British Pound Forecast: GBP/USD

GBP/USD struggles to extend the advance from the start of the week as Bank of England (BoE) Governor Andrew Bailey acknowledges that ‘inflation has come down faster than we expected a year ago,’ but the exchange rate may stage a larger recovery as it appears to be bouncing back ahead of the monthly low (1.2597).

GBP/USD Struggles as BoE Bailey Sees Faster Disinflation

Keep in mind, GBP/USD cleared the June low (1.2613) after closing below the 200-Day SMA (1.2820) for the first time since May, and the exchange rate may struggle to hold its ground ahead of the next BoE meeting on December 19 as it no longer responds to the positive slope in the long-term moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, GBP/USD may continue to give back the advance from the May low (1.2446) as the BoE appears to be on track to further unwind its restrictive policy, and the update to the UK Consumer Price Index (CPI) may do little to derail the central bank as ‘both inflation perceptions and inflation expectations have continued to fall alongside consumer price inflation itself.’

UK Economic Calendar

Even though the headline CPI is expected to increase to 2.2% in October from 1.7% per annum the month prior, the core reading for inflation is seen narrowing to 3.1% from 3.2% during the same period.

With that said, further evidence of slowing price growth may generate a bearish reaction in the British Pound as it fuels speculation for lower UK interest rates, but a higher-than-expected CPI report may keep GBP/USD above the monthly low (1.2597) as it encourages BoE Governor Bailey and Co. to further combat inflation.

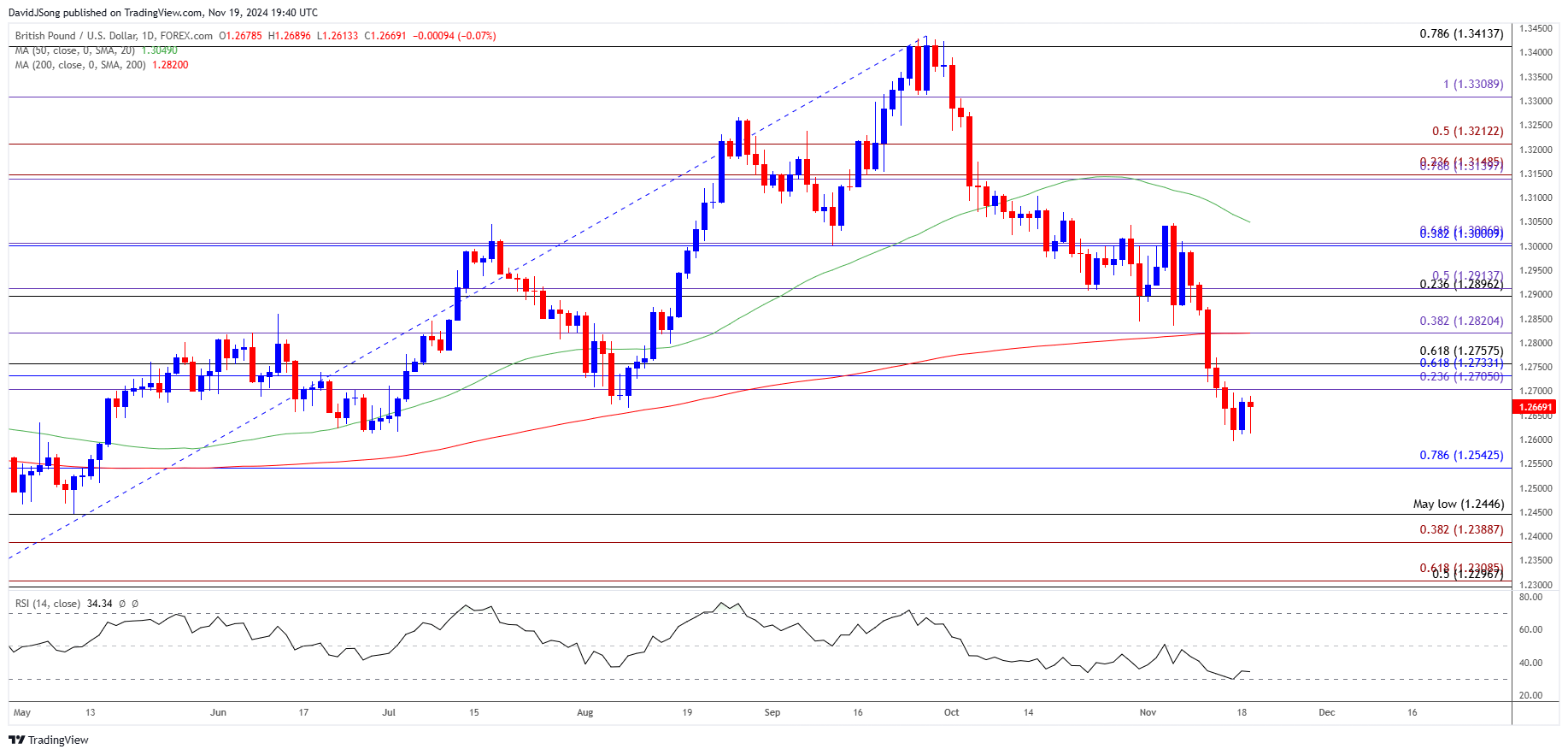

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- The selloff from earlier this month appears to have stalled as GBP/USD no longer carves a series of lower highs and lows, and the exchange rate may consolidate over the remainder of the week as it holds above the monthly low (1.2597).

- Need a close back above the 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement) region to bring 1.2820 (38.2% Fibonacci extension) back on the radar, with the next area of interest coming in around 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension).

- However, failure to defend the monthly low (1.2597) may push GBP/USD towards 1.2540 (78.6% Fibonacci retracement), with the next region of interest coming in around the May low (1.2446).

Additional Market Outlooks

Gold Price Recovery Keeps RSI Above Oversold Zone

US Dollar Forecast: EUR/USD Rebound Pulls RSI Out of Oversold Zone

USD/JPY Rebounds as BoJ Ueda Pledges to Support Economic Activity

Canadian Dollar Forecast: USD/CAD Rally Clears 2022 High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong