Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold prices coil into multi-month consolidation- approaching resistance

- XAU/USD carving monthly opening-range just above 2025 yearly open- NFPs on tap

- Resistance 2671/80, 2715 (key), 2744- Support 2624, 2594-2603 (key), 2565

Gold prices may be poised for a breakout in the days ahead as XAU/USD continues to coil within the December range. Battle lines drawn on the short-term technical charts heading into the close of the week with U.S. Non-Farm Payrolls on tap.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.Gold Price Chart – XAU/USD Daily

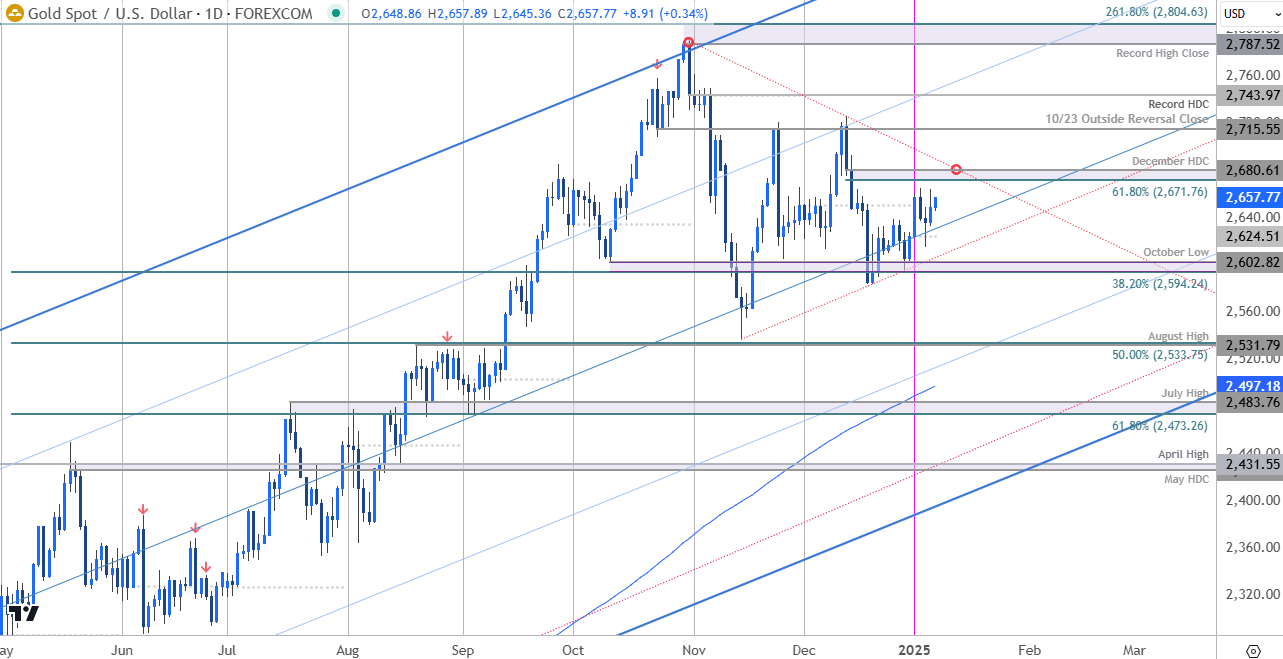

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In my last Gold Short-term Price Outlook we noted that a rebound in XAU/USD was approaching resistance and that, “losses should be limited to 2594 IF price is heading for a breakout with a close above 2693 needed to suggest a low is in place.” Price briefly registered an intraday high at 2726 two-days later before plunging more than 5.2%.

A rebound off slope support into the close of December has now extended more than 3.1% off the lows with gold now approaching technical resistance near 2671/80- a region defined by the 61.8% retracement of the December range and the December high-day reversal close (HDC). Looking for a larger reaction there IF reached with a breach / close above the October trendline (red) needed to validate a breakout of a multi-month consolidation.

Gold Price Chart – XAU/USD 240min

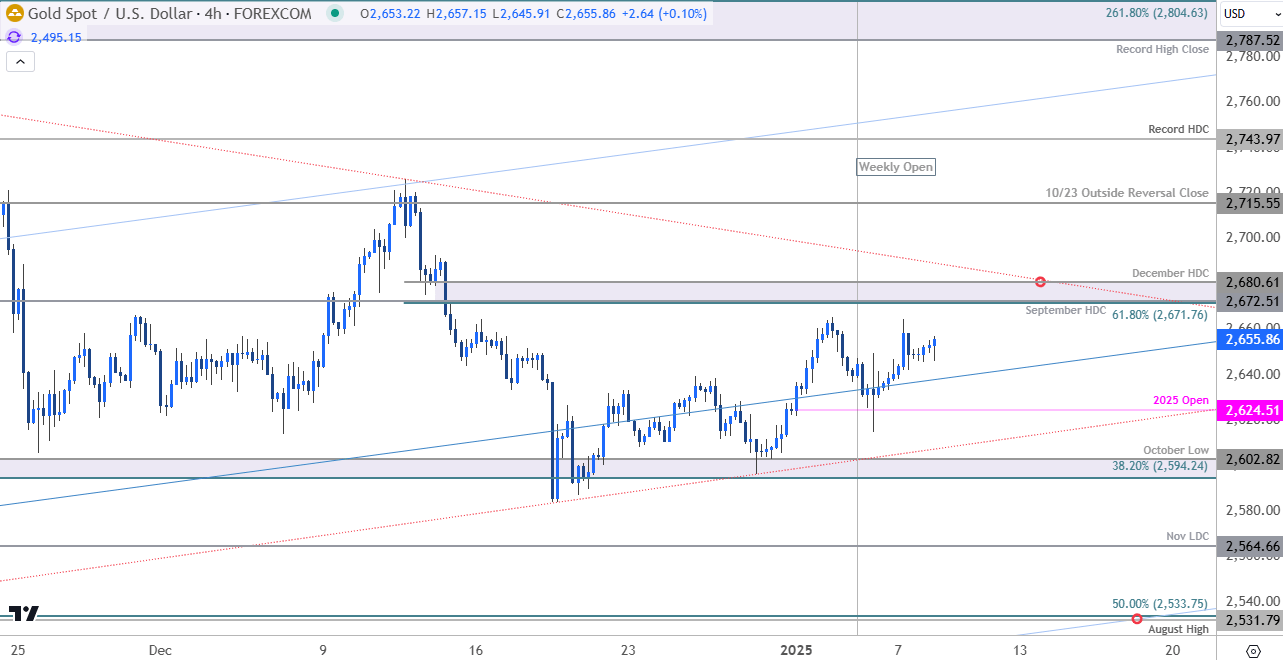

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD setting the monthly opening-range lows at the objective 2025 yearly open near 2624. Key support rests with the 38.2% retracement of the May rally / October low at 2594-2603 – a break / close below this threshold would threaten a larger correction in gold with such a scenario exposing the November low-day close (LDC) at 2565 and the 50% retracement /August high at 2532/34 (both areas of interest for possible downside exhaustion IF reached).

A topside breakout of this formation keeps the focus on the 10/23 outside reversal close at 2715- a close above this level is ultimately needed to mark uptrend resumption towards the record HDC at 2744 and the record high / close / 2.618% extension at 2787-2804.

Bottom line: The gold recovery is approaching consolidation resistance just higher with the monthly opening-range taking shape just below. The immediate focus is on a breakout of the 2594-2680 range. From a trading standpoint, loses should be limited to the November trendline IF price is heading higher on this stretch with a close above 2715 needed to mark uptrend resumption.

Keep in mind we get the release of key US employment data this week with Non-Farm Payrolls on tap Friday. Stay nimble into the releases and watch the weekly closes for guidance. Review my latest Gold Weekly Technical Forecast for a closer look at the longer-term look at the XAU/USD trade levels.

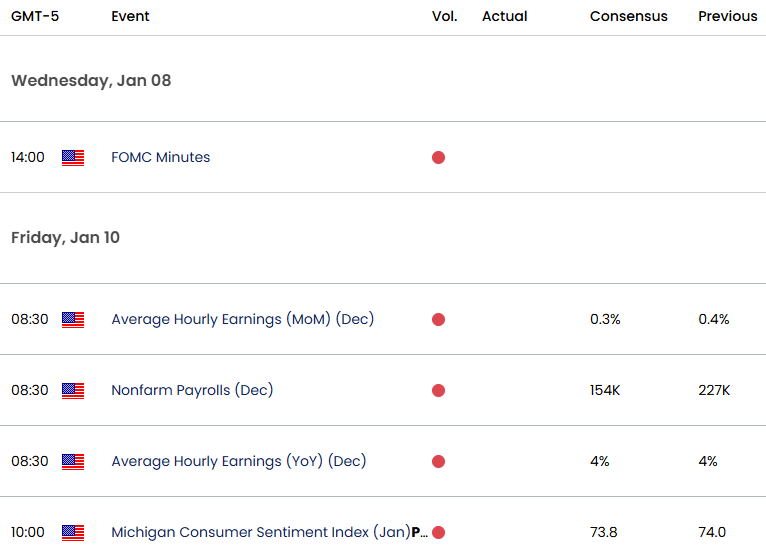

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- US Dollar Short-term Outlook: USD Bulls Rest After Five-Week Run

- Australian Dollar Short-term Outlook: AUD/USD Bears Lay in Wait

- Euro Short-term Outlook: EUR/USD December Range Unfazed by ECB

- Canadian Dollar Short-term Outlook: USD/CAD Bulls Brace for BoC

- Japanese Yen Short-term Outlook: USD/JPY Recovery at Trend Resistance

- Swiss Franc Short-term Outlook: USD/CHF Charge Uptrend Support

- British Pound Short-term Outlook: GBP/USD Bulls Emerge

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex