Gold Talking Points:

- I went over gold in-depth in yesterday’s webinar, and this morning updates given the metal’s continued price action with bulls pushing up to another ATH just inside of the 2790 level.

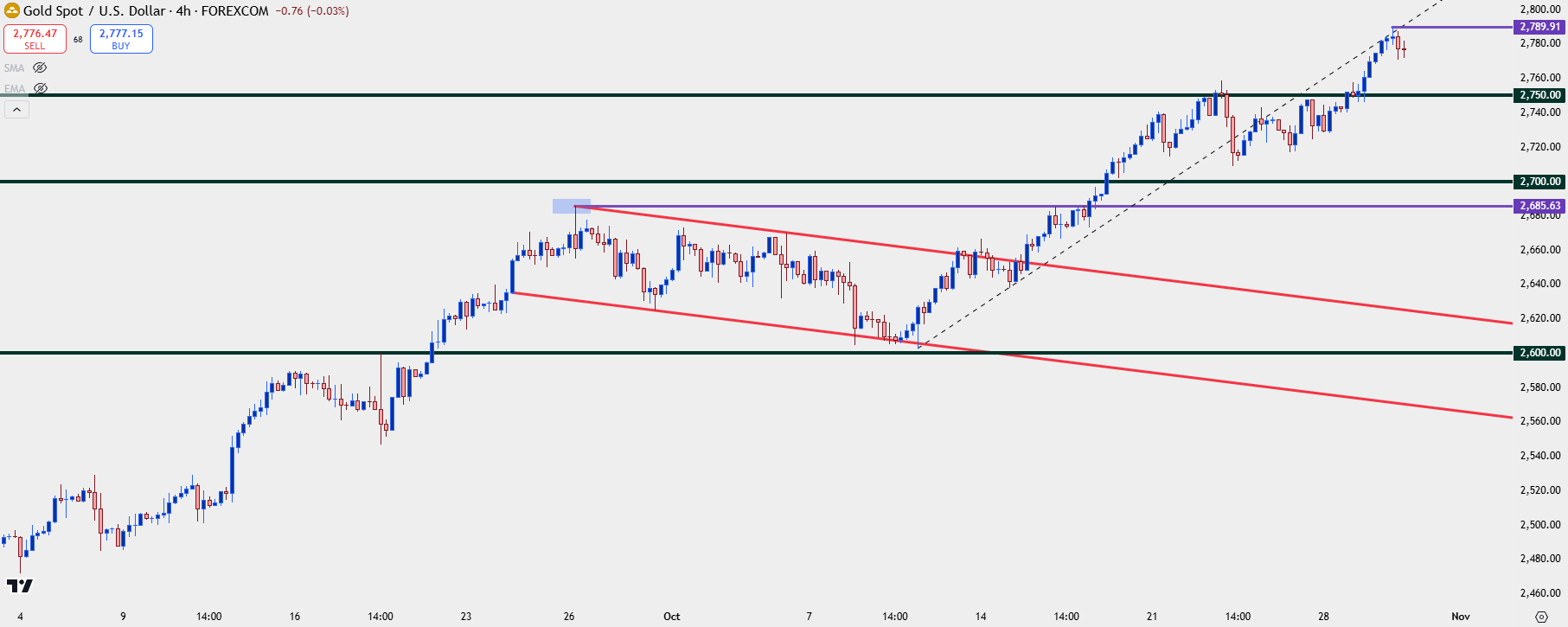

- The current pullback feels similar to the prior episode, when gold stalled ahead of a test of the 2700 psychological level. In that iteration, prices then built a bull flag formation as three weeks of sideways grind appeared before buyers were ultimately able to force a push up and through the next big figure at 2700.

- I look at gold in-depth each week in the Tuesday webinar, and you’re welcome to join the next one. Click here for registration information.

The banner year for gold has continued and this morning brought yet another fresh all-time-high into the mix. At this point, price held highs just about $10 inside of the next major psychological level of 2800 and this resembles last month’s episode when gold bulls shied away from 2700, at least initially. The high then held at 2685 and a bearish channel developed thereafter, which, when taken with the prior bullish trend made for a bull flag formation.

That was one of those episodes were there was ample reason for a larger pullback as the bullish move has pressed aggressively over the past few months, extending what was already a bullish outlay in 2024 trade. But – buyers continued to defend the 2600 level, not even allowing for a re-test below that price, and it was around the morning of the release of US CPI a few weeks ago that bulls took back over.

The initial move there re-tested 2685, but this time, buyers had little trouble pressing right through that. Eventually, a bit of resistance showed at 2750 and that’s a level that’s remained in-play so far this week as resistance-turned-support.

Gold Four Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

The Role of Big Figures

Psychological levels can have large impact on market pricing dynamics. This works in our everyday lives, as well, as most retailers on planet Earth use some form of pricing strategies designed to make their products seem less expensive. Ending a price in increments of 99 cents can help to induce demand as $9.99 seems much cheaper than just two cents below $10.01. In reality the difference is only about 2%, but as human beings, we value simplicity and for many of us, our brains do the work without us even noticing, where the $9.99 will feel like a value while $10.01 will feel less so.

This can work in markets, too, especially a market like spot gold where not all activity is coming from speculators. As a case in point, the $2k level in gold held resistance for three-and-a-half years, even when the Fed was pedal to the floor with accommodation.

But it was earlier this year, as the Fed was laying the groundwork for rate cuts even with inflation remaining elevated by most counts, that the metal was finally able to find some support around that prior resistance of $2k, eventually launching into a bullish move that hasn’t calmed since.

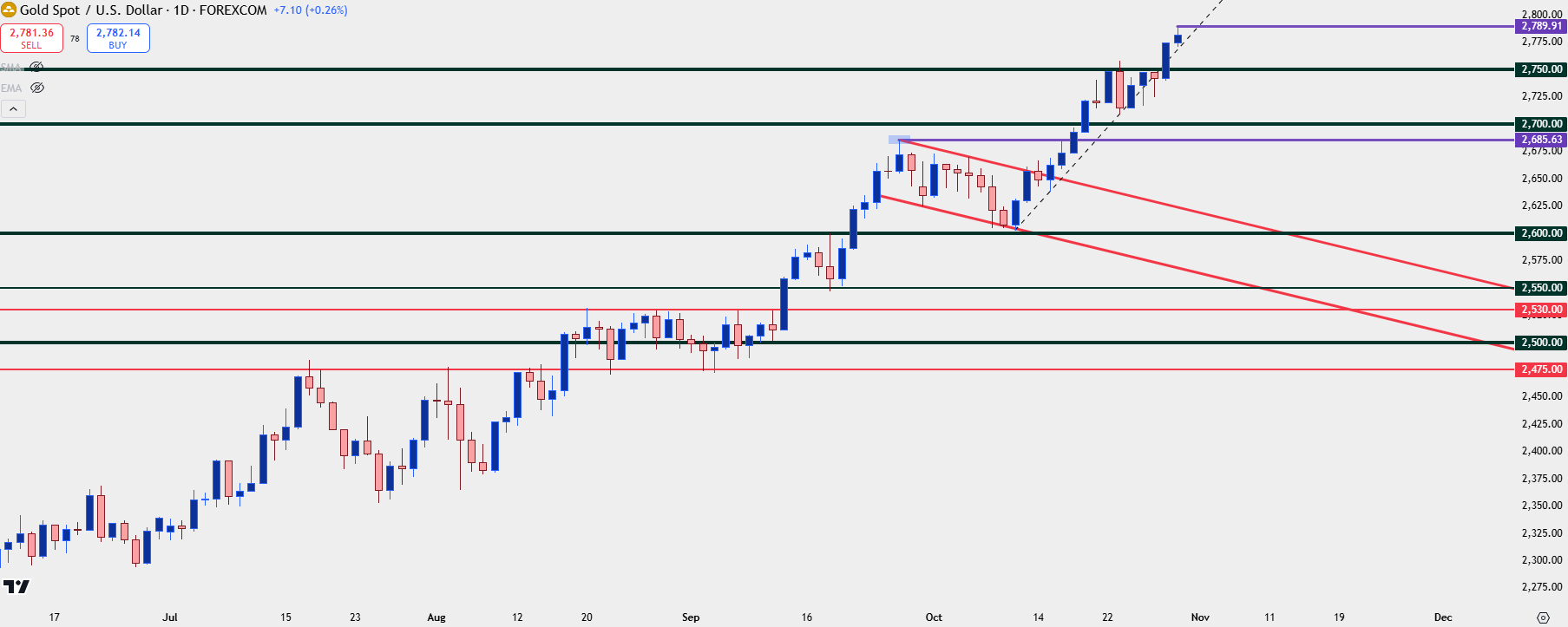

I went over this in-depth in yesterday’s webinar and I also highlighted shorter-term situations around less rounded levels, such as the resistance in Q2 at 2400 and the support thereafter at 2300. Then the 2500 level played and that took some time to gain acceptance: There was a few weeks of range between 2575 and 2530 until price eventually broke out on the ECB rate cut, leaving 2500 behind and moving up to 2600 on the announcement of the FOMC rate decision.

That was an interesting scenario, with that 2600 price trading for a few minutes after the FOMC statement release, only for price to recoil during the press conference until it found support at a minor psychological level of 2550.

That led to the next run, with bulls making a strong push until price came less than $15 way from the 2700 level, which led to the bull flag.

The point of this is that with a strong and well-entrenched trend, price getting close to the next major big figure has dissuaded bulls from chasing an already overbought trend and, instead, has allowed for a bit of pullback.

That may be what we’re seeing already after buyers made a hard press to just about $10 away from the 2800 level.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold Strategy

As I’ve been saying for a while now, I have little interest in bearish setups in gold. Perhaps this pullback does drive a bit deeper, but the dominant trend has been so clear that trying to get short feels like swimming upstream to hard current.

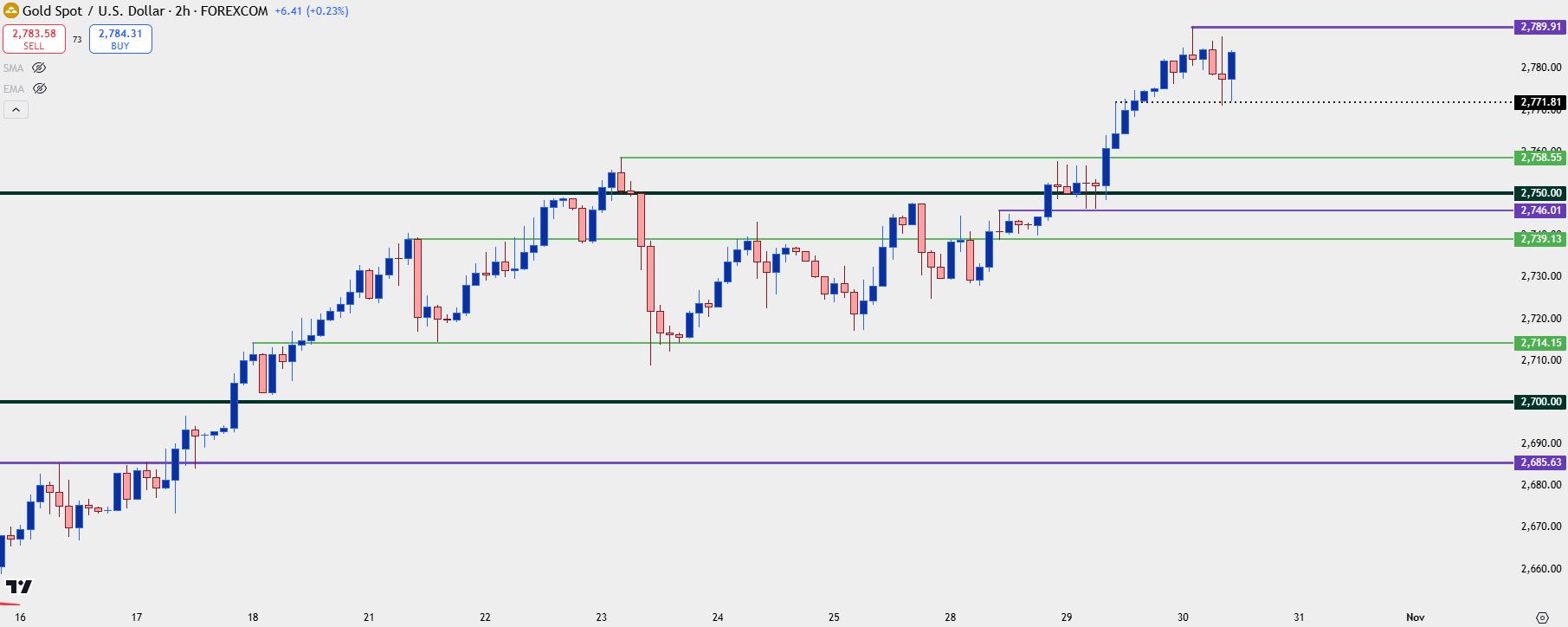

That also doesn’t mean that I want to chase the move-higher as we’re still fairly far away from the recent support of 2750 to justify topside setups, in my mind.

Given where resistance has played so far, just around that 2800 level, I’m of the mind that that’s the level that will next need to gain acceptance. And we’ve previously had acceptance at 2750 after the support showing there that’s evident on the two-hour chart below. So, ideally, any corresponding pullbacks will remain above that prior higher-low to keep the door open for bullish momentum setups. Given that the prior low was right around a previous point of resistance at 2746, this could even keep the door open for a 2750 test provided that buyers defend the prior low. But, even more attractive would be a hold of support around or above the 2758 level that was a prior swing high.

If we do get violation of those shorter-term lows, then I will likely be expecting a more drawn-out pullback scenario, somewhat similar to the bull flag that had developed last month after the stall inside of the 2700 level.

Gold Two-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist