Despite rebounding on Friday, gold was unable to post a positive close on the week. It finished lower for the second consecutive week, albeit only modestly. Given that we still haven’t observed any bearish reversal signals on the metal, and with the Fed and most other central banks outside of Japan likely to loosen their policies, both the technical and fundamental gold outlook remains bullish.

This week promises to be a big one for the markets with lots of data, central bank meetings and company earnings to come. For gold, most of the attention will be on the FOMC rate announcement on Wednesday and the July jobs report on Friday. Ahead of these events, I think the risks are tilted to the downside for the dollar, which, if correct, should be positive for gold.

FOMC should prepare market for September cut

I think the Fed might adopt a more dovish tone at this week’s meeting, reflecting recent comments and weakness in US data. While the disinflation process has been painfully slow, the fact that the unemployment rate has been climbing should start to worry some Fed officials that the current policy is far too restrictive than needed. The unemployment rate is now at 4.1%, so it is already higher than the Fed's year-end target. Several other jobs market data have all pointed to a softening labour market recently, too. By holding policy excessively tight while the rest of the world’s other major central banks are loosening policy (outside of Japan), the Fed might be causing an unnecessary economic strain, which it will want to avoid given its mismanagement of inflation and interest rates.

In fact, markets are already leaning towards easing, with a September rate cut fully priced in. Investors have factors in around 68 basis points worth of cuts by year-end, meaning more than two full 25 basis point of cuts and some are now expected. In the likely event the Fed is dovish this week, those bets could increase further, to potentially 3 expected cuts before the year is out. That, in turn, should boost the gold outlook as investors drive bond yields further lower.

BOJ and NFP additional risk factors for the dollar

Additionally, downside risks from the upcoming jobs report and a potential surprise hike by the Bank of Japan could further contribute to a bearish dollar move this week, with the latter indirectly supporting our bullish gold outlook.

The yen has roared back in recent weeks amid the unwind of carry trades, supported by the narrowing of yield spreads between Japanese bonds and those of the rest of the world. Just as the Fed prepares to implement rate cuts, the Bank of Japan has only recently started to tighten its monetary policy. In the upcoming BOJ meeting this week, speculation is growing that the central bank might raise interest rates by around ten basis points.

In as far as the US jobs report is concerned, economists are expecting to see around 177,000 net jobs gains for July. As mentioned, the unemployment rate has been steadily rising and the pace of job gains have slowed with other labour market indicators also softening in recent months. If this trend continues, it will only cement expectations of a September rate cut, potentially undermining the dollar and underpinning gold.

Gold outlook: technical analysis and levels to watch

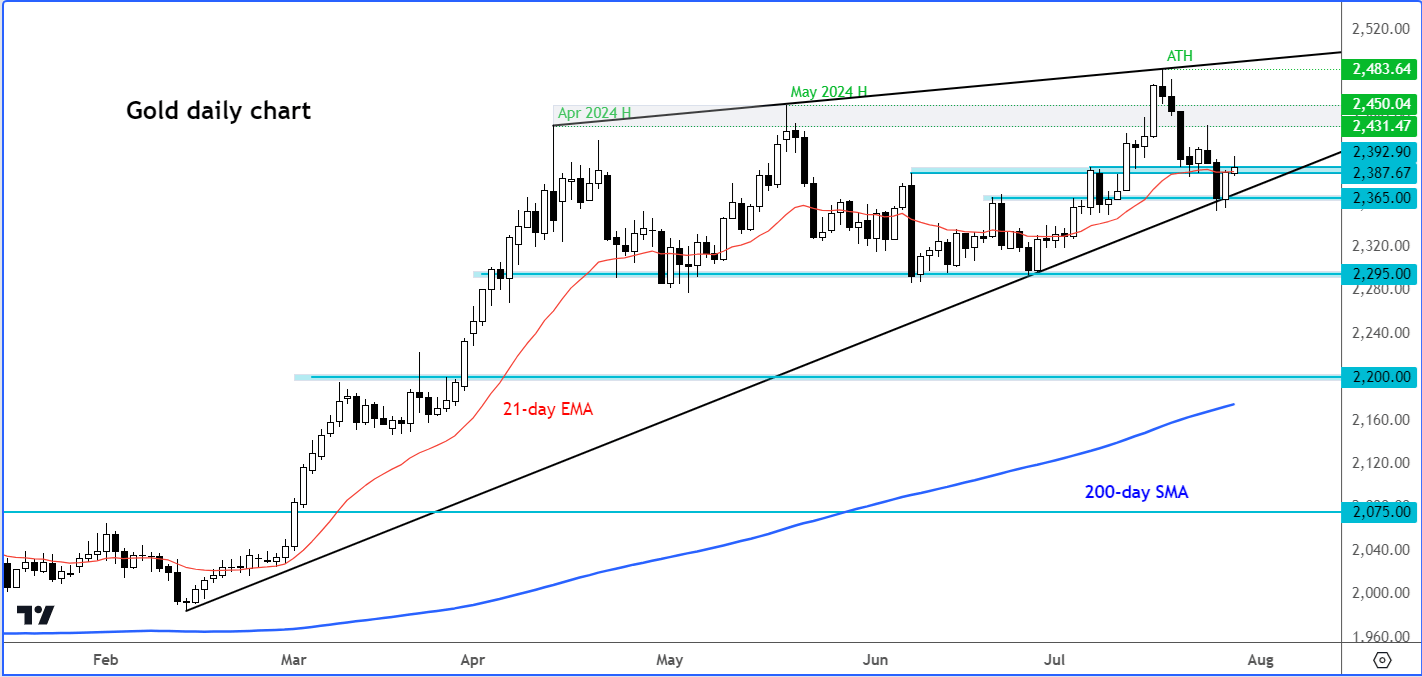

Source: TradingView.com

From a technical point of view, the trend on the gold chart is still bullish despite recent volatility. More technical damage needs to be incurred for that to change. Indeed, the precious metal has not yet broken its series of higher highs and higher lows that stretch back several months, even if it has struggled to hold the more recent breakout attempts. Short-term support at $2360ish was tested on Friday but the bulls showed up to form an inside bar formation on the daily chart of gold. The metal needs to hold its own around this level to prevent a deeper correction. This $2360 level converges with the bullish trend line going back to February. Below it, the next key support is around $2295, which has provided a floor to gold on at least 3 separate occasions since April.

In terms of resistance levels to watch, the first line of defence for the bears come in at around $2400, Beyond this, you have a band of resistance between $2430 to $2450, where gold formed interim highs in April and May. Should we eventually rise above $2450, then there are no prior reference points to target above July’s current all-time high at $2483, meaning we could easily see a continuation towards $2500, the next psychologically important level.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R