Gold Talking Points:

- Gold prices have been in a strong bullish trend for the past nine months with only minimal pullback, but sellers showed up with aggression at the November open.

- This week is starting with a healthy bounce and last Friday showed a doji that was also an inside bar, hinting at the prospect of a near-term pullback. The question now is whether that can turn into anything more.

- I look at gold in-depth in the Tuesday webinar every week. You’re welcome to join: Click here for registration information.

Well, gold is no longer overbought on the daily chart. The bullish trend there pushed for most of this year and especially over the past nine months. It was in mid-February that the metal showed its last and final test below the $2k level following a stronger-than-expected CPI report. But dovish comments from Chicago Fed President Austan Goolsbee a day later helped to prod gold prices higher, and that ascent largely remained for most of the nine months following.

Gold was especially strong in the month of October and that showed even as RSI divergence continued to build. The sell-off that started on October 31st was fast and aggressive and that ran through last week. But the short-term move may be overdone, and the Friday daily candle is of interest, as it printed as both a doji and an inside bar as buyers defended support at 2,538.46, which is the 50% mark of the June-October major move.

That level traded on Thursday and helped to mark the low, and after the Friday inside bar this week has opened with strength and buyers have already forced a move up to resistance, as there’s confluence between the 38.2% Fibonacci retracement of that same study and the 2,600 psychological level.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

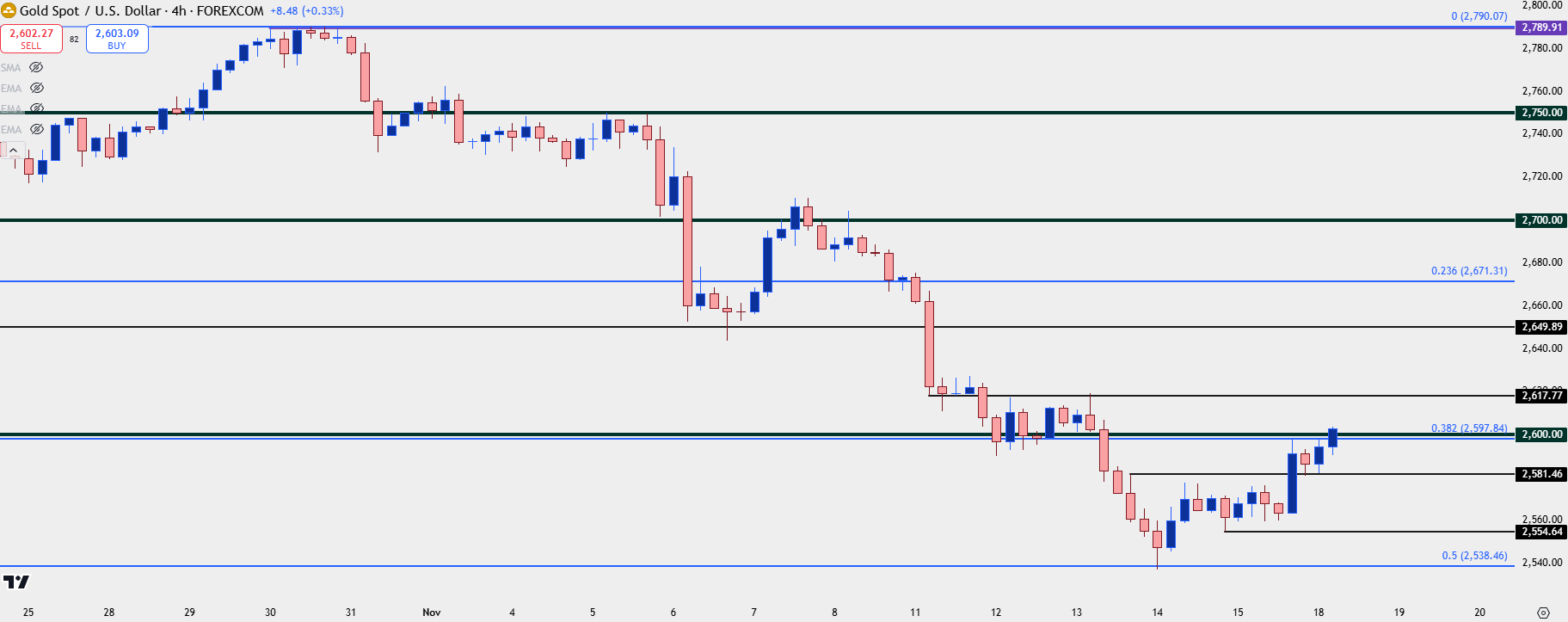

Gold Strategy

From the four-hour chart we can see bulls already pushing a series of higher-highs and lows, with resistance showing right at that confluent spot noted above, around the 2,600 level. The shorter-term chart also highlights a few different additional levels of note, such as the 2,617 swing that set the highs last Wednesday, or the 2,649 level that helped to prod a bounce after the initial move following the election. For bulls to continue taking control and driving the topside move, they’ll need to encounter each of those prices and, ideally, in that scenario, there will be some element of higher-low support showing around current resistance of 2,600 to allow for bullish trend construction.

If the 2,600 level does hold resistance at the end of Monday, the price that bulls need to hold support above to retain some element of control over the short-term move is the Friday swing low, plotted at 2554

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist