Gold Price Outlook: XAU/USD

The price of gold snaps a three-day rally to hold below the December high ($2726) ahead of the inauguration of US President Donald Trump.

Gold Price Snaps Three-Day Rally Ahead of Trump Inauguration

The price of gold struggles to extend the recent series of higher highs and lows as it pulls back from a fresh monthly high ($2725), and bullion may continue to trade within the November rang as it holds below pre-US election prices.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, executive orders from the Trump administration may spur greater volatility in the price of gold should the Federal Reserve respond to the looming change in fiscal policy, and the threat of an error by major central banks may keep bullion afloat as it serves as an alternative to fiat currencies.

With that said, the price of gold may continue to give back the advance from the monthly low ($2615) as it snaps the bullish price series from earlier this week, but bullion may attempt to retrace the decline following the US election should it trade back above the December high ($2726).

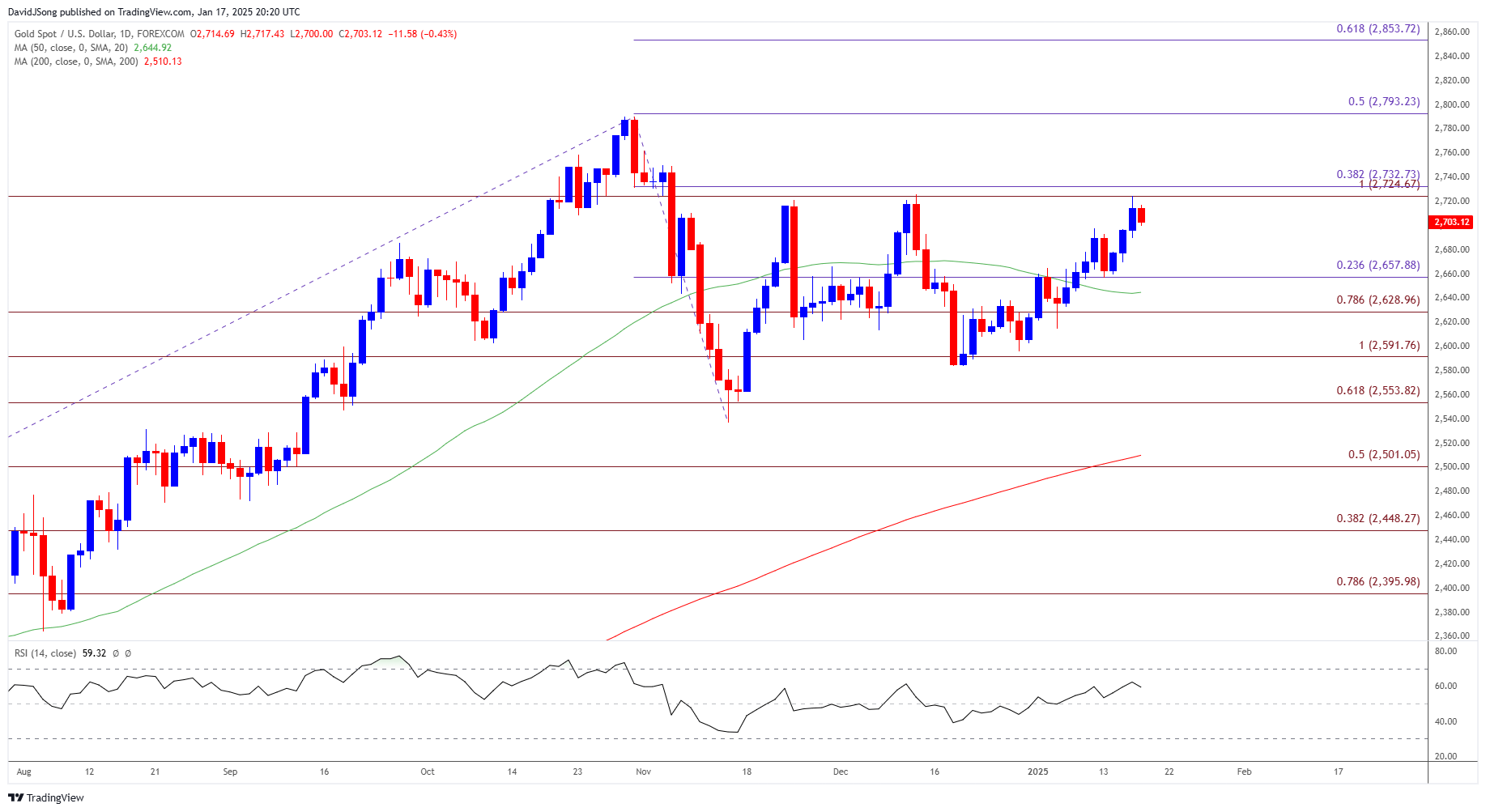

XAU/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; XAU/USD on TradingView

- The price of gold may mirror the price action from December as the recent advance appears to be stalling ahead of $2730 (100% Fibonacci extension), with a break/close below the $2630 (78.6% Fibonacci extension) to $2660 (23.6% Fibonacci extension) zone raising the scope for a move towards the monthly low ($2615).

- Next area of interest comes in around $2590 (100% Fibonacci extension), but the price of gold may continue to trade within a defined range should it hold above the December low ($2584).

- At the same time, gold may threaten the range bound price action should it break/close above $2730 (100% Fibonacci extension), with a break above the November high ($2762) bringing the 2024 high ($2790) on the radar.

Additional Market Outlooks

GBP/USD Pullback Pushes RSI Toward Oversold Territory

AUD/USD Vulnerable amid Struggle to Push Above Weekly High

USD/CHF Snaps Bearish Price Series to Hold Above Weekly Low

US Dollar Forecast: USD/CAD Susceptible to Test of Monthly Low

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong