- The macro environment was not favourable for gold last week, yet it managed to finish not far from where it started

- Dips below $2000 were quickly bought, suggesting the path of least resistance may be higher near-term

- The US dollar rally is looking fatigued and inflation expectations are strengthening. Both would normally act as tailwinds for commodity prices

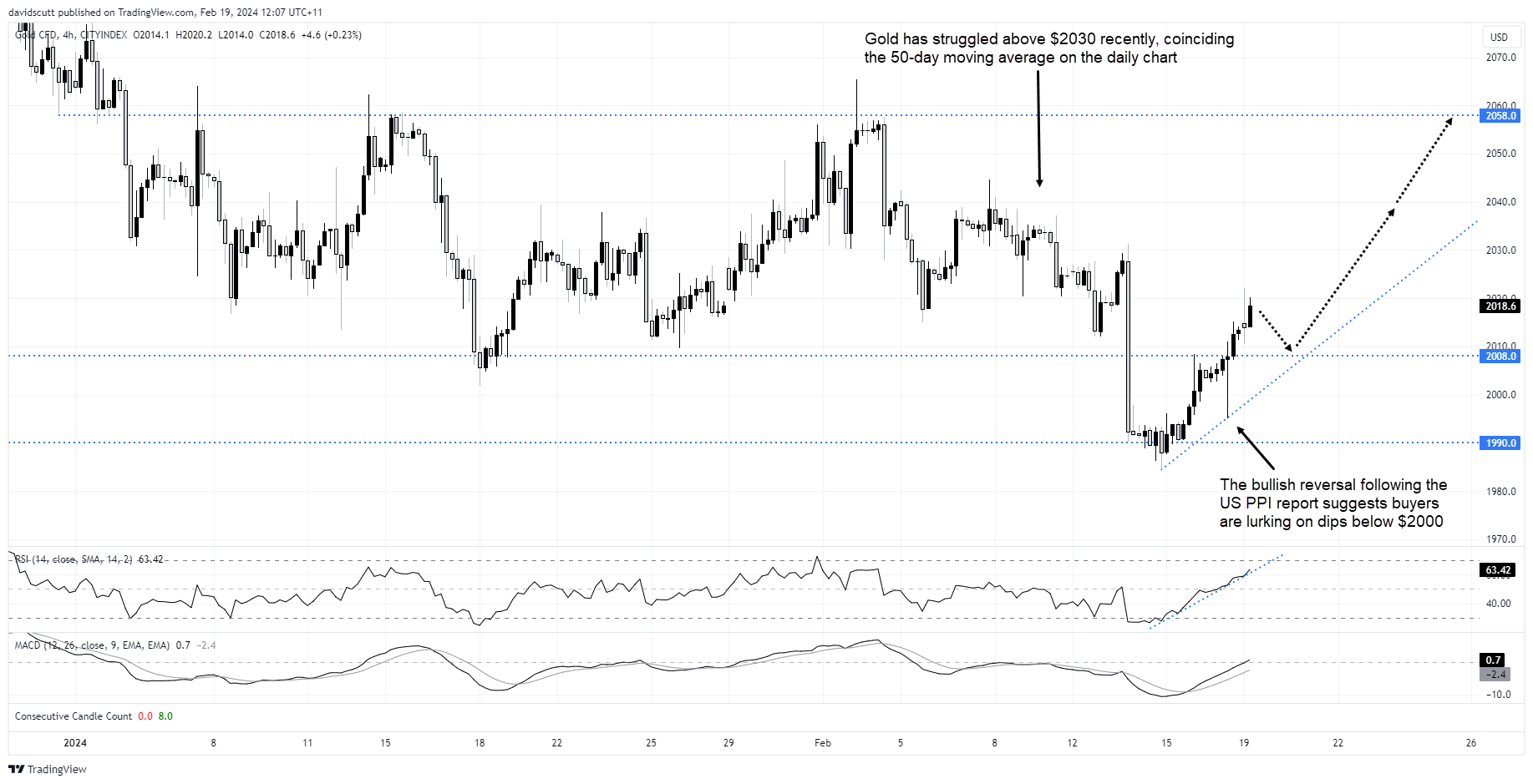

- Gold has struggled around the 50-day moving average recently, making that the first target for bulls to overcome

Higher bond yields, stronger US dollar, no major escalation in geopolitical tensions in the Middle East. It’s the kind of backdrop you wouldn’t expect gold to thrive in. But its first probe below $2000 per ounce in 2024 didn’t last long last week, rebounding strongly to push back into the range it’s been operating in since mid-December.

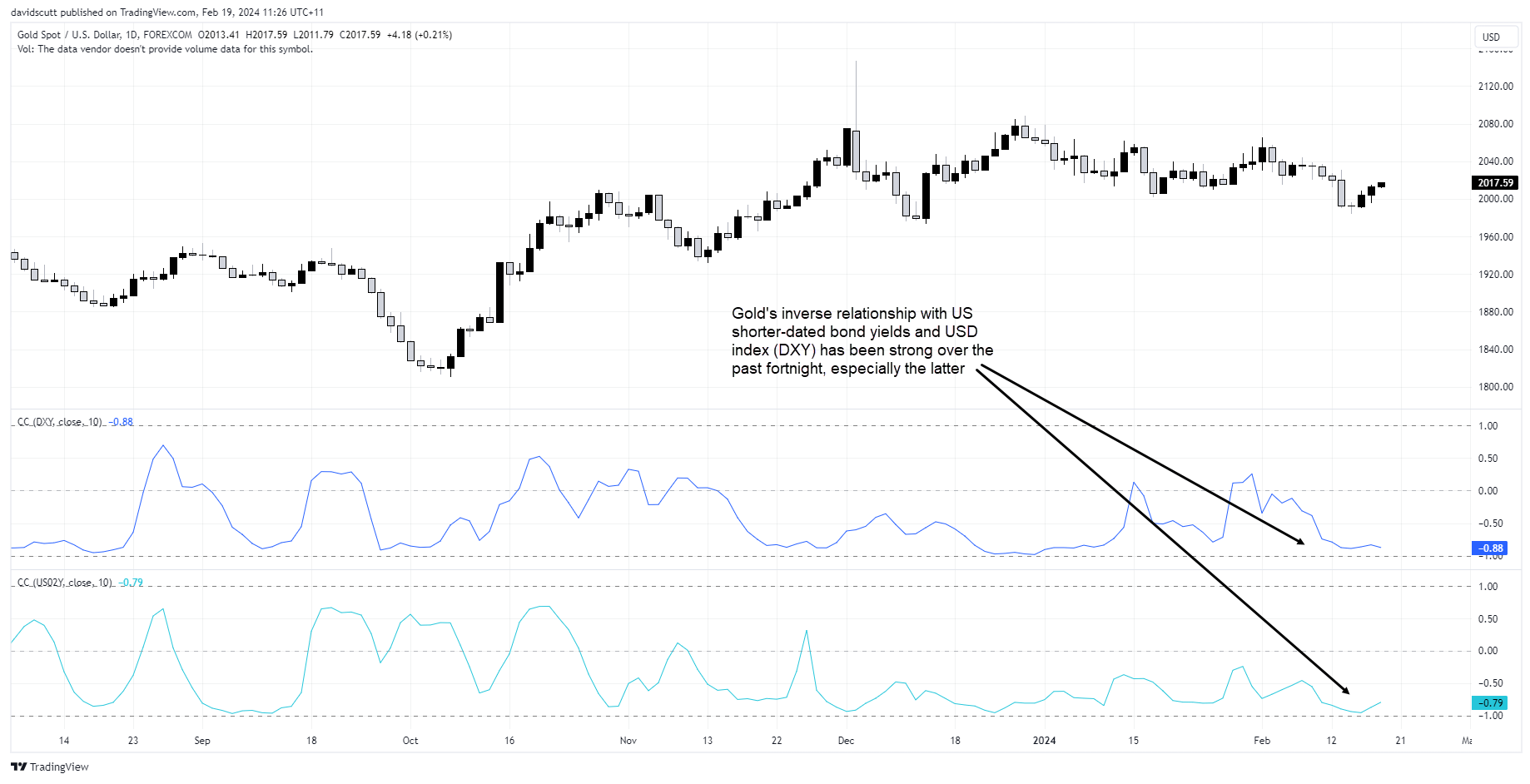

Gold has a strong inverse relationship with DXY right now

The price action suggests there are plenty of willing buyers out there despite gold sitting at historically elevated levels, pointing to the potential for further gains should the macro environment begin to swing around in bullion’s favour. With the US dollar rally looking shaky amidst growing evidence of continued stickiness in inflationary pressures, you could argue it already is.

Over the past fortnight, the inverse relationship between gold and the US dollar index (DXY) has been particularly strong, exceeding levels seen for shorter and longer-dated bond yields over the same period.

And the DXY rally looks fatigued

With gold and DXY moving in the opposite direction most days, it’s noteworthy how poorly the US dollar traded last week despite widening yield differentials with other major currencies. The inverse hammer candle printed on Friday, which came despite the release of a hot US producer price inflation report during the session, provides a warning that after a relentless rise since late last year, the dollar’s fuel from rising US yields may be nearing exhaustion.

If the USD does weaken, that should provide a tailwind for gold.

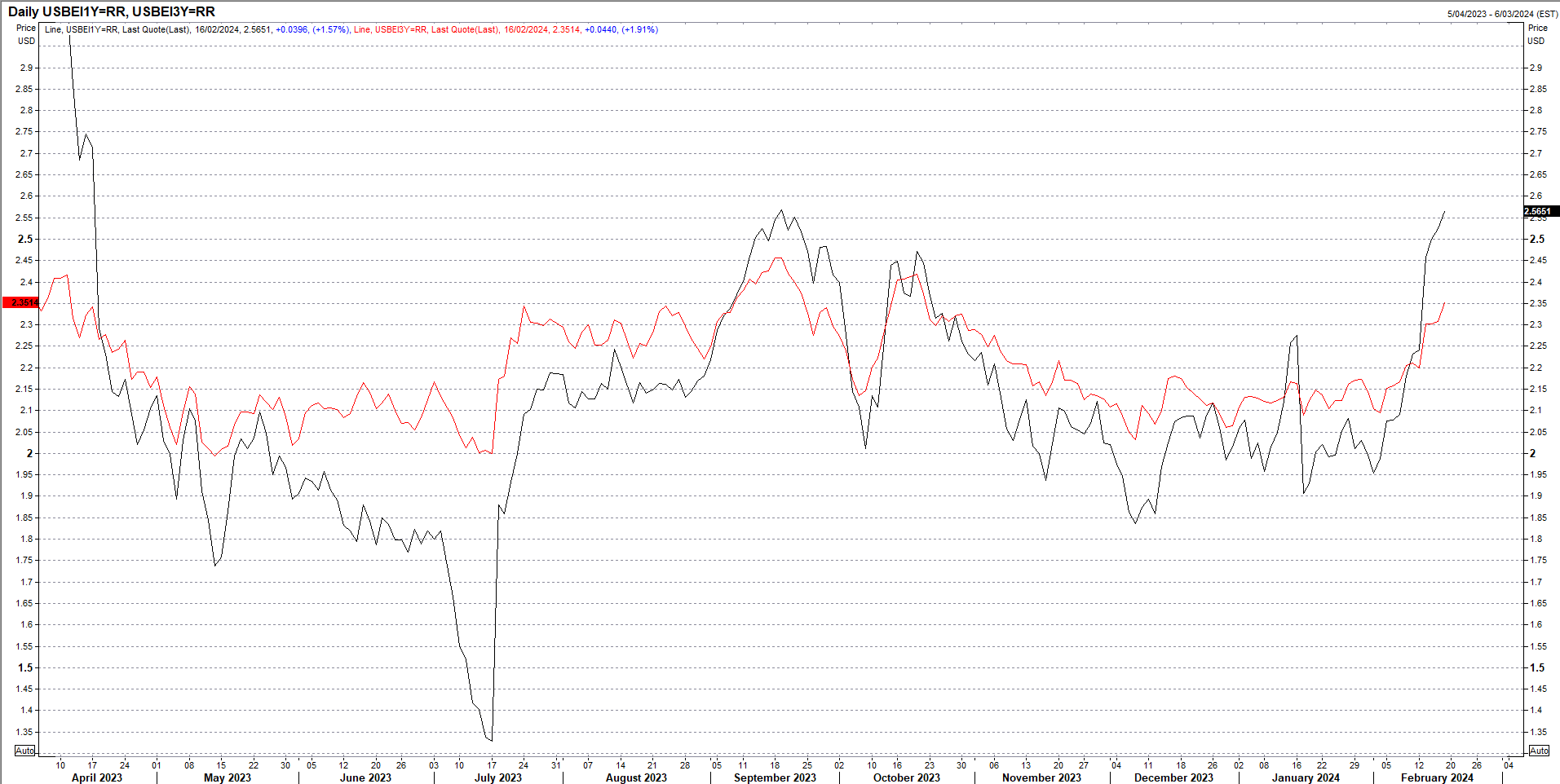

Inflation expectations are picking up

Another factor that may help gold is a pickup in market-based inflation expectations, suggesting traders may be starting to question whether the disinflationary trend in the second half of 2023 is stalling.

US one and three-year inflation breakevens, shown in black and red respectively below, hit the highest level since October last week following the US CPI and PPI reports. That’s important as is signifies that despite 2024 Fed rate cut bets having been halved in a little over a month, average inflation rates over the next year and 36 months are expected to be significantly higher than just a few weeks ago, and well above the Fed’s 2% target.

Source: Refinitiv

Given their physical nature, an expectation of higher inflation may help underpin commodity prices, including for precious metals such as gold.

Gold was hoovered up on dips below $2000 last week

The performance from gold last week was impressive despite higher US bond yields and dollar, recovering most of the ground ceded following the hot US CPI report on Tuesday. It attracted plenty of bids below $1990, seeing it push back to former horizontal support at $2008. It was then hammered lower Friday on the hot US PPI report before rebounding to break back into its former trading range. Despite some initial struggles at $2020, the path of least resistance appears to be higher right now.

For those considering long positions, pullbacks towards $2008 provide decent risk-reward, allowing for stops to be placed below the level targeting a move back towards $2058 where it was rejected on three occasions earlier this year. There’s may be sellers lurking above $2030 where the 50-day moving average sits on the daily chart, meaning the trade – should it be successful – may be more of a grind rather than quick-run affair.

As discussed in an early post on the AUD/USD outlook, despite a decent amount of known risk events on the calendar this week, few screen as likely to have a meaningful and longer-lasting impact on markets.

-- Written by David Scutt

Follow David on Twitter @scutty