Key Events

- Trump Victory: Boosts dollar strength

- US ISM Services PMI: Climbs to March 2023 highs

- BOE: Expected to cut rates by 25 bps on Thursday

- Fed: Expected to cut rates by 25 bps on Thursday

- FOMC Meeting: caution for irregular volatility following the elections

Trump Returns to the White House in 2025

In a tight race, Trump’s victory has driven US market optimism, spurring a rally in US equities and pushing the dollar higher amid anticipated inflationary pressures. This certainty in US leadership has also contributed to a pullback in gold, with prices retesting the $2700 mark as investors adjust expectations.

However, Trump’s trade and tariff policies impose bearish risks on the UK economy.

BOE vs Fed Decision

While both the BOE and Fed are expected to cut rates by 25 bps on Thursday, their inflationary landscapes differ significantly. In the UK, CPI has eased to 1.7% from 2.2% in August, paving the way for a more accommodative monetary policy and supporting expansionary fiscal measures.

In contrast, the US faces “sticky” inflation levels, heightened by Trump’s policies. The recent ISM Services PMI, reaching its highest point since March 2023, reinforces a cautious Fed outlook and may underpin the dollar’s strength at the FOMC meeting.

Technical Outlook

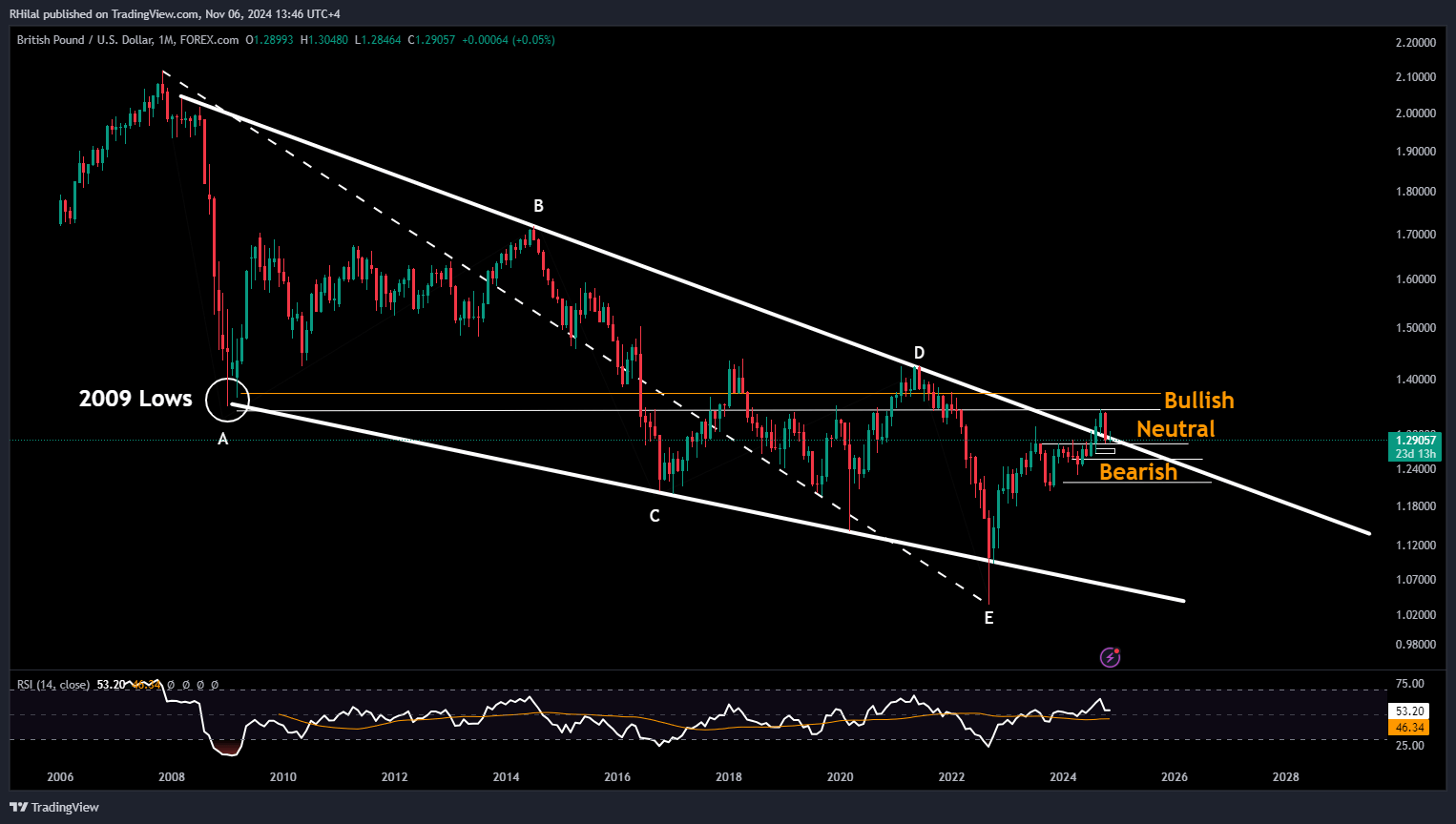

GBPUSD Outlook: Monthly Time Frame

Source: Tradingview

The GBPUSD’s recent pullback from the 1.3430 high to the 1.2840 low has reached a crucial juncture. The pair is balancing between the inner edge of its 15-year consolidation, risking a potential downtrend continuation, or reclaiming an upward trend.

The monthly RSI stands neutral at 53, and GBPUSD clings to the upper border of a 15-year consolidation zone. Support at the 1.2840 low aligns with the 50% Fibonacci retracement of the uptrend from April 2024 (1.23) to September 2024 highs (1.3430).

The area around 1.2840 also aligns with the highs from December 2023 and March 2024, resisting the bearish engulfing pattern observed between September and October 2024.

- Bullish Scenario: A reversal and continuation above 1.2840 could drive a rebound toward 1.3430 and possibly 1.37.

- Bearish Scenario: A close below 1.28 could trigger further declines to 1.2680 and 1.2570, reinforcing a downtrend.

— Written by Razan Hilal, CMT – on X: @Rh_waves