On Tuesday, December 17, 2024, Germany released key economic indicators that gave us some insight into the state of its economy. The Ifo Business Climate Index, the ZEW Current Conditions, and the ZEW Economic Sentiment painted a mixed picture. While two key measures came in below expectations, one surprised to the upside, suggesting cautious optimism amid lingering economic uncertainties.

Ifo Business Climate Index: Weaker Than Expected

The Ifo Business Climate Index, a highly regarded measure of German business sentiment, disappointed market expectations in December. It fell to 89.7, lower than the forecast of 90.5 and down from the previous month’s reading of 90.8.

The decline signals increasing pessimism among German firms as Europe’s largest economy grapples with weak industrial activity, weakening demand, and persistent cost pressures. Key contributors to the decline include sluggish performance in the manufacturing sector, where firms face global competition, high energy costs, and a slowdown in key export markets like China. Similarly, construction and retail trade continue to struggle under higher financing costs due to elevated interest rates.

The lower-than-expected Ifo reading raises concerns about Germany’s near-term growth outlook. Analysts are particularly worried about the persistence of weak domestic demand, which might have added to the weakened economic recovery in 2024.

ZEW Current Conditions: Ongoing Economic Weakness

The ZEW Current Conditions Index for December also highlighted Germany’s economic struggles, coming in at -77.4, missing the consensus forecast of -75.0. This represents a decline from the previous month’s reading of -75.6.

The ZEW Current Conditions Index measures the current economic environment as perceived by financial market experts. The numbers are now at levels not seen since May 2020, indicating that Germany’s economy remains in a weakening state.

The index highlights the challenges faced by businesses on the ground, including weak consumer confidence, impacted by inflation and high borrowing costs. Germany’s industrial heartland, a key driver of the economy, has yet to see a significant rebound, with the automotive sector and chemical industries remaining under pressure.

ZEW Economic Sentiment: A Positive Surprise

In contrast to the weaker Ifo and ZEW Current Conditions data, the ZEW Economic Sentiment Index provided a rare bright spot. The index climbed to 15.2, surpassing expectations of 12.5 and significantly improving from the previous month’s figure of 10.8.

The ZEW Economic Sentiment Index measures the expectations of financial analysts and institutional investors for Germany’s economic performance over the next six months. The improvement suggests that market participants anticipate a modest easing in the medium term, perhaps due to stabilizing global conditions and expectations of more rate cuts from the European Central Bank (ECB) in 2025.

Factors contributing to this optimism include:

Easing inflationary pressures across the Eurozone.

Expectations of a rate-cut cycle in the coming quarters, which would provide much-needed relief for businesses and households.

Hopes for stronger global trade demand, particularly from China and the United States.

It appears that market participants see the current conditions as weak, but have growing confidence that Germany could avoid a deeper economic downturn in the next 6 months, which could be positive.

Implications for the German Economy

Short-term concerns: The weaker business climate and current conditions highlight perceived ongoing risks, including slow domestic demand, high energy costs, and geopolitical uncertainties in the current environment.

Medium-term optimism: The better-than-expected ZEW sentiment would indicate an increasing confidence for the next 6 months, in terms of monetary policy easing and a more beneficial business environment.

Market Reaction and Outlook

The markets reacted cautiously to the data, with the German DAX index experiencing only minor volatility.

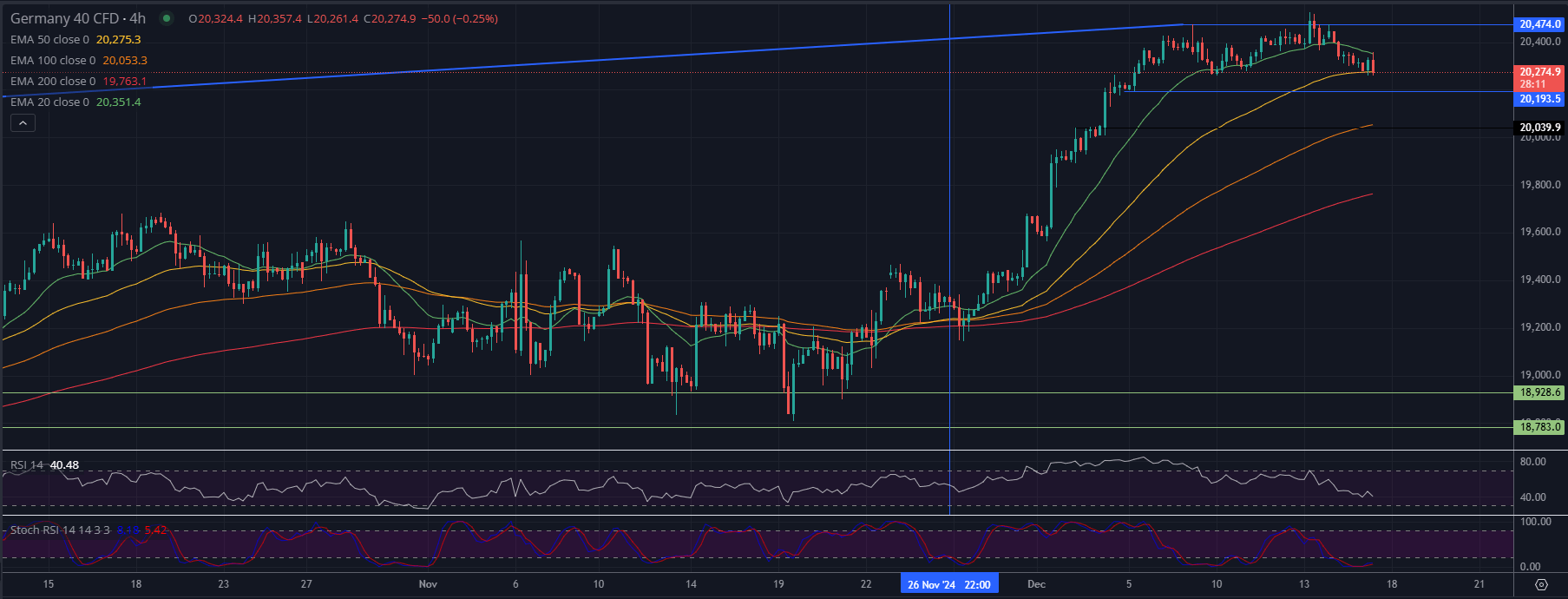

Technical Analysis of the Germany DAX Index (4-Hour Chart)

Price Action Overview

- The DAX index is in the midst of a short-term correction after reaching a recent high at 20,474.

- The price has fallen and is testing the 20,193.5 support level, a key horizontal area where buying interest may emerge.

- The strong upward momentum that began in late November has paused, signaling possible consolidation or a further pullback.

Moving Averages Analysis

- 20 EMA (20,351.4):

- The price is trading below the 20 EMA, suggesting short-term weakness and a slowing bullish trend.

- 50 EMA (20,275.3):

- The index is testing the 50 EMA, which acts as immediate support.

- 100 EMA (20,053.3):

- If the price breaks below the 50 EMA, the 100 EMA will serve as the next major dynamic support level.

- 200 EMA (19,763.1):

- The 200 EMA remains far below the current price, indicating that the overall medium- to long-term uptrend remains intact.

The alignment of moving averages (20 > 50 > 100 > 200) confirms that the broader trend remains bullish, though short-term weakness persists.

Key Support and Resistance Levels

- Support Levels:

- 20,193.5: Immediate support being tested. A confirmed break below this level could push the price toward the 100 EMA at 20,053.3.

- 19,928.6 and 19,783.0: Key support zones further below if selling pressure intensifies.

- Resistance Levels:

- 20,474: The recent swing high, which now acts as resistance.

- A recovery above 20,474 would resume the bullish trend and open the door for further upside.

Technical Indicators

- Relative Strength Index (RSI):

- Current Value: 40.48: RSI is trending downward and approaching oversold territory. This indicates weakening momentum but suggests a potential bounce if it nears 30.

- Stochastic RSI:

- Current Levels: ~5.42 and 8.8: The Stochastic RSI is deep in the oversold zone, signaling that a short-term reversal or bounce could be imminent.

Outlook and Scenarios

- Bullish Scenario:

- If the DAX holds above the 20,193.5 support and rebounds, the next move would target the 20,351 (20 EMA) and ultimately retest resistance at 20,474.

- A break above 20,474 would signal a continuation of the broader bullish trend, with potential upside toward 20,600.

- Bearish Scenario:

- A confirmed break below 20,193.5 could trigger further declines, with the next major support at the 100 EMA (20,053.3).

- A sharper pullback could test 19,763.1 (200 EMA), a significant support area for long-term buyers.

Investors are now closely monitoring signals from the ECB, which may adjust its policy stance to support economic recovery.

The mixed results underscore the need for targeted fiscal and monetary measures to bolster business confidence and investment. For now, Germany remains in a delicate position, balancing current economic challenges with growing optimism for 2025.