British Pound Outlook: GBP/USD

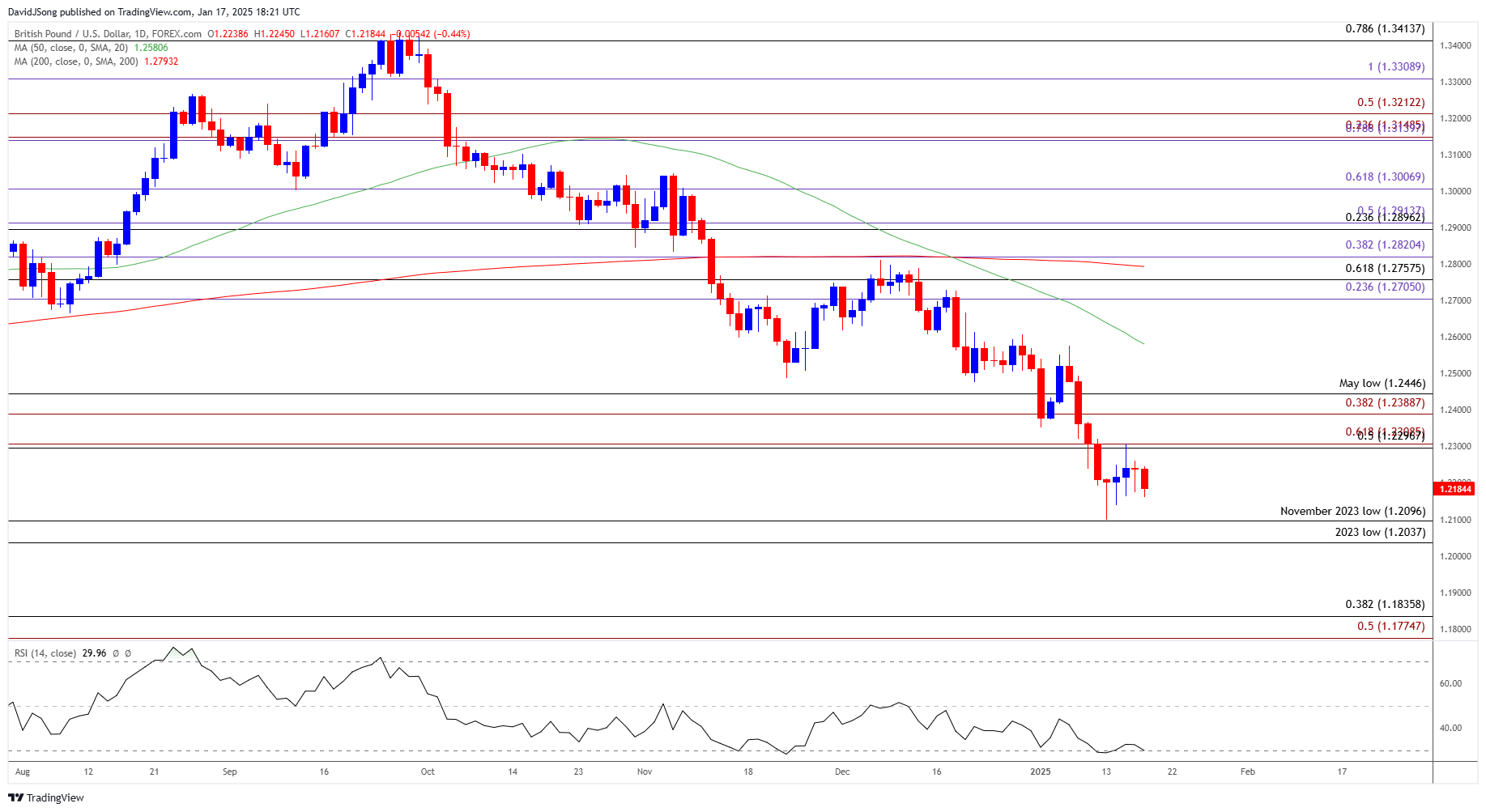

GBP/USD continues to pullback from the weekly high (1.2307) as the UK Retail Sales report shows an unexpected 0.3% decline in December, with the recent weakness in the exchange rate pushing the Relative Strength Index (RSI) toward oversold territory.

GBP/USD Pullback Pushes RSI Toward Oversold Territory

In turn, GBP/USD may track the negative slope in the 50-Day SMA (1.2580) as it fails to extend the series of higher highs and lows from the start of the week, and the exchange rate may stage further attempts to test the November 2023 low (1.2096) as it still holds below the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

At the same time, a move below 30 in the RSI is likely to be accompanied by a further decline in GBP/USD like the price action from last year, but data prints coming out of the UK may continue to sway the exchange rate as the Bank of England (BoE) voted 6 to 3 in December to retain the current policy.

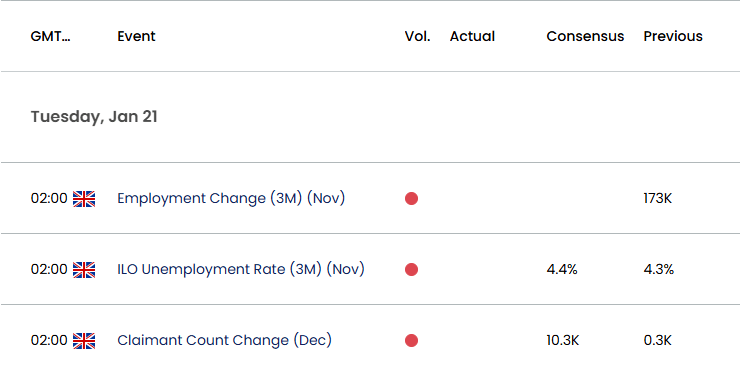

UK Economic Calendar

Looking ahead, the UK Employment report may encourage the BoE to keep interest rates on hold should the update show a further expansion in job growth, and a positive development may curb the recent weakness in the British Pound as the Monetary Policy Committee (MPC) pledges to ‘decide the appropriate degree of monetary policy restrictiveness at each meeting.’

With that said, GBP/USD may face range bound conditions should it defend the monthly low (1.2100), but a weaker-than-expected UK Employment report may fuel the recent decline in the exchange rate as it boosts speculation for a BoE rate-cut.

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD snaps the series of higher highs and lows from earlier this week after failing to trade back above the 1.2300 (50% Fibonacci retracement) to 1.2310 (61.8% Fibonacci extension) region, and the exchange rate may stage another attempt to test the November 2023 low (1.2096) should it continue to give back the advance from the monthly low (1.2100).

- A breach below the 2023 low (1.2037) opens up the 1.1780 (50% Fibonacci extension) to 1.1840 (38.2% Fibonacci retracement) zone, but GBP/USD may face range bound conditions if it defends the monthly low (1.2100).

- Need a move back above the 1.2300 (50% Fibonacci retracement) to 1.2310 (61.8% Fibonacci extension) region to bring the 1.2390 (38.2% Fibonacci extension) to 1.2446 (May low) zone back on the radar, with the next area of interest coming in around the monthly high (1.2576).

Additional Market Outlooks

AUD/USD Vulnerable amid Struggle to Push Above Weekly High

USD/CHF Snaps Bearish Price Series to Hold Above Weekly Low

US Dollar Forecast: USD/CAD Susceptible to Test of Monthly Low

Gold Price Recovery Stalls Ahead of December High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong