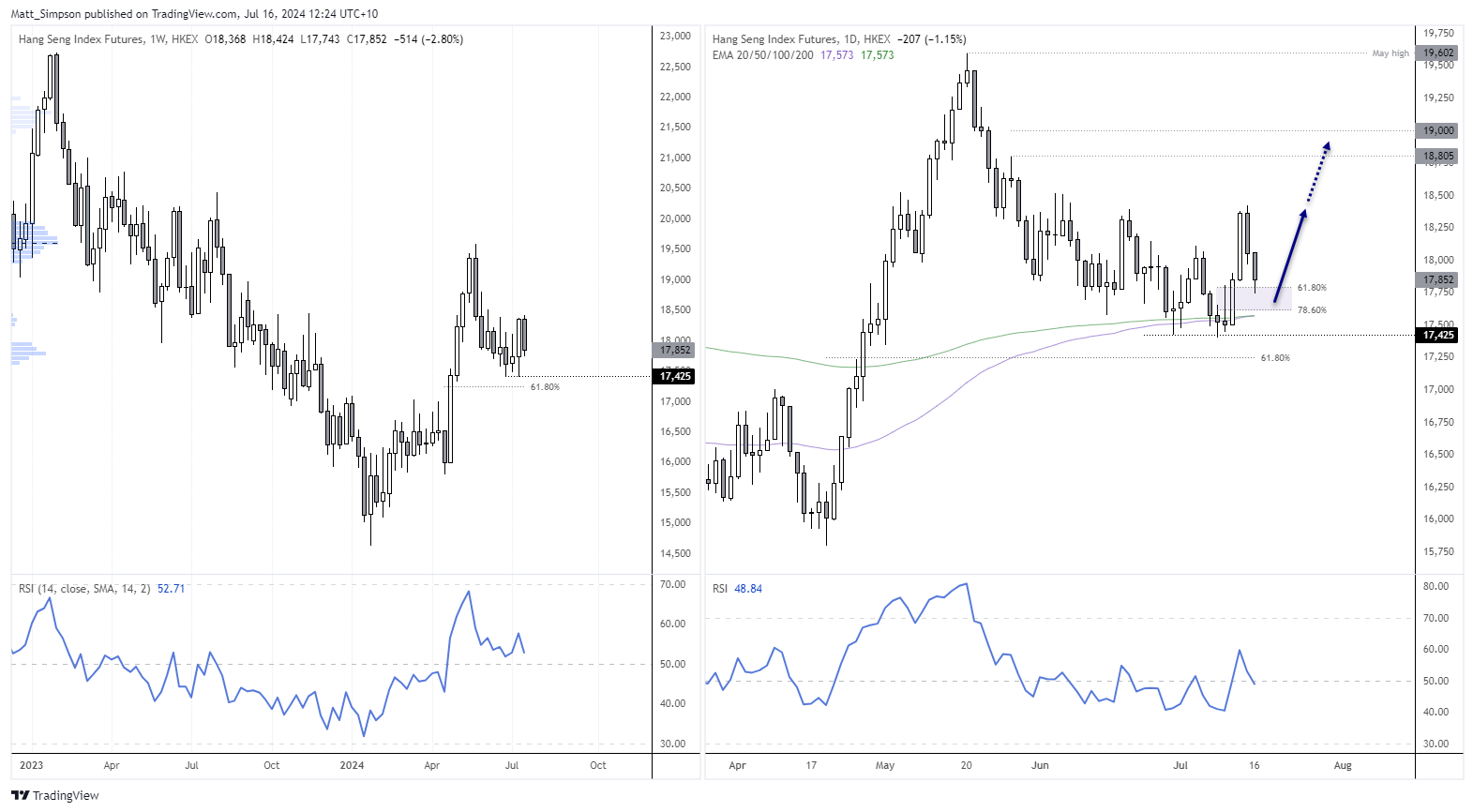

Hang Seng technical analysis:

The trend structure of the Hang Seng is similar to the A50. However, prices have pulled back further over the past two days, which in some ways makes it more appealing for a bullish set-up. A double bottom formed at 17,425 on the weekly chart, and last week’s bullish outside candle is the third of a three-week bullish reversal pattern, called a morning star formation. And as it is formed on the weekly chart, it carries extra weight.

The daily chart shows a strong two-day rally from 200 and 100-day EMAs, and prices have since retraced to a 61.8% Fibonacci level. The area between the 78.6% and 61.8% level might be the ideal zone for bulls to seek dips to enter, ahead of an anticipated move towards 18,500, 18,800 or even 19,000.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge