- Gold off lows but outlook dims as rising yields increase opportunity cost of holding metals

- Dollar strength, driven by US data, so far unable to add pressure on the metal

- Reduced Israel-Iran tensions and China's demand challenges additional factors that could weigh on prices

In early trading, gold was down as oil prices took a 5% plunge, amid an apparent easing in Middle East tensions and an uptick in US Treasury yields. The restrained reaction by Israel after recent attacks has spurred optimism, with markets hoping for stability in the region. This reduced safe-haven appeal for gold, as European equities rebounded and oil prices plunged. While gold subsequently came well off its lows to approach last week’s record high, it remains to be seen whether and how high the metal can rise further from here. For, there are increasing factors that point to a less rosy gold outlook as we begin a very busy two weeks, with lots of data, US election and central banks meetings on the way.

Will gold finally ease off or continue to march higher?

With gold repeatedly hitting record highs recently, it remains to be seen whether today’s small pullback is merely a pause, before ongoing bullish momentum sends prices to new unchartered territory, or as we witnessing at least a temporary top if not a complete reversal? Reduced Middle East risks, coupled with a strong dollar and rising yields, have certainly made it harder for investors to justify holding the metal without a fresh bullish catalyst. The high opportunity cost of non-yielding assets like gold is becoming increasingly evident as bond yields soar. Meanwhile, lingering US election uncertainties may provide some support, yet without significant new drivers, gold buyers may find themselves on pause until a clearer correction emerges.

Dollar Strength and Rising Yields Threaten Gold's Appeal

The relentless climb of the US 10-year Treasury yield, which now sits near 4.30%, reflects the market's anticipation of a slower rate cut trajectory from the Federal Reserve. Paired with dollar strength, particularly against the yen, these factors underscore my scepticism about gold in the short-term outlook. The upcoming wave of US data releases could reinforce this sentiment, potentially finally putting some downward pressure on the buck-denominated precious metal. Should yields and the dollar maintain their momentum, we may see the gold outlook soften in the near term as the cost of holding non-yielding assets climbs. No such sign has been evidenced yet, though.

China's Economic Uncertainty Could Weigh on Gold

As the world’s largest gold consumer, China’s economic challenges hold significant weight for gold outlook. Despite Beijing's recent stimulus measures, lacklustre economic data and the yuan's ongoing weakness have cast a shadow over Chinese demand for the metal. Initial market optimism around government support is now fading, and without clear, substantial interventions, commodities could bear the brunt. Crude and copper have already felt this impact, and should China’s struggles persist, gold may not be far behind in following suit.

Technical gold outlook: Key levels to watch

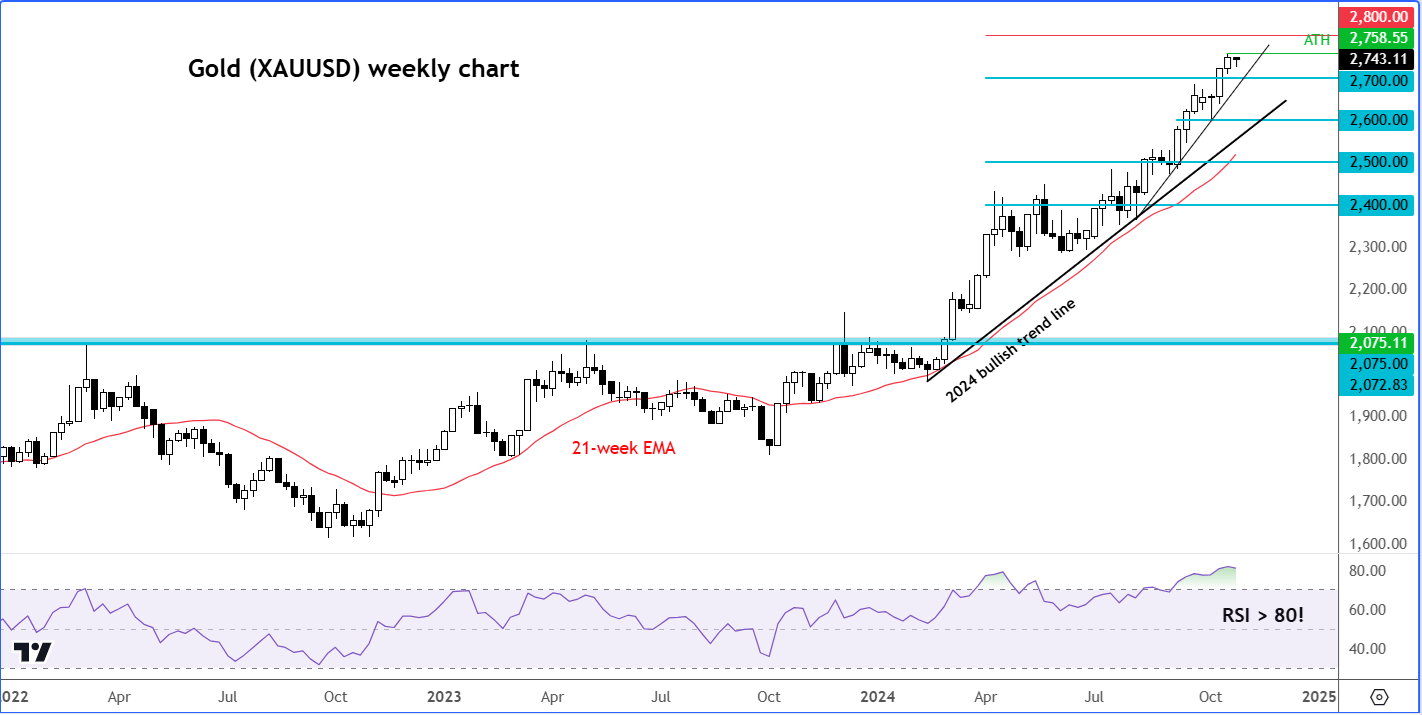

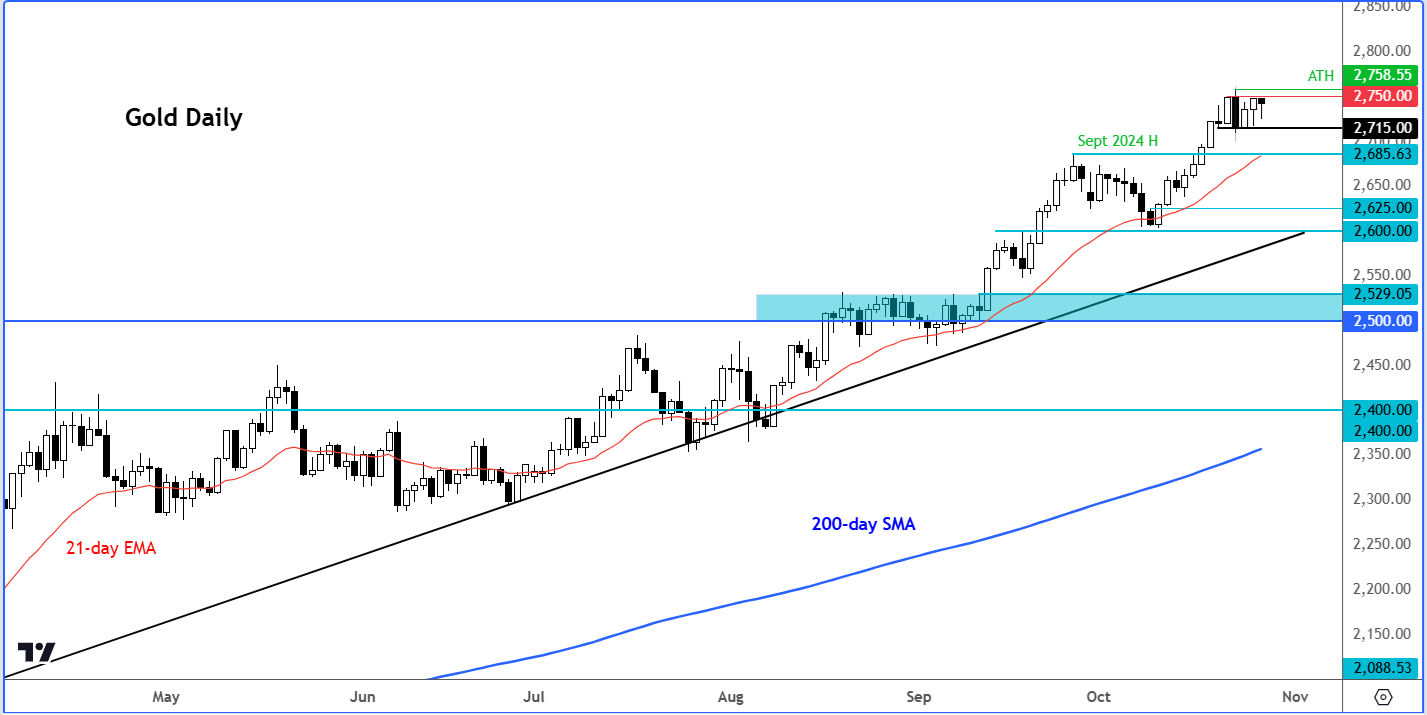

So far, we haven’t seen any bearish reversal pattern to suggest the technical gold outlook has turned bearish. However, momentum indicators suggest that it may be nearing a reversal – but confirmation is needed.

After hitting recent highs, momentum has waned somewhat as the metal meets resistance from a stronger dollar and higher yields. The Relative Strength Index (RSI) remains overbought on long-term charts, signalling potential for a pullback reminiscent of the 2020 correction.

However, a true bearish shift would require a break in key support levels, such as a daily close below the $2715-20 range, which could prompt the gold price to move towards the $2685 level and potentially lower.

While the long-term outlook remains positive, the short-term picture presents some potential downside risk. As traders, balancing long-term bullish expectations with the flexibility to respond to short-term pressures is key in navigating gold's volatile terrain.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R